Amsterdam Stock Market: Three Days Of Losses Totaling 11%

Table of Contents

Analyzing the Causes of the Amsterdam Stock Market Decline

Several interconnected factors contributed to the recent slump in the Amsterdam Stock Market. Understanding these causes is crucial for navigating future market volatility.

Global Economic Uncertainty

The global economic landscape is currently fraught with uncertainty, significantly impacting the AEX. Rising interest rates aimed at curbing inflation are dampening economic growth. The ongoing energy crisis, exacerbated by the war in Ukraine, is creating further instability. Supply chain disruptions and the looming threat of a recession in major economies are all contributing to a climate of fear and uncertainty. These global headwinds have directly affected Dutch companies listed on the AEX, leading to decreased investor confidence.

- Rising interest rates: Higher borrowing costs make expansion and investment more expensive for businesses.

- Energy crisis: Increased energy prices impact production costs and profitability across various sectors.

- War in Ukraine: Geopolitical instability creates uncertainty and disrupts global trade.

- Supply chain disruptions: Continued supply chain bottlenecks lead to production delays and higher prices.

- Potential recession: Fears of a global recession are causing investors to move to safer assets.

Sector-Specific Performance

The impact of the market downturn wasn't uniform across all sectors. Some industries suffered more significant losses than others.

- Energy sector losses: The energy sector, already facing volatility, experienced substantial losses due to fluctuating prices and geopolitical concerns.

- Tech stock decline: Tech stocks, often sensitive to interest rate hikes and economic uncertainty, also saw a significant decline.

- Impact on financial services: The financial services sector, while relatively resilient, also felt the pressure of decreased investor confidence.

- Performance of specific companies: Companies like ASML (a major semiconductor equipment manufacturer) and Unilever (a consumer goods giant) felt the impact, though their responses varied. (Note: Charts illustrating sector performance would be included here in a published article.)

Investor Sentiment and Market Volatility

Investor sentiment played a crucial role in amplifying the initial decline. A decrease in confidence led to increased market volatility and panic selling, further driving down prices.

- Decline in investor confidence: Negative news headlines and economic forecasts eroded investor confidence.

- Increased market volatility: The rapid and significant price swings heightened anxiety and uncertainty.

- Short-selling activity: Short-selling, the practice of betting against a stock's price, likely exacerbated the downturn.

- Influence of media: Negative news coverage and social media commentary likely influenced investor behavior and contributed to panic selling.

Impact of the 11% Drop on Dutch Businesses and Investors

The 11% drop in the AEX has significant consequences for both Dutch businesses and investors.

Effect on Dutch Companies

The market downturn has immediate and potential long-term implications for companies listed on the AEX.

- Reduced valuations: The decline in the AEX has significantly reduced the market capitalization of Dutch companies.

- Difficulty in raising capital: Companies may find it more challenging to secure funding for future projects and expansion.

- Impact on future investments: Reduced valuations and economic uncertainty could discourage future investments.

- Potential job losses: In some sectors, companies might be forced to cut costs, potentially leading to job losses.

Investor Losses and Portfolio Adjustments

Individual and institutional investors experienced substantial losses due to the market decline.

- Portfolio rebalancing strategies: Investors are likely reviewing their portfolios and making adjustments to mitigate further losses.

- Potential for long-term recovery: While the short-term outlook is uncertain, most markets historically recover over the long term.

- Advice for investors on managing risk: Diversification and a long-term investment strategy are crucial for managing risk during market volatility.

Looking Ahead: Potential Recovery and Future Outlook for the Amsterdam Stock Market

While the recent downturn has been significant, several factors could contribute to a market rebound.

Factors Contributing to Potential Recovery

Several factors could lead to a recovery in the Amsterdam Stock Market.

- Government intervention: Government policies aimed at stimulating economic growth could boost investor confidence.

- Positive economic indicators: Positive economic data could signal an improvement in the overall economic outlook.

- Technological advancements: Innovation and technological breakthroughs could drive growth in specific sectors.

- Changes in investor sentiment: A shift in investor sentiment from fear to optimism could trigger a market rebound.

Expert Predictions and Market Analysis

Financial analysts offer varying predictions about the AEX's future trajectory. Some anticipate a gradual recovery, while others foresee further short-term losses. (Note: Quotes from financial analysts would be included here in a published article.) Long-term forecasts generally remain positive, contingent upon global economic stability and the resolution of geopolitical uncertainties.

Conclusion: Navigating the Amsterdam Stock Market After Significant Losses

The three-day decline in the Amsterdam Stock Market highlights the impact of global economic uncertainty and market volatility. Understanding these factors is crucial for both businesses and investors. The significant losses experienced underscore the importance of careful portfolio management, risk assessment, and a long-term investment strategy. Stay informed about the latest developments in the Amsterdam Stock Market to make well-informed investment decisions. Consult a financial advisor to discuss how this recent downturn impacts your portfolio, and develop a robust Amsterdam Stock Market investment strategy for navigating future uncertainty.

Featured Posts

-

Get A First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025

Get A First Look Tulsa King Season 2 Blu Ray With Sylvester Stallone

May 24, 2025 -

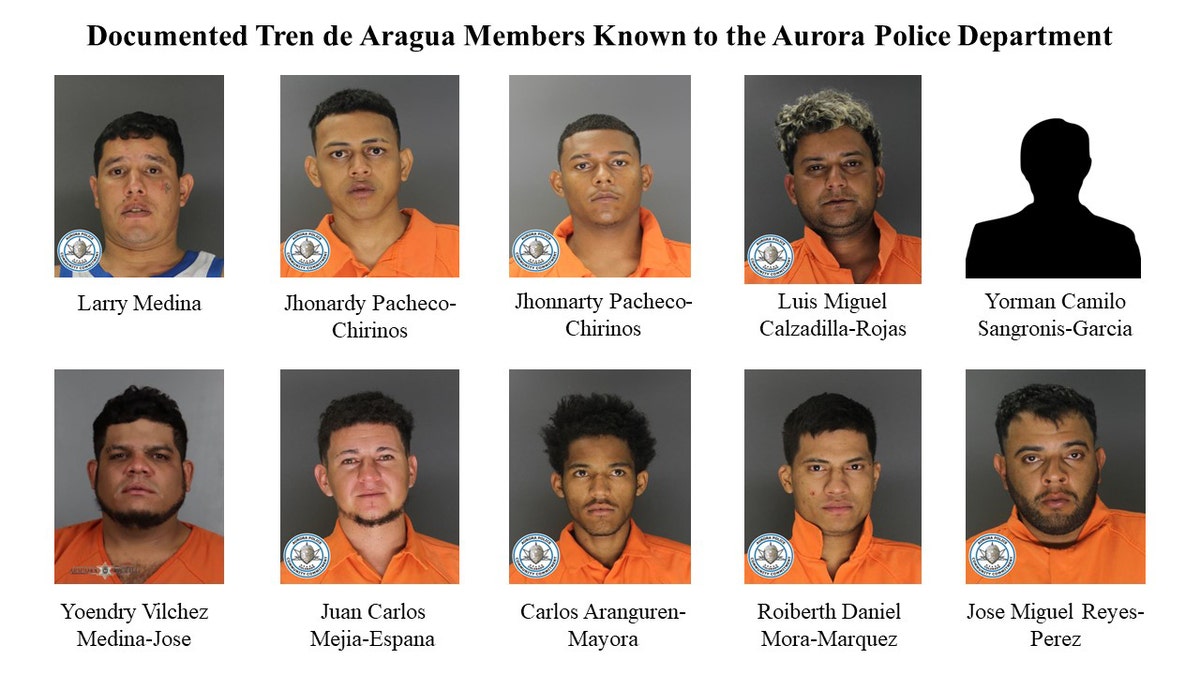

Mia Farrow Trump Should Face Charges For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Trump Should Face Charges For Deporting Venezuelan Gang Members

May 24, 2025 -

Jejak Sejarah Porsche 356 Dari Pabrik Zuffenhausen Jerman

May 24, 2025

Jejak Sejarah Porsche 356 Dari Pabrik Zuffenhausen Jerman

May 24, 2025 -

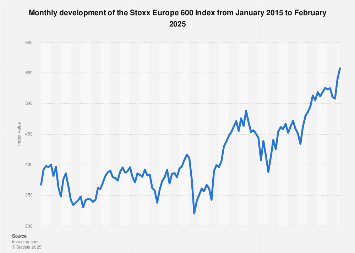

16 Nisan 2025 Avrupa Borsalari Raporu Stoxx Europe 600 Ve Dax 40 In Duesuesue

May 24, 2025

16 Nisan 2025 Avrupa Borsalari Raporu Stoxx Europe 600 Ve Dax 40 In Duesuesue

May 24, 2025 -

Important Notice

May 24, 2025

Important Notice

May 24, 2025