Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV) in the context of the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the total value of a fund's assets minus its liabilities, divided by the number of outstanding shares. In simple terms, it's the per-share value of what the fund owns. For the Amundi DJIA UCITS ETF, the NAV reflects the net asset value of the holdings designed to track the Dow Jones Industrial Average (DJIA) index. This ETF aims to replicate the performance of the DJIA, so its NAV should closely mirror the index's value, adjusted for expenses and other factors. The ETF's investment objective—to track the DJIA—directly impacts the NAV calculation, as the fund manager buys and sells assets to maintain a portfolio mirroring the index's composition.

- NAV reflects the total value of the ETF's holdings, representing the underlying assets' market value.

- It's calculated daily, usually at the close of the market, providing a snapshot of the fund's value.

- NAV per share is crucial for understanding the ETF's intrinsic value, providing a measure of its true worth independent of market trading price.

- Differences between NAV and the market price of the ETF shares can occur due to supply and demand in the market. While they typically track closely, short-term fluctuations can cause discrepancies.

How is the Amundi DJIA UCITS ETF NAV Calculated?

Calculating the Amundi DJIA UCITS ETF NAV involves a multi-step process. First, the fund manager determines the market value of each asset held within the ETF's portfolio. This is typically done using the closing prices of the DJIA component stocks. The total value of these assets is then calculated. Next, any liabilities, such as management fees and expenses, are deducted from the total asset value. Finally, this net asset value is divided by the total number of outstanding shares to arrive at the NAV per share. The fund manager, in conjunction with the custodian bank responsible for holding the assets, ensures the accuracy of this calculation. Currency fluctuations, if the underlying assets are denominated in currencies other than the ETF's base currency, will also be factored in, impacting the final NAV.

- Step-by-step (Simplified): 1. Determine market value of DJIA components; 2. Sum the values; 3. Subtract liabilities (fees, expenses); 4. Divide by the number of outstanding shares.

- Management fees and other operating expenses are deducted before the final NAV is calculated.

- Market prices for each component of the DJIA are used to ensure the NAV accurately reflects the index's value.

- Accurate valuation is crucial for transparency and investor confidence. Independent audits help ensure accuracy.

The Importance of Monitoring Amundi DJIA UCITS ETF NAV

Monitoring the Amundi DJIA UCITS ETF NAV is crucial for several reasons. Changes in the NAV directly reflect the performance of your investment. A rising NAV generally indicates positive returns, while a declining NAV suggests losses. While the NAV and the ETF's market price usually track closely, understanding the relationship is vital. Short-term market fluctuations can cause temporary discrepancies. However, over the long term, the NAV should be a strong indicator of the ETF's underlying performance. You can find the Amundi DJIA UCITS ETF NAV data on the Amundi website, financial news portals, and through your brokerage account.

- Regular NAV monitoring helps track investment performance and identify trends.

- Understanding NAV fluctuations allows investors to assess risk and make informed decisions.

- Comparing the current NAV to historical data allows for trend analysis, providing insights into long-term performance.

- Using NAV data helps evaluate the effectiveness of investment strategies and potentially make adjustments.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several key factors influence the Amundi DJIA UCITS ETF NAV. The most significant is the performance of the Dow Jones Industrial Average (DJIA) itself. Positive movements in the DJIA generally lead to a higher NAV, while negative movements result in a lower NAV. Currency exchange rates can also play a role, particularly if the ETF holds assets denominated in currencies other than its base currency. Finally, fund expenses, including management fees, reduce the overall return and consequently, the NAV.

- Market movements in the DJIA are the primary driver of NAV fluctuations.

- Economic news, geopolitical events, and investor sentiment significantly influence the DJIA and, therefore, the NAV.

- Dividend payments from the underlying DJIA stocks will adjust the NAV, increasing it after the dividend is reinvested.

- Management fees and other expenses gradually reduce the NAV over time.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is crucial for informed investment decisions. By monitoring the daily NAV, analyzing its fluctuations, and understanding the factors that influence it, investors can better track their investment performance, assess risk, and make strategic adjustments to their portfolio. Remember to regularly check the official sources for the most up-to-date Amundi DJIA UCITS ETF NAV information. Stay informed about your Amundi DJIA UCITS ETF NAV and its variations to maximize your investment potential.

Featured Posts

-

Change At The Top Guccis Supply Chain Leadership Transition

May 24, 2025

Change At The Top Guccis Supply Chain Leadership Transition

May 24, 2025 -

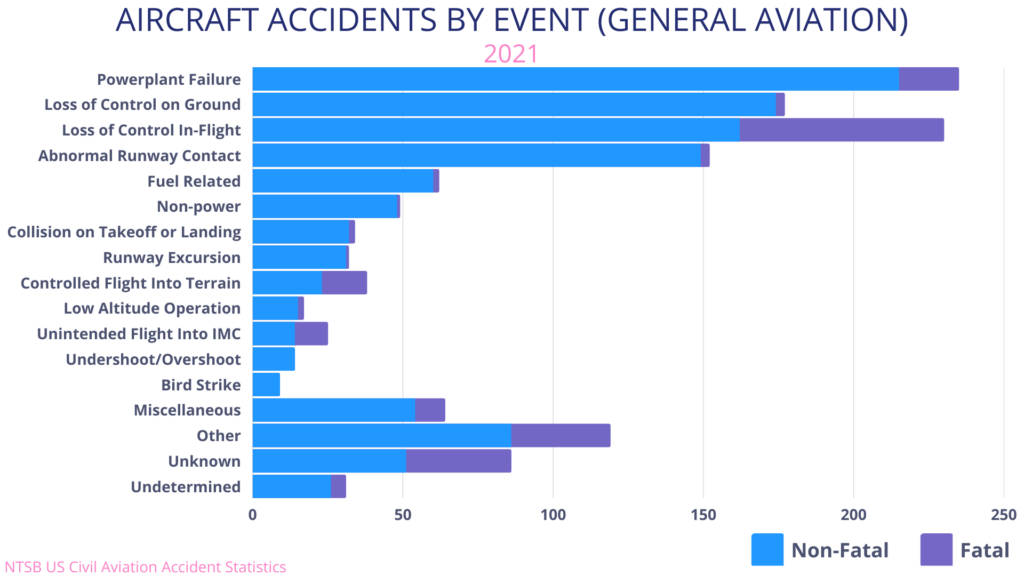

Close Calls And Crashes A Visual Exploration Of Airplane Safety

May 24, 2025

Close Calls And Crashes A Visual Exploration Of Airplane Safety

May 24, 2025 -

Over 100 Firearms Seized In Massachusetts Crackdown 18 Brazilian Nationals Charged

May 24, 2025

Over 100 Firearms Seized In Massachusetts Crackdown 18 Brazilian Nationals Charged

May 24, 2025 -

Hromadne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025

Hromadne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025 -

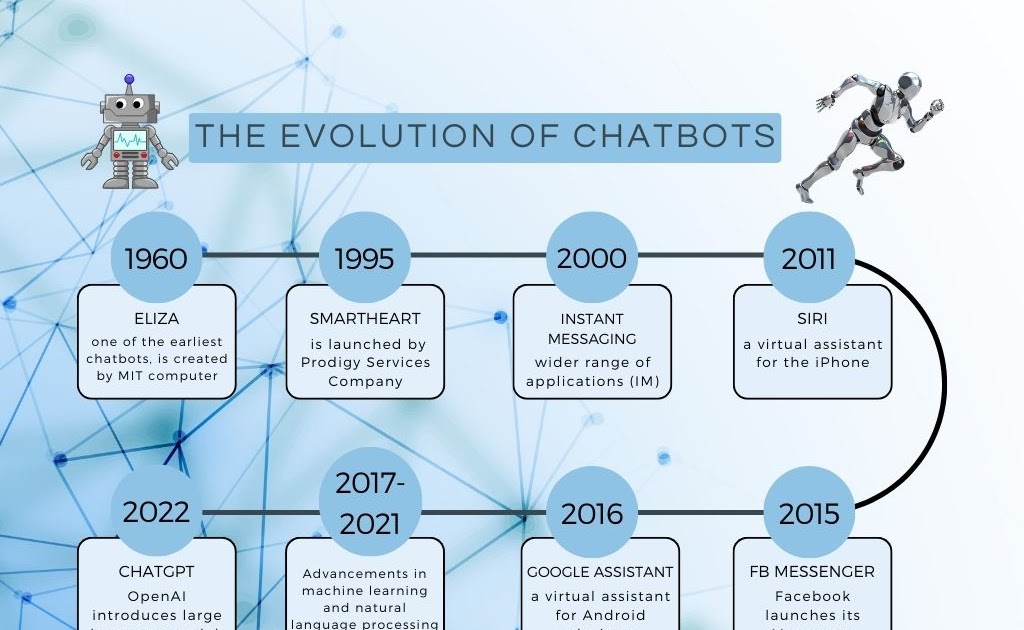

Legal Battle Over Character Ai Chatbots Is Their Speech Protected

May 24, 2025

Legal Battle Over Character Ai Chatbots Is Their Speech Protected

May 24, 2025