Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

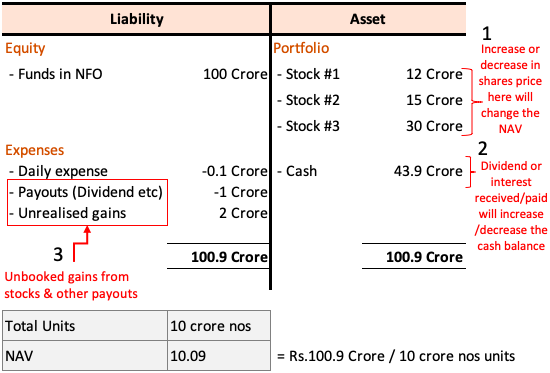

Net Asset Value (NAV) represents the true value of an ETF's underlying assets. For the Amundi DJIA UCITS ETF, this means the total value of its holdings in the 30 companies that make up the Dow Jones Industrial Average, less any liabilities such as management fees. It's crucial to understand that NAV differs from the market price of the ETF, which can fluctuate throughout the trading day due to supply and demand.

- NAV represents the net asset value per share. This means it shows the theoretical value of one share of the ETF.

- It's calculated daily by subtracting liabilities from the total value of the ETF’s assets. This daily calculation ensures the NAV reflects the current market value of the underlying holdings.

- NAV provides a transparent view of the ETF’s holdings. This allows investors to understand the composition of their investment.

- Understanding NAV helps investors assess the ETF’s performance accurately. It provides a more accurate picture than simply looking at the market price alone.

- Tracking NAV fluctuations helps in making informed buy/sell decisions. Significant deviations between NAV and market price can signal potential opportunities.

The importance of NAV lies in its role as a reliable indicator of the ETF's intrinsic value. By understanding and monitoring the NAV, investors can make more informed decisions and better assess the true performance of their investment.

How is the Amundi DJIA UCITS ETF NAV Calculated?

The Amundi DJIA UCITS ETF aims to replicate the performance of the Dow Jones Industrial Average. Its NAV calculation reflects this tracking methodology. The process generally involves:

- Daily valuation of the underlying Dow Jones Industrial Average components. The value of each of the 30 constituent stocks is determined at the end of the trading day.

- Consideration of currency exchange rates (if applicable). If the ETF holds assets denominated in currencies other than the base currency, exchange rates are factored into the calculation.

- Deduction of management fees and other expenses. These costs are subtracted from the total asset value to arrive at the net asset value.

- Calculation of NAV per share. The total net asset value is divided by the number of outstanding shares to determine the NAV per share.

- Publication of the daily NAV. The calculated NAV is typically published at the end of each trading day on Amundi's website and various financial data providers.

Understanding this process provides clarity on how the NAV is determined and helps investors interpret the reported value.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors can influence daily NAV changes for the Amundi DJIA UCITS ETF:

- Performance of the Dow Jones Industrial Average. The primary driver of NAV changes is the overall performance of the DJIA. A rising DJIA generally leads to a higher NAV, and vice-versa.

- Changes in the value of the underlying stocks. Individual stock price movements within the DJIA can affect the overall NAV.

- Currency fluctuations (if applicable). Exchange rate variations can impact the NAV if the ETF holds assets in different currencies.

- Management fees and expenses. These costs reduce the NAV over time.

- Dividend payments. Dividend payments from the underlying stocks will affect the NAV, typically decreasing it on the ex-dividend date.

Monitoring these factors provides insight into the potential for NAV fluctuations and allows investors to better anticipate changes in the ETF's value.

Accessing Amundi DJIA UCITS ETF NAV Information

Finding the daily NAV for the Amundi DJIA UCITS ETF is straightforward. Investors can access this information through several reliable sources:

- Amundi's official website: Amundi typically provides updated NAV information directly on its website, often within the ETF's fact sheet or dedicated pages.

- Major financial news websites: Many financial news sources, such as Bloomberg, Yahoo Finance, and Google Finance, provide real-time or near real-time NAV data for ETFs.

- Your brokerage account: Most brokerage platforms display the NAV of your held ETFs directly within your account summary.

- Dedicated ETF data providers: Specialized financial data providers offer comprehensive ETF information, including NAV data.

- Regular updates and potential time delays: Note that the availability and timeliness of NAV updates can vary depending on the source.

Using NAV to Make Informed Investment Decisions

The NAV of the Amundi DJIA UCITS ETF is a valuable tool for making informed investment decisions. It shouldn't be the sole factor, but it forms a crucial component of your analysis.

- Comparing NAV to market price to spot potential discrepancies. A significant difference between the NAV and the market price might present a buying or selling opportunity, although this requires further investigation.

- Using NAV to track long-term performance. Monitoring the NAV over time provides a clearer picture of the ETF’s performance relative to the Dow Jones Industrial Average.

- Considering NAV in risk management strategies. Understanding NAV fluctuations can help in assessing and managing risk effectively.

- Integrating NAV data into broader portfolio analysis. The NAV should be considered within the context of your overall investment portfolio.

- Seek professional financial advice when necessary. A financial advisor can help you interpret NAV data and integrate it into a broader investment plan.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is paramount for investors seeking efficient exposure to the Dow Jones Industrial Average. By carefully monitoring its NAV and considering the factors that influence it, investors can make better-informed decisions and manage their investments more effectively. Regularly review the Amundi DJIA UCITS ETF NAV and its relationship to the market price to optimize your investment strategy. Remember to consult a financial advisor before making any investment decisions. Learn more about the Amundi DJIA UCITS ETF and its NAV today!

Featured Posts

-

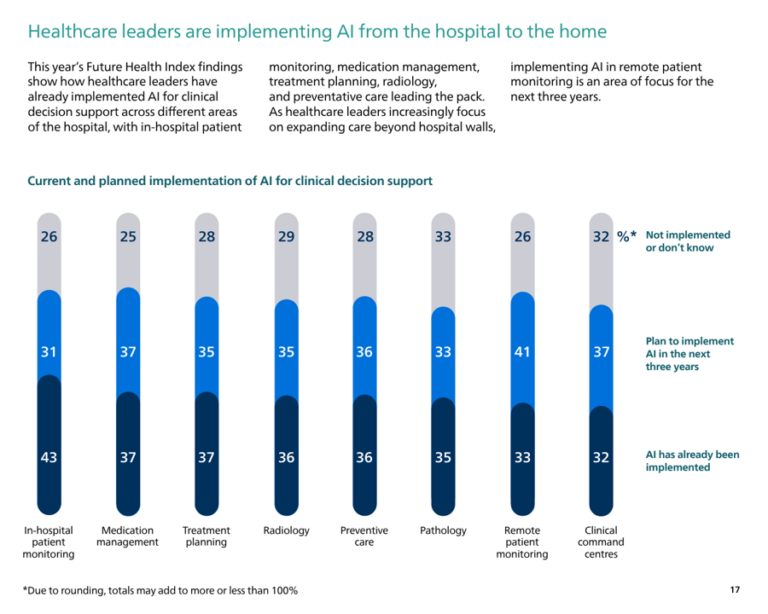

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025 -

Kharkovschina Svadebniy Den Pochti 40 Par Zaklyuchili Brak Foto

May 24, 2025

Kharkovschina Svadebniy Den Pochti 40 Par Zaklyuchili Brak Foto

May 24, 2025 -

Fatal Shop Stabbing Leads To Rearrest Of Previously Bailed Teen

May 24, 2025

Fatal Shop Stabbing Leads To Rearrest Of Previously Bailed Teen

May 24, 2025 -

What Happened Kyle Walker Mystery Women And Annie Kilners Home Return

May 24, 2025

What Happened Kyle Walker Mystery Women And Annie Kilners Home Return

May 24, 2025 -

Prayers For Today Show Anchor Amidst Extended Absence

May 24, 2025

Prayers For Today Show Anchor Amidst Extended Absence

May 24, 2025