Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an ETF's holdings per share. It's a crucial figure reflecting the total value of all the assets the ETF owns, minus any liabilities. Essentially, it shows you the intrinsic worth of your investment. Imagine the ETF holds shares of 30 companies; the NAV calculation sums the current market value of those shares, subtracts any expenses, and divides the result by the total number of outstanding ETF shares. This calculation provides the NAV per share.

- NAV is calculated daily, providing a snapshot of the ETF's value at the end of each trading day.

- It reflects the market value of all assets held by the ETF, including stocks, bonds, or other securities.

- The NAV is crucial for determining a fair price for the ETF shares. While the market price may fluctuate based on supply and demand, the NAV provides a benchmark of the ETF’s inherent value.

- Differences between the NAV and the market price are often due to the forces of supply and demand in the secondary market. A high demand can temporarily push the market price above the NAV, and vice versa.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily based on the closing prices of the 30 constituent companies of the Dow Jones Industrial Average. The ETF aims to replicate the performance of this index, so the NAV closely mirrors the index's value. The calculation process involves several key steps:

- Daily Valuation: The market value of each of the 30 Dow Jones Industrial Average components is determined at the close of the market.

- Currency Conversion: If the ETF holds assets in currencies other than the base currency of the ETF, appropriate exchange rates are applied.

- Expense Deduction: The ETF's operating expenses and management fees are deducted from the total asset value before calculating the NAV per share.

- Index Replication Methodology: Amundi utilizes a specific methodology for replicating the Dow Jones Industrial Average. Understanding whether it's full replication (holding all 30 stocks in the same proportion as the index) or sampling (holding a representative subset of the index components) can help understand potential tracking discrepancies.

The Importance of NAV for Amundi Dow Jones Industrial Average UCITS ETF Investors

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is vital for making informed investment decisions. Changes in the NAV directly reflect the performance of your investment and the underlying assets.

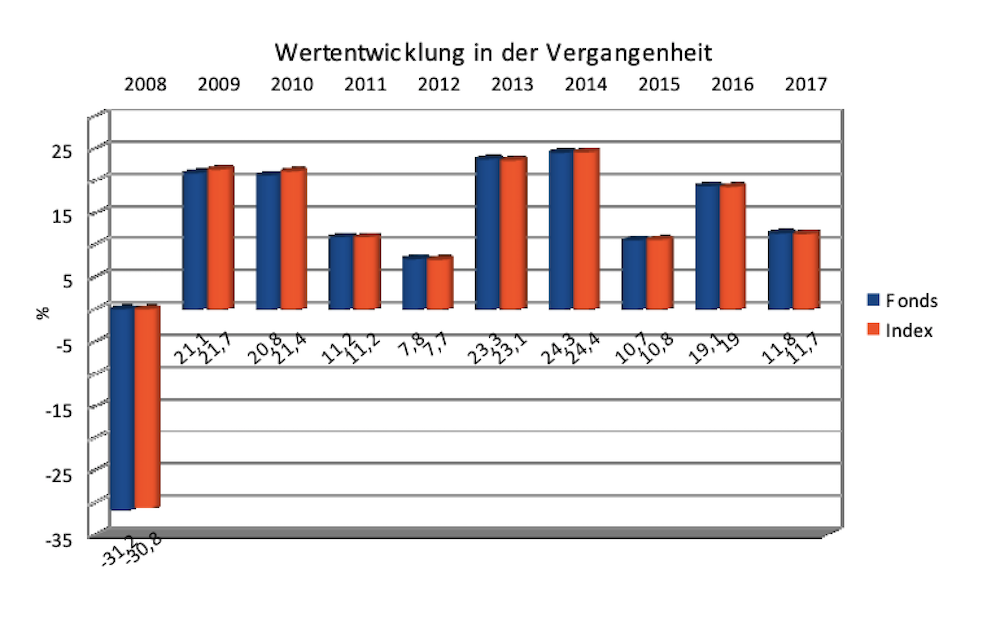

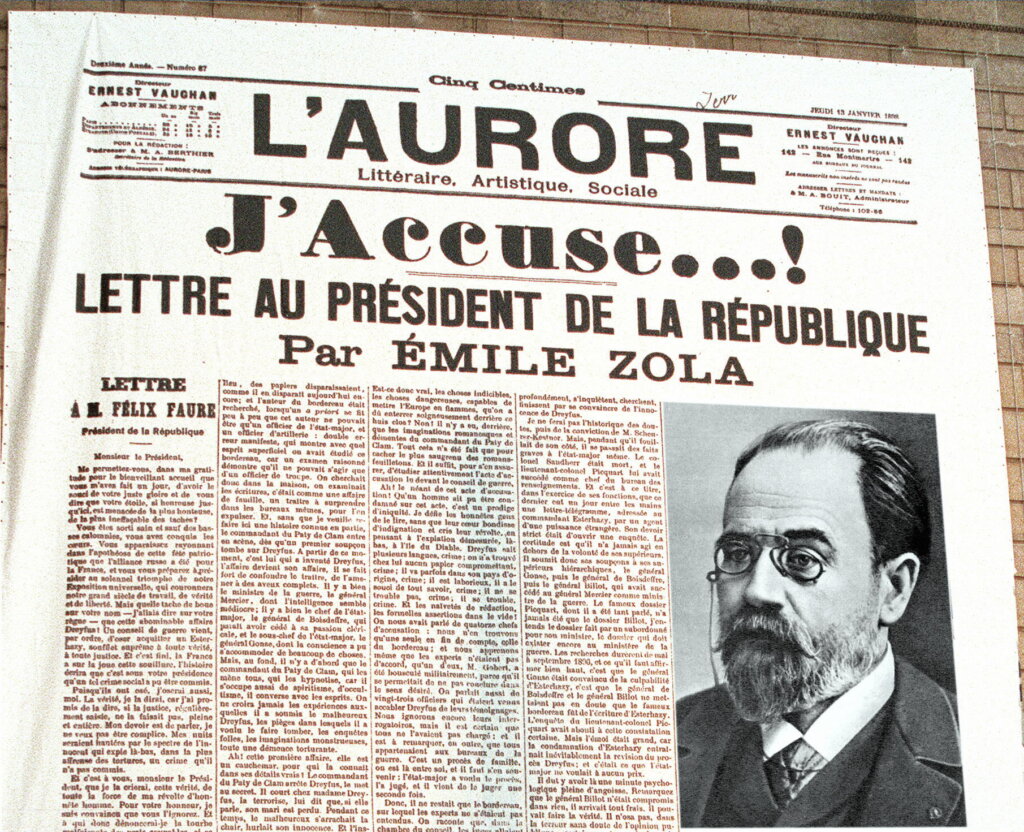

- Performance Tracking: Regularly checking the NAV allows you to track the performance of your investment over time.

- Benchmarking: Comparing the ETF's NAV performance to the Dow Jones Industrial Average itself helps assess how effectively the ETF tracks its benchmark index.

- Informed Decision-Making: Analyzing NAV trends can help you decide when to buy or sell your ETF shares based on your investment goals and risk tolerance.

- Market Fluctuation Awareness: Understanding how market fluctuations impact the NAV helps you anticipate potential changes in your investment’s value.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Amundi's Website: The ETF provider's official website is usually the most accurate and up-to-date source.

- Financial News Websites: Many reputable financial news sources provide real-time or delayed ETF NAV data.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV alongside other relevant information.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for any investor. By regularly monitoring the NAV, you can effectively track performance, benchmark against the index, and make informed investment decisions. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and how to monitor its Net Asset Value to make informed investment decisions. Regularly check the Amundi Dow Jones Industrial Average UCITS ETF's NAV for optimal portfolio management.

Featured Posts

-

Joy Crookes Unveils Haunting New Track I Know You D Kill Listen Now

May 24, 2025

Joy Crookes Unveils Haunting New Track I Know You D Kill Listen Now

May 24, 2025 -

Prezzi Abbigliamento Usa L Influenza Dei Dazi Sulle Importazioni

May 24, 2025

Prezzi Abbigliamento Usa L Influenza Dei Dazi Sulle Importazioni

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekent Dit Voor Beleggers

May 24, 2025 -

France To Rehabilitate Dreyfus Parliament Debates Posthumous Promotion

May 24, 2025

France To Rehabilitate Dreyfus Parliament Debates Posthumous Promotion

May 24, 2025 -

Demna Gvasalia Transforming Guccis Creative Direction

May 24, 2025

Demna Gvasalia Transforming Guccis Creative Direction

May 24, 2025

Latest Posts

-

Heineken Tops Revenue Projections Tariff Concerns And Future Outlook

May 24, 2025

Heineken Tops Revenue Projections Tariff Concerns And Future Outlook

May 24, 2025 -

Mercato Azionario Europeo La Fed E Le Prospettive Per Le Banche Italiane

May 24, 2025

Mercato Azionario Europeo La Fed E Le Prospettive Per Le Banche Italiane

May 24, 2025 -

Heineken Exceeds Revenue Expectations Maintains Outlook Despite Tariffs

May 24, 2025

Heineken Exceeds Revenue Expectations Maintains Outlook Despite Tariffs

May 24, 2025 -

Analisi Borsa Impatto Decisioni Fed Su Piazza Affari

May 24, 2025

Analisi Borsa Impatto Decisioni Fed Su Piazza Affari

May 24, 2025 -

Amsterdam Stock Market Plummets 7 At Open Trade War Weighs Heavily

May 24, 2025

Amsterdam Stock Market Plummets 7 At Open Trade War Weighs Heavily

May 24, 2025