Amundi Dow Jones Industrial Average UCITS ETF: A NAV Deep Dive

Table of Contents

What is the Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, all divided by the number of outstanding shares. Understanding the NAV is crucial for evaluating an ETF's true worth.

-

Components of NAV: The NAV calculation involves two key components:

- Assets: These comprise the market value of all the securities held within the ETF, in this case, the 30 stocks comprising the Dow Jones Industrial Average.

- Liabilities: These are the ETF's expenses, including management fees and other operational costs.

-

Daily NAV Calculation: The Amundi Dow Jones Industrial Average UCITS ETF's NAV is calculated daily, typically at the close of the market. This involves determining the closing prices of all 30 constituent stocks of the DJIA, summing their values, deducting liabilities, and then dividing by the total number of outstanding ETF shares.

-

Market Fluctuations and NAV: The NAV directly reflects the performance of the underlying Dow Jones Industrial Average. When the DJIA rises, the ETF's NAV generally increases, and vice versa. This daily fluctuation makes understanding the NAV crucial for daily price tracking.

-

NAV vs. Market Price: While closely related, the NAV and the market price of an ETF can differ slightly. The market price reflects the price at which the ETF is currently trading on the exchange, influenced by supply and demand. Discrepancies between NAV and market price are often minor but can exist.

-

Keyword Optimization: This section utilizes keywords like "NAV calculation," "ETF NAV," "Daily NAV," "Amundi ETF NAV," and "Dow Jones ETF NAV" to improve search engine optimization.

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF's NAV Performance

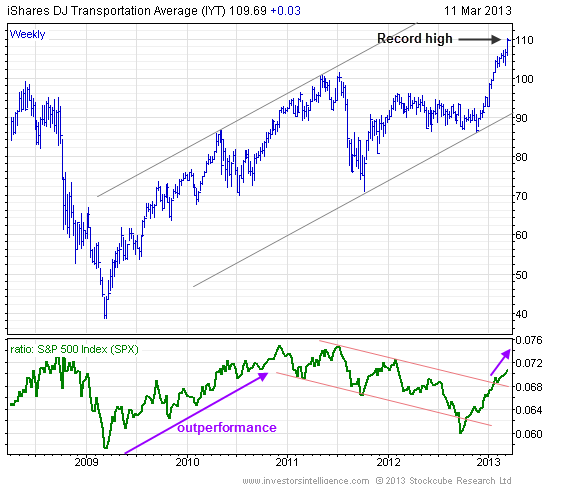

Analyzing historical NAV data is essential for understanding the ETF's long-term performance and potential risks. (Insert a chart or graph showcasing historical NAV data here. The chart should clearly show the NAV's performance over time, ideally with comparisons to the Dow Jones Industrial Average itself.)

-

Trends and Patterns: The chart (above) reveals the historical NAV performance, highlighting any upward or downward trends, periods of volatility, and significant events impacting performance. Analyzing these trends can provide insights into the ETF's overall growth and risk profile.

-

Comparison to DJIA: Comparing the ETF's NAV performance to that of the Dow Jones Industrial Average itself reveals the effectiveness of the tracking. Ideally, the ETF's NAV should closely mirror the DJIA’s movements. Any significant deviation should be investigated.

-

Influencing Factors: Several factors influence NAV fluctuations:

- Market Conditions: Broad market trends (bull or bear markets) heavily influence the DJIA, and subsequently, the ETF's NAV.

- Economic Indicators: Macroeconomic indicators like inflation, interest rates, and GDP growth can significantly impact the performance of the DJIA components and the ETF's NAV.

- Geopolitical Events: Unexpected geopolitical events can cause market volatility, leading to fluctuations in the ETF's NAV.

-

Keyword Optimization: This section uses keywords like "Amundi Dow Jones ETF NAV performance," "historical NAV," "Dow Jones Industrial Average performance," "ETF NAV chart," and "NAV trends."

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Numerous factors contribute to the Amundi Dow Jones Industrial Average UCITS ETF's NAV. Understanding these factors is crucial for informed investment decisions.

-

Underlying Assets (DJIA Components): The performance of the 30 companies comprising the Dow Jones Industrial Average directly affects the ETF's NAV. Strong performance by these companies leads to a higher NAV, and vice versa.

-

Currency Fluctuations: If the ETF is denominated in a currency different from your home currency, exchange rate fluctuations can impact your return, affecting the NAV in your local currency.

-

Management Fees and Expenses: The ETF's management fees and operating expenses are deducted from the assets, directly impacting the NAV. A higher expense ratio will generally result in a lower NAV.

-

Dividend Payouts: When the companies within the DJIA pay dividends, the ETF receives these dividends, which, after deducting expenses, generally increase the NAV.

-

Keyword Optimization: Keywords like "NAV drivers," "DJIA impact on NAV," "currency risk," "expense ratio," and "dividend impact" are strategically incorporated.

Investing in the Amundi Dow Jones Industrial Average UCITS ETF: NAV Considerations

Understanding the NAV is paramount for successful investment in the Amundi Dow Jones Industrial Average UCITS ETF.

-

Investment Decision-Making: Regularly monitoring the NAV provides insights into the ETF's performance, helping investors determine whether the investment aligns with their financial goals. Comparing the current NAV to the purchase price helps assess the realized gains or losses.

-

Benefits of NAV Monitoring: Tracking the NAV helps investors make informed buy or sell decisions, optimizing their portfolio performance. Significant deviations from expected NAV based on market movements might warrant further investigation.

-

NAV alongside Other Metrics: While crucial, the NAV should be considered alongside other investment metrics such as the price-to-earnings ratio (P/E) of the underlying companies, dividend yield, and overall market sentiment.

-

Potential Risks: Investing in ETFs carries risks, including NAV fluctuations. Market downturns can lead to substantial NAV declines, impacting investors' returns. Diversification and a long-term investment horizon are recommended to mitigate these risks.

-

Keyword Optimization: This section utilizes keywords such as "Amundi Dow Jones ETF investment," "NAV monitoring," "ETF investment strategy," "risk management," and "NAV analysis."

Conclusion: Key Takeaways and Call to Action

The Amundi Dow Jones Industrial Average UCITS ETF's NAV is a critical indicator of its performance and reflects the value of its underlying assets. Understanding its calculation, analyzing historical trends, and recognizing the factors influencing its fluctuations are crucial for making informed investment decisions. Regular NAV monitoring, combined with a thorough understanding of market conditions and the ETF's expense ratio, is essential for successfully managing your investment in this type of index tracking ETF.

To learn more about the Amundi Dow Jones Industrial Average UCITS ETF's NAV and its implications for your investment strategy, explore resources like the ETF's fact sheet and consult with a qualified financial advisor. Remember, understanding the NAV is a key step towards investing wisely in the Amundi Dow Jones Industrial Average UCITS ETF and similar Dow Jones Industrial Average ETFs. Make informed decisions and build a robust investment portfolio.

Featured Posts

-

The Kyle Walker Milan Party New Revelations Following Wife Annie Kilners Return To Uk

May 24, 2025

The Kyle Walker Milan Party New Revelations Following Wife Annie Kilners Return To Uk

May 24, 2025 -

Duisburg Essen Universitaet Im Fokus Wegen Notenbestechung

May 24, 2025

Duisburg Essen Universitaet Im Fokus Wegen Notenbestechung

May 24, 2025 -

The China Factor Assessing Risks And Opportunities For Premium Auto Brands Like Bmw And Porsche

May 24, 2025

The China Factor Assessing Risks And Opportunities For Premium Auto Brands Like Bmw And Porsche

May 24, 2025 -

Ihanet Edildiginde Aninda Intikam Alan Burclar

May 24, 2025

Ihanet Edildiginde Aninda Intikam Alan Burclar

May 24, 2025 -

News Corp Undervalued Business Units And Investment Potential

May 24, 2025

News Corp Undervalued Business Units And Investment Potential

May 24, 2025