Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV And Its Significance

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is an index fund that tracks the performance of the iconic Dow Jones Industrial Average (DJIA). But what does that actually mean? Let's break it down. "UCITS" stands for Undertakings for Collective Investment in Transferable Securities, a European Union regulatory framework ensuring high standards of investor protection. This means the ETF operates under strict regulatory oversight, providing a layer of security for investors.

The ETF's investment strategy is straightforward: it aims to replicate the composition and performance of the DJIA. This is known as index tracking, a passive investment approach that seeks to mirror the returns of a specific market index. The advantage? Lower costs compared to actively managed funds, which require skilled fund managers to select individual stocks.

- UCITS Regulatory Benefits: UCITS ETFs benefit from harmonized regulations across the EU, simplifying cross-border investment.

- Index Tracking Advantages: Low management fees, diversification across 30 major US companies, and generally lower risk compared to individual stock picking.

- Underlying Assets: The ETF holds shares in the 30 companies that make up the Dow Jones Industrial Average, providing broad exposure to the US economy.

- Comparison with Actively Managed Funds: While actively managed funds aim to outperform the market, they typically come with higher fees and may not always achieve their goals. Index funds like this Amundi ETF offer a more predictable, cost-effective way to gain market exposure.

Understanding Daily NAV and its Calculation

The daily NAV (Net Asset Value) represents the value of one share of the Amundi Dow Jones Industrial Average UCITS ETF at the end of each trading day. It's calculated by taking the total market value of all the ETF's assets (the shares of the 30 DJIA companies) and dividing it by the total number of outstanding ETF shares.

-

Step-by-Step NAV Calculation (Simplified):

- Determine the closing market price of each of the 30 DJIA stocks.

- Multiply each stock's closing price by the number of shares of that stock held by the ETF.

- Sum up the values obtained in step 2 to get the total asset value.

- Divide the total asset value by the total number of outstanding ETF shares. The result is the NAV.

-

Influence of Market Movements: Daily fluctuations in the prices of the underlying DJIA stocks directly impact the ETF's NAV. A rise in the DJIA generally leads to a higher NAV, while a fall results in a lower NAV.

-

NAV vs. Market Price: The NAV is not always identical to the ETF's market price (the price at which you can buy or sell the ETF on an exchange). A small difference, often referred to as the bid-ask spread, exists due to market supply and demand.

-

Where to Find Daily NAV: You can usually find the daily NAV on the Amundi ETF's official website, major financial news websites (like Yahoo Finance or Google Finance), and through your brokerage platform.

The Significance of Daily NAV for Investors

Monitoring the daily NAV is critical for making informed investment decisions. It helps you track your investment's performance and manage your portfolio effectively.

-

Monitoring Investment Performance: The daily NAV allows you to see how your investment is performing on a day-to-day basis, providing a clear picture of gains or losses.

-

Making Buy/Sell Decisions: While timing the market is risky, observing trends in the NAV can inform your decisions. A significant and sustained drop might trigger a re-evaluation of your investment strategy. (Consult a financial advisor before making any major investment decisions).

-

Calculating Returns and Profits/Losses: By comparing the initial purchase price with the current NAV, you can easily calculate your returns.

-

Portfolio Rebalancing Strategies: Regular monitoring of the NAV can inform your rebalancing strategy, ensuring your portfolio remains aligned with your investment goals.

-

Understanding Risk Exposure: Consistent monitoring of NAV fluctuations helps assess your risk tolerance and adjust your strategy accordingly.

Accessing and Interpreting Daily NAV Data

Reliable sources for daily NAV data include:

- The Amundi ETF Website: The official source for the most accurate and up-to-date information.

- Financial News Websites: Major financial news providers usually publish ETF NAV data.

- Brokerage Platforms: Your brokerage account will display the NAV of your holdings. Always check the data's timestamp to ensure you are using the most recent information.

Conclusion

The Amundi Dow Jones Industrial Average UCITS ETF offers a straightforward way to gain exposure to the Dow Jones Industrial Average. Understanding the daily NAV, its calculation, and its significance is vital for successful investing. By regularly monitoring the daily NAV, you can effectively track your investment's performance, make informed decisions, and manage your risk appropriately. Stay informed about the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF for successful investing! Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Wta Italian Open Chinese Tennis Ace Advances

May 25, 2025

Wta Italian Open Chinese Tennis Ace Advances

May 25, 2025 -

Dazi Trump Sul Tessile Analisi Dell Impatto Su Nike E Lululemon

May 25, 2025

Dazi Trump Sul Tessile Analisi Dell Impatto Su Nike E Lululemon

May 25, 2025 -

Melanie Thierry Et Raphael Parentalite Et Difference D Age Entre Leurs Enfants

May 25, 2025

Melanie Thierry Et Raphael Parentalite Et Difference D Age Entre Leurs Enfants

May 25, 2025 -

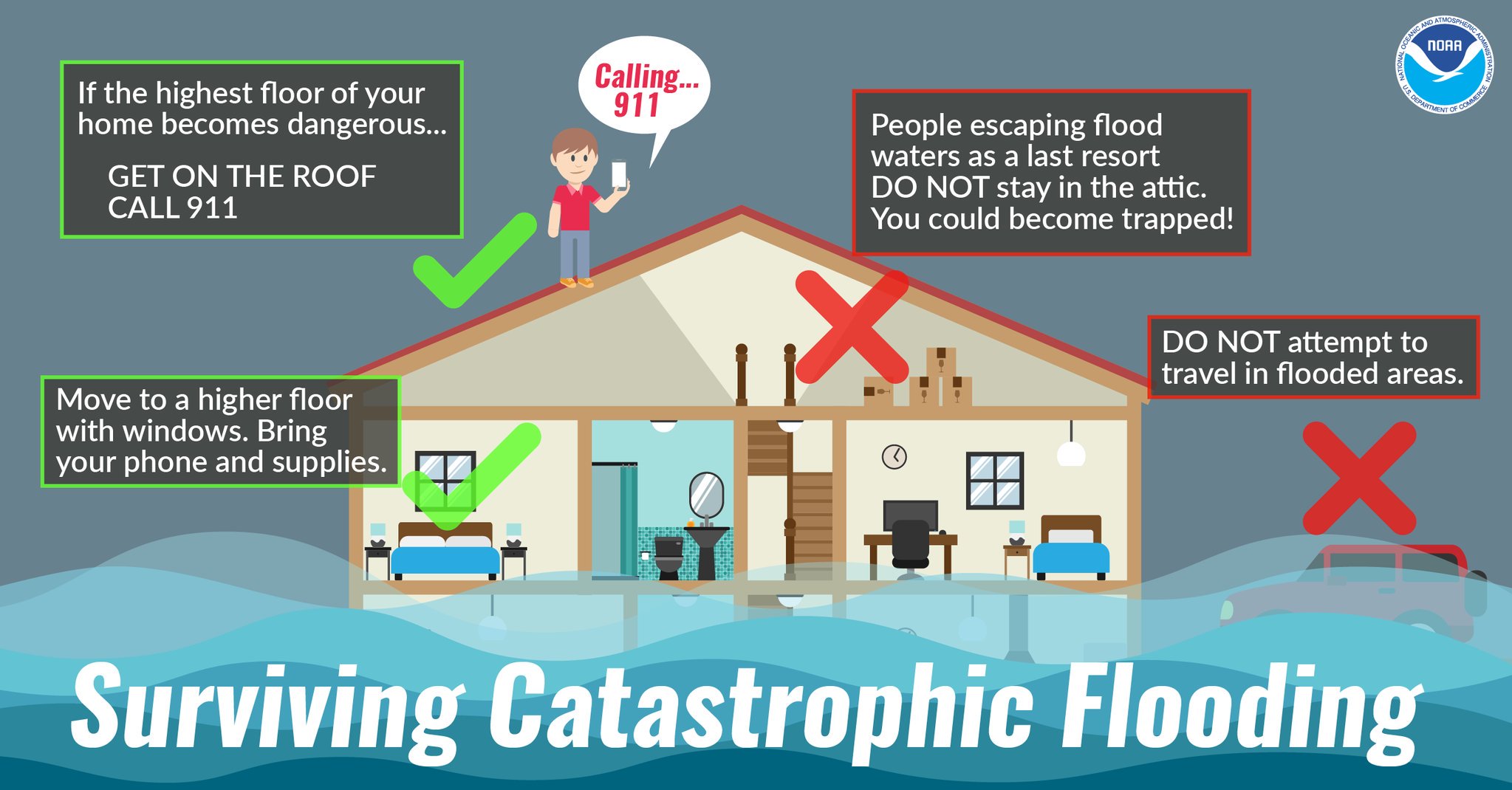

Navigating Flood Alerts Staying Safe During Flood Events

May 25, 2025

Navigating Flood Alerts Staying Safe During Flood Events

May 25, 2025 -

Wedbushs Apple Outlook Bullish Despite Price Target Reduction

May 25, 2025

Wedbushs Apple Outlook Bullish Despite Price Target Reduction

May 25, 2025