Amundi Dow Jones Industrial Average UCITS ETF: NAV And Investment Decisions

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF represents the net value of its underlying assets per share. This value is calculated daily by taking the total market value of all the holdings (the 30 constituent companies of the Dow Jones Industrial Average), subtracting any liabilities, and then dividing by the total number of outstanding ETF shares. This calculation provides a snapshot of the ETF's intrinsic worth.

Several factors influence the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF's NAV. The primary driver is the movement of the Dow Jones Industrial Average itself. If the index rises, the NAV of the ETF generally rises as well, and vice versa. Currency fluctuations can also play a role, especially if the ETF holds assets denominated in currencies other than the base currency of the ETF.

- Daily NAV Calculation Process: The NAV is typically calculated at the end of each trading day, reflecting the closing prices of the underlying stocks.

- Factors Affecting NAV Fluctuations: Changes in the prices of the Dow Jones Industrial Average components, currency exchange rates, and dividend payouts from the underlying companies all impact the NAV.

- Understanding Premium/Discount to NAV: The market price of the ETF can sometimes trade at a slight premium or discount to its NAV. This is usually minimal for liquid ETFs like this one, but it’s important to be aware of the difference.

- Importance of Monitoring NAV Changes: Regularly monitoring NAV changes helps investors track the ETF's performance and assess its overall health.

Analyzing NAV Trends for Informed Investment Decisions

Analyzing historical NAV data is essential for evaluating the Amundi Dow Jones Industrial Average UCITS ETF's performance and informing investment decisions. By charting the NAV over time, investors can identify upward and downward trends, providing insights into the ETF's growth trajectory. Comparing the ETF's NAV performance against the Dow Jones Industrial Average itself allows for assessment of the tracking accuracy of the fund.

The approach to NAV analysis differs based on investment horizons. Long-term investors may focus on the overall upward trend, while short-term traders might scrutinize more immediate NAV movements. However, relying solely on short-term NAV fluctuations for trading decisions is risky. A thorough risk assessment, considering factors like market volatility and personal risk tolerance, is crucial regardless of your investment timeframe.

- Analyzing Historical NAV Charts: Use charting tools to visualize NAV trends and identify significant changes.

- Identifying Upward and Downward Trends: Recognizing these trends allows for identifying potential entry and exit points, though timing the market is inherently challenging.

- Comparing Performance to the Dow Jones Industrial Average: This comparison assesses the ETF's effectiveness in tracking the index.

- Assessing Risk Tolerance Based on NAV Volatility: Highly volatile NAV movements suggest higher risk, which must align with an investor's risk profile.

The Role of NAV in Diversification Strategies

The Amundi Dow Jones Industrial Average UCITS ETF plays a significant role in portfolio diversification. By investing in this ETF, investors gain exposure to a basket of large, well-established US companies, reducing the risk associated with investing in individual stocks. Monitoring the NAV alongside other asset classes within a portfolio helps in assessing overall risk and return.

The ETF's passive investment strategy, mirroring the Dow Jones Industrial Average, offers simplicity and cost-effectiveness compared to actively managed funds. By comparing the NAV performance of the ETF against other asset classes like bonds or real estate, investors can optimize their asset allocation for a balanced risk-return profile.

- How the ETF Contributes to a Diversified Portfolio: It adds a large-cap US equity component, reducing overall portfolio volatility.

- The Benefits of Passive Investing with this ETF: Lower expense ratios and simplified investment management.

- Comparing NAV Performance Against Other Asset Classes: Helps in optimizing asset allocation within a diversified portfolio.

Practical Applications: Using NAV for Investment Decisions

While NAV shouldn't be the sole determinant of investment timing, it provides valuable insights. For example, a significant dip in NAV might present a buying opportunity for long-term investors, provided their analysis supports it. Conversely, a sustained period of high NAV could signal a potential time to rebalance or partially sell, depending on individual circumstances and risk tolerance. However, trying to precisely time the market based solely on short-term NAV fluctuations is generally discouraged.

A long-term perspective is crucial. Rather than focusing on daily NAV movements, investors should concentrate on the bigger picture, aligning their investments with their financial goals and risk tolerance. Stop-loss orders can be used to limit potential losses if the NAV falls below a predetermined threshold.

- Examples of Using NAV to Guide Investment Timing: Buying during periods of lower NAV and potentially selling at higher NAV points.

- The Limitations of Market Timing Based on NAV: It's incredibly difficult to consistently predict short-term market movements accurately.

- The Importance of a Long-Term Investment Horizon: Focusing on long-term growth rather than short-term fluctuations.

- The Role of Stop-Loss Orders in Risk Management: Setting a price point at which to automatically sell, mitigating potential losses.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is vital for making informed investment decisions. Analyzing both short-term and long-term NAV trends, combined with a thorough understanding of your own risk tolerance and investment goals, provides a solid foundation for successful investing. Remember to consider the ETF's role within a broader, diversified portfolio.

Make informed decisions about the Amundi Dow Jones Industrial Average UCITS ETF by diligently monitoring its NAV and understanding its implications for your portfolio. However, it is always advisable to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Us Band Announces Glastonbury Performance Unofficial Confirmation

May 24, 2025

Us Band Announces Glastonbury Performance Unofficial Confirmation

May 24, 2025 -

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025

How To Get Tickets For Bbc Radio 1s Big Weekend

May 24, 2025 -

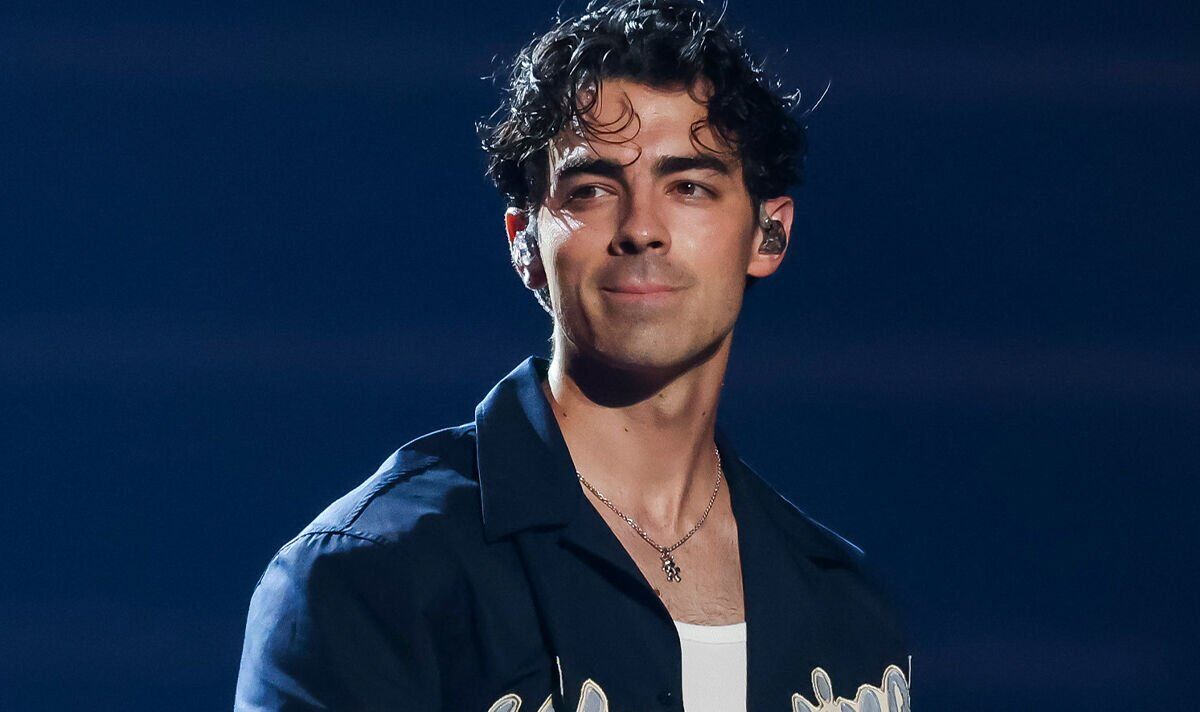

Joe Jonas Responds To Couples Argument About Him

May 24, 2025

Joe Jonas Responds To Couples Argument About Him

May 24, 2025 -

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025 -

Vash Personalniy Goroskop I Predskazaniya

May 24, 2025

Vash Personalniy Goroskop I Predskazaniya

May 24, 2025