Amundi MSCI All Country World UCITS ETF USD Acc: How To Interpret The NAV

Table of Contents

What is Net Asset Value (NAV)?

The Net Asset Value (NAV) of an ETF represents the total value of its underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means the NAV reflects the collective value of all the stocks and other assets held within the ETF, mirroring the MSCI All Country World Index, a benchmark tracking the performance of a broad range of global equities. Understanding NAV calculation is essential for evaluating ETF valuation.

-

Daily NAV Calculation: The NAV is calculated daily, typically at the end of the trading day, reflecting the closing prices of the underlying assets. This process involves valuing each holding within the ETF's portfolio based on the market prices at that time.

-

Factors Influencing NAV: Several factors can influence the daily NAV, including:

- Market Fluctuations: Changes in the prices of the underlying stocks significantly impact the ETF's NAV. A rising market generally leads to a higher NAV, while a falling market leads to a lower NAV.

- Currency Exchange Rates: As the ETF holds assets in various currencies, fluctuations in exchange rates can influence the overall NAV, particularly for investors holding shares in a different currency.

- Dividend Distributions: When underlying companies pay dividends, the ETF receives these payments, which are then either reinvested or distributed to shareholders, impacting the NAV.

-

Difference Between NAV and Market Price: The NAV and the market price of an ETF might differ slightly. This discrepancy is usually small and can be attributed to supply and demand in the market, trading costs, and other market factors. The NAV provides a more fundamental valuation.

How to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. You can access this information from several reliable sources:

-

Amundi's Official Website: Check the official Amundi website [insert link here if available]. Look for the ETF's fact sheet or pricing information section. You'll typically find the latest NAV clearly displayed.

-

Financial Data Providers: Reputable financial data providers, such as Bloomberg, Yahoo Finance, and Google Finance, usually list real-time or end-of-day NAVs for major ETFs. Search for the ETF's ticker symbol to find the information.

-

Your Brokerage Account: Most online brokerage platforms display the NAV (and market price) of your holdings directly within your account dashboard. Check your account's portfolio section for the most up-to-date NAV.

Interpreting the NAV for Investment Decisions

Tracking changes in the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc allows you to monitor your investment's performance over time.

-

Tracking Performance: By regularly checking the NAV (daily, weekly, monthly, or yearly), you can see how your investment is growing (or declining) in value. This data provides a clear picture of your returns.

-

Comparing to Benchmarks: Compare the NAV's growth to the MSCI All Country World Index, the ETF's benchmark. This comparison will show how well the ETF is performing relative to the broader global market. A consistent outperformance suggests strong management.

-

Making Buy/Sell Decisions Based on NAV: While NAV is a key factor, it shouldn't be the only factor influencing your buy/sell decisions. Consider other market conditions, your investment goals, and risk tolerance before making any transactions.

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc's NAV in Context

While the NAV is crucial, don't overlook other key factors:

-

Expense Ratio and Fees Impact: The ETF's expense ratio (management fees) will impact your overall returns. A higher expense ratio means a smaller proportion of your investment's growth will be realized.

-

Importance of Diversification: The Amundi MSCI All Country World UCITS ETF USD Acc offers global diversification across numerous markets and sectors. This diversification helps mitigate risk, a critical factor regardless of NAV performance.

Conclusion: Mastering the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is essential for effective investment management. By knowing how to find and interpret the NAV, and by considering it alongside other relevant factors like expense ratios and diversification, you can make more informed investment decisions. Regularly monitoring the NAV, along with other key performance indicators, will empower you to track your investment's progress and adjust your strategy accordingly. Continue your research into ETF investing to further enhance your understanding and build a successful investment portfolio.

Featured Posts

-

Living The Dream Your Escape To The Country Awaits

May 25, 2025

Living The Dream Your Escape To The Country Awaits

May 25, 2025 -

Trumps Demands Forcing A Deal From Republicans

May 25, 2025

Trumps Demands Forcing A Deal From Republicans

May 25, 2025 -

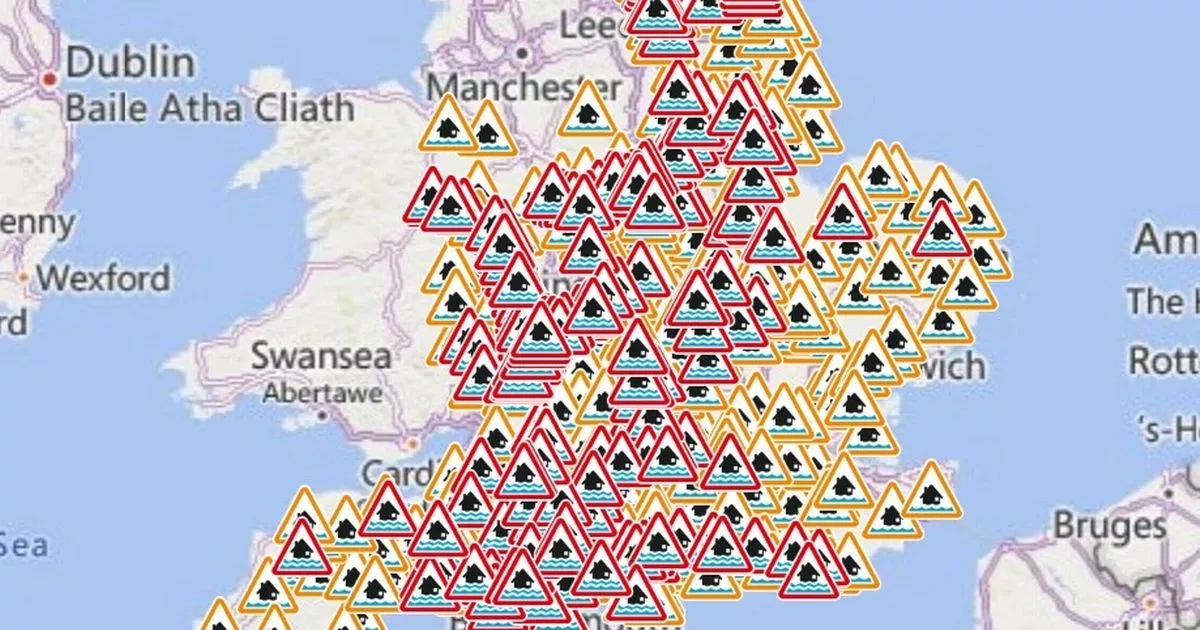

Flood Alerts Types Meaning And How To Prepare

May 25, 2025

Flood Alerts Types Meaning And How To Prepare

May 25, 2025 -

Naomi Kempbell Efektna Poyava U Biliy Tunitsi Na Shou Biznes Zakhodi V Londoni

May 25, 2025

Naomi Kempbell Efektna Poyava U Biliy Tunitsi Na Shou Biznes Zakhodi V Londoni

May 25, 2025 -

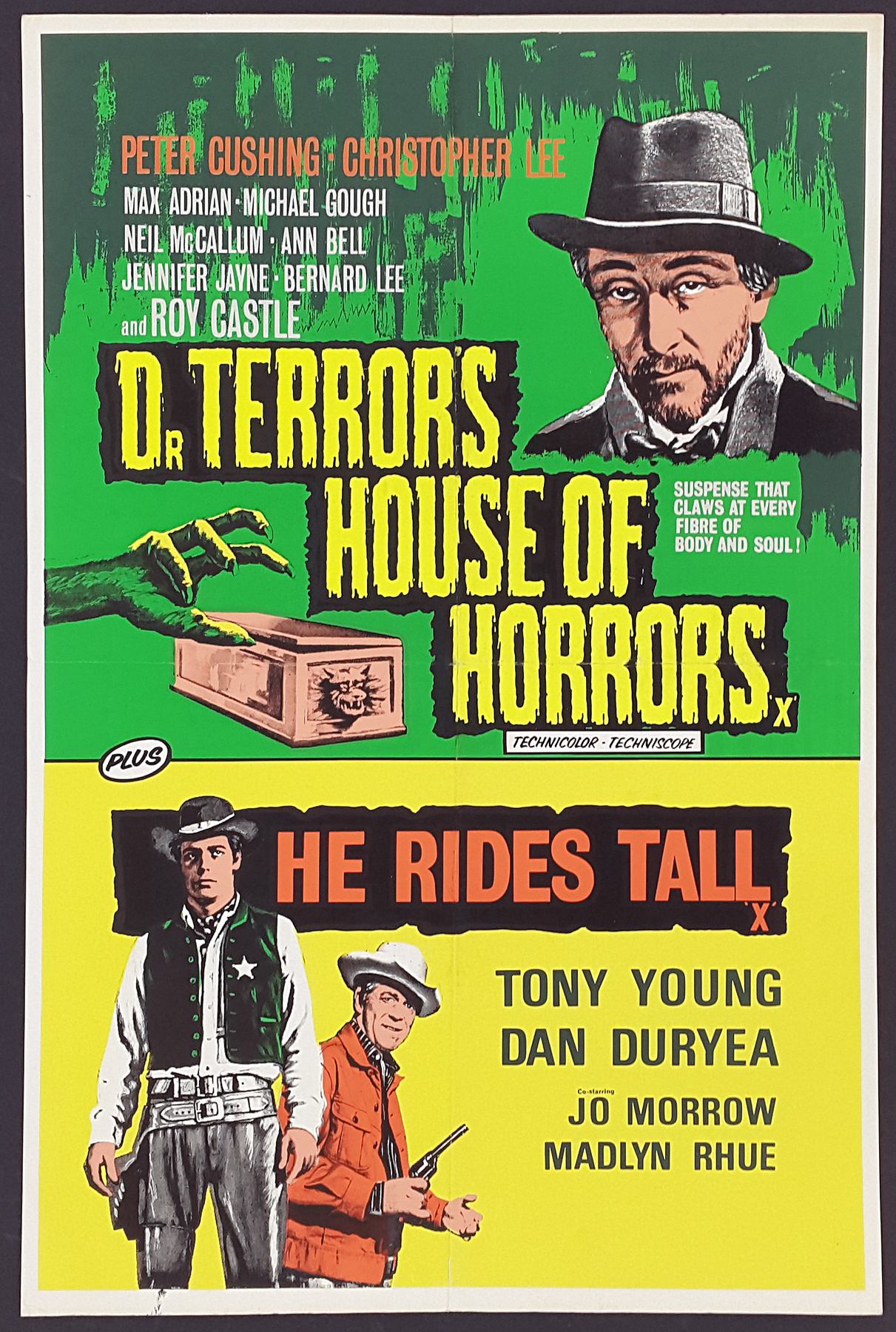

Conquering Dr Terrors House Of Horrors Tips And Tricks

May 25, 2025

Conquering Dr Terrors House Of Horrors Tips And Tricks

May 25, 2025