Amundi MSCI All Country World UCITS ETF USD Acc: NAV Calculation And Implications

Table of Contents

Understanding the Amundi ETF and its Composition

The Amundi ETF aims to track the performance of the MSCI All Country World Index, providing investors with broad exposure to a wide range of global equities. This means your investment is diversified across developed and emerging markets, offering a potentially robust portfolio against localized economic downturns. Understanding the ETF's holdings is paramount for comprehending its NAV calculation, as the value of these underlying assets directly impacts the NAV.

- Wide range of global equities: The ETF invests in thousands of companies across numerous sectors and geographies.

- Exposure to developed and emerging markets: This diversification mitigates risk associated with investing in a single country or region.

- Currency exposure (USD Acc): The "USD Acc" designation means the ETF's NAV is calculated in US dollars. This is important because fluctuations in exchange rates will directly impact the value reported in other currencies.

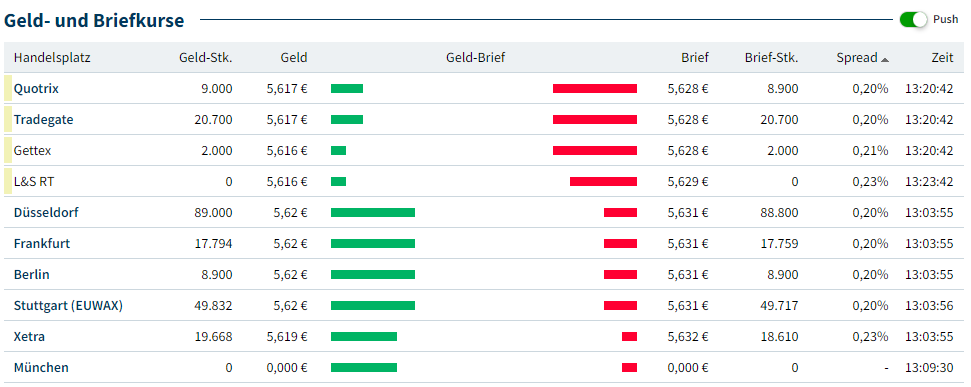

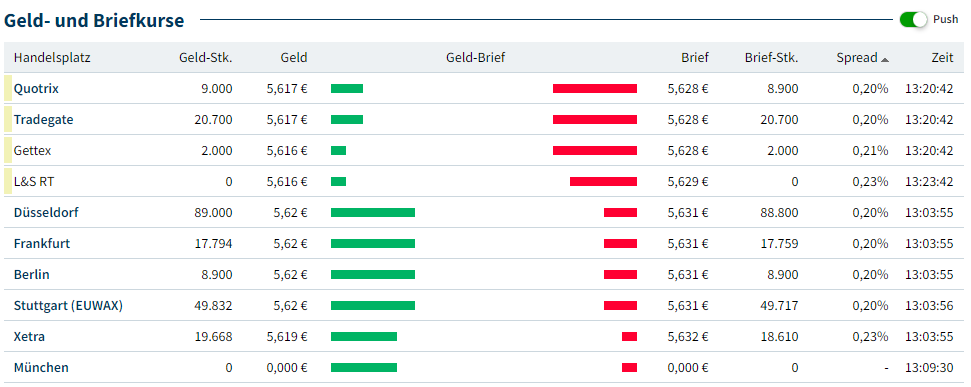

The NAV Calculation Process for the Amundi ETF

The NAV of the Amundi ETF, like all ETFs, is calculated using a fundamental formula: Total Assets - Total Liabilities. Let's break down each component:

Total Assets: This includes the total market value of all the securities held within the ETF, along with any accrued income, such as dividends received from underlying companies. The market value is determined by the closing prices of the assets on the relevant exchange.

Total Liabilities: This encompasses all the ETF's expenses and obligations. This primarily includes management fees, operating expenses, and any payable amounts.

- Daily market value updates of underlying assets: The NAV is typically calculated daily, reflecting the current market prices of the holdings.

- Impact of currency exchange rates: As mentioned, the USD Acc designation means that the NAV is calculated in US dollars. This means currency exchange rates influence the value of non-USD holdings when converting them to USD for NAV calculation.

- Inclusion of dividends and other income: Any dividends or other income received by the ETF is added to the total assets before NAV calculation.

- Deduction of management fees and expenses: The ETF's expenses are subtracted from the total assets to arrive at the net asset value.

Impact of Currency Fluctuations on NAV

Changes in exchange rates between the US dollar and other currencies significantly affect the Amundi ETF's NAV. If the US dollar strengthens against other currencies, the USD value of the non-USD holdings will increase, boosting the NAV. Conversely, a weakening US dollar will decrease the USD value of these holdings, reducing the NAV.

- Hedging strategies (if any): The Amundi ETF might employ hedging strategies to mitigate currency risk, but this isn't always the case. Check the ETF's prospectus for details.

- Risk associated with currency fluctuations for USD-denominated investors: While offering global diversification, currency fluctuations represent a risk for USD-denominated investors, potentially leading to unexpected gains or losses.

- Potential for gains or losses due to currency movements: Currency movements can significantly impact returns, either positively or negatively, independent of the underlying asset performance.

Implications of NAV for Investment Decisions

Understanding the Amundi ETF's NAV is paramount for evaluating its performance and making informed investment decisions. By tracking the NAV over time, you can gauge the ETF's growth. Comparing the NAV to the market price of the ETF will show you if the ETF is trading at a premium or discount.

- Tracking the NAV over time to measure performance: Regularly monitoring the NAV helps assess the long-term performance of your investment.

- Comparing NAV to other similar ETFs: Comparing the NAV performance of the Amundi ETF to similar globally diversified ETFs can help you make informed comparisons.

- Understanding the difference between NAV and market price (Premium/Discount): The market price can deviate from the NAV due to supply and demand. A premium indicates the market price is higher than the NAV, and a discount indicates the market price is lower.

- NAV as a key metric for buy/sell signals: While not the sole indicator, the NAV, in conjunction with market analysis, can provide insights for buy or sell decisions.

Conclusion

This article explored the NAV calculation for the Amundi MSCI All Country World UCITS ETF USD Acc and its significant implications for investors. Understanding the components influencing NAV, particularly currency fluctuations, is crucial for evaluating performance and making informed investment decisions. The NAV serves as a key indicator of the ETF's underlying asset value, providing a crucial metric for performance tracking and strategic portfolio management.

Call to Action: Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV by visiting [Link to relevant resource]. Understanding Amundi ETF NAV calculations is a critical step in effective global diversification investment strategies.

Featured Posts

-

Gryozy Lyubvi Ili Ilicha Podrobnosti Iz Gazety Trud

May 25, 2025

Gryozy Lyubvi Ili Ilicha Podrobnosti Iz Gazety Trud

May 25, 2025 -

Real Madrid In Doert Yildiz Oyuncusuna Sorusturma Acildi

May 25, 2025

Real Madrid In Doert Yildiz Oyuncusuna Sorusturma Acildi

May 25, 2025 -

Jazda Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025

Jazda Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025 -

Na Uitstel Trump Aex Fondsen Boeken Winst

May 25, 2025

Na Uitstel Trump Aex Fondsen Boeken Winst

May 25, 2025 -

I Mercedes Kai I Pithanotita Apoktisis Toy Verstappen

May 25, 2025

I Mercedes Kai I Pithanotita Apoktisis Toy Verstappen

May 25, 2025