Amundi MSCI All Country World UCITS ETF USD Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is the NAV and how is it calculated for the Amundi MSCI All Country World UCITS ETF USD Acc?

The Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means calculating the total value of all the global equities held in the fund, after deducting liabilities. The calculation is straightforward: Total Assets – Total Liabilities = NAV.

The value of the underlying assets, which are global equities in this case, is the primary driver of NAV fluctuations. Daily market movements directly impact the price of these equities, causing the NAV to rise or fall. Furthermore, the fact that this is a USD Acc (Accumulation) ETF means that currency exchange rates also play a significant role. Changes in the value of the currencies of the underlying assets relative to the US dollar will influence the NAV.

- Daily NAV Calculation Process: The NAV is typically calculated at the end of each trading day, reflecting the closing prices of all the underlying assets.

- Impact of Market Movements on NAV: A rising global stock market generally leads to an increase in the ETF's NAV, while a falling market results in a decrease.

- Factors Affecting the NAV Besides Market Fluctuations: Besides market movements, factors like management fees, dividend distributions (in the case of distributing ETFs), and other expenses also affect the NAV, albeit usually to a lesser extent.

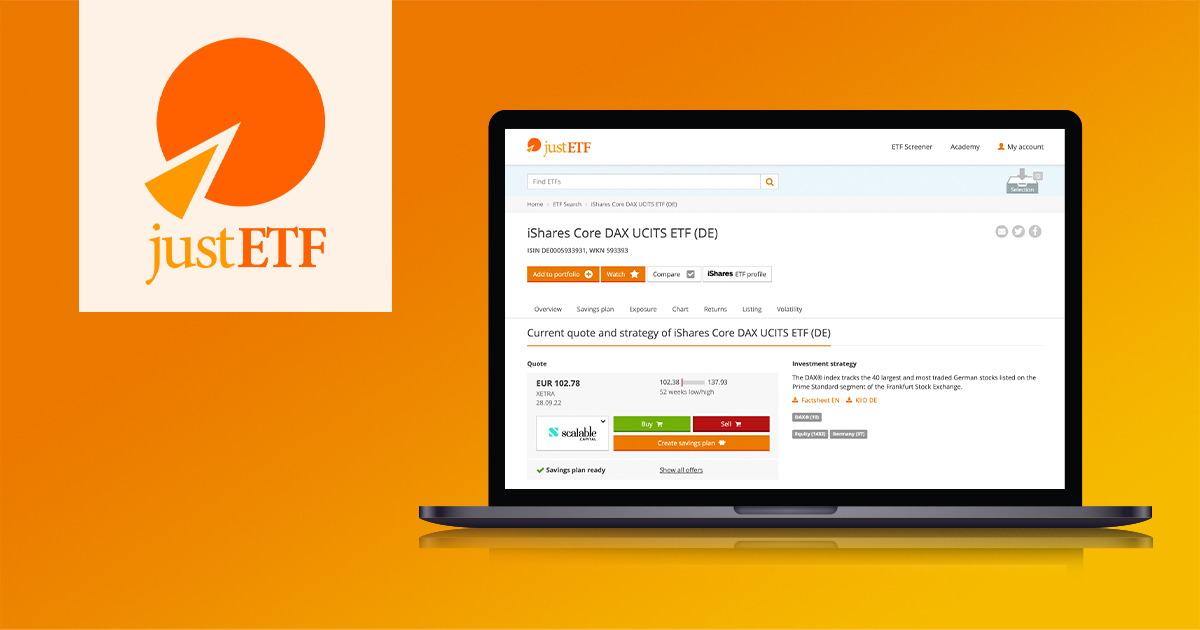

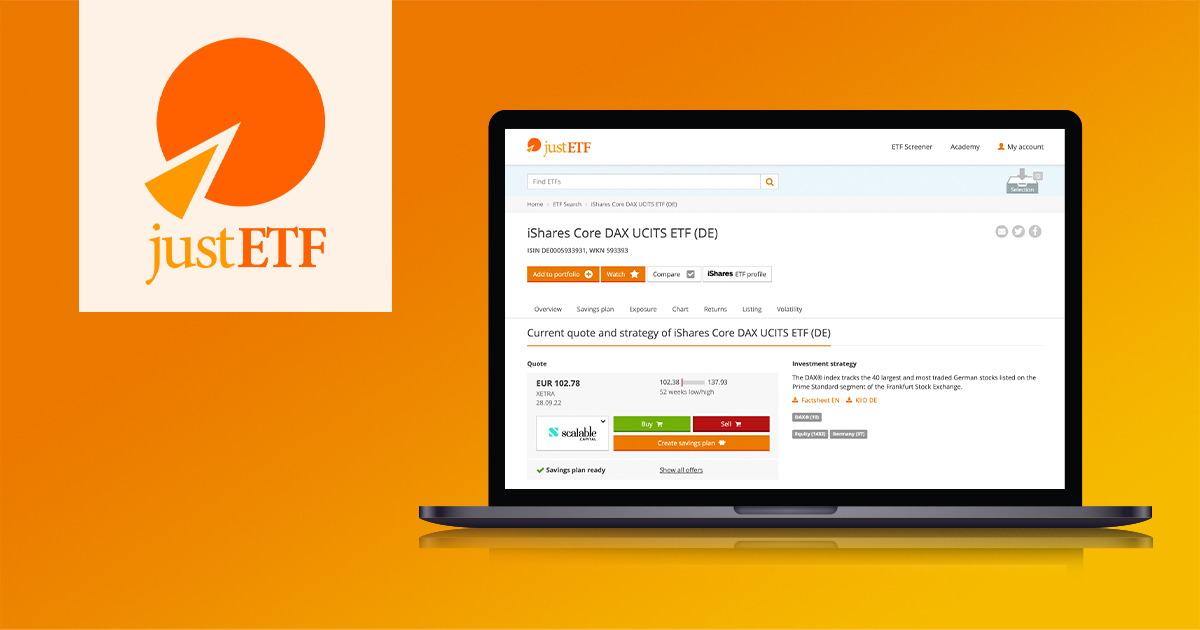

How to find the Amundi MSCI All Country World UCITS ETF USD Acc NAV?

Accessing the Amundi MSCI All Country World UCITS ETF USD Acc NAV is relatively easy. Several reliable sources provide real-time and historical NAV data:

- Official Amundi Website: The most accurate and up-to-date information can be found on the official Amundi website. Look for dedicated fund fact sheets or investor resources.

- Major Financial News Websites: Reputable financial news websites such as Bloomberg, Yahoo Finance, or Google Finance often list ETF NAVs.

- Your Brokerage Account: Your brokerage account will display the current NAV alongside other relevant information about your ETF holdings.

It's crucial to rely on official sources to avoid inaccuracies. Unofficial sources may provide delayed or incorrect data, potentially leading to flawed investment decisions. Always verify information from multiple reliable sources if you have any doubts.

Understanding NAV changes and their implications.

Interpreting changes in the Amundi MSCI All Country World UCITS ETF USD Acc NAV requires understanding the context. An increase in NAV generally signifies positive performance of the underlying global equities, potentially reflecting positive economic indicators or investor sentiment. Conversely, a decrease suggests underperformance.

- Short-term vs. Long-term NAV Trends: Short-term fluctuations are normal. Focus on long-term trends to assess the ETF's overall performance and the effectiveness of your investment strategy.

- Impact of Global Events on NAV: Global events like economic recessions, geopolitical instability, or major policy changes can significantly impact the NAV, often causing short-term volatility.

- Correlation between NAV and ETF Share Price: While not always identical, the NAV and the ETF's share price should closely track each other. Significant discrepancies may indicate arbitrage opportunities or market inefficiencies.

Using NAV to make informed investment decisions with the Amundi MSCI All Country World UCITS ETF USD Acc.

The NAV is a crucial tool for making informed investment decisions. It helps in several ways:

- Using NAV for Performance Evaluation: Compare the NAV's growth over time against its benchmark index (MSCI All Country World Index in this case) to evaluate its performance.

- Comparing NAV to Other ETFs in the Same Asset Class: Use the NAV to compare the Amundi MSCI All Country World UCITS ETF USD Acc to similar ETFs to identify potentially better-performing options. Remember to factor in expense ratios and fees.

- Importance of Considering Fees and Expense Ratios: While NAV reflects the underlying asset values, remember that fees and expense ratios reduce the overall return. Consider these when comparing different ETFs.

Conclusion: Mastering the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV is paramount for successful investing in this global equity ETF. We've covered its definition, calculation, reliable data sources, and its role in making informed decisions. Regularly monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV, alongside other relevant financial metrics, will allow you to make more strategic and effective investment choices. We encourage further research into related ETFs and investment strategies to further enhance your understanding. Begin your Amundi MSCI All Country World UCITS ETF USD Acc NAV analysis today and make the most of your investment opportunities.

Featured Posts

-

Myrtle Beach Disputes Most Unsafe Beach Ranking

May 25, 2025

Myrtle Beach Disputes Most Unsafe Beach Ranking

May 25, 2025 -

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025 -

Trumps Tariff Comments Boost European Stock Markets Lvmh Falls

May 25, 2025

Trumps Tariff Comments Boost European Stock Markets Lvmh Falls

May 25, 2025 -

French Government Considers Ban On Hijabs For Minors In Public Areas

May 25, 2025

French Government Considers Ban On Hijabs For Minors In Public Areas

May 25, 2025 -

Top Players Influence On The Growth Of Tennis In China

May 25, 2025

Top Players Influence On The Growth Of Tennis In China

May 25, 2025