Amundi MSCI World Ex-US UCITS ETF Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

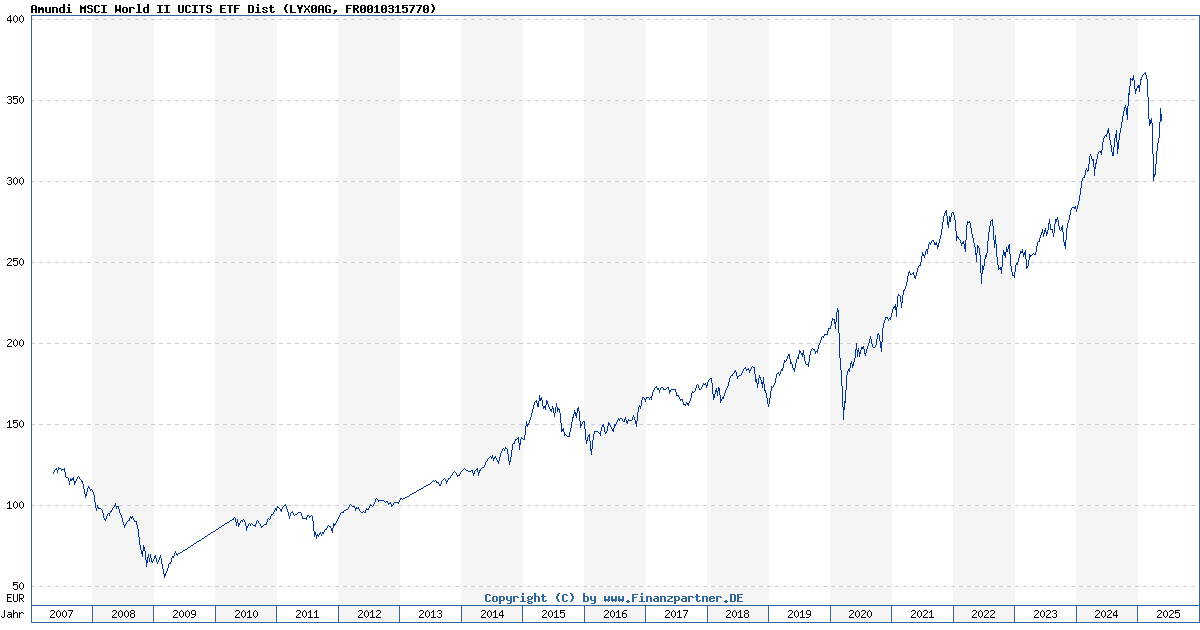

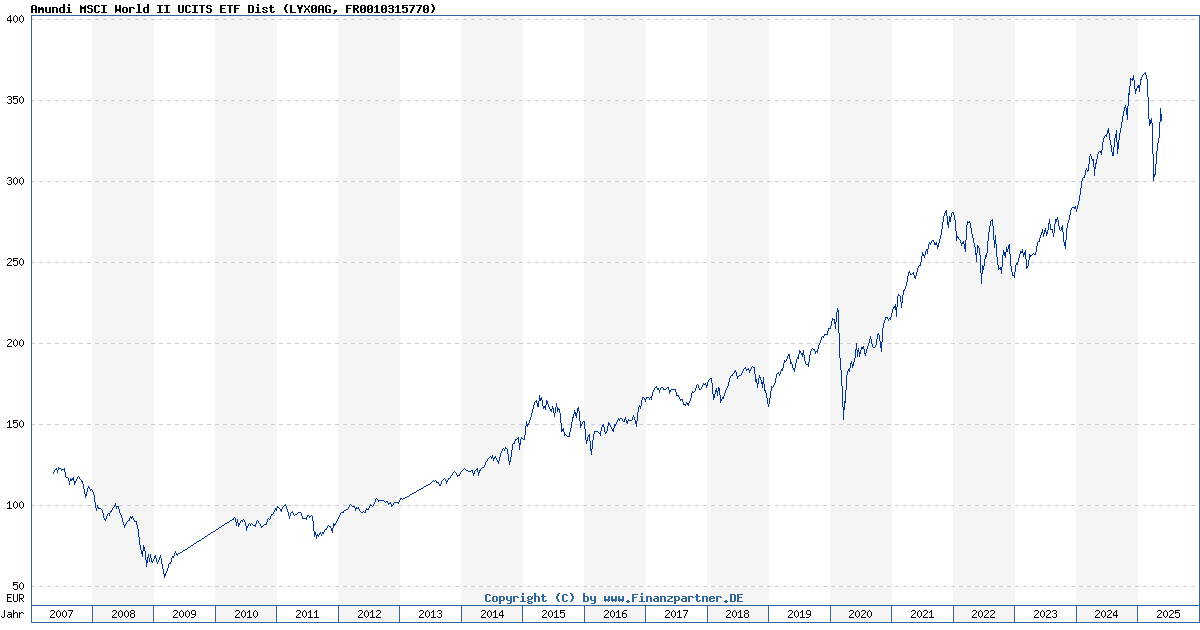

Net Asset Value (NAV) represents the intrinsic value of each share in the Amundi MSCI World ex-US UCITS ETF Acc. It's calculated by taking the total market value of all the assets held within the ETF (which invests in a diversified portfolio of non-US companies across developed and emerging markets, mirroring the MSCI World ex-US Index), subtracting any liabilities, and then dividing that figure by the total number of outstanding ETF shares. Think of it as the net worth of the ETF per share.

The calculation is straightforward: (Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

It's crucial to differentiate between NAV and the market price of the ETF. While the NAV reflects the underlying asset value, the market price fluctuates based on supply and demand throughout the trading day. Discrepancies can occur due to market trading activity and investor sentiment.

- NAV reflects the intrinsic value of the ETF.

- Market price can fluctuate based on supply and demand, creating short-term price discrepancies from NAV.

- Understanding this difference helps in identifying potential buying opportunities when the market price is below the NAV (though this is not always guaranteed to lead to profit).

How NAV Impacts Amundi MSCI World ex-US UCITS ETF Acc Investors

Daily NAV changes directly impact your returns as an investor in the Amundi MSCI World ex-US UCITS ETF Acc. The NAV at the time of your purchase determines your initial investment cost, and the difference between the NAV at purchase and the NAV at sale determines your profit or loss (excluding any fees).

NAV is the bedrock for calculating your investment gains or losses. By tracking the NAV over time, you can monitor the ETF's performance against its benchmark index, the MSCI World ex-US Index. This allows you to assess the effectiveness of your investment and make informed decisions on adjustments or holding your position.

- NAV is the basis for calculating your investment gains or losses.

- Tracking NAV helps monitor the ETF’s performance over time and compare it to its benchmark.

- Comparing NAV to the market price may help identify potential arbitrage opportunities (though trading strategies like this should be carefully researched and understood beforehand).

Where to Find the Amundi MSCI World ex-US UCITS ETF Acc NAV

Finding the daily NAV for the Amundi MSCI World ex-US UCITS ETF Acc is relatively straightforward. Several reliable sources provide this information:

- Amundi's official website: Check the ETF's dedicated page on the Amundi website. The NAV will usually be displayed prominently alongside other key information.

- Major financial news websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance typically list ETF NAVs. Search for the ETF ticker symbol (usually found on your brokerage statement).

- Your brokerage account platform: Most online brokerage platforms display the current NAV of your holdings, along with other relevant details.

Always ensure you are checking the NAV at the end of the trading day for the most accurate representation. Pay close attention to the date and time stamp associated with the NAV data.

- Amundi's official website is the primary source for accurate NAV data.

- Major financial news websites provide convenient access to the NAV.

- Your brokerage account is a personalized and convenient source for your specific holdings.

- Always check the date and time stamp to ensure accuracy.

NAV and its Relation to Other ETF Metrics

While NAV is a critical metric, it's essential to consider it alongside other key figures to get a holistic view of the Amundi MSCI World ex-US UCITS ETF Acc's performance. These include:

- Expense Ratio: This reflects the annual cost of managing the ETF, expressed as a percentage of your investment. A higher expense ratio will reduce your overall return.

- Total Expense Ratio (TER): Similar to the expense ratio but may include additional costs.

- Management Fees: These are the fees paid to the fund manager for their services.

Understanding these additional metrics provides a more comprehensive assessment of the ETF's overall investment performance and cost-effectiveness. By comparing the NAV performance against these metrics, you can assess whether the ETF is meeting your investment goals.

- NAV is only one factor in evaluating ETF performance.

- Expense ratio and TER significantly impact the overall return.

- Consider all fees when assessing investment costs.

Conclusion

Mastering Amundi MSCI World ex-US UCITS ETF Acc NAV is key to successful investing. This guide has outlined how NAV is calculated, its direct impact on your investment returns, and where to find reliable NAV information. Remember that while NAV is a crucial indicator of the ETF’s intrinsic value, it should be considered in conjunction with other metrics such as expense ratios and management fees to make fully informed investment decisions. Actively monitor the Amundi MSCI World ex-US UCITS ETF Acc NAV, and use this information to optimize your investment strategy. By understanding the nuances of Amundi MSCI World ex-US UCITS ETF Acc NAV, you can make better investment choices and achieve your financial goals.

Featured Posts

-

Facing Retribution For Advocating Change A Guide To Resilience

May 25, 2025

Facing Retribution For Advocating Change A Guide To Resilience

May 25, 2025 -

Silence Brise Thierry Ardisson Evoque Tout Le Monde En Parle Apres Le Scandale Baffie

May 25, 2025

Silence Brise Thierry Ardisson Evoque Tout Le Monde En Parle Apres Le Scandale Baffie

May 25, 2025 -

Roc Agel La Discreta Propiedad Grimaldi Donde Se Refugio Charlene

May 25, 2025

Roc Agel La Discreta Propiedad Grimaldi Donde Se Refugio Charlene

May 25, 2025 -

2025 Porsche Cayenne A Complete Interior And Exterior Photo Gallery

May 25, 2025

2025 Porsche Cayenne A Complete Interior And Exterior Photo Gallery

May 25, 2025 -

Reliving Glory Jenson Button Back In The 2009 Brawn

May 25, 2025

Reliving Glory Jenson Button Back In The 2009 Brawn

May 25, 2025