Amundi MSCI World II UCITS ETF Dist: NAV Calculation And Implications

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Net Asset Value (NAV) represents the total value of an ETF's underlying assets per share. For ETF investors, the NAV is a fundamental metric. It reflects the true value of your investment, unlike the market price, which can fluctuate throughout the trading day due to supply and demand. The difference between NAV and market price is often small, but understanding this distinction is key.

Several factors cause daily NAV fluctuations in ETFs like the Amundi MSCI World II UCITS ETF Dist:

-

Market movements: Changes in the prices of the underlying assets directly impact the NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

-

Currency fluctuations: Since many ETFs hold international assets, currency exchange rates play a significant role. Changes in exchange rates can positively or negatively affect the NAV, depending on the currency composition of the portfolio.

-

Dividend distributions: When the ETF distributes dividends, the NAV adjusts accordingly. The NAV will decrease by the amount of the distribution on the ex-dividend date.

-

Key takeaways:

- NAV is calculated daily, providing a snapshot of the ETF's value.

- It reflects the total value of all the ETF's holdings.

- NAV is essential for accurate performance measurement and comparison.

- The market price of an ETF may differ slightly from its NAV due to supply and demand.

Detailed Breakdown of Amundi MSCI World II UCITS ETF Dist NAV Calculation

The Amundi MSCI World II UCITS ETF Dist NAV calculation follows a transparent methodology adhering to UCITS (Undertakings for Collective Investment in Transferable Securities) regulations. This ensures accuracy and regulatory compliance. The calculation involves several key components:

-

Market value of underlying assets: This is the primary component, representing the sum of the current market prices of all assets held within the ETF. Amundi, as the fund manager, uses various valuation methods including market price for liquid assets and fair value estimations for less liquid holdings.

-

Accrued income: This includes any interest earned on bonds, dividends received from stocks, and other income generated by the ETF's holdings.

-

Expenses: The ETF's operating expenses, including management fees, are deducted from the total value of assets. This expense ratio directly impacts the NAV.

-

Key aspects of the NAV calculation:

- Asset valuation methods: A combination of market price and fair value estimations ensures accuracy.

- Currency conversion: Currency exchange rates are applied to convert the values of foreign assets into the base currency of the ETF. Fluctuations in these rates affect the final NAV.

- Expense ratio: The management expense ratio reduces the NAV, representing the cost of managing the ETF.

- Dividend distribution: A pre-distribution NAV is calculated before dividends are paid out. A post-distribution NAV reflects the reduction in value due to the dividend payments.

Implications of NAV for Amundi MSCI World II UCITS ETF Dist Investors

Understanding the NAV of the Amundi MSCI World II UCITS ETF Dist is crucial for informed investment decisions. It empowers investors to:

-

Track performance accurately: By monitoring the NAV over time, investors can gauge the performance of their investment, comparing it to the ETF's historical performance.

-

Compare returns against benchmarks: The NAV allows for a direct comparison of the ETF's return against its benchmark index, the MSCI World Index. This facilitates performance evaluation against the broader market.

-

Inform buy/sell decisions: Investors might use NAV to identify opportune moments to buy low and sell high, minimizing potential losses and maximizing gains. However, remember that market timing based solely on NAV is not a guaranteed strategy.

-

Understand the impact of distributions: Investors need to understand that dividend distributions temporarily reduce the NAV, but they also represent a return on investment.

-

Key uses of NAV information:

- Performance monitoring: Track the NAV's changes over time to assess the investment's growth.

- Benchmark comparison: Compare the ETF's performance to the MSCI World Index.

- Buy/sell decisions: Use NAV data in conjunction with other market analysis tools to make informed trading decisions.

- Distribution understanding: Understand the impact of dividend distributions on NAV and overall returns.

Tax Implications of Distributions

Dividend distributions from the Amundi MSCI World II UCITS ETF Dist have tax implications that vary depending on the investor's jurisdiction. The post-distribution NAV reflects the reduction in value due to these payouts. Understanding these tax implications is critical for accurate financial planning.

- Key Tax Considerations:

- Dividend income taxation: Dividends received are generally subject to income tax in the investor's country of residence.

- Tax treaties: International tax treaties might affect the tax treatment of dividends.

- Professional advice: It’s advisable to consult with a qualified tax advisor to determine the specific tax implications in your jurisdiction.

Conclusion

Understanding the Amundi MSCI World II UCITS ETF Dist NAV calculation is paramount for making informed investment decisions. The NAV provides a true reflection of the ETF's underlying asset value, serving as a crucial metric for performance tracking, benchmarking, and strategic investment choices. Regularly monitoring the Amundi MSCI World II UCITS ETF Dist NAV, along with understanding its implications, is key to optimizing your investment strategy. For comprehensive details, refer to the official Amundi documentation and seek professional financial advice tailored to your individual circumstances. Learn more about the Amundi MSCI World II UCITS ETF Dist NAV and enhance your investment approach today.

Featured Posts

-

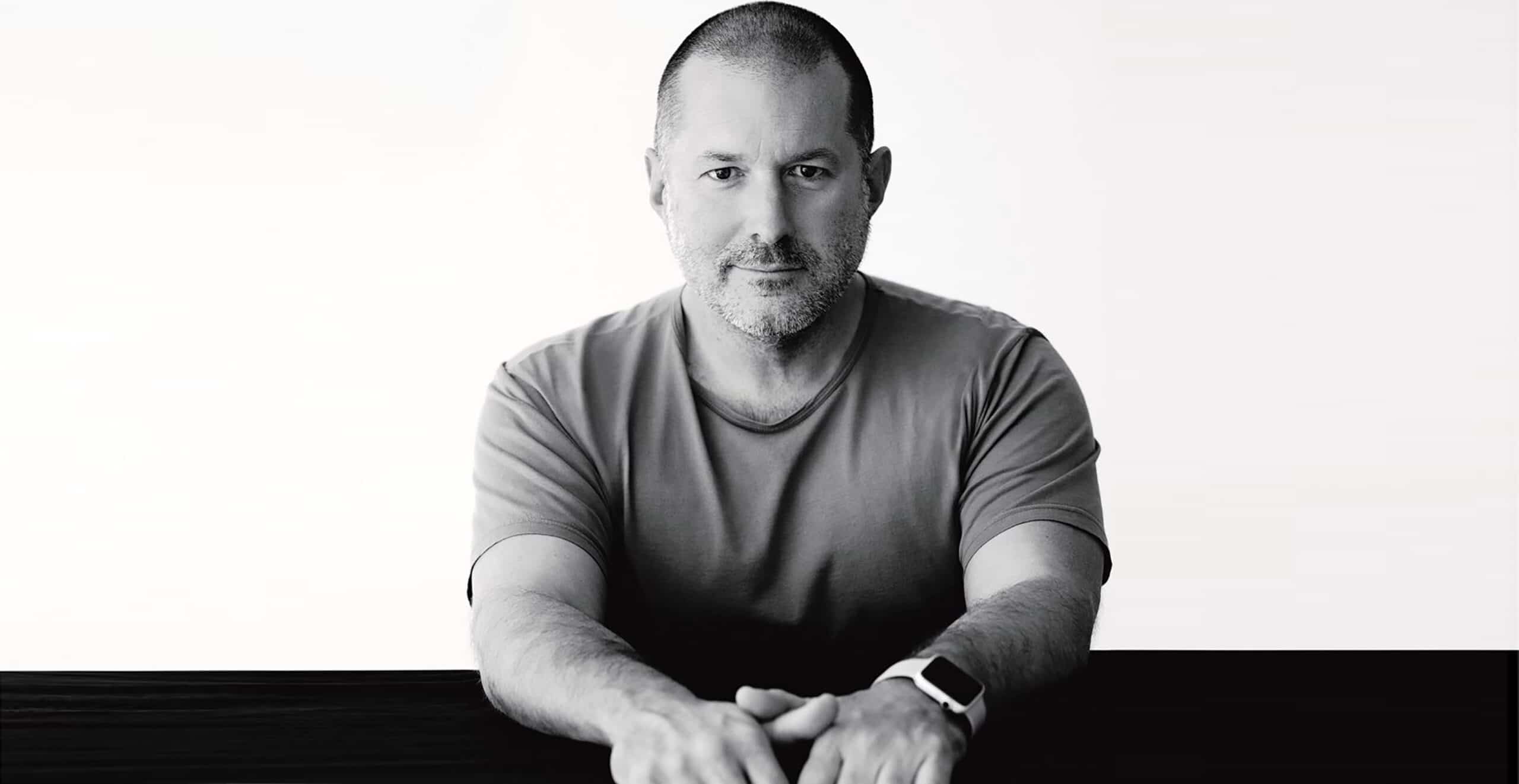

Sam Altmans Secret Device Exclusive Details On The Jony Ive Collaboration

May 24, 2025

Sam Altmans Secret Device Exclusive Details On The Jony Ive Collaboration

May 24, 2025 -

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025 -

Must Have Gear For Passionate Ferrari Owners

May 24, 2025

Must Have Gear For Passionate Ferrari Owners

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

Jonathan Groffs Just In Time A Night Of Broadway Stars

May 24, 2025

Jonathan Groffs Just In Time A Night Of Broadway Stars

May 24, 2025