Amundi MSCI World II UCITS ETF USD Hedged Dist: Understanding Net Asset Value (NAV)

Table of Contents

Understanding the Fundamentals of Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. Think of it as the true worth of a single share of the ETF. It's calculated daily, typically at the market close, by subtracting the ETF's total liabilities from its total assets and then dividing the result by the number of outstanding shares. The formula is simple:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

- Assets: This includes all the stocks, bonds, and other securities held within the ETF's portfolio. The Amundi MSCI World II UCITS ETF USD Hedged Dist, for instance, holds a diverse range of global equities.

- Liabilities: These encompass various expenses, such as management fees, administrative costs, and any other financial obligations of the ETF.

- NAV reflects the intrinsic value: The NAV provides a snapshot of the ETF's true worth, independent of its market trading price.

NAV and the Amundi MSCI World II UCITS ETF USD Hedged Dist: A Deeper Dive

The Amundi MSCI World II UCITS ETF USD Hedged Dist is designed to track the performance of the MSCI World Index, offering exposure to a broad range of global equities. A key feature is its USD hedging strategy. This means the ETF aims to mitigate the impact of currency fluctuations between the base currency of the underlying assets and the US dollar.

- Impact of Currency Hedging: The USD hedging can influence the NAV calculation. While it aims to reduce volatility caused by currency exchange rate movements, it doesn't eliminate it entirely. Changes in the USD exchange rate against other currencies can still subtly affect the NAV.

- Finding the NAV: You can typically find the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist on Amundi's official website, reputable financial news websites, and through your brokerage account.

- Benefits of Currency Hedging: For investors primarily concerned with USD-denominated returns, the hedging strategy can provide more predictable performance. However, it's important to remember that hedging strategies themselves have associated costs.

- Market Fluctuations and NAV: The NAV will naturally fluctuate daily depending on the performance of the underlying assets. Market downturns will generally lead to a decrease in NAV, while market upturns will generally lead to an increase. Regularly checking the NAV is important to monitor the health of your investment.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is crucial for making informed investment decisions.

- Buy/Sell Points: While not the sole determinant, NAV can be a valuable tool in assessing whether an ETF is trading at a premium or discount to its intrinsic value. Buying when the market price is below NAV and selling when it's above NAV can potentially improve investment returns.

- NAV vs. Market Price: The market price of an ETF can differ from its NAV due to supply and demand. Short-term market sentiment and trading volume can cause temporary discrepancies.

- Performance Evaluation: Tracking changes in the NAV over time provides a clear picture of the Amundi MSCI World II UCITS ETF USD Hedged Dist's performance. Comparing NAV changes to benchmark indices can help in evaluating the ETF's effectiveness.

- Premium/Discount to NAV: A premium exists when the market price is higher than the NAV, indicating potential overvaluation. A discount indicates the opposite – potential undervaluation.

- Transaction Costs: Remember to factor in brokerage fees and other transaction costs when making buy/sell decisions based on NAV. These costs can impact your overall profitability.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist's Prospectus

The prospectus is a crucial document that provides comprehensive information about the Amundi MSCI World II UCITS ETF USD Hedged Dist, including details on its investment strategy, fees, risk factors, and importantly, the precise methodology for calculating its NAV. Always refer to the prospectus for the most accurate and up-to-date information. You can usually find the prospectus on Amundi's investor relations website.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV

Understanding the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings is vital for successful investment management. Regularly monitoring the NAV, comparing it to the market price, and using this information alongside other market indicators allows for more informed decisions about buying, selling, and overall portfolio management. Consult the prospectus for detailed information and further research the nuances of ETF investing and NAV analysis to enhance your financial planning. Stay informed about the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist to optimize your investment strategy.

Featured Posts

-

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 25, 2025 -

Porsche 956 Tavan Sergisinin Teknik Ve Tarihsel Aciklamalari

May 25, 2025

Porsche 956 Tavan Sergisinin Teknik Ve Tarihsel Aciklamalari

May 25, 2025 -

Us Tariff Fallout Strategies For Increased Canada Mexico Trade

May 25, 2025

Us Tariff Fallout Strategies For Increased Canada Mexico Trade

May 25, 2025 -

Flash Flood Warning Issued For Parts Of Pennsylvania Through Thursday

May 25, 2025

Flash Flood Warning Issued For Parts Of Pennsylvania Through Thursday

May 25, 2025 -

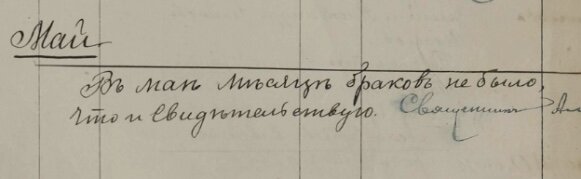

Svadby Na Kharkovschine 600 Brakov Za Mesyats Tendentsii I Statistika

May 25, 2025

Svadby Na Kharkovschine 600 Brakov Za Mesyats Tendentsii I Statistika

May 25, 2025