Analysis: Brexit's Negative Impact On UK Luxury Exports To The EU

Table of Contents

Increased Trade Barriers and Bureaucracy

Brexit introduced a new layer of complexity to exporting UK luxury goods to the EU. The seamless trade previously enjoyed within the single market has been replaced by increased customs checks, paperwork, and regulatory hurdles. This "Brexit red tape" represents a significant non-tariff barrier, impacting the efficiency and profitability of the luxury export business.

- Increased shipping costs and delays: Customs procedures add time and expense to the shipping process, delaying deliveries and increasing transportation costs. This is particularly problematic for time-sensitive luxury goods.

- Complex documentation requirements: The intricate paperwork involved in exporting to the EU often leads to errors and delays, resulting in goods being held up at borders. This necessitates increased staffing and expertise in customs compliance.

- Higher administrative burden: Luxury brands now face a significantly higher administrative burden, diverting resources away from core business activities and impacting overall profitability. Managing compliance adds considerable overhead.

- Increased risk of goods being held up at borders: Delays and potential rejection of shipments due to incorrect documentation represent a considerable risk for luxury exporters. This can damage brand reputation and lead to significant financial losses.

Keywords: customs checks, tariffs, non-tariff barriers, trade friction, Brexit red tape, supply chain disruptions.

Weakening Pound and Inflationary Pressures

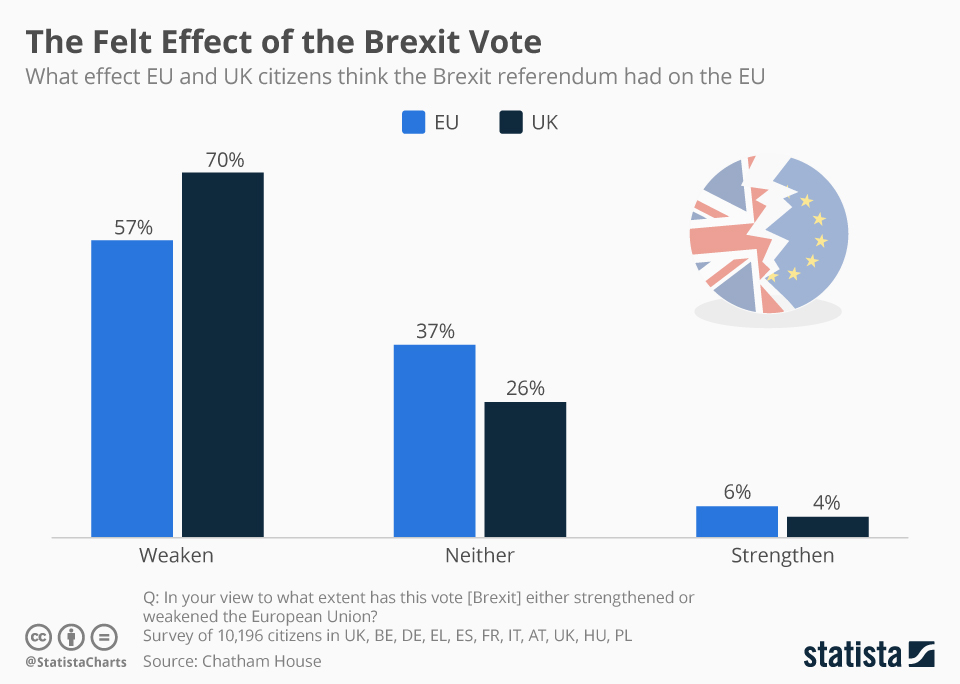

The depreciation of the pound sterling since Brexit has negatively impacted the price competitiveness of UK luxury goods in the EU market. This, coupled with rising inflation, creates a double whammy for exporters.

- Higher prices for EU consumers: Currency fluctuations translate to higher prices for EU consumers, reducing demand for UK luxury products compared to competitors whose prices remain stable in Euros.

- Reduced demand for UK luxury products: The higher prices make UK luxury goods less attractive to EU consumers, impacting market share and sales volume.

- Increased input costs for raw materials and manufacturing: Many luxury goods rely on imported raw materials, and the weakened pound increases the cost of these inputs, further squeezing profit margins.

- Inflationary pressures squeezing profit margins: Rising inflation in both the UK and the EU adds to the pressure on profit margins, making it difficult for luxury brands to maintain profitability.

Keywords: pound sterling, currency exchange rates, inflation, price competitiveness, market share.

Loss of Access to the EU Single Market

Brexit has significantly diminished the advantages of the EU single market for UK luxury exporters. The ease of trade and access to a vast consumer base are now considerably restricted.

- Reduced market access for UK brands: Navigating new customs regulations and trade barriers makes accessing the EU market significantly more challenging.

- Increased competition from EU-based luxury brands: UK luxury brands now face increased competition from EU-based competitors who retain privileged access to the single market.

- Loss of free movement of goods and services: The free movement of goods and services, a cornerstone of the single market, is no longer available to UK luxury exporters, leading to increased costs and complexity.

- Difficulty in expanding into new EU markets: The added complexities of exporting make it more difficult and costly for UK luxury brands to expand into new EU markets.

Impact on Specific Luxury Sectors

The impact of Brexit varies across different luxury sectors. For example, the UK fashion industry has experienced significant supply chain disruptions, while the luxury car sector has faced challenges related to parts sourcing and regulatory compliance. Specific brands have reported substantial losses in EU sales, highlighting the wide-ranging effects of Brexit on the UK luxury goods sector. Quantifiable data, where available from industry reports, could be included here.

Challenges for Small and Medium-Sized Enterprises (SMEs)

Brexit's impact has been particularly harsh on smaller luxury brands. SMEs often lack the resources and expertise to navigate the new regulatory landscape.

- Higher compliance costs for SMEs: The increased administrative burden and compliance costs disproportionately affect smaller businesses with limited resources.

- Difficulties accessing funding and support: Securing funding and accessing government support to navigate Brexit-related challenges has been difficult for many SMEs.

- Increased risk of business failure for smaller exporters: The combined impact of increased costs, reduced market access, and administrative burdens increases the risk of business failure for smaller luxury exporters.

Keywords: SMEs, small businesses, Brexit impact on SMEs, funding, compliance costs.

Conclusion: Understanding Brexit's Ongoing Impact on UK Luxury Exports to the EU

Brexit has had a significant and multifaceted negative impact on UK luxury exports to the EU. Increased trade barriers, currency fluctuations, the loss of single market access, and the disproportionate challenges faced by SMEs have all contributed to a decline in exports and profitability within the sector. The economic consequences are substantial, and addressing these issues requires a comprehensive understanding of the challenges and potential policy adjustments to mitigate the negative effects of Brexit. To analyze Brexit's impact further and understand the ongoing challenges for UK luxury exports, further research on Brexit and the luxury industry is crucial. We encourage readers to explore available resources and engage in discussions on mitigating the negative effects of Brexit to secure the future of the UK luxury goods sector.

Featured Posts

-

Maiara E Maraisa No Festival Da Cunha Confirmacao De Isabelle Nogueira

May 20, 2025

Maiara E Maraisa No Festival Da Cunha Confirmacao De Isabelle Nogueira

May 20, 2025 -

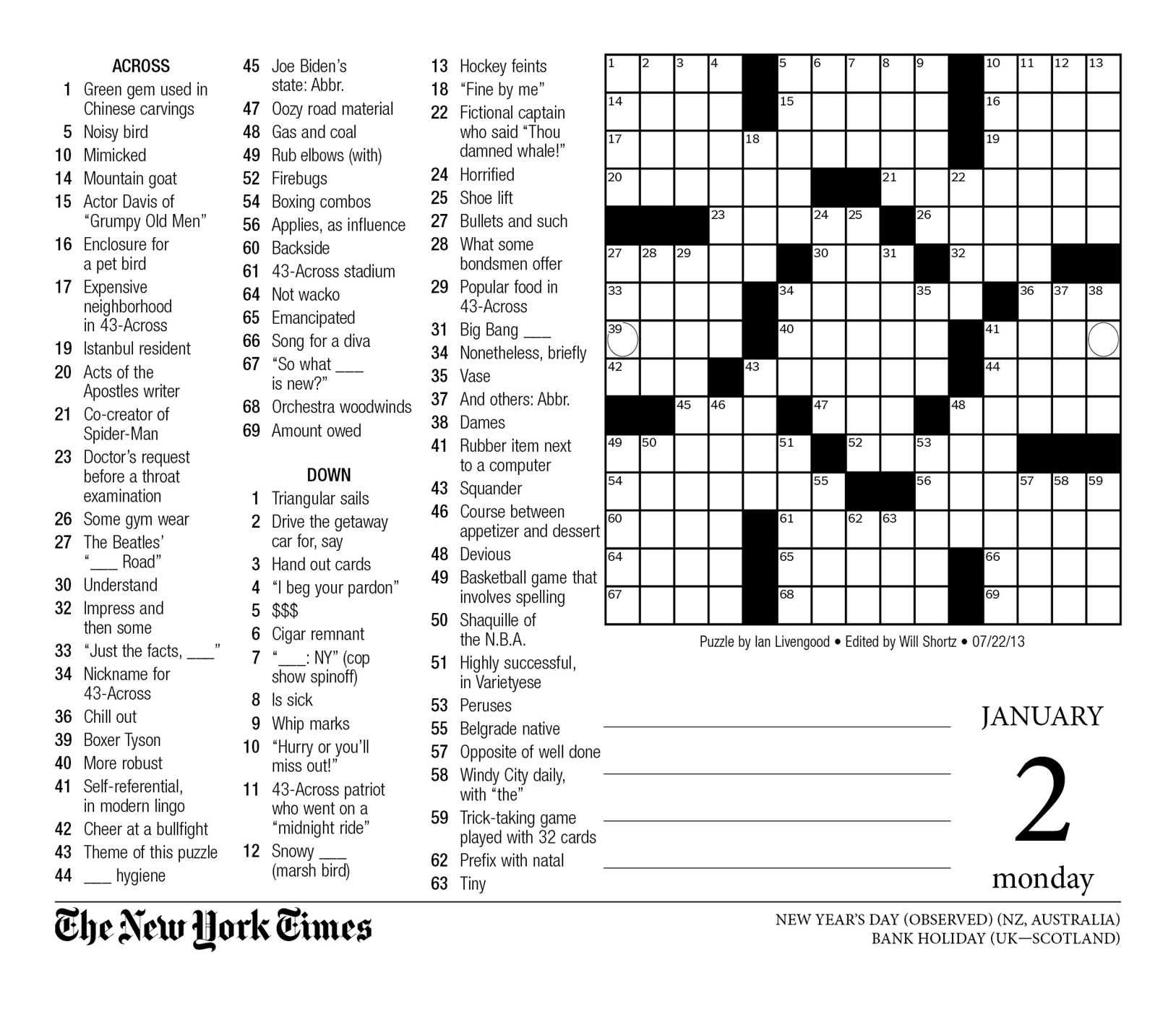

Nyt Mini Crossword May 1 Solving The Marvel The Avengers Clue

May 20, 2025

Nyt Mini Crossword May 1 Solving The Marvel The Avengers Clue

May 20, 2025 -

Manchester Uniteds Fa Cup Victory Fueled By Rashfords Brace Against Aston Villa

May 20, 2025

Manchester Uniteds Fa Cup Victory Fueled By Rashfords Brace Against Aston Villa

May 20, 2025 -

Nyt Mini Crossword Answers March 18

May 20, 2025

Nyt Mini Crossword Answers March 18

May 20, 2025 -

Journalist Reveals Worrying Matheus Cunha News For Man United

May 20, 2025

Journalist Reveals Worrying Matheus Cunha News For Man United

May 20, 2025