Analysis: Did Trump Tariffs Kill The Affirm Holdings (AFRM) IPO?

Table of Contents

The Economic Climate Surrounding AFRM's IPO

The State of the US Economy During the Trump Tariffs

The Trump administration's imposition of tariffs created a complex economic landscape. While the US economy experienced periods of growth during this time, the trade wars sparked uncertainty and inflation. This impacted consumer spending, a crucial factor influencing the performance of companies like Affirm.

- Specific Tariffs: Tariffs on imported goods, particularly consumer electronics and apparel, directly affected consumer spending power. These sectors are closely linked to the buy now, pay later (BNPL) market.

- GDP Growth: Though GDP growth remained positive in certain periods, the volatility caused by trade disputes created instability. Investors often react negatively to economic uncertainty, which can impact IPO performance.

- Consumer Confidence: Indices measuring consumer confidence showed fluctuating results, reflecting the anxieties caused by the trade wars and inflation. This uncertainty could translate into reduced spending and a dampening effect on BNPL demand.

The Fintech Sector and Tariff Sensitivity

The fintech sector, including BNPL companies like AFRM, is sensitive to economic downturns. Tariffs can indirectly impact fintechs through several channels:

- Increased Operational Costs: Tariffs on imported components or services used by fintech companies can increase their operational costs, squeezing profit margins.

- Impact on Consumer Borrowing: Economic uncertainty and reduced consumer spending can lead to decreased demand for BNPL services, as consumers become more cautious about taking on debt.

- Reduced Investment: Investor sentiment is crucial for fintech companies. Economic instability caused by tariffs might deter investors from pouring funds into a relatively young and volatile sector.

Affirm Holdings (AFRM)'s Business Model and Tariff Exposure

Direct Impact of Tariffs on AFRM's Operations

While AFRM's core business model is digital, indirect effects of tariffs could have impacted its operations:

- Supply Chain: If AFRM utilizes any imported components or services for its technology infrastructure, tariffs could have increased its input costs.

- Cost of Goods: Indirectly, tariffs on goods purchased by AFRM's merchant partners could influence the overall pricing and affordability of products offered using AFRM's BNPL services.

- International Expansion: If AFRM had plans for international expansion, tariffs and trade tensions might have complicated these strategies and increased associated costs and risks.

Indirect Impact via Consumer Spending

The most significant impact of tariffs on AFRM likely came through their indirect influence on consumer spending:

- Consumer Spending Trends: Data from the period needs to be analyzed to assess the correlation between tariff implementation and changes in consumer spending on discretionary goods – a major segment for BNPL use.

- Correlation Between Tariffs and BNPL Usage: A thorough analysis is required to determine whether a decrease in consumer spending during the tariff period led to a reduced demand for AFRM's services. This would require comparing BNPL usage trends with consumer spending data and tariff imposition timelines.

Analysis of AFRM's IPO Performance and Market Conditions

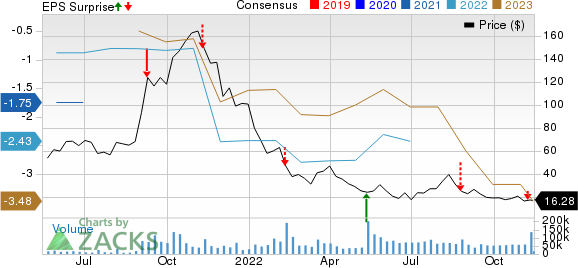

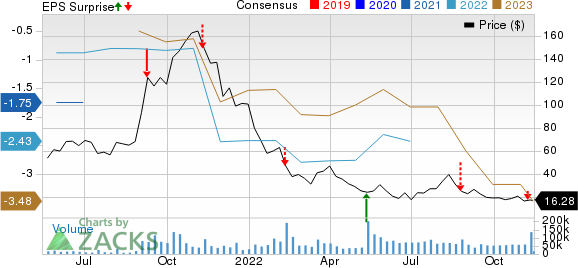

AFRM's Stock Performance Post-IPO

AFRM's stock performance since its IPO presents a complex picture. While it initially saw positive growth, it experienced significant declines. A detailed analysis is required to determine which factors were most influential. This involves scrutinizing:

- Stock Price Charts: Charting AFRM's stock price against key dates related to tariff implementations and other significant economic events.

- Key Performance Indicators (KPIs): Examining key metrics such as revenue growth, customer acquisition costs, and default rates to assess the underlying financial health of the company.

- Comparisons to Other Similar IPOs: Benchmarking AFRM's performance against comparable fintech IPOs during the same period can help isolate the impact of specific factors.

Other Factors Influencing AFRM's Stock Performance

It is important to acknowledge that factors beyond tariffs likely impacted AFRM’s performance:

- Market Sentiment: The overall investor sentiment and market volatility around the time of the IPO played a significant role.

- Investor Confidence: General confidence in the fintech sector and BNPL business models influenced investment decisions.

- Competitive Landscape: The increasing competition in the BNPL market could have impacted AFRM’s growth trajectory.

- Regulatory Changes: Potential regulatory changes or scrutiny affecting the BNPL sector could have also influenced investor sentiment.

Conclusion: Did Trump Tariffs Really Impact the Affirm Holdings (AFRM) IPO?

While a definitive answer requires deeper, data-driven analysis, the evidence suggests that the Trump-era tariffs likely played a contributing, albeit indirect, role in AFRM's IPO performance. The economic uncertainty and reduced consumer spending created by tariffs likely decreased demand for BNPL services. However, it’s crucial to acknowledge that other factors, such as broader market trends and competitive pressures, also significantly impacted AFRM’s stock performance. Attributing a specific percentage of the decline solely to tariffs would be an oversimplification.

Therefore, while the Trump tariffs might not have "killed" the AFRM IPO, they likely contributed to the challenging market conditions it faced. Further research is needed to quantify this contribution precisely. We encourage you to share your perspectives in the comments, contribute relevant articles, and delve further into the impact of trade policies on fintech IPOs and the specific effects of Trump tariffs on Affirm Holdings (AFRM).

Featured Posts

-

Comunicado Oficial Salud Del Expresidente Uruguayo Jose Mujica

May 14, 2025

Comunicado Oficial Salud Del Expresidente Uruguayo Jose Mujica

May 14, 2025 -

The Eurovangelists Contribution To Mfd Spring Break

May 14, 2025

The Eurovangelists Contribution To Mfd Spring Break

May 14, 2025 -

Winning With Dynamax Sobble A Pokemon Go Max Mondays Guide

May 14, 2025

Winning With Dynamax Sobble A Pokemon Go Max Mondays Guide

May 14, 2025 -

Fa Cup Awoniyi Confirmed In Starting Xi

May 14, 2025

Fa Cup Awoniyi Confirmed In Starting Xi

May 14, 2025 -

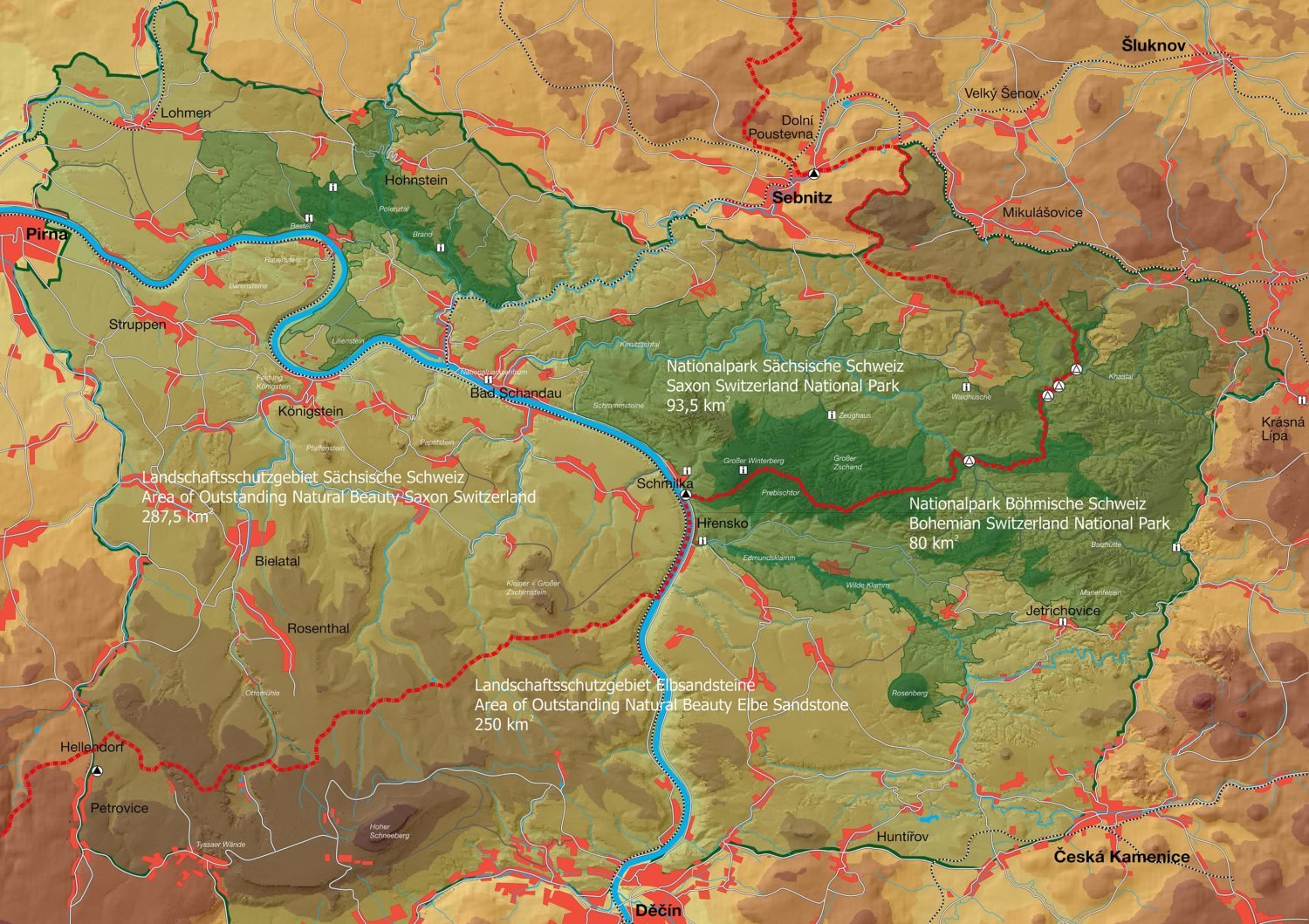

Erfolgreicher Naturschutz 190 000 Baeume Im Nationalpark Saechsische Schweiz Gepflanzt

May 14, 2025

Erfolgreicher Naturschutz 190 000 Baeume Im Nationalpark Saechsische Schweiz Gepflanzt

May 14, 2025