Analysis: Economists On The ECB's Potential Rate Cut Delays

Table of Contents

Divergent Opinions Among Economists

The debate surrounding the ECB's monetary policy is sharply divided. Economists fall into two broad camps: hawks and doves. Understanding their contrasting viewpoints is crucial to understanding the uncertainty surrounding the ECB's potential rate cut delays.

Hawks vs. Doves

- Hawks: These economists prioritize fighting inflation, even at the risk of slowing economic growth. They argue that prematurely cutting interest rates could reignite inflationary pressures, undoing the progress made so far. Notable economists like [cite a prominent hawk and their view] have voiced concerns about the persistence of core inflation and the need for a more restrictive monetary policy.

- Doves: Conversely, doves emphasize the need to support economic growth, even if it means tolerating slightly higher inflation in the short term. They argue that the current economic slowdown necessitates immediate rate cuts to prevent a deeper recession. [Cite a prominent dove and their view], for example, points to weakening economic indicators as a reason for easing monetary policy.

Impact of Geopolitical Uncertainty

Geopolitical factors significantly complicate the ECB's decision-making process and contribute significantly to the uncertainty surrounding the ECB's potential rate cut delays.

- The War in Ukraine: The ongoing conflict has fueled energy price spikes, exacerbating inflationary pressures across the Eurozone. This significantly impacts the hawks' argument for tighter monetary policy.

- Energy Crisis: The energy crisis, partly stemming from the war, has dampened economic growth prospects, strengthening the doves' case for rate cuts to stimulate the economy. The energy crisis is a major factor when assessing the ECB's potential rate cut delays.

- Global Supply Chain Disruptions: Ongoing supply chain bottlenecks further complicate the inflation picture, making it difficult to predict the impact of monetary policy changes.

Analyzing the Economic Indicators

Understanding the current economic climate requires careful scrutiny of key indicators. Differing interpretations of this data underpin the contrasting viewpoints on ECB's potential rate cut delays.

Inflation Data and its Interpretation

Recent inflation figures in the Eurozone show a [state current inflation rate].

- Headline Inflation: This broader measure includes volatile components like energy prices, currently showing [state current headline inflation].

- Core Inflation: Excluding volatile elements, core inflation provides a clearer picture of underlying price pressures. [State current core inflation rate]. Discrepancies between headline and core inflation fuel the debate amongst economists. Hawks often focus on core inflation, while doves might emphasize the downward trend in headline inflation.

GDP Growth Projections and their Influence

Economic growth forecasts vary significantly, influencing the debate on the need for rate cuts.

- Optimistic Projections: Some institutions project a [state a positive growth projection] GDP growth for the Eurozone in [state year], suggesting the economy can withstand tighter monetary policy.

- Pessimistic Projections: Others forecast slower growth, or even a recession, increasing pressure on the ECB to cut rates to stimulate the economy. These varying projections significantly impact opinions on the ECB's potential rate cut delays.

Potential Consequences of Delayed Rate Cuts

Delays in implementing rate cuts could have significant repercussions for the Eurozone economy and its financial markets.

Impact on Economic Growth

- Prolonged Recession: Delaying rate cuts, if the economy is already weakening, could prolong a recession, leading to job losses and reduced consumer spending.

- Stubborn Inflation: Conversely, premature rate cuts could exacerbate inflation, further eroding consumer purchasing power. This is a central concern for hawks in the debate surrounding ECB's potential rate cut delays.

Implications for Financial Markets

- Euro Volatility: Delayed rate cuts could weaken the Euro against other currencies, impacting international trade and investment.

- Bond Yields and Stock Markets: Market reactions to delayed rate cuts are uncertain. Some analysts predict increased volatility in bond yields and stock markets, potentially leading to investor uncertainty.

Conclusion: Synthesizing Expert Views on ECB's Potential Rate Cut Delays

Economists offer widely diverging opinions on the timing and necessity of ECB rate cuts. The debate is heavily influenced by differing interpretations of inflation data, GDP growth projections, and the unpredictable impact of geopolitical events. Understanding these contrasting viewpoints is crucial for navigating the current economic uncertainty.

Key Takeaways: The uncertainty surrounding the ECB's potential rate cut delays highlights the complex interplay between inflation control and economic growth. The ongoing geopolitical instability and varying interpretations of economic indicators make accurate prediction challenging.

Call to Action: Stay informed about the evolving economic situation and the ECB's policy decisions. Analyzing the ECB's rate decisions requires continuous monitoring of key economic indicators and expert opinions. For deeper understanding of future ECB rate cuts and ECB monetary policy analysis, refer to reputable sources such as [list some reputable sources]. Keep abreast of the debate surrounding the ECB's potential rate cut delays to understand the future trajectory of the Eurozone economy.

Featured Posts

-

Wildfires Force Evacuations Devastate Homes In Eastern Newfoundland

May 31, 2025

Wildfires Force Evacuations Devastate Homes In Eastern Newfoundland

May 31, 2025 -

Miley Cyrus I Jej Flowers Sukces Debiutanckiego Singla

May 31, 2025

Miley Cyrus I Jej Flowers Sukces Debiutanckiego Singla

May 31, 2025 -

Foire Au Jambon 2025 Explosion Des Frais D Organisation Et Deficit La Ville De Bayonne Seule Responsable

May 31, 2025

Foire Au Jambon 2025 Explosion Des Frais D Organisation Et Deficit La Ville De Bayonne Seule Responsable

May 31, 2025 -

Wasserstand Bodensee Steigende Tendenz Oder Nur Kurzfristige Schwankung

May 31, 2025

Wasserstand Bodensee Steigende Tendenz Oder Nur Kurzfristige Schwankung

May 31, 2025 -

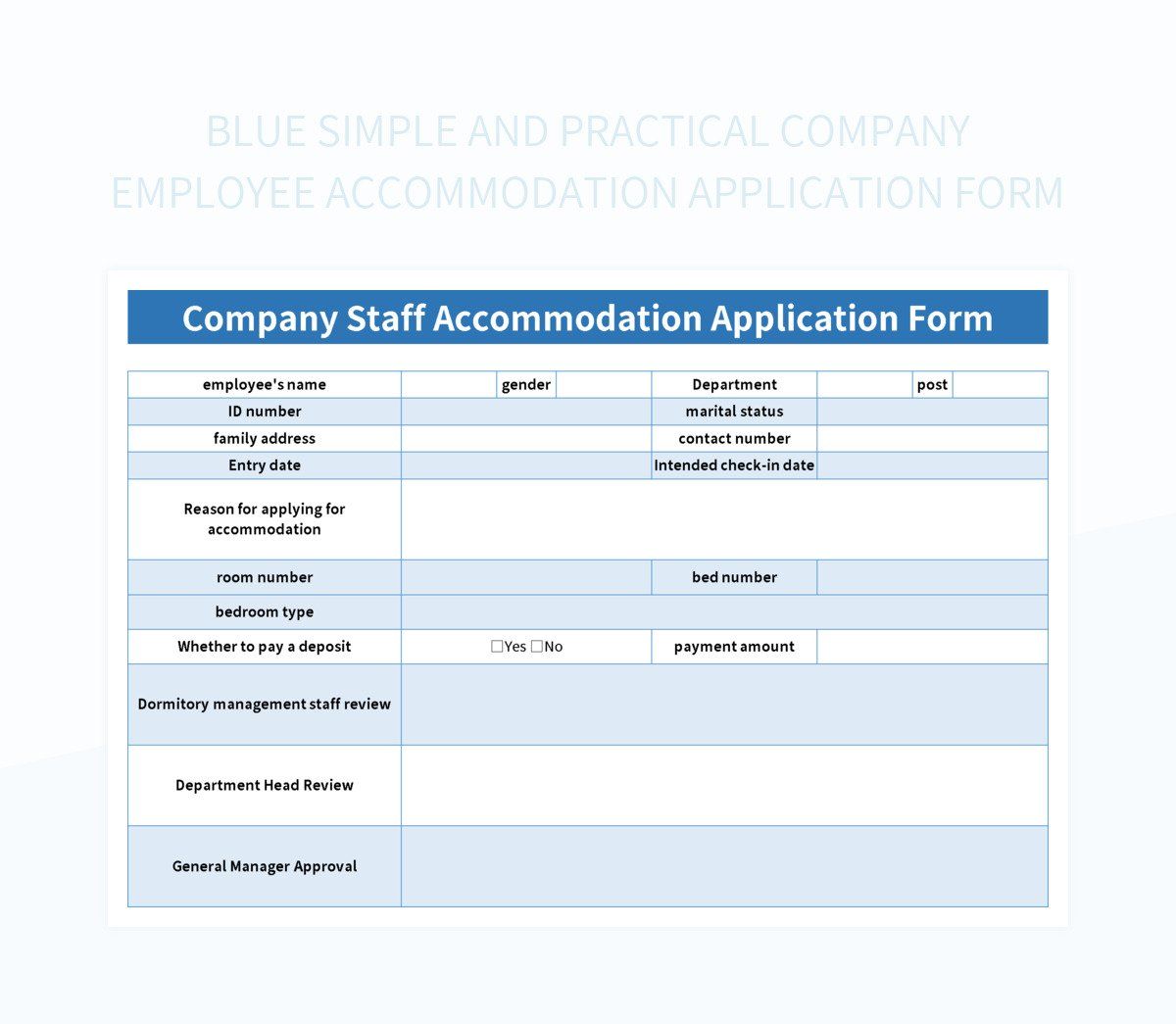

Free Accommodation In Germany Boosting Population With A Two Week Offer

May 31, 2025

Free Accommodation In Germany Boosting Population With A Two Week Offer

May 31, 2025