Analysis Of ING Group's 2024 Annual Report On Form 20-F

Table of Contents

Financial Highlights and Key Performance Indicators (KPIs)

Analyzing ING's financial performance requires a close look at several key performance indicators (KPIs). The ING Group's 2024 Annual Report (Form 20-F) provides the data necessary for this in-depth examination.

Revenue Analysis

ING's revenue streams are diverse, encompassing Wholesale Banking, Retail Banking, and other segments. Understanding the performance of each is vital. The 2024 financial results within the ING Group's 2024 Annual Report (Form 20-F) will likely show:

- Breakdown by Segment: A detailed analysis of revenue generated from Wholesale Banking (including corporate lending and trading), Retail Banking (including mortgages, savings, and consumer lending), and other business segments. Year-over-year comparisons will reveal growth or decline in each area.

- Year-over-Year Comparison: Tracking the percentage change in overall ING revenue and revenue per segment from 2023 to 2024 provides crucial insights into growth trends and the overall health of ING's business model.

- Significant Changes: The report will likely highlight any major shifts in revenue sources, perhaps due to changes in market conditions, strategic decisions, or economic factors impacting specific sectors. This analysis within the ING Group's 2024 Annual Report (Form 20-F) is vital for understanding future performance. Keywords like "ING revenue" and "2024 financial results" will be heavily used in this section of the report.

Profitability and Margins

ING's profitability is a critical aspect of its financial health. The ING Group's 2024 Annual Report (Form 20-F) will provide the metrics needed to assess this, including:

- Net Income: Analyzing the year-over-year change in net income provides a clear picture of ING's overall profitability.

- Profitability Ratios: Key ratios like net profit margin and return on equity (ROE) will be examined, allowing for comparison to previous years and industry benchmarks.

- Cost Management: The report will likely discuss cost-cutting measures and their effectiveness in boosting profitability. Efficient cost management is crucial for maintaining healthy profit margins. Economic factors, such as interest rate changes, will also have an impact, impacting "ING profitability" and "ING net income."

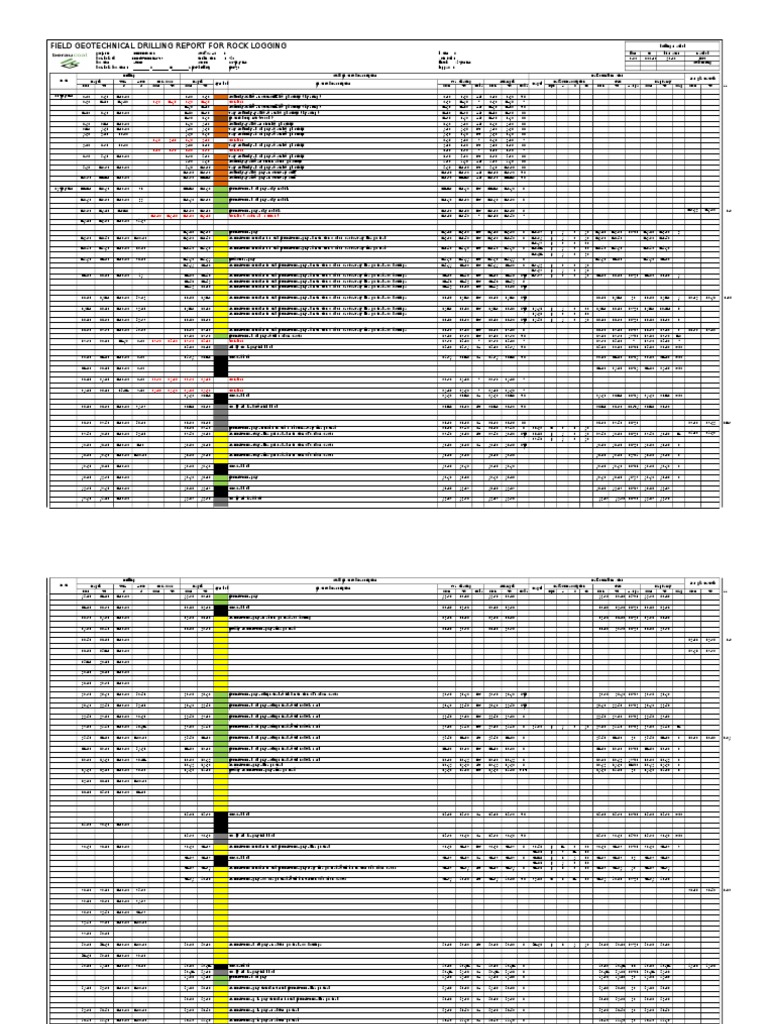

Capital Adequacy and Risk Management

Assessing ING's capital position and risk management strategies is paramount. The ING Group's 2024 Annual Report (Form 20-F) will detail:

- Capital Ratios: The Common Equity Tier 1 (CET1) ratio and other capital adequacy ratios are critical indicators of ING's financial strength and ability to absorb potential losses. Analyzing the CET1 ratio in the context of regulatory requirements will indicate compliance and overall financial resilience.

- Risk Mitigation Strategies: The report will discuss ING's approaches to managing various risks, such as credit risk, market risk, and operational risk. Effective risk management is crucial for maintaining financial stability. Key phrases like "ING capital adequacy" and "risk management ING" are crucial for understanding this aspect of the report.

- Regulatory Compliance: Adherence to regulatory requirements is paramount for financial institutions. The report will confirm ING's compliance with relevant regulations.

Strategic Initiatives and Future Outlook

The ING Group's 2024 Annual Report (Form 20-F) will outline strategic plans and future prospects.

Growth Strategies

ING's growth strategy will be a significant focus within the report. Expect details on:

- Mergers and Acquisitions: Any significant M&A activity undertaken in 2024 will be discussed, including their rationale and anticipated impact on growth.

- Digital Transformation: ING's investments in digital technologies and their role in driving growth and efficiency will be highlighted. This includes the effectiveness of their digital transformation initiatives.

- Expansion Plans: Details on geographic expansion or expansion into new product offerings will be outlined in the ING Group's 2024 Annual Report (Form 20-F). Keywords such as "ING growth strategy" and "ING digital transformation" are highly relevant here.

Sustainability and ESG Performance

The report will likely showcase ING's commitment to Environmental, Social, and Governance (ESG) factors:

- ESG Targets: Progress towards achieving ESG targets will be reported, including metrics on carbon emissions reduction, diversity and inclusion, and ethical business practices.

- Sustainability Reporting: The report will detail the methods used for sustainability reporting and the key findings.

- Environmental Impact: The environmental impact of ING's operations and its strategies for reducing its carbon footprint will be addressed. This section is crucial for understanding ING's "ING sustainability" and "ING ESG" performance.

Management Discussion and Analysis (MD&A)

The MD&A section provides crucial insights from management's perspective:

- Financial Performance Commentary: Management's assessment of the overall financial performance will be included.

- Risk Assessment: Key risks and uncertainties faced by ING, and the strategies to mitigate them, will be detailed.

- Future Outlook: Management's outlook for the future, including expectations for growth and profitability, will be discussed. This section is critical for understanding the "ING MD&A" and "ING outlook."

Comparison to Industry Peers

Benchmarking ING's performance against its competitors provides valuable context:

- Comparative Analysis: Key metrics such as revenue, profitability, and capital ratios will be compared against those of ING's main competitors.

- Industry Trends: Analysis will contextualize ING's performance in light of broader industry trends. This helps in understanding ING's competitiveness within its industry using keywords such as "ING competitors" and "industry comparison ING."

Conclusion: Key Takeaways and Call to Action

The ING Group's 2024 Annual Report (Form 20-F) provides invaluable insights into the bank's financial performance, strategic direction, and future prospects. This analysis highlights key financial KPIs, strategic initiatives, and a comparison to industry peers. Understanding these aspects is vital for investors, stakeholders, and anyone seeking a comprehensive understanding of ING's financial health. For a detailed understanding of ING's financials, we strongly recommend a thorough review of the full ING Group's 2024 Annual Report (Form 20-F). You can also supplement your understanding with further ING 20-F analysis and explore independent research reports offering insights into ING's annual report. Gaining a deeper understanding of ING's financials is crucial for making informed decisions, whether you're an investor, analyst, or simply interested in the performance of this global financial institution.

Featured Posts

-

Is Elias Rodriguez From Psl Chicago Investigating The Dc Jewish Museum Suspects Background

May 23, 2025

Is Elias Rodriguez From Psl Chicago Investigating The Dc Jewish Museum Suspects Background

May 23, 2025 -

Tulsa King Season 2 Blu Ray Exclusive Sylvester Stallone Sneak Peek

May 23, 2025

Tulsa King Season 2 Blu Ray Exclusive Sylvester Stallone Sneak Peek

May 23, 2025 -

Millions Stolen Inside The Office365 Executive Account Hacking Scheme

May 23, 2025

Millions Stolen Inside The Office365 Executive Account Hacking Scheme

May 23, 2025 -

Metallica Glasgow Hampden Ticket Information And How To Buy

May 23, 2025

Metallica Glasgow Hampden Ticket Information And How To Buy

May 23, 2025 -

Decoding The Big Rig Rock Report 3 12 96 1 The Rocket

May 23, 2025

Decoding The Big Rig Rock Report 3 12 96 1 The Rocket

May 23, 2025