Analysis Of Musk's X Debt Sale: Impact On Company Financials

Table of Contents

The Scale of the Debt Sale and its Purpose

Total Debt Amount and Sources

The exact figures surrounding Musk's X debt sale remain somewhat opaque, but reports suggest a substantial amount borrowed to refinance existing debt and potentially fund ongoing operations and future acquisitions. While precise details of lenders and interest rates haven't been fully disclosed, it's evident the debt sale involves a mix of loans and potentially high-yield bonds, reflecting the inherent risk associated with the transaction.

- Estimated Debt Amount: While precise numbers vary across reports, estimates place the total debt in the billions of dollars.

- Sources of Debt: A combination of bank loans, private equity investments, and potentially high-yield bonds is likely. The specific terms, including interest rates and maturity dates, are yet to be publicly released, adding to the uncertainty.

- Purpose of Financing: The financing likely serves to consolidate existing debt, injecting much-needed capital into X's operations, which have reportedly been strained since the acquisition. Additionally, it might support future investment plans, though these remain unclear. Alternative funding strategies, such as further equity offerings, may have been considered but rejected for various reasons, perhaps due to Musk's reluctance to dilute his ownership stake further.

Short-Term vs. Long-Term Implications

The short-term impact of the debt sale provides immediate liquidity, allowing X to meet its financial obligations and potentially pursue strategic initiatives. However, the long-term implications are more complex and potentially risky. The substantial interest payments associated with this debt could significantly impact X's profitability.

- Short-Term Benefits: Improved cash flow, ability to pay off immediate liabilities, potential for strategic acquisitions or investments.

- Long-Term Risks: Increased interest expense, potential credit rating downgrade impacting future borrowing costs, risk of default if revenue projections aren't met. A higher debt burden could limit X's financial flexibility, hindering its ability to adapt to unforeseen circumstances or capitalize on emerging opportunities.

Impact on X's Financial Ratios and Creditworthiness

Debt-to-Equity Ratio Analysis

The debt sale dramatically alters X's capital structure, significantly increasing its debt-to-equity ratio. This ratio, a key indicator of financial leverage, measures the proportion of debt to equity financing. A higher ratio suggests increased financial risk. Analyzing the before-and-after figures reveals the magnitude of this change.

- Before Debt Sale: The pre-sale debt-to-equity ratio would need to be sourced from publicly available financial statements (if available) to make a meaningful comparison.

- After Debt Sale: The new debt-to-equity ratio will likely be considerably higher, potentially raising concerns among investors and credit rating agencies. This increased leverage exposes X to greater financial risk in times of economic downturn or decreased revenues.

Credit Rating and Access to Future Funding

The increased debt burden could lead to a credit rating downgrade, making it more expensive for X to secure future financing. Lenders perceive higher risk and will demand higher interest rates to compensate. This could significantly hamper X's ability to pursue expansion plans or navigate unforeseen challenges.

- Potential Downgrade: Credit rating agencies closely monitor a company's debt levels and financial health. A significant increase in debt could trigger a downgrade, reflecting increased financial risk.

- Increased Borrowing Costs: A lower credit rating translates to higher interest rates on future loans, increasing X's debt servicing costs.

- Limitations on Future Investment: The increased debt load could restrict X's ability to secure capital for future investments, hindering innovation and growth.

Cash Flow Projections and Debt Servicing

X's ability to service its debt depends critically on its projected cash flows. The company must generate sufficient revenue to cover operating expenses, interest payments, and principal repayments. A shortfall could lead to financial distress.

- Revenue Projections: Accurate revenue forecasting is critical for assessing debt servicing capabilities. Aggressive growth projections are necessary to justify the current debt levels.

- Operating Expenses: Efficient cost management is crucial for maximizing free cash flow available to service the debt.

- Interest Expense: A significant portion of X's cash flow will be allocated to interest payments, potentially squeezing resources available for other critical functions.

Strategic Implications and Future Outlook for X

Impact on X's Business Strategy

The debt sale might influence X's strategic priorities, forcing a focus on cost reduction and revenue generation to service the debt. This could necessitate a reassessment of investment plans and perhaps a more conservative approach to expansion.

- Prioritization of Profitability: X might need to prioritize projects and initiatives that generate the quickest returns, potentially delaying long-term investments.

- Cost-Cutting Measures: Measures to reduce operational expenses, including potential layoffs or scaling back on certain initiatives, could be implemented.

Market Reactions and Investor Sentiment

The market's response to the debt sale reflects investor sentiment towards X's future prospects. Negative reactions could lead to a decline in X's stock price, while a positive response might signal confidence in the company's ability to manage the increased debt.

- Stock Price Movements: The market often reacts swiftly to news regarding a company's financial health, influencing its stock price.

- Analyst Ratings: Financial analysts' opinions and rating changes could significantly influence investor perception.

Potential Risks and Opportunities

The debt sale presents both substantial risks and potential opportunities. While the increased leverage exposes X to significant financial risk, it could also provide the resources needed to pursue strategic initiatives and drive growth if effectively managed.

- Risk of Default: Failure to generate sufficient revenue to cover debt servicing obligations could lead to default and potentially bankruptcy.

- Opportunities for Growth: The capital infusion could enable X to pursue acquisitions, enhance product development, or expand into new markets, provided that it's managed cautiously.

Conclusion

Musk's X debt sale is a high-stakes gamble with profound implications for the platform's future. While the short-term liquidity boost offers advantages, the long-term consequences, especially the substantial debt burden, pose significant challenges. Careful management of the debt, coupled with robust revenue generation and controlled expenditure, will be critical for X to navigate this perilous financial landscape. The increased debt-to-equity ratio, potential credit rating downgrade, and increased borrowing costs are all cause for concern. Continued monitoring of X’s financial performance, and further analysis of Musk's X debt sale strategy, will be crucial for understanding the long-term effects on the company's financial performance. Stay informed about the evolving financial situation at X and continue researching the impact of this significant debt financing decision. Further reading on corporate finance and debt management strategies can offer valuable insights into the challenges and opportunities facing X.

Featured Posts

-

Middle Management Their Value To Companies And Their Staff

Apr 29, 2025

Middle Management Their Value To Companies And Their Staff

Apr 29, 2025 -

One Dead Multiple Injured In Clearwater Ferry Collision

Apr 29, 2025

One Dead Multiple Injured In Clearwater Ferry Collision

Apr 29, 2025 -

Beyond Bmw And Porsche The Broader Challenges Facing Automakers In China

Apr 29, 2025

Beyond Bmw And Porsche The Broader Challenges Facing Automakers In China

Apr 29, 2025 -

Falcons Dcs Son Issues Apology For Prank Call To Shedeur Sanders

Apr 29, 2025

Falcons Dcs Son Issues Apology For Prank Call To Shedeur Sanders

Apr 29, 2025 -

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion To The Football League

Apr 29, 2025

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion To The Football League

Apr 29, 2025

Latest Posts

-

2024 Metais Porsche Pardavimai Lietuvoje Soktelejo Trecdaliu

Apr 29, 2025

2024 Metais Porsche Pardavimai Lietuvoje Soktelejo Trecdaliu

Apr 29, 2025 -

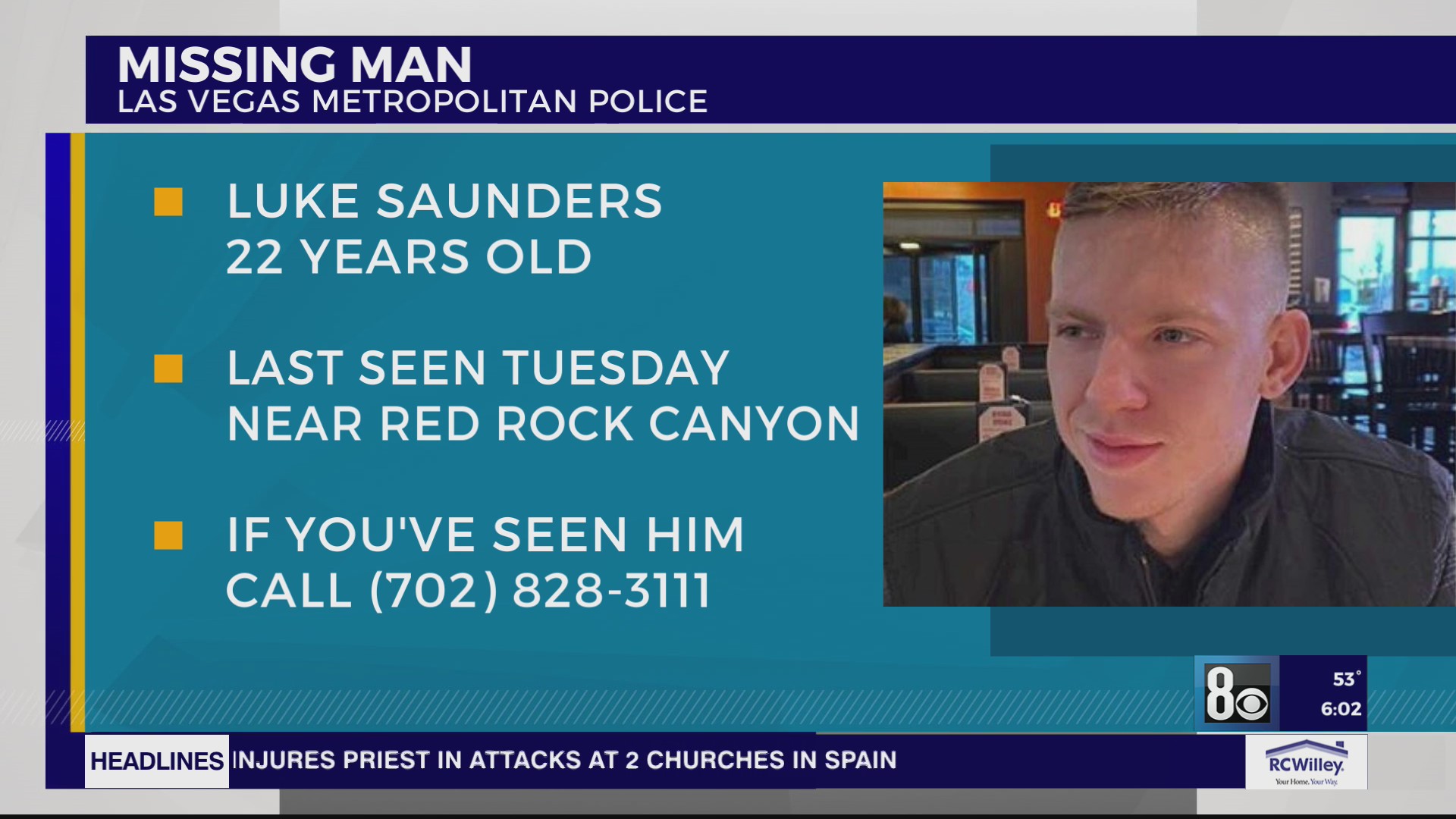

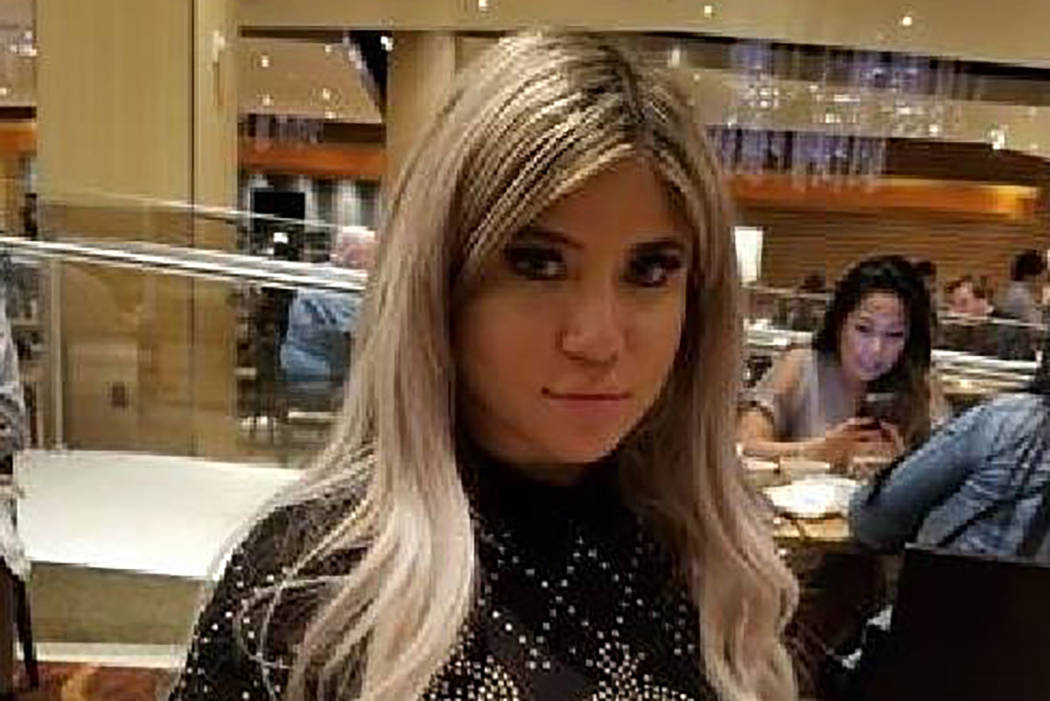

Urgent Appeal British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025

Urgent Appeal British Paralympian Missing In Las Vegas For Over A Week

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025 -

British Paralympian Missing In Las Vegas Search Intensifies After Week Without Contact

Apr 29, 2025

British Paralympian Missing In Las Vegas Search Intensifies After Week Without Contact

Apr 29, 2025 -

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025