Analysis Of Trump's Oil Price Views: Goldman Sachs Report

Table of Contents

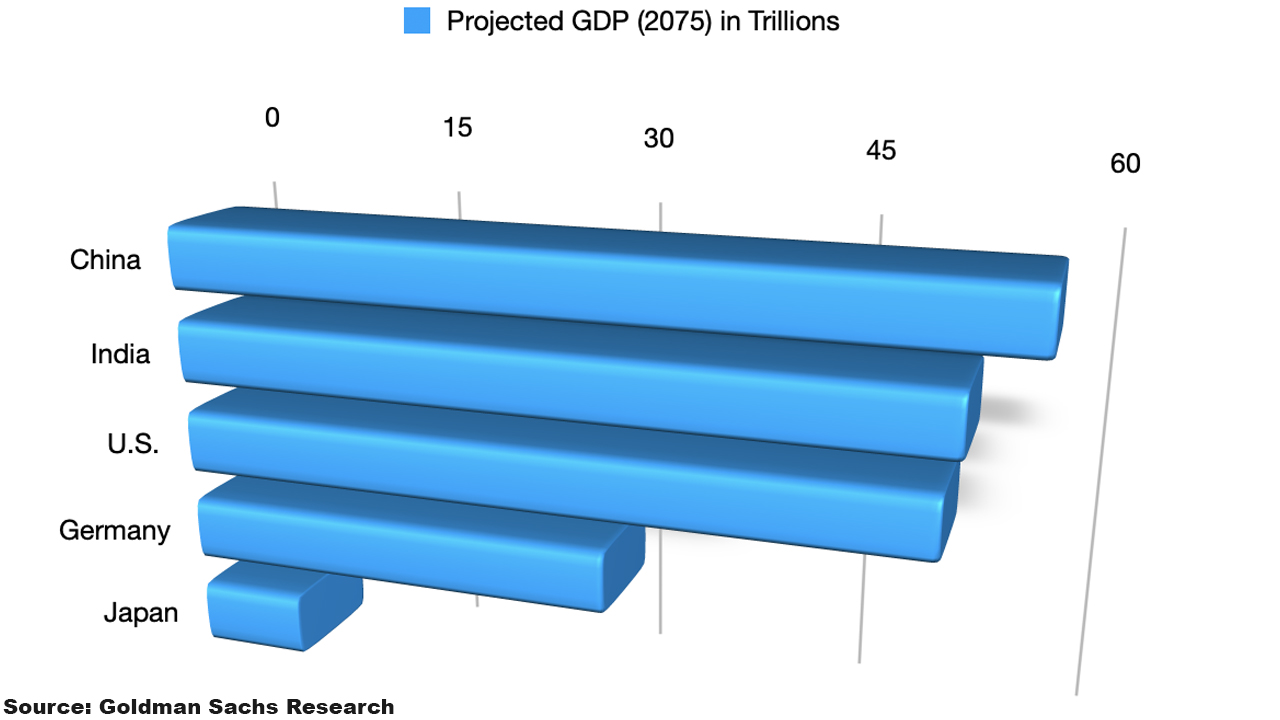

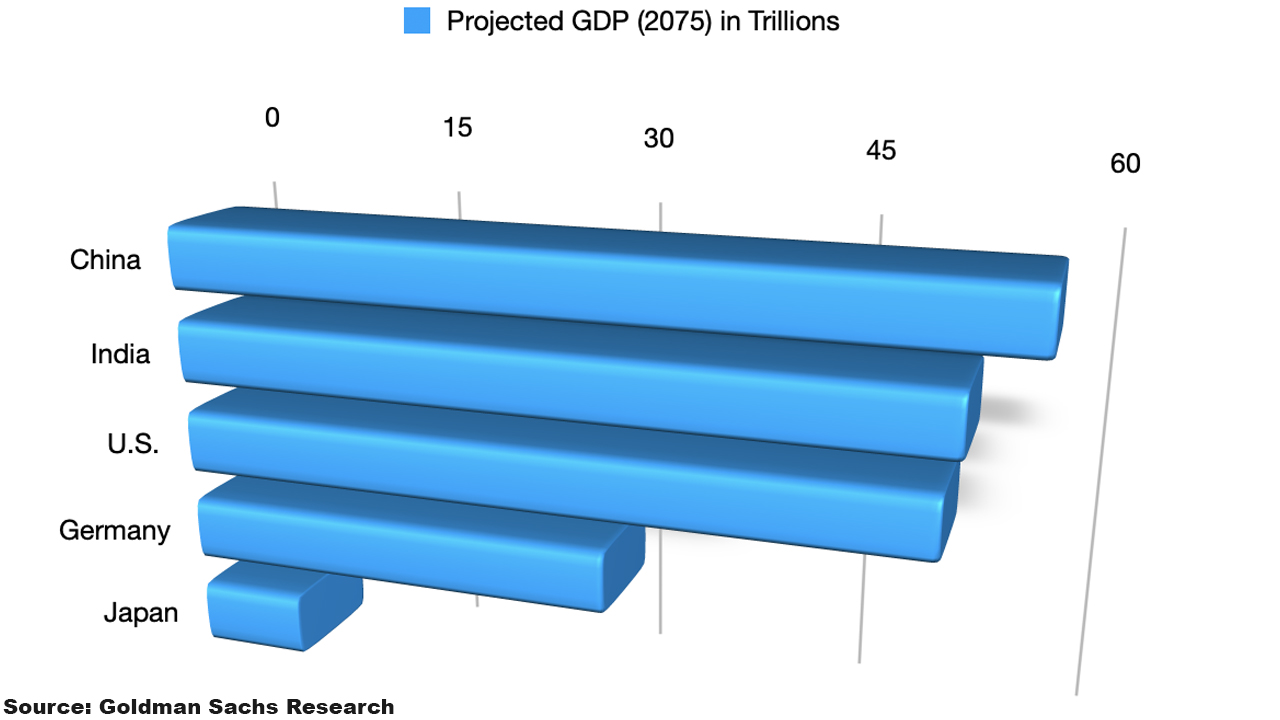

Goldman Sachs's Methodology and Data Sources

This hypothetical Goldman Sachs report employs a robust methodology to analyze Trump's oil price views. The report likely utilized a mixed-methods approach, combining quantitative and qualitative data analysis techniques.

-

Quantitative Analysis: This would involve econometric modeling, statistical analysis of oil price time series data, and potentially causal inference techniques to assess the correlation (or lack thereof) between specific policy decisions and resulting oil price fluctuations. Regression analysis might be employed to isolate the impact of Trump's policies from other contributing factors.

-

Qualitative Analysis: This component would involve a thorough review of Trump's public statements, tweets, and official government documents relating to energy policy and oil prices. The analysis would likely focus on identifying key themes, preferences, and potential biases in his pronouncements.

Data Sources: The report's data would likely come from a variety of sources, including:

- Government Reports: Data from the Energy Information Administration (EIA), the U.S. Department of Energy, and other relevant government agencies would be crucial.

- Market Data: Information on oil futures prices, spot prices, production levels, and global supply and demand from reputable sources like Bloomberg, Refinitiv, and the Intercontinental Exchange (ICE) would be essential.

- News Media Archives: A comprehensive review of news articles, press releases, and transcripts of speeches and interviews would provide context and qualitative data.

Specific Data Points (Hypothetical):

- Analysis of Trump's public statements on oil prices and production, revealing a preference for lower prices to stimulate economic growth.

- Correlation between Trump's actions (e.g., sanctions on Iran and Venezuela) and subsequent short-term oil price spikes.

- Comparison of oil price trends during Trump's presidency with previous administrations, potentially revealing different volatility patterns.

Trump's Stated Preferences Regarding Oil Prices

Throughout his presidency, Trump expressed mixed signals regarding his ideal oil price levels. While he often touted the benefits of energy independence and lower gasoline prices for consumers, his actions sometimes seemed at odds with those stated goals.

-

Rationale: His preference for lower prices was primarily driven by the desire to boost the U.S. economy, improve consumer spending, and maintain a competitive advantage in the global market. Energy independence was also a key policy objective.

-

Specific Instances (Hypothetical):

- "We want energy prices to come down...to help our economy." (Hypothetical quote from a press conference)

- Tweets criticizing OPEC for maintaining high oil prices.

- Policy decisions such as deregulation, aimed at increasing domestic oil and gas production, pushing prices lower.

The Impact of Trump's Policies on Oil Prices

Trump's administration implemented several policies that significantly impacted oil prices, both domestically and internationally.

-

Deregulation: Easing environmental regulations on oil and gas production led to increased domestic supply, potentially exerting downward pressure on prices.

-

Sanctions: Sanctions imposed on oil-producing nations like Iran and Venezuela temporarily disrupted global supply chains, leading to price increases. The impact of these sanctions was however a complex interplay of various global factors.

-

Trade Deals: While the impact of trade deals on oil prices is nuanced and often indirect, Trump's renegotiation of NAFTA (into USMCA) and other trade agreements may have subtly affected energy trade flows.

Effects of Specific Policies (Hypothetical):

- Deregulation increased domestic oil production by X%, contributing to a Y% decrease in oil prices.

- Sanctions on Iran led to a Z% increase in global oil prices in the short term.

- Trade deals had a minor but measurable influence on the price of imported oil.

Goldman Sachs's Conclusions and Predictions (Hypothetical)

This hypothetical Goldman Sachs report would likely conclude that Trump's policies had a complex and multifaceted impact on oil prices, with both short-term and long-term effects. While deregulation efforts initially boosted domestic production and may have slightly lowered prices in the short term, the impact of sanctions on global supply chains and other geopolitical factors largely counteracted these effects.

Key Predictions (Hypothetical):

- Continued volatility in oil prices due to ongoing geopolitical uncertainty.

- A gradual increase in oil prices in the long term due to growing global demand.

- The need for a more balanced approach to energy policy, incorporating both economic growth and environmental sustainability.

- Future administrations should adopt strategies that consider the long-term consequences of short-term decisions.

Conclusion

This analysis of the hypothetical Goldman Sachs report provides valuable insight into the complexities surrounding Trump's oil price views and their influence on the global energy market. Understanding the interplay between political rhetoric, policy decisions, and market dynamics is crucial for navigating the unpredictable world of oil prices. By examining the hypothetical findings of this report, investors, policymakers, and energy industry professionals can gain a more informed perspective on the potential impact of future political decisions on oil prices. For a deeper understanding of the intricacies of Trump's oil policies and their global ramifications, further research and analysis into this topic are strongly recommended. Continue your research on Trump's oil price views and related policy impacts to stay informed about this crucial area.

Featured Posts

-

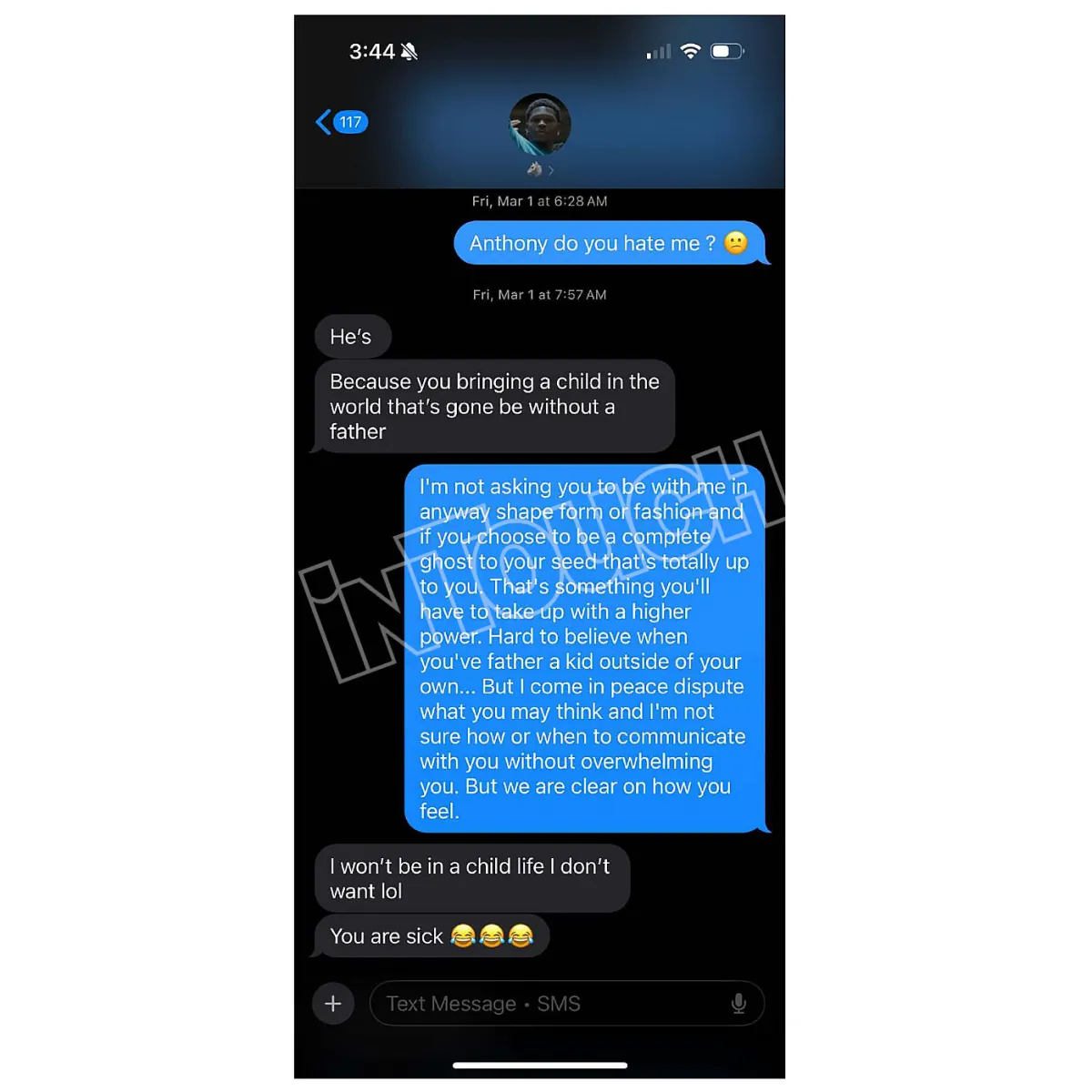

The Anthony Edwards Baby Mama Saga Unfolding On Twitter

May 16, 2025

The Anthony Edwards Baby Mama Saga Unfolding On Twitter

May 16, 2025 -

Nhl Playoffs The Ultimate Guide For Fans

May 16, 2025

Nhl Playoffs The Ultimate Guide For Fans

May 16, 2025 -

Bahia Derrota A Paysandu 0 1 Goles Y Cronica Del Encuentro

May 16, 2025

Bahia Derrota A Paysandu 0 1 Goles Y Cronica Del Encuentro

May 16, 2025 -

When Do Joe And Jill Biden Appear On The View A Viewers Guide

May 16, 2025

When Do Joe And Jill Biden Appear On The View A Viewers Guide

May 16, 2025 -

Nhl Fans Furious Over New Draft Lottery System

May 16, 2025

Nhl Fans Furious Over New Draft Lottery System

May 16, 2025