Analysis: RBC Earnings Miss And The Rise In Non-Performing Loans

Table of Contents

RBC's Earnings Miss: A Deeper Dive

Factors Contributing to the Earnings Shortfall

Several interconnected factors contributed to RBC's disappointing earnings. The recent economic slowdown, characterized by high inflation and rising interest rates, significantly impacted various aspects of RBC's business.

- Rising Interest Rates and Reduced Investment Banking Revenue: Higher interest rates dampened investment activity, leading to a decrease in investment banking fees and revenue. This impacted profitability across several business units. Data from [Cite Source: e.g., RBC's financial statements] shows a [Percentage]% year-over-year decline in investment banking revenue.

- Increased Loan Defaults: The economic downturn led to a rise in loan defaults across various sectors, particularly in consumer lending and commercial real estate. This resulted in a higher provision for loan losses, directly impacting profitability.

- Economic Slowdown and Reduced Consumer Spending: Reduced consumer spending and business investment negatively impacted revenue streams associated with personal and commercial banking. This translated into lower net interest income and fee-based revenue.

- Increased Operating Costs: While not always directly related to an economic downturn, rising operational costs, such as salaries and technology investments, also put pressure on profitability.

Comparison to Previous Quarters and Industry Peers

Comparing RBC's Q[Quarter] 2024 performance to previous quarters reveals a clear downward trend in key financial metrics such as earnings per share (EPS) and return on equity (ROE). A comparison to other major Canadian banks (TD Bank, BMO, Scotiabank) shows that while all experienced some impact from the economic climate, RBC's decline was comparatively more significant. [Insert chart/graph comparing RBC's performance to its peers]. This suggests that RBC may be more exposed to certain vulnerabilities in the current market environment, specifically related to its loan portfolio and investment banking operations. The competitive landscape is certainly more challenging, impacting market share and profitability.

The Rise of Non-Performing Loans (NPLs) at RBC

Understanding Non-Performing Loans

Non-performing loans (NPLs) are loans where borrowers have failed to make scheduled payments for a specified period. They are a critical indicator of a bank's financial health and credit risk. An increase in NPLs indicates potential credit losses and can significantly impact a bank's capital adequacy and profitability. NPLs are categorized based on the length of delinquency, with different implications for provisioning and recovery strategies. The higher the NPL ratio, the greater the potential financial burden on the bank.

Key Sectors Driving the Increase in NPLs

The rise in NPLs at RBC is particularly noticeable in several key sectors:

- Real Estate: The cooling Canadian housing market has contributed to a rise in mortgage delinquencies and defaults, impacting RBC’s real estate loan portfolio significantly.

- Energy: Fluctuations in global energy prices and economic uncertainty have increased the risk of defaults within the energy sector, affecting loans to oil and gas companies.

- Consumer Loans: Reduced disposable income due to inflation and increased interest rates is leading to higher rates of credit card and personal loan defaults.

The reasons for increased defaults vary across sectors, but are largely linked to the macroeconomic environment and the impact of rising interest rates on borrowers' ability to service their debt.

RBC's Response to the Rising NPLs

RBC is actively implementing strategies to mitigate the impact of rising NPLs:

- Strengthened Credit Underwriting: RBC is tightening its lending criteria to reduce the risk of future defaults, focusing on more stringent credit assessments and improved risk management practices.

- Enhanced Loan Recovery Strategies: RBC is investing in improved systems and processes to accelerate the recovery of non-performing loans. This includes more efficient debt collection procedures and improved communication with borrowers.

- Increased Provision for Loan Losses: RBC has increased its provisions for loan losses to reflect the higher risk in the current economic climate. This is a proactive measure to protect against potential future losses.

Conclusion

RBC's recent earnings miss is significantly linked to the rise in non-performing loans, driven by the current economic slowdown, high interest rates, and sector-specific challenges. The increase in NPLs in key sectors like real estate, energy, and consumer lending points to a broader economic vulnerability. RBC's response, while proactive, highlights the challenges facing the Canadian banking sector. The long-term implications include potential further revenue decline and pressure on profitability if economic conditions worsen. Staying informed about RBC's financial performance and the evolving landscape of non-performing loans is crucial for understanding the health of the Canadian financial system. Stay updated on further analysis of RBC's financial performance and the ongoing impact of rising non-performing loans by subscribing to our newsletter or following us on social media.

Featured Posts

-

Dragons Den Star Backs Life Changing Moroccan Childrens Charity

May 31, 2025

Dragons Den Star Backs Life Changing Moroccan Childrens Charity

May 31, 2025 -

Griekspoor Triumphs Stunning Win Over Top Seeded Zverev

May 31, 2025

Griekspoor Triumphs Stunning Win Over Top Seeded Zverev

May 31, 2025 -

The Texas Panhandles Long Road To Recovery Reflecting On The Year Since The Largest Wildfire

May 31, 2025

The Texas Panhandles Long Road To Recovery Reflecting On The Year Since The Largest Wildfire

May 31, 2025 -

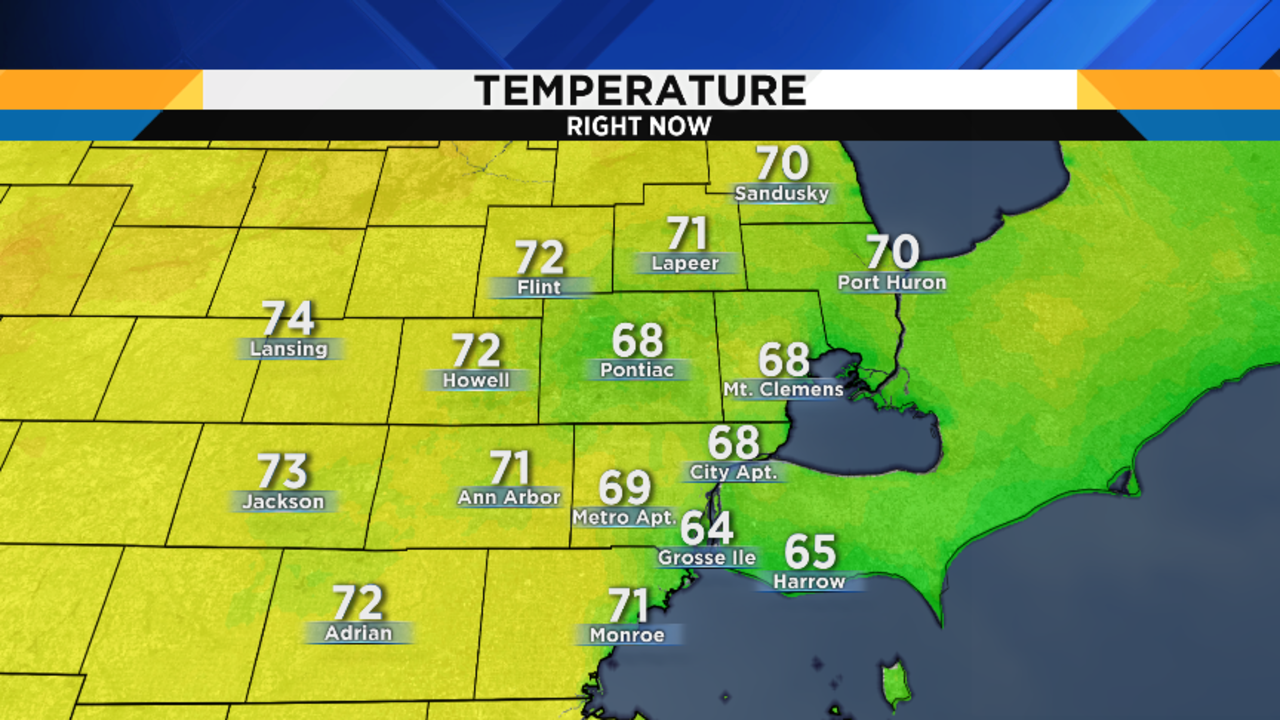

Metro Detroit Weather Forecast Mondays Cool Temperatures Give Way To Sunshine

May 31, 2025

Metro Detroit Weather Forecast Mondays Cool Temperatures Give Way To Sunshine

May 31, 2025 -

Is This The Good Life Evaluating Your Current Path And Making Changes

May 31, 2025

Is This The Good Life Evaluating Your Current Path And Making Changes

May 31, 2025