Analysis: SpaceX's $43 Billion Advantage Over Musk's Tesla Holdings

Table of Contents

SpaceX's Valuation Surge: Factors Driving the $43 Billion Lead

SpaceX's remarkable valuation isn't just hype; it's driven by several key factors that point to a strong future.

Government Contracts and Long-Term Vision

SpaceX's valuation benefits significantly from its strategic partnerships with government entities. These long-term contracts provide substantial revenue streams and demonstrate confidence in the company's capabilities.

- NASA Partnerships: SpaceX secured numerous NASA contracts, including the Commercial Crew Program, delivering astronauts to the International Space Station, and the Human Landing System program, aiming for a return to the Moon. These contracts provide substantial funding and validate SpaceX's technological prowess.

- Starlink's Government Contracts: Starlink, SpaceX's satellite internet constellation, has secured contracts with various government agencies for both military and civilian applications. This signifies a growing acceptance and reliance on Starlink’s infrastructure.

- Long-Term Vision: SpaceX's ambitious long-term vision—colonizing Mars—attracts investors seeking exposure to the burgeoning space exploration and colonization market. This audacious goal fuels investment and increases the company's perceived future value. The future potential of space-based industries, including space tourism and asteroid mining, further enhances SpaceX’s valuation.

Starlink's Exponential Growth and Revenue Potential

Starlink, SpaceX's satellite internet service, is a major driver of the company's valuation. Its exponential subscriber growth and projected revenue streams are unlike anything seen in the satellite internet market.

- Subscriber Growth: Starlink boasts millions of subscribers globally, with projections for continued rapid expansion into underserved and remote areas. This large and rapidly growing customer base translates directly into significant revenue generation.

- Competitive Advantage: Starlink's low-latency, high-speed internet service offers a competitive advantage over traditional satellite internet providers and even some ground-based options in certain areas. This edge attracts both individual and enterprise customers.

- Revenue Projections: Analysts predict Starlink's revenue to reach tens of billions of dollars in the coming years, significantly contributing to SpaceX's overall valuation and making it a key element in the SpaceX vs Tesla valuation comparison.

Reusable Rocket Technology and Cost Reduction

SpaceX's reusable rocket technology is a game-changer in the space launch industry. This innovation dramatically reduces launch costs, providing a significant competitive advantage.

- Falcon 9 and Starship: The reusable Falcon 9 and the upcoming Starship represent a paradigm shift in space launch capabilities. The ability to reuse rocket stages dramatically cuts down on operational expenses compared to traditional expendable rockets.

- Cost Comparison: Traditional space launches are incredibly expensive. SpaceX's reusable rockets make launching payloads into space significantly more affordable, opening up new possibilities for commercial and scientific endeavors.

- Market Dominance: This cost advantage allows SpaceX to undercut competitors and capture a larger share of the space launch market, further boosting its valuation.

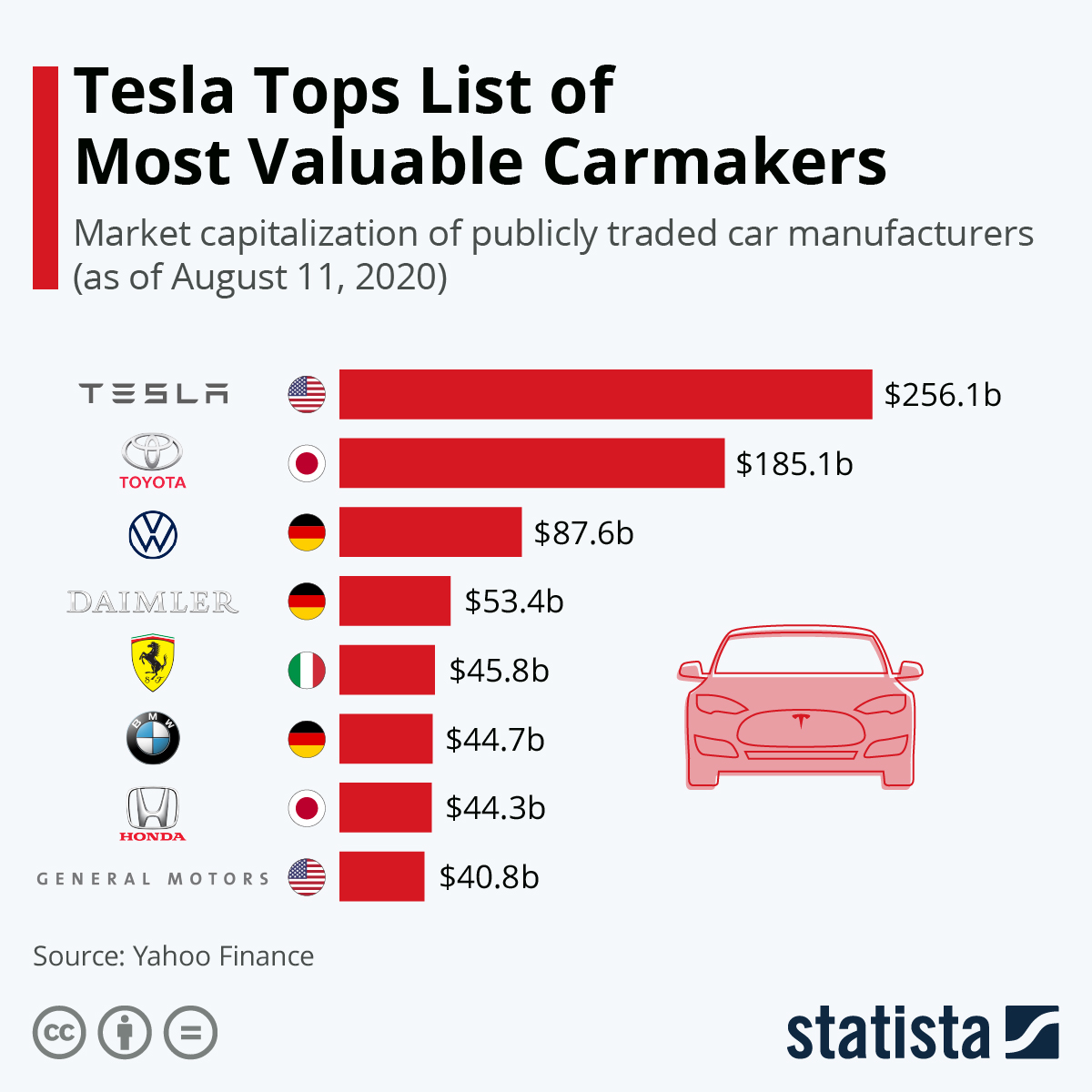

Tesla's Market Position and Challenges

While Tesla remains a dominant player in the EV market, several factors contribute to its lower valuation compared to SpaceX.

Market Volatility and Dependence on Consumer Demand

The EV market is subject to significant volatility. Tesla's performance is heavily dependent on consumer demand and susceptible to market shifts.

- Fluctuating Demand: Consumer preferences for EVs can change, impacting Tesla's sales and overall profitability. Economic downturns can also significantly reduce demand.

- Competition: Tesla faces growing competition from established automakers and new EV startups. This competition impacts Tesla's market share and profitability.

- Economic Sensitivity: Tesla's high price point makes its vehicles more susceptible to economic downturns impacting consumer spending power.

Production Bottlenecks and Supply Chain Issues

Tesla has historically faced challenges with production bottlenecks and supply chain disruptions, impacting its ability to meet demand and maintain profitability.

- Production Challenges: Scaling production to meet growing demand has proven challenging for Tesla in the past, resulting in production delays and lost revenue.

- Supply Chain Disruptions: Global supply chain disruptions have affected Tesla’s access to critical components, leading to production slowdowns and increased costs.

- Mitigation Efforts: Tesla is actively working to address these challenges through automation, improved supply chain management, and the expansion of its manufacturing facilities.

Regulatory Landscape and Future Uncertainties

The regulatory landscape for EVs and autonomous driving technology is constantly evolving, creating uncertainties for Tesla.

- Autonomous Driving Regulations: The regulatory approval process for autonomous driving technology is complex and varies across jurisdictions, potentially delaying the deployment and adoption of Tesla's self-driving capabilities.

- EV Subsidies and Incentives: Government subsidies and tax incentives for EVs can be unpredictable, impacting Tesla's competitiveness and profitability.

- Geopolitical Risks: Global political instability and trade wars can disrupt Tesla's supply chains and access to international markets, adding an element of uncertainty to its future prospects.

Implications of the Valuation Gap: Future Outlook for SpaceX and Tesla

The significant valuation difference between SpaceX and Tesla has several important implications.

Diversification and Risk Mitigation

SpaceX's diversified revenue streams—from government contracts to commercial launches and Starlink—offer a more stable financial outlook compared to Tesla's more concentrated market position in the EV industry. This diversification mitigates risk and enhances investor confidence.

Investment Strategies and Future Funding

The valuation difference might influence future investment rounds and expansion plans for both companies. SpaceX's higher valuation may attract larger investments for its ambitious space exploration endeavors, while Tesla might need to focus on optimizing its operations and streamlining its production to attract comparable levels of investment.

Musk's Leadership and Strategic Allocation of Resources

Musk's leadership and resource allocation decisions significantly impact the growth trajectories of both companies. The ongoing balance between investments in SpaceX's ambitious space projects and Tesla's EV production and expansion will continue to shape their respective valuations and market positions.

Conclusion

The substantial valuation gap between SpaceX and Tesla underscores the transformative potential of space exploration and the growing importance of space-based technologies. SpaceX's diversified revenue streams, driven by government contracts, Starlink's rapid growth, and revolutionary reusable rocket technology, contribute to its commanding lead in the SpaceX vs Tesla valuation comparison. While Tesla remains a powerhouse in the EV market, its susceptibility to market volatility, production challenges, and regulatory uncertainties present a more complex financial picture. Continue following this space to stay updated on the ongoing SpaceX vs Tesla valuation debate and the future of these innovative companies.

Featured Posts

-

Jeanine Pirro Unveiling The Untold Story Of A Fox News Icon

May 10, 2025

Jeanine Pirro Unveiling The Untold Story Of A Fox News Icon

May 10, 2025 -

A Data Driven Look At The Countrys Newest Business Hubs

May 10, 2025

A Data Driven Look At The Countrys Newest Business Hubs

May 10, 2025 -

Elon Musks Billions Us Economic Factors And Their Effect On Teslas Valuation

May 10, 2025

Elon Musks Billions Us Economic Factors And Their Effect On Teslas Valuation

May 10, 2025 -

Strands Nyt Crossword Clue Solutions Thursday April 10th Game 403

May 10, 2025

Strands Nyt Crossword Clue Solutions Thursday April 10th Game 403

May 10, 2025 -

Muutokset Britannian Kruununperimysjaerjestyksessae Yksityiskohtainen Selvitys

May 10, 2025

Muutokset Britannian Kruununperimysjaerjestyksessae Yksityiskohtainen Selvitys

May 10, 2025