Analysis: SSE's £3 Billion Spending Reduction And Its Implications

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

SSE's decision to slash its spending by £3 billion stems from a confluence of factors, primarily revolving around cost reduction and a reassessment of investment priorities in a volatile energy market. The company faces significant financial pressures, necessitating a strategic response to secure its long-term sustainability.

-

Increased pressure from rising inflation and interest rates: Soaring inflation and increased interest rates have significantly impacted SSE's operating costs and borrowing capabilities. This inflationary environment necessitates a re-evaluation of capital expenditure to maintain profitability.

-

Need to improve profitability and shareholder returns amidst fluctuating energy prices: The energy market is inherently volatile, with prices subject to significant fluctuations. To ensure healthy profitability and deliver attractive returns to shareholders, SSE needs to optimize its spending and prioritize projects with the highest potential return on investment (ROI).

-

Focus on debt reduction and strengthening the company's financial position: Reducing debt is crucial for strengthening SSE's balance sheet and improving its credit rating. The £3 billion spending cut contributes directly to this goal, enhancing financial resilience against future market uncertainties.

-

Re-evaluation of investment priorities in response to changing market conditions and government policies: The energy landscape is constantly evolving, influenced by changes in government regulations, technological advancements, and shifting consumer demands. SSE's spending reduction reflects a necessary adaptation to these dynamics.

-

Potential impact of new environmental regulations: The UK's ambitious net-zero targets and stricter environmental regulations impose additional costs on energy companies. SSE’s spending review likely considers the financial implications of complying with these evolving regulations.

Impact on SSE's Operations and Projects

The £3 billion spending reduction will undoubtedly have a significant impact on SSE's operations and projects. The company will likely prioritize existing commitments while carefully evaluating new investments.

-

Potential delays or cancellations of planned renewable energy projects (wind, solar): Renewable energy projects often require substantial upfront capital investment. The spending cut may lead to delays or cancellations of some projects, potentially slowing down SSE's renewable energy deployment.

-

Revised timelines for existing infrastructure upgrades and developments: Existing projects may experience revised timelines as SSE prioritizes cost efficiency and optimizes resource allocation. This may involve streamlining processes and delaying non-critical upgrades.

-

Increased focus on operational efficiency and cost-cutting measures across various departments: SSE will likely implement rigorous cost-cutting measures across all departments to maximize efficiency and reduce operational expenditures. This could involve streamlining processes, optimizing workforce deployment, and exploring technological solutions.

-

Potential impact on employment levels, depending on project cancellations and efficiency drives: The spending reduction may lead to workforce adjustments, particularly if projects are cancelled or significantly delayed. However, SSE may also focus on retraining and reskilling its workforce for roles in more efficient and sustainable operations.

-

Re-prioritization of R&D and technological investments: While R&D remains important for long-term growth, the spending reduction might necessitate a reassessment of R&D priorities, focusing on technologies with the highest potential ROI and alignment with SSE's revised strategic goals.

Broader Implications for the UK Energy Sector

SSE's £3 billion spending reduction has wider implications for the UK energy sector, particularly concerning the energy transition and investment climate.

-

Potential slowdown in the deployment of renewable energy projects across the UK: SSE's decision might signal a broader trend of reduced investment in renewable energy projects across the UK energy sector. This could impact the country's ability to meet its ambitious climate targets.

-

Impact on competition within the energy market, particularly among renewable energy providers: Reduced investment in renewable energy could reshape the competitive landscape, potentially favoring larger, more established players with greater financial resilience.

-

Implications for government policies aimed at achieving net-zero targets: The reduced investment in renewable energy could challenge the UK government's plans to achieve net-zero emissions by 2050. It might necessitate a re-evaluation of policies to incentivize investment in the sector.

-

Potential effect on investor confidence in the UK energy sector: SSE's decision could impact investor confidence in the UK energy sector, potentially leading to decreased investment overall. This could hamper the growth of renewable energy and other vital energy infrastructure projects.

-

A case study for other energy companies facing similar financial challenges: SSE's experience serves as a cautionary tale for other energy companies struggling with similar financial pressures. It highlights the need for robust financial planning, adaptable strategies, and efficient resource allocation in a challenging energy market.

Conclusion

SSE's £3 billion spending reduction is a significant development with far-reaching implications for the company and the UK energy sector as a whole. While aimed at strengthening financial stability, the move may slow the pace of renewable energy deployment and raise questions about the long-term viability of certain projects. The decision highlights the challenges facing energy companies in navigating fluctuating market conditions and achieving sustainable growth in a rapidly evolving energy landscape. Understanding the complexities of this significant cost-cutting measure is crucial for all stakeholders.

Call to Action: To stay informed about the ongoing developments and implications of SSE's spending reduction and its impact on the UK energy sector, continue to follow our analysis and subscribe to our newsletter for regular updates on major energy news. Understanding the complexities of SSE's £3 billion spending cut is crucial for navigating the future of energy.

Featured Posts

-

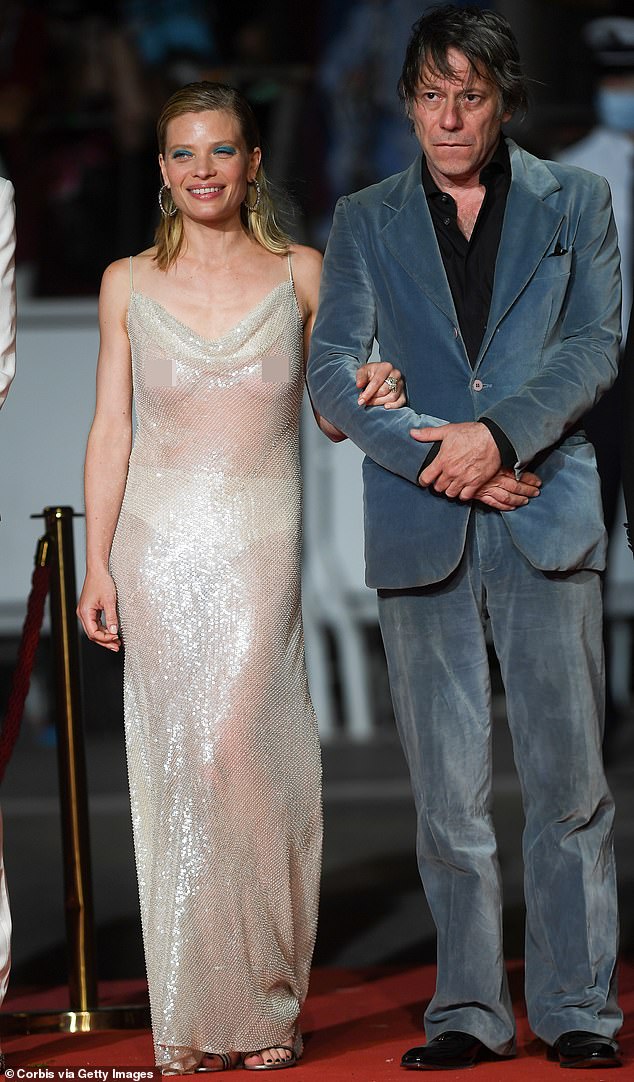

Melanie Thierry Actrice Francaise Talents Et Roles Inoubliables

May 25, 2025

Melanie Thierry Actrice Francaise Talents Et Roles Inoubliables

May 25, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets How To Get Yours Now

May 25, 2025

Bbc Radio 1 Big Weekend 2025 Tickets How To Get Yours Now

May 25, 2025 -

Verstappen Mercedes I Sxesi Poy Elikse

May 25, 2025

Verstappen Mercedes I Sxesi Poy Elikse

May 25, 2025 -

Naomi Kampel Stis Maldives Apolaystikes Diakopes Sta 54 Tis Me Mpikini

May 25, 2025

Naomi Kampel Stis Maldives Apolaystikes Diakopes Sta 54 Tis Me Mpikini

May 25, 2025 -

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025