Analysis: The House's Passage Of The Revised Trump Tax Bill

Table of Contents

Key Provisions of the Revised Trump Tax Bill

The revised Trump Tax Bill incorporates several key changes from its original iteration, impacting various aspects of the tax code. These modifications aim to stimulate economic growth and benefit specific sectors, according to proponents. However, critics argue that the changes disproportionately favor certain income brackets and industries.

- Changes to Individual Income Tax Rates: The bill [details changes to individual tax brackets – e.g., lowered rates for certain brackets, increased standard deduction]. These alterations in income tax brackets directly affect the disposable income of millions of Americans.

- Modifications to Corporate Tax Rates: A significant reduction in the corporate tax rate from [original rate] to [new rate] is a central feature of the revised Trump tax legislation. This is intended to boost business investment and competitiveness.

- Alterations to Deductions and Credits: The bill modifies several key tax deductions and credits. This includes changes to [e.g., the standard deduction, child tax credit, mortgage interest deduction]. These changes significantly impact taxpayers' overall tax liabilities.

- Impact on Specific Industries: The revised Trump tax bill’s impact varies across industries. For example, [Explain the impact on a specific industry, e.g., the real estate industry might see reduced deductions, while the manufacturing sector could benefit from lower corporate taxes]. This targeted approach raises questions about fairness and potential unintended consequences.

The rationale presented by the bill's proponents centers on the idea that these tax cuts, particularly the corporate tax rate reduction, will stimulate economic growth through increased investment and job creation. This "trickle-down" effect is central to their argument for tax reform.

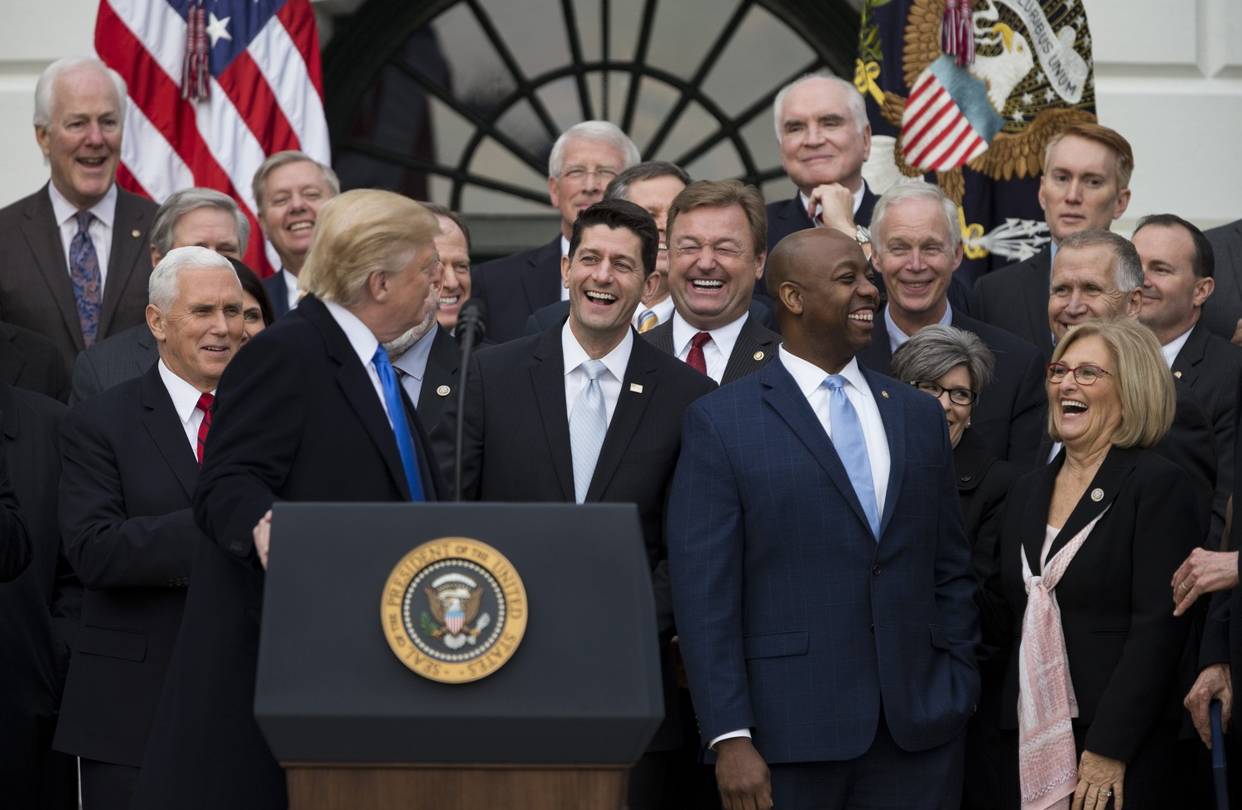

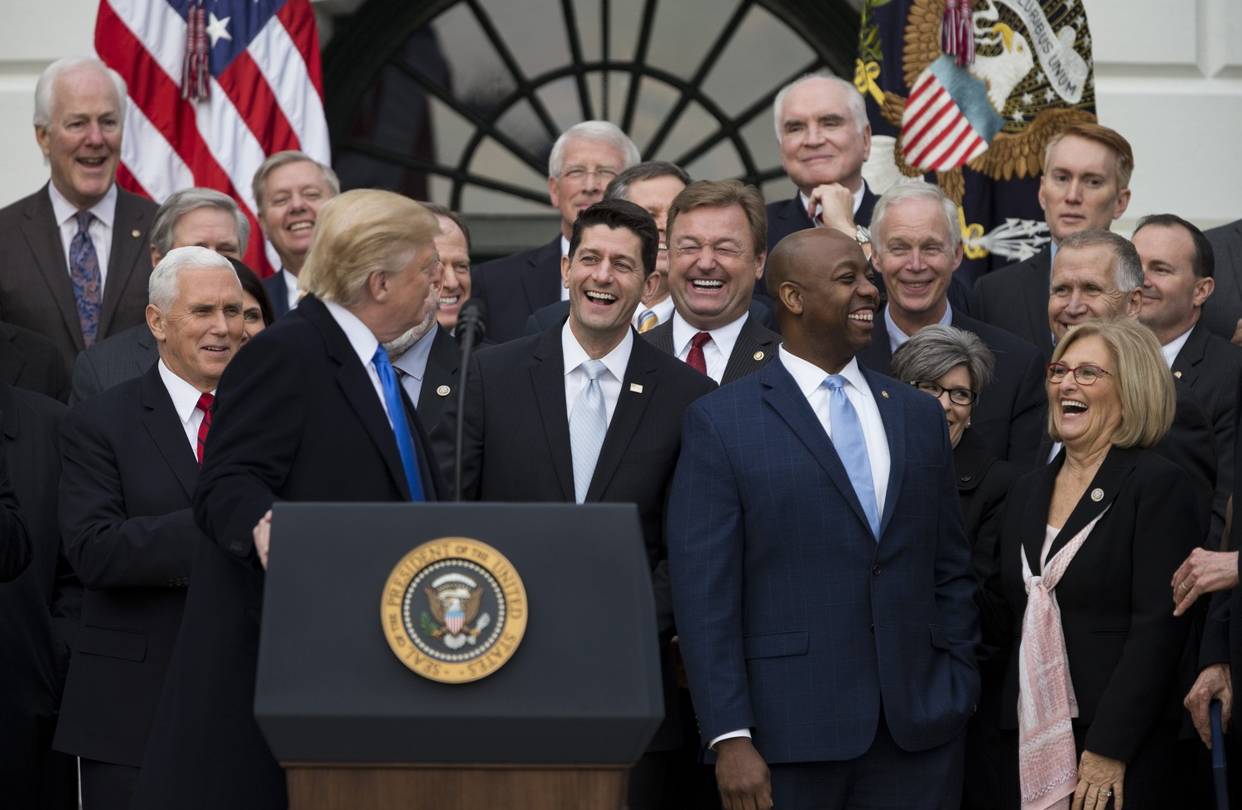

Political Ramifications of the House Vote

The House vote on the revised Trump Tax Bill largely followed party lines, highlighting the deep partisan divisions surrounding this significant piece of legislation. This partisan politics has already fueled intense debate and will likely dominate the political landscape for months to come.

- Implications for Future Legislative Agendas: The passage of the bill signals the priorities of the current majority party and sets the stage for future legislative battles. Expect further debates on fiscal policy and related issues.

- Potential Impact on Upcoming Elections: The bill's popularity (or lack thereof) amongst voters will undoubtedly influence the upcoming midterm elections and could sway voter sentiment.

- Key Political Figures and their Stances: [Mention key political figures and their positions on the bill, including their rationale]. The strong opinions expressed by these individuals reflect the broader political divides surrounding the legislation.

The highly polarized nature of the vote underscores the deep divisions within the American political landscape and suggests a continued battle over the future direction of economic policy.

Economic Projections and Analyses of the Revised Trump Tax Bill

The economic consequences of the revised Trump Tax Bill are a subject of intense debate among economists. Various models predict significantly differing outcomes, highlighting the uncertainty surrounding the bill's long-term effects.

- Differing Expert Opinions: Some economists predict robust GDP growth spurred by increased investment and consumer spending, while others warn of increased national debt and inflationary pressures.

- Economic Models and Predictions: [Mention specific economic models used and their predictions, including potential impacts on GDP growth, inflation rate, and job creation]. The wide range of predictions reflects the complexity of the issue and inherent difficulties in economic forecasting.

- Impact on Fiscal Policy: The bill’s long-term impact on the national debt and the overall fiscal policy of the government will require careful monitoring. This ongoing debate regarding fiscal policy highlights the need for continuous assessment.

Public Opinion and Reaction to the Revised Trump Tax Bill

Public opinion regarding the revised Trump Tax Bill is highly divided, reflecting the political polarization surrounding the legislation. Media coverage has fueled this division, with various outlets offering contrasting perspectives on the bill's impact.

- Public Opinion Polls and Surveys: Surveys reveal a mixed public response, with [mention specific data from polls and surveys, highlighting different demographics and their views].

- Media Coverage and Public Discourse: Media coverage has ranged from strongly supportive to highly critical, contributing significantly to the shaping of public perception.

- Potential Long-Term Social and Economic Consequences: The long-term social and economic consequences are difficult to predict, but experts point to potential impacts on income inequality and long-term economic stability. This uncertainty is a key concern amongst those critical of the bill.

Conclusion: The Future of the Revised Trump Tax Bill

The House's passage of the revised Trump Tax Bill represents a significant shift in American fiscal policy. Its key provisions, including altered income tax brackets and corporate tax rates, will have far-reaching consequences. The highly partisan vote underscores the deep political divisions surrounding this legislation, and the economic projections vary widely, reflecting uncertainty surrounding its overall impact. Public reaction remains divided, with ongoing debate shaping public perception. Stay informed on the developments of the revised Trump Tax Bill as it progresses through the Senate and beyond. Learn more about the potential impact of the Trump Tax Bill on your finances and follow the progress of this crucial piece of legislation. Continue your research on the revised Trump tax legislation and its effects to understand its implications fully.

Featured Posts

-

Aleksandrova Proshla Samsonovu V Shtutgarte

May 24, 2025

Aleksandrova Proshla Samsonovu V Shtutgarte

May 24, 2025 -

Aleksandrova Vybivaet Samsonovu V Pervom Raunde Shtutgarta

May 24, 2025

Aleksandrova Vybivaet Samsonovu V Pervom Raunde Shtutgarta

May 24, 2025 -

Claim Your Bbc Big Weekend 2025 Sefton Park Tickets A Practical Guide

May 24, 2025

Claim Your Bbc Big Weekend 2025 Sefton Park Tickets A Practical Guide

May 24, 2025 -

The Jonas Brothers Joe And The Couples Public Argument

May 24, 2025

The Jonas Brothers Joe And The Couples Public Argument

May 24, 2025 -

Atp Masters 1000 Indian Wells Drapers Historic First Title

May 24, 2025

Atp Masters 1000 Indian Wells Drapers Historic First Title

May 24, 2025