Analysis: The Recent Retreat Of Taiwanese Investors From US Bond ETFs

Table of Contents

Geopolitical Tensions and Shifting Investment Strategies

The increasing geopolitical risks surrounding Taiwan are significantly influencing investment decisions. The complex US-China relationship and escalating cross-strait tensions have created an environment of heightened uncertainty, impacting investor sentiment and risk appetite. This uncertainty has led many Taiwanese investors to reassess their portfolio diversification strategies.

- Increased uncertainty regarding Taiwan's political and economic future: The unpredictable nature of the geopolitical landscape makes long-term investment planning challenging, pushing investors towards perceived safer havens.

- Diversification away from US assets due to perceived increased risk: The concentration of assets in the US market is seen as less desirable given the geopolitical volatility.

- Shift towards investments perceived as less susceptible to geopolitical volatility: Investors are exploring alternative investment avenues, including assets deemed less vulnerable to regional conflicts and political instability. This includes a potential increase in investment in Asian markets and other more geographically diverse portfolios.

Interest Rate Hikes and Bond Market Volatility

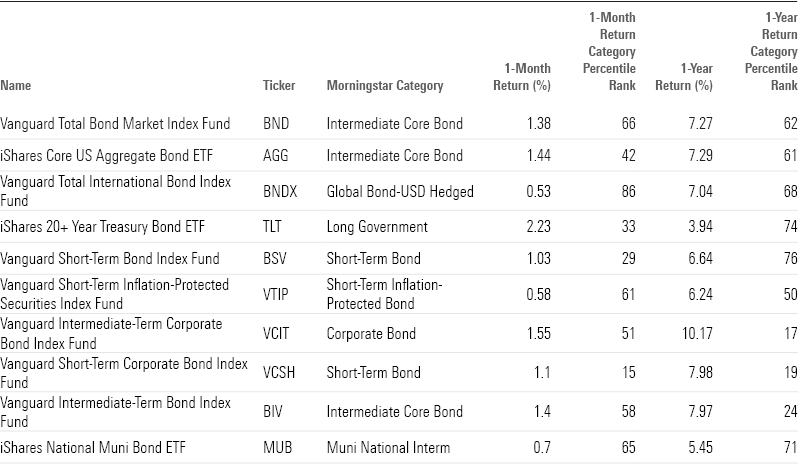

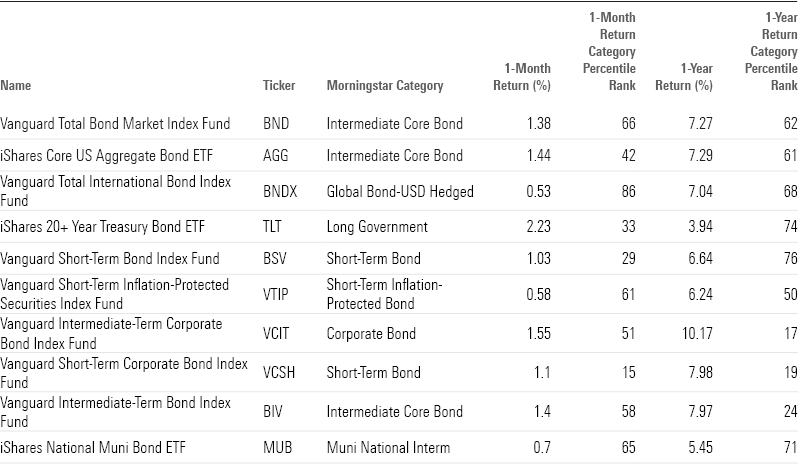

The recent aggressive US interest rate hikes have significantly impacted the attractiveness of US Bond ETFs. The inverse relationship between interest rates and bond prices means that rising interest rates typically lead to falling bond prices, reducing the returns on these ETFs. This, coupled with the potential for further volatility in the US bond market, has made investors reconsider their exposure.

- Falling bond prices impacting returns on US Bond ETFs: Lower bond prices directly translate to reduced returns for investors, making other investment vehicles more appealing.

- Search for higher yields in other markets: With yields potentially depressed in the US bond market, investors are seeking higher returns elsewhere, exploring opportunities in emerging markets or other asset classes.

- Concerns about potential future interest rate increases: The anticipation of further interest rate increases adds to the uncertainty, making investors hesitant to commit to US bonds in the short to medium term.

Domestic Investment Opportunities in Taiwan

The attractiveness of domestic investment opportunities within Taiwan is also contributing to the outflow of capital from US Bond ETFs. Taiwan's robust economic growth, fueled by technological advancements and government initiatives, is creating compelling investment opportunities within its own borders.

- Increased infrastructure projects and economic growth in Taiwan: Significant government investment in infrastructure and technological development is fostering economic expansion and creating lucrative investment possibilities.

- Attractive returns on Taiwanese equities and real estate: Investors are finding potentially higher returns and potentially lower risk within the Taiwanese market itself, especially in high-growth sectors.

- Government policies encouraging local investment: Government incentives and initiatives are encouraging domestic investment, further bolstering the appeal of the Taiwanese market.

Currency Fluctuations and Exchange Rate Risk

Fluctuations in the Taiwan dollar (TWD) against the US dollar (USD) play a crucial role in the investment decisions of Taiwanese investors. A stronger US dollar negatively impacts returns when converting USD back to TWD. The inherent exchange rate risk associated with investing in US-denominated assets is prompting investors to reassess their strategies.

- Impact of a stronger US dollar on returns for Taiwanese investors: A stronger USD diminishes the value of returns when converted back to TWD, reducing the overall profitability of the investment.

- Hedging costs and their effect on overall profitability: While hedging strategies can mitigate exchange rate risk, the costs associated with hedging can significantly impact overall profitability.

- Shifting investment strategies to mitigate exchange rate risk: Investors are increasingly adopting strategies to minimize exchange rate risk, including diversification into assets less sensitive to currency fluctuations.

Understanding the Retreat and Future Implications for Taiwanese Investors in US Bond ETFs

The decline in Taiwanese investment in US Bond ETFs is a multifaceted phenomenon driven by a confluence of factors. Geopolitical uncertainty, rising US interest rates, the allure of domestic investment opportunities in Taiwan, and concerns about currency fluctuations are all contributing to this shift. Looking ahead, we can anticipate continued volatility in both the Taiwanese and US markets, influencing investor decisions and shaping future investment strategies.

To better understand the evolving global financial landscape, further research and analysis of Taiwanese investors' investment strategies in US Bond ETFs are crucial. Staying informed on developments in both the Taiwanese and US markets is essential for making informed investment decisions. Understanding the interplay between geopolitical risks, interest rate policies, and currency fluctuations will be key to navigating the complexities of international investment in the years to come.

Featured Posts

-

Superman Faces Darkseids Legion Dc July 2025 Solicitations Breakdown

May 08, 2025

Superman Faces Darkseids Legion Dc July 2025 Solicitations Breakdown

May 08, 2025 -

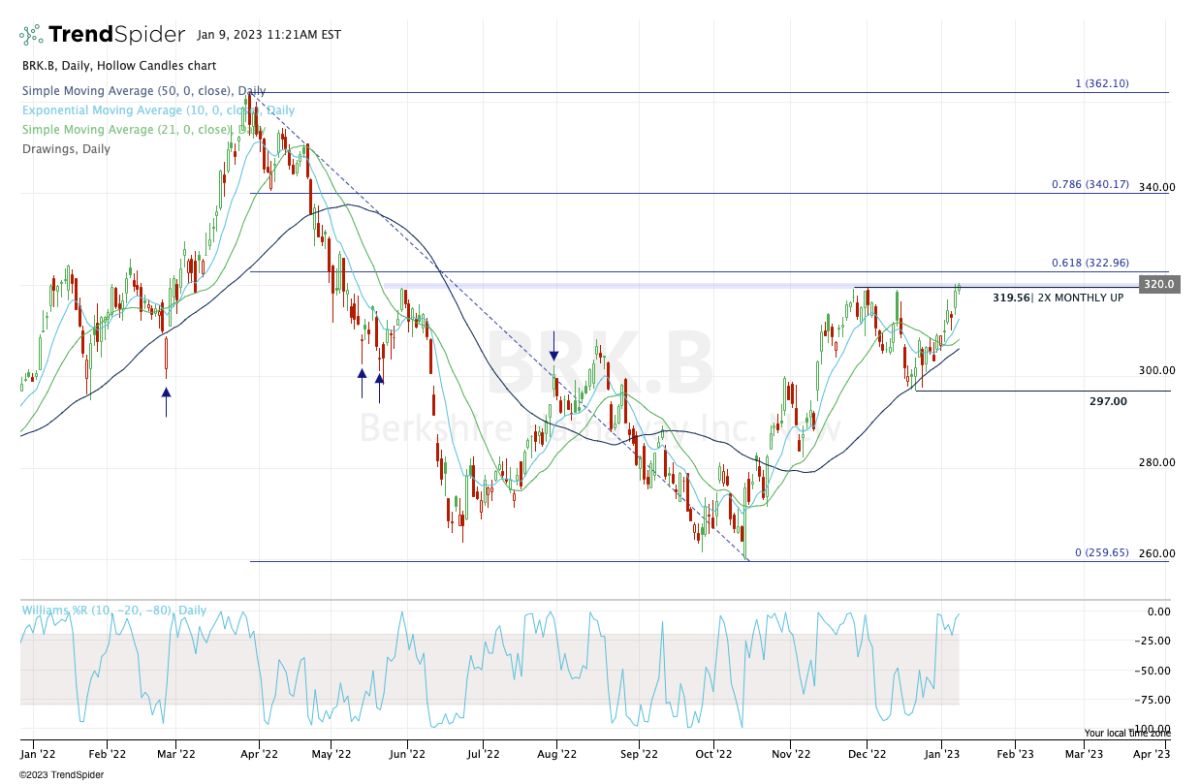

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025 -

Pulgar Un Gesto Que Llego Al Corazon De La Aficion Del Flamengo

May 08, 2025

Pulgar Un Gesto Que Llego Al Corazon De La Aficion Del Flamengo

May 08, 2025 -

Is This An Ethereum Buy Signal Weekly Chart Analysis

May 08, 2025

Is This An Ethereum Buy Signal Weekly Chart Analysis

May 08, 2025 -

Jwazat Sfr Jely Awr Bhyk Mangne Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025

Jwazat Sfr Jely Awr Bhyk Mangne Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025