Analysis: The Republican Factions Blocking Trump's Tax Reform

Table of Contents

The Fiscal Conservative Faction

This group, a significant voice within the Republican party, prioritized fiscal responsibility above all else. Their primary concern revolved around the long-term effects of the proposed tax cuts, specifically the potential impact on the national debt.

Concerns about the National Debt

Fiscal conservatives harbored deep anxieties about the proposed tax cuts significantly increasing the national debt and deficit spending. Their objections stemmed from several key concerns:

- Lack of Offsetting Spending Cuts: The plan lacked corresponding cuts in government spending to offset the revenue losses from the tax cuts. This raised concerns about irresponsible fiscal management.

- Future Generational Burden: The increased debt would place a significant burden on future generations, forcing them to shoulder the costs of current tax cuts.

- Impact on Interest Rates: Increased borrowing to cover the deficit could drive up interest rates, negatively affecting economic growth.

Statistics projected a substantial increase in the national debt under the Trump administration's proposed tax plan. Estimates varied, but all pointed towards a significant expansion of the deficit over the following decade. Prominent fiscal conservative Republicans, such as [Insert names and quotes from prominent fiscal conservatives here, linking to relevant articles], voiced their opposition, emphasizing the unsustainable nature of the plan.

Alternative Approaches to Tax Reform

Instead of broad-based tax cuts, fiscal conservatives advocated for alternative approaches focusing on targeted tax relief and long-term fiscal sustainability. These proposals often involved:

- Reforming the Tax Code for Increased Efficiency: Focusing on simplifying the tax code to improve efficiency and reduce loopholes, rather than across-the-board cuts.

- Targeted Tax Cuts: Implementing targeted tax cuts benefiting specific sectors or income brackets deemed to stimulate economic growth effectively.

- Spending Cuts: Prioritizing spending cuts as a means of reducing the deficit alongside tax reforms.

These alternative proposals differed significantly from Trump's plan, which was characterized by large, across-the-board cuts. The contrast highlighted the fundamental differences in approach to fiscal policy between the Trump administration and this influential faction within the Republican party.

The Freedom Caucus and its Influence

The House Freedom Caucus, known for its staunch conservative stance, presented a different set of objections to Trump's tax reform. Their concerns went beyond mere fiscal responsibility; they incorporated significant social and ideological elements.

Objections Based on Principles

The Freedom Caucus’s core principles clashed with certain aspects of Trump's tax plan. Key objections included:

- Corporate Tax Cuts: The large corporate tax cuts were seen as benefiting large corporations at the expense of small businesses and individual taxpayers.

- Individual Tax Cuts for High-Income Earners: The plan's provisions for significant tax cuts for high-income earners were criticized for exacerbating income inequality.

- Lack of Focus on Social Issues: Members felt the tax plan didn't sufficiently address their concerns related to social issues, which often influenced their voting decisions.

Prominent members of the Freedom Caucus, such as [Insert names and quotes from key Freedom Caucus members here, linking to relevant articles], publicly voiced their reservations. Their voting record on related legislation demonstrated a consistent pattern of opposition to measures they deemed inconsistent with their principles.

Negotiating Power and Leverage

The Freedom Caucus, despite its relatively small size, possessed significant influence within the Republican party. Its members demonstrated a mastery of strategic political maneuvering, employing tactics such as:

- Threatening to withhold support for legislation: Their willingness to block key legislation gave them considerable leverage in negotiations.

- Public pressure campaigns: The Caucus effectively used public pressure campaigns to sway public opinion and influence the debate.

- Strategic alliances with other factions: They forged alliances with other groups sharing similar concerns, amplifying their impact.

Their ability to block or significantly alter legislation highlighted their disproportionate influence within the Republican party, particularly during the Trump administration.

The Moderate Republican Wing's Hesitations

A segment of moderate Republicans expressed reservations about the distributional effects of Trump's tax plan and its potential impact on different segments of the population.

Concerns about Inequality

Moderate Republicans voiced concerns that the tax cuts would exacerbate income inequality, widening the gap between the rich and the poor. Their worries were based on:

- Regressive nature of some tax cuts: Some tax cuts disproportionately benefited high-income earners, raising concerns about fairness.

- Impact on Social Programs: Reduced government revenue could necessitate cuts to vital social programs, negatively impacting vulnerable populations.

- Long-term economic consequences: The potential for increased income inequality could lead to long-term economic instability.

Analysis showed the tax plan disproportionately benefiting the wealthiest Americans, a point repeatedly raised by moderate Republicans who cited [Insert statistics and data on income inequality and the tax plan here, linking to reputable sources].

Lack of Broad Public Support

Moderate Republicans were also apprehensive about enacting a tax plan lacking broad public support. Their concerns stemmed from:

- Potential political backlash: Passing an unpopular tax bill could result in negative electoral consequences for the Republican party.

- Erosion of public trust: Enacting legislation perceived as unfair or benefiting only the wealthy could damage public trust in government.

- Need for bipartisanship: They favored a more bipartisan approach to tax reform, arguing that it would yield more sustainable and widely accepted results.

Public opinion polls consistently showed lukewarm support for the proposed tax plan, confirming the moderate Republicans' concerns about its lack of broad public appeal.

Conclusion

The failure of Trump's tax reform efforts underscored the significant internal divisions within the Republican party. The interplay between fiscal conservatives, the Freedom Caucus, and moderate Republicans proved to be a major obstacle, preventing the passage of the proposed legislation. Understanding the motivations and strategies of these factions is essential for analyzing future legislative battles and predicting the success or failure of future tax reform initiatives. To stay informed about the ongoing power struggles within the Republican party and their impact on tax policy, continue following news and analysis regarding Republican factions blocking Trump's tax reform and related legislative efforts.

Featured Posts

-

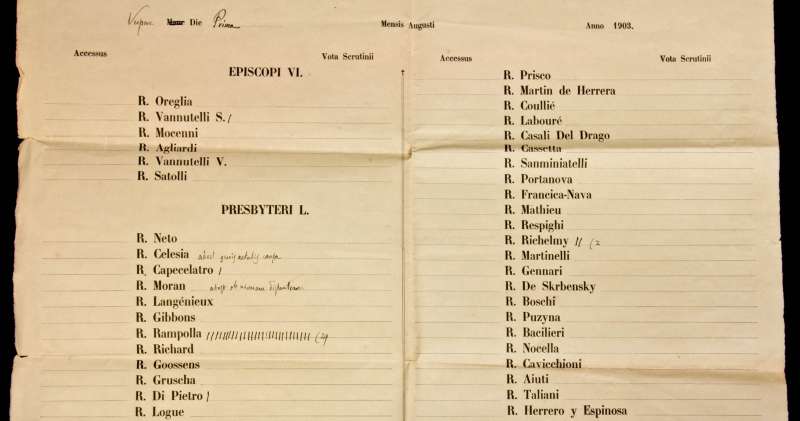

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025 -

Reliance Earnings Beat Expectations Boost For Indian Large Cap Stocks

Apr 29, 2025

Reliance Earnings Beat Expectations Boost For Indian Large Cap Stocks

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Registration Purchase And Faqs

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Registration Purchase And Faqs

Apr 29, 2025 -

Rock Throwing Incident Results In Teens Murder Conviction

Apr 29, 2025

Rock Throwing Incident Results In Teens Murder Conviction

Apr 29, 2025 -

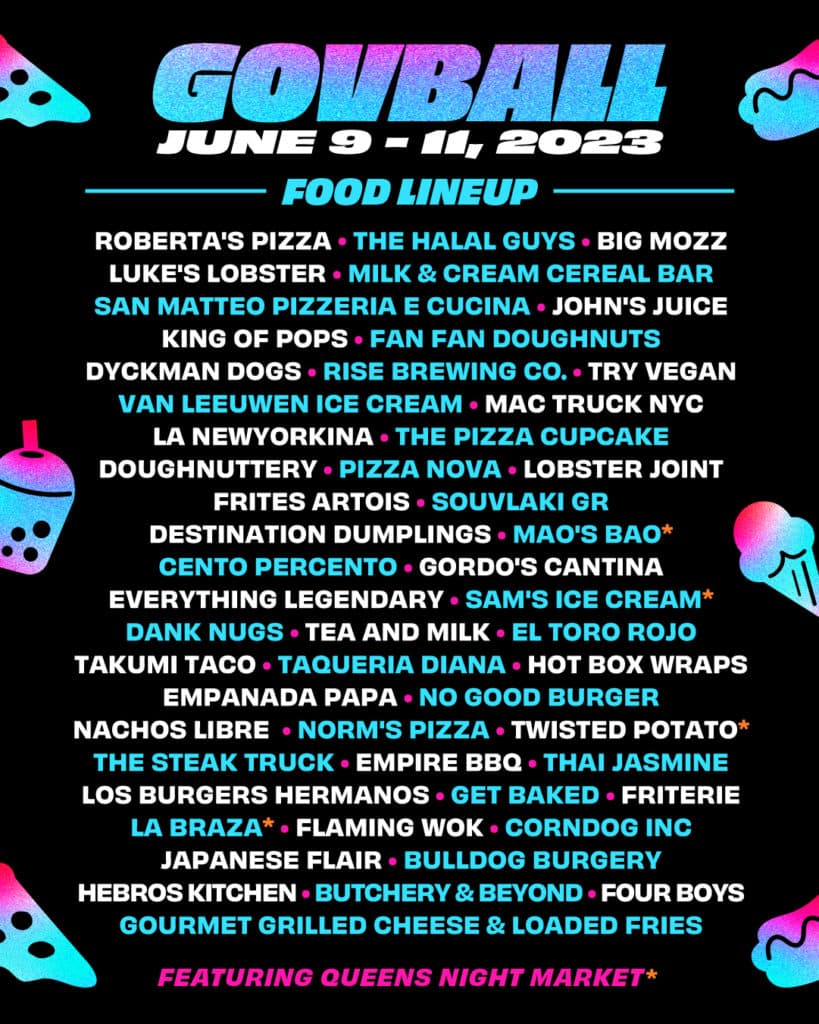

The Devastating Effect Of River Road Construction On Louisville Restaurants

Apr 29, 2025

The Devastating Effect Of River Road Construction On Louisville Restaurants

Apr 29, 2025