Analysis: Trump Tariffs And The $174 Billion Drop In Billionaire Net Worth

Table of Contents

The Direct Impact of Tariffs on Billionaire Portfolios

The Trump tariffs didn't just impact everyday consumers; they significantly impacted the portfolios of billionaires. This impact manifested in two primary ways: through the stock market and international investments.

Impact on Stock Market Performance

Tariffs negatively affected stock prices across various sectors, particularly those heavily reliant on global trade. The imposition of tariffs led to:

-

Decreased consumer spending due to higher prices: Increased prices on imported goods, resulting from tariffs, reduced consumer purchasing power, impacting sales and profits of companies reliant on consumer spending. Retail giants, for example, experienced a notable downturn.

-

Supply chain disruptions leading to production slowdowns: Tariffs disrupted established global supply chains, forcing companies to seek more expensive alternatives or face production delays. This uncertainty impacted business valuations.

-

Increased uncertainty leading to decreased investment: The uncertainty created by the trade war discouraged investment, impacting stock prices and valuations across various sectors.

The decline in market capitalization was substantial for companies deeply involved in international trade. For instance, the technology sector, heavily reliant on global supply chains and consumer electronics imports, witnessed a significant drop in valuations impacting the net worth of many tech billionaires. Specific examples of billionaires whose net worth declined due to the impact on their company stock are readily available in financial news archives from that period.

Impact on International Investments

Billionaires with extensive international investments felt the brunt of the tariffs in several ways:

-

Reduced exports and market access: Retaliatory tariffs imposed by other countries in response to the US tariffs significantly reduced export opportunities for American companies, directly impacting the bottom line and stock prices of companies owned by these billionaires.

-

Currency fluctuations due to trade tensions: The trade war created significant currency volatility, impacting the value of international holdings. Fluctuations in exchange rates led to unpredictable losses for billionaires with diverse international portfolios.

-

Increased costs for importing raw materials and components: Tariffs increased the cost of importing essential raw materials and components, negatively affecting the profitability of companies and reducing their market valuation.

Case studies showcasing the impact on specific billionaire's foreign holdings would illuminate the scope of the losses resulting from these interconnected factors. The combination of retaliatory tariffs and general market instability exacerbated the negative effects on billionaire net worth tied to international investments.

Indirect Economic Consequences and Their Impact on Billionaire Wealth

Beyond the direct market impact, the Trump tariffs had significant indirect economic consequences that rippled through the economy, diminishing billionaire wealth.

Slowdown in Economic Growth

The tariffs contributed to a broader economic slowdown, impacting various sectors. This slowdown stemmed from:

-

Decreased consumer confidence and spending: Uncertainty about the economic outlook and higher prices on goods dampened consumer confidence, leading to reduced spending and impacting businesses across the spectrum.

-

Reduced business investment and expansion: Businesses became hesitant to invest and expand due to the uncertainty caused by the trade war, further slowing economic growth.

-

Increased unemployment and wage stagnation: The slowdown in economic activity led to job losses and wage stagnation in certain sectors, reducing overall consumer demand and impacting businesses negatively.

Economic reports from that period clearly show a decline in GDP growth, confirming the slowdown directly linked to the negative economic impacts of the tariffs. This reduced economic activity directly impacted the value of assets held by billionaires whose wealth was tied to those sectors.

Increased Inflation and Its Effects

The tariffs contributed to inflationary pressures, further negatively impacting billionaire wealth. This increase in inflation resulted from:

-

Rising prices for imported goods and services: Tariffs directly increased the prices of imported goods, leading to inflationary pressures throughout the economy.

-

Reduced purchasing power for consumers: Higher prices reduced the real purchasing power of consumers, affecting consumer demand and impacting businesses' profitability.

-

Increased costs for businesses: Businesses faced increased costs due to higher input prices, reducing their profits and negatively affecting their market valuations.

Data on inflation rates during the period of tariff implementation clearly demonstrates the significant inflationary pressure. The erosion of the real value of billionaire assets due to inflation further amplified the losses associated with the tariffs.

Alternative Explanations and Counterarguments

Attributing the $174 billion drop in billionaire net worth solely to Trump tariffs would be an oversimplification. Other factors undoubtedly played a role:

-

Global economic slowdown as a contributing factor: The global economy experienced a period of slowdown during this time, impacting markets and investment returns regardless of the tariffs.

-

Fluctuations in the global financial markets: Unpredictable global market events can cause significant fluctuations in asset values, influencing billionaire net worth independently of trade policies.

-

Sector-specific challenges independent of tariffs: Some sectors faced challenges unrelated to the tariffs, such as technological disruptions or increased competition, which also affected billionaire net worth.

While acknowledging these factors, the substantial impact of the Trump tariffs on various sectors, coupled with the resulting economic slowdown and inflation, suggests that the tariffs played a significant, albeit not exclusive, role in the reported decline in billionaire net worth.

Conclusion

This analysis reveals a strong correlation between the implementation of Trump tariffs and the significant $174 billion drop in billionaire net worth. While other economic factors contributed, the direct and indirect consequences of the tariffs – market volatility, supply chain disruptions, and inflation – played a substantial role. Understanding this complex relationship between trade policy and wealth distribution is crucial for policymakers and investors. To gain a more complete understanding of the long-term effects of trade policies on wealth distribution, further research and analysis of Trump tariffs and their impact on billionaire net worth are essential. Continue exploring the economic implications of protectionist trade measures and their effects on different economic segments to fully grasp the consequences of such policies.

Featured Posts

-

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025

Palantir Stock Before May 5th Is It A Buy Wall Streets Verdict

May 09, 2025 -

Indian Insurers Push For Relaxed Bond Forward Regulations

May 09, 2025

Indian Insurers Push For Relaxed Bond Forward Regulations

May 09, 2025 -

West Ham United And The 25m Financial Gap What Next

May 09, 2025

West Ham United And The 25m Financial Gap What Next

May 09, 2025 -

Woman Kills Man In Racist Stabbing Unprovoked Attack

May 09, 2025

Woman Kills Man In Racist Stabbing Unprovoked Attack

May 09, 2025 -

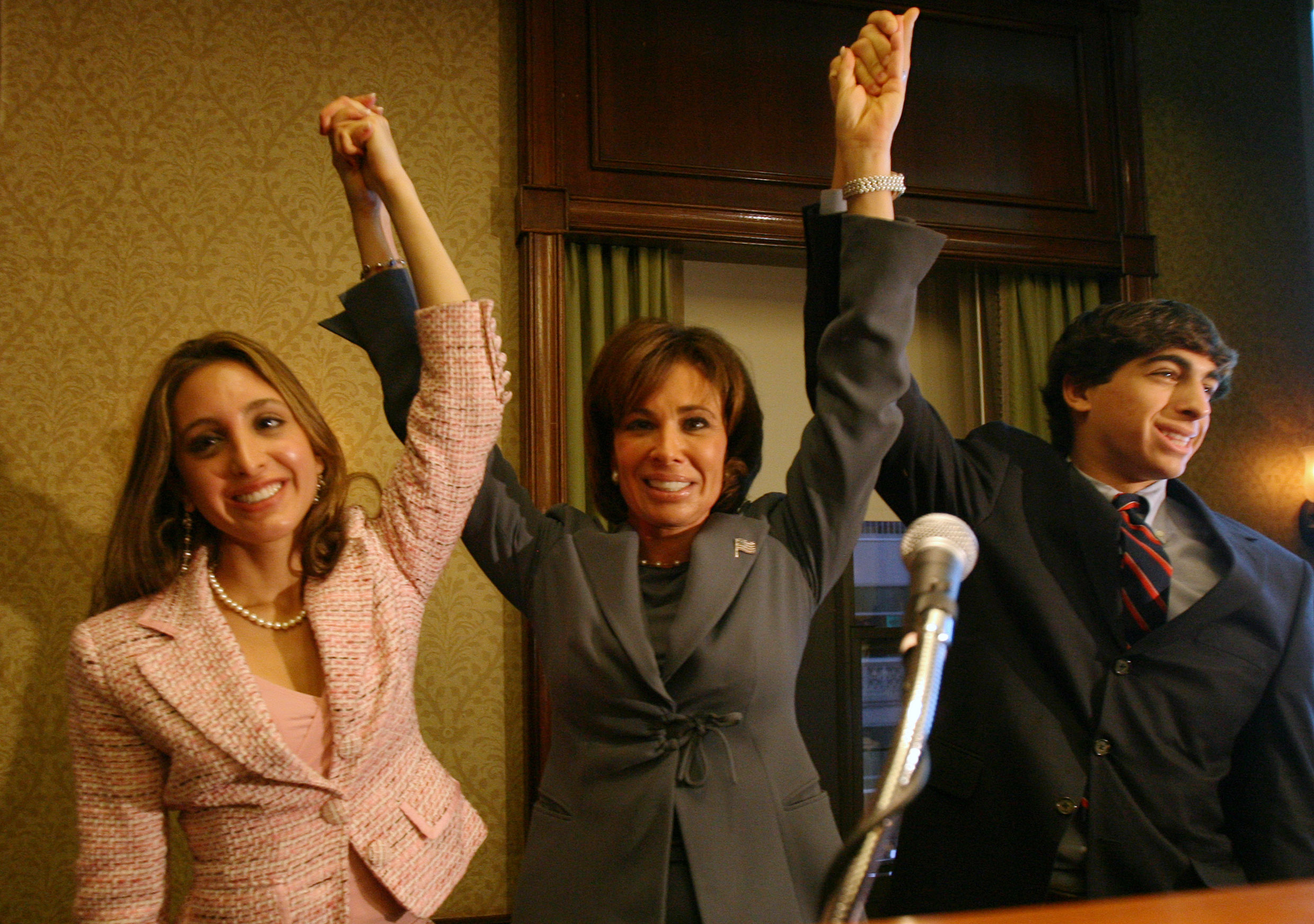

Jeanine Pirros Appointment As Dc Prosecutor Trumps Choice Analyzed

May 09, 2025

Jeanine Pirros Appointment As Dc Prosecutor Trumps Choice Analyzed

May 09, 2025