Analysis: UK Inflation, BOE Rate Cuts, And The Pound's Reaction

Table of Contents

Understanding Current UK Inflation

Inflation Drivers in the UK

The UK's current inflationary pressures are multifaceted. Several key drivers have contributed to the sustained rise in the Consumer Price Index (CPI) and Retail Price Index (RPI):

- Soaring Energy Prices: The global energy crisis, exacerbated by the war in Ukraine, has significantly increased household energy bills, pushing up inflation across the board. The Office for National Statistics (ONS) has consistently highlighted energy as a major contributor to CPI increases.

- Supply Chain Disruptions: Lingering supply chain bottlenecks, stemming from the pandemic and geopolitical instability, have led to shortages and increased prices for various goods. This imported inflation has further fueled domestic price increases.

- Wage Growth: While wage growth has been present, it hasn't kept pace with inflation in many sectors. This wage-price spiral contributes to inflationary pressures as businesses pass on increased labor costs to consumers.

The ONS reported a CPI inflation rate of [Insert latest CPI figure]% in [Insert month and year], highlighting the persistent nature of this challenge. This high inflation rate significantly impacts the UK economy and the Pound's value.

The Impact of High Inflation on UK Consumers and Businesses

High inflation has far-reaching consequences for UK consumers and businesses:

- Reduced Consumer Spending: Rising prices erode purchasing power, leading to reduced consumer spending and potentially slower economic growth. The consumer confidence index has shown a significant decline reflecting this.

- Increased Borrowing Costs: Higher inflation typically leads to increased interest rates, making borrowing more expensive for businesses and households. This dampens investment and consumer confidence.

- Uncertainty and Reduced Investment: High and volatile inflation creates uncertainty, discouraging businesses from investing and expanding, further hindering economic growth.

These impacts are interconnected and contribute to a challenging economic environment for the UK.

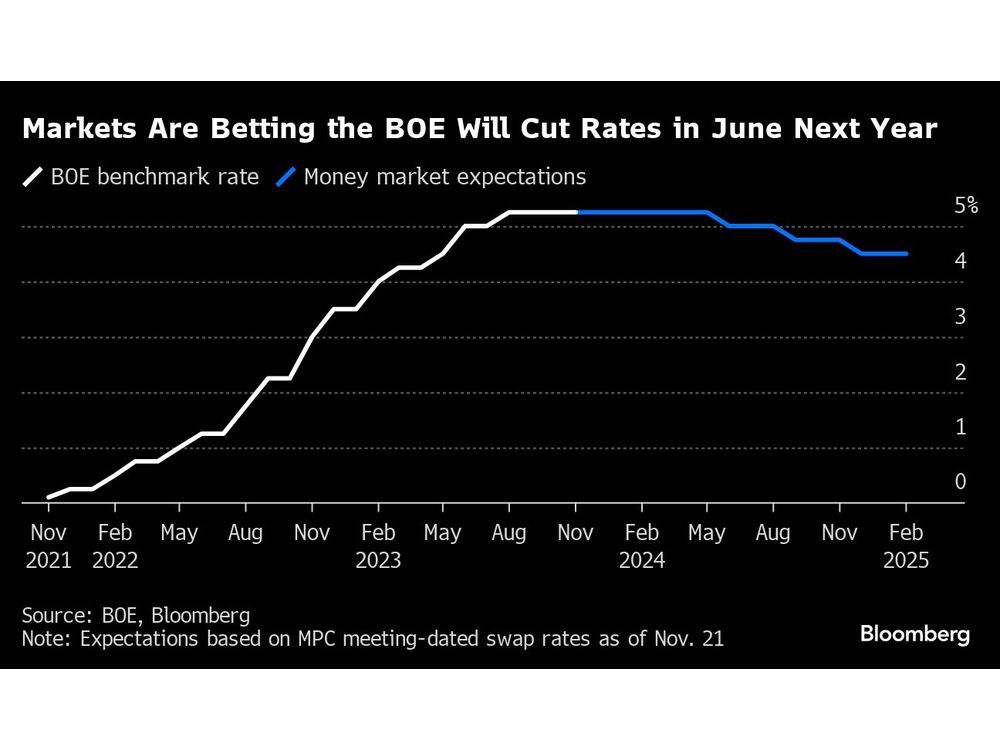

The Bank of England's Response: Rate Cuts and Monetary Policy

BOE's Monetary Policy Tools

The BOE employs various tools to manage inflation and maintain price stability:

- Interest Rate Changes: The most prominent tool is adjusting the Bank Rate – the interest rate at which the BOE lends money to commercial banks. Increasing the Bank Rate aims to curb borrowing and spending, reducing inflationary pressure. Decreasing it stimulates the economy.

- Quantitative Easing (QE): This involves the BOE purchasing government bonds and other assets to increase the money supply and lower long-term interest rates. This is typically used during periods of low inflation or economic recession.

Recent BOE decisions have involved [Insert details on recent BOE rate decisions and their justifications, including specific dates and rate changes].

Analyzing the Effectiveness of Rate Cuts

Rate cuts can stimulate economic activity by reducing borrowing costs, encouraging investment and spending. However, in the current climate, the effectiveness of rate cuts is debated:

- Arguments for Rate Cuts: Proponents argue that rate cuts can prevent a sharp economic downturn, particularly when inflation is driven by supply-side shocks rather than excessive demand.

- Arguments against Rate Cuts: Critics argue that rate cuts in a high-inflation environment could further fuel inflation, leading to a wage-price spiral and potentially eroding the value of the Pound. They may also lead to asset bubbles.

Historical data on BOE rate changes and their impact on inflation offers valuable insights but does not provide a clear-cut answer in this unique situation.

The Pound's Reaction to Inflation and BOE Actions

GBP Exchange Rate Volatility

The Pound Sterling's value has experienced significant volatility in response to inflation and BOE policy announcements:

- GBP Depreciation: Periods of high inflation and uncertainty often lead to a weakening of the Pound against other major currencies, as investors seek safer havens.

- GBP Appreciation: Conversely, periods of positive economic news, including decisive BOE actions to control inflation, can lead to an appreciation of the Pound.

[Insert charts or graphs illustrating GBP exchange rate movements against major currencies, clearly showing periods of volatility linked to inflation announcements and BOE policy decisions.]

Factors Influencing the Pound's Performance

Besides inflation and BOE policy, other factors significantly influence the Pound's performance:

- Global Economic Conditions: Global economic growth, trade tensions, and geopolitical events all impact the Pound's value.

- Brexit: The ongoing effects of Brexit, including trade negotiations and economic adjustments, continue to play a substantial role in the Pound's performance.

Analyzing these factors alongside inflation and BOE policy provides a more comprehensive understanding of GBP exchange rate fluctuations.

Conclusion: Synthesizing the Analysis of UK Inflation, BOE Rate Cuts, and the Pound's Reaction

This analysis reveals a complex and interconnected relationship between UK inflation, BOE rate cuts, and the Pound's reaction. High inflation, driven by multiple factors, puts pressure on the BOE to manage price stability. The effectiveness of its monetary policy tools, including rate cuts, is subject to debate and depends on the specific economic context. The Pound Sterling's value reflects this interplay, exhibiting significant volatility in response to both inflationary pressures and BOE actions. Other global and domestic factors further complicate this picture. Understanding these dynamics is crucial for navigating the current economic climate. Stay updated on future analyses of UK inflation, BOE rate cuts, and the pound's reaction by subscribing to our newsletter.

Featured Posts

-

Mwshr Daks Alalmany Artfae Jdyd Ytkhta Dhrwt Mars

May 25, 2025

Mwshr Daks Alalmany Artfae Jdyd Ytkhta Dhrwt Mars

May 25, 2025 -

I Mercedes Apomakrynetai Apo Ton Verstappen

May 25, 2025

I Mercedes Apomakrynetai Apo Ton Verstappen

May 25, 2025 -

Myrtle Beach Hit And Run Arrest Made In Deadly Crash

May 25, 2025

Myrtle Beach Hit And Run Arrest Made In Deadly Crash

May 25, 2025 -

Dave Turmel Canadas Top Fugitive Captured In Italy

May 25, 2025

Dave Turmel Canadas Top Fugitive Captured In Italy

May 25, 2025 -

Kazuo Ishiguro How Memory Shapes Identity And Imagination

May 25, 2025

Kazuo Ishiguro How Memory Shapes Identity And Imagination

May 25, 2025