Analysis: XRP (Ripple) Investment At Sub-$3 Levels

Table of Contents

Ripple's Technological Advantages and Market Position

Ripple's technology and market position are crucial factors in assessing XRP's investment potential.

Scalability and Transaction Speed

XRP boasts significantly faster transaction speeds and lower fees compared to Bitcoin and Ethereum. This scalability is a key advantage for its intended use in cross-border payments.

- Transaction Times: XRP transactions are typically confirmed within a few seconds, contrasting sharply with Bitcoin's minutes and Ethereum's potentially longer confirmation times.

- Transaction Fees: XRP's transaction fees are incredibly low, making it a cost-effective solution for high-volume transactions, unlike the fluctuating and often high fees associated with other cryptocurrencies.

- RippleNet's Role: RippleNet, Ripple's network for institutional clients, leverages XRP's speed and efficiency to facilitate seamless global payments, further solidifying its practical application. This network adoption significantly impacts XRP's utility and potential value. Keywords: XRP transaction speed, RippleNet, scalability, low transaction fees.

Global Partnerships and Adoption

Ripple has secured numerous partnerships with major financial institutions worldwide, demonstrating significant institutional adoption.

- Key Partnerships: Ripple collaborates with banks and payment providers across various regions, including Santander, SBI Holdings, and many more. These partnerships showcase the real-world applications of XRP and RippleNet.

- Geographic Reach and Market Penetration: Ripple's global reach and penetration into the financial sector are substantial factors influencing XRP's long-term potential. This widespread adoption is a strong indicator of future growth. Keywords: Ripple partnerships, institutional adoption, global payments.

Regulatory Landscape and Legal Battles

The ongoing legal battle between Ripple and the SEC casts a shadow over XRP's future.

- SEC Lawsuit Summary: The SEC alleges that XRP is an unregistered security, creating significant regulatory uncertainty. The outcome of this lawsuit could dramatically impact XRP's price.

- Potential Outcomes and Implications: A favorable ruling could lead to a significant price surge, while an unfavorable outcome could result in a prolonged downturn. The uncertainty itself creates significant risk. Keywords: SEC lawsuit, XRP regulation, legal uncertainty.

Fundamental Analysis of XRP

A thorough fundamental analysis is vital for assessing XRP's investment prospects.

Market Capitalization and Supply

XRP's market capitalization and circulating supply are key metrics to consider.

- Market Cap Comparison: Comparing XRP's market cap to other major cryptocurrencies helps gauge its relative size and potential for growth.

- Circulating Supply Analysis: The total supply of XRP is a fixed number, which can influence its price appreciation over time. Keywords: XRP market cap, circulating supply, market dominance.

Price History and Volatility

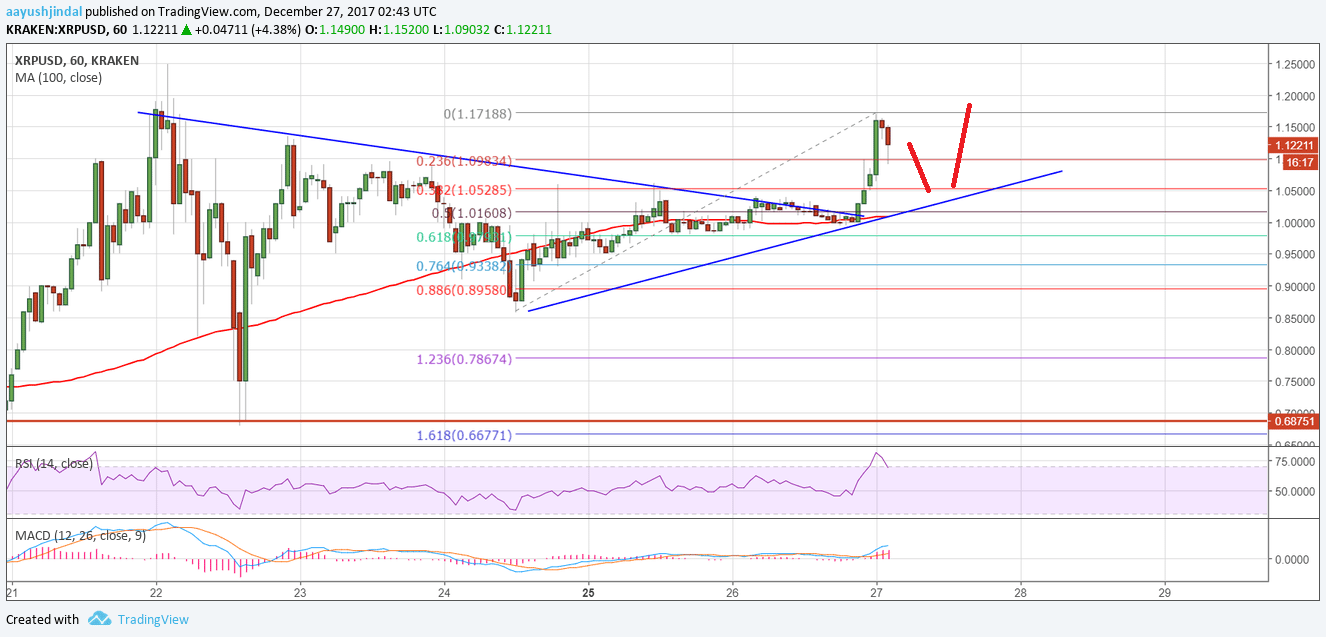

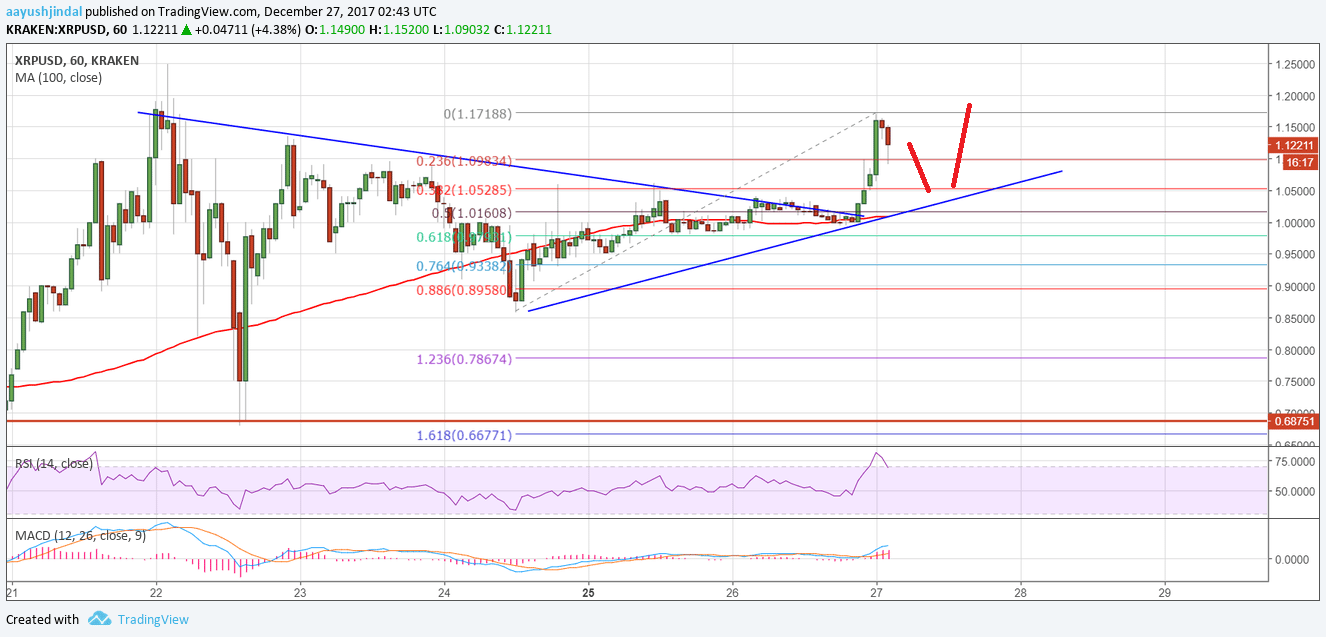

Analyzing XRP's price history can reveal potential trends and volatility patterns.

- Price Fluctuations: XRP's price has shown significant volatility, influenced by market sentiment, regulatory developments, and technological advancements. Analyzing historical charts is critical.

- Influencing Factors: Understanding the factors driving XRP's price fluctuations is crucial for informed investment decisions. Keywords: XRP price prediction, XRP price chart, price volatility.

Community Sentiment and Social Media Buzz

Monitoring community sentiment can provide insights into investor confidence.

- Social Media Analysis: Analyzing social media mentions and discussions surrounding XRP helps gauge the overall community sentiment towards the cryptocurrency.

- Bullish and Bearish Sentiments: Identifying prevailing bullish or bearish sentiments can help predict potential price movements. Keywords: XRP community, social media sentiment, crypto community.

Risk Assessment and Investment Strategies

Investing in XRP involves significant risk; careful consideration is essential.

Potential Risks and Rewards

Cryptocurrency investments, including XRP, are inherently risky.

- Market Volatility: The cryptocurrency market is notoriously volatile, with prices subject to rapid and unpredictable swings.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, creating considerable uncertainty.

- Technological Risks: Technological advancements and security breaches can also impact XRP's value. Keywords: XRP investment risks, cryptocurrency investment, high-risk investment.

Diversification and Portfolio Allocation

Diversifying your investment portfolio is crucial for risk management.

- Percentage Allocation: Allocating a percentage of your investment portfolio to XRP should depend on your risk tolerance and overall investment strategy. Avoid overexposure. Keywords: portfolio diversification, asset allocation, risk management.

Long-Term vs. Short-Term Investment

Consider your investment horizon before investing in XRP.

- Long-Term Strategy: A long-term investment strategy may be suitable for those willing to withstand short-term price fluctuations for potentially greater long-term returns.

- Short-Term Trading: Short-term trading is considerably riskier due to the high volatility of XRP. Keywords: long-term investment, short-term trading, XRP investment strategy.

Conclusion: Should You Invest in XRP Below $3?

Our analysis reveals that XRP presents a compelling blend of technological advantages and potential risks. While its speed, low fees, and growing partnerships are positive factors, the SEC lawsuit and inherent volatility of the cryptocurrency market must be carefully considered. Investing in XRP below $3 could present an opportunity, but it’s not without substantial risk.

Final Verdict: The decision of whether to invest in XRP below $3 is highly individual and depends on your risk tolerance, investment goals, and thorough due diligence.

Call to action: While investing in XRP below $3 presents opportunities, careful consideration of the risks is crucial. Conduct your own thorough research and consult with a financial advisor before making any investment decisions regarding XRP. Remember that this is not financial advice.

Featured Posts

-

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii

May 01, 2025

Thanh Pho Hue To Chuc Giai Bong Da Thanh Nien Lan Thu Vii

May 01, 2025 -

Chinas Push For Us Drug Import Substitutes A Deep Dive

May 01, 2025

Chinas Push For Us Drug Import Substitutes A Deep Dive

May 01, 2025 -

Dzilijan Anderson Novo Lice Zenstvenosti U Retro Stilu

May 01, 2025

Dzilijan Anderson Novo Lice Zenstvenosti U Retro Stilu

May 01, 2025 -

Onderzoek Naar Neersteekincident In Van Mesdagkliniek Verdachte Malek F

May 01, 2025

Onderzoek Naar Neersteekincident In Van Mesdagkliniek Verdachte Malek F

May 01, 2025 -

L Accompagnement Numerique La Cle De Thes Dansants Reussis

May 01, 2025

L Accompagnement Numerique La Cle De Thes Dansants Reussis

May 01, 2025