Analyst's Bitcoin Price Chart Shows Potential Rally Zone (May 6th)

Table of Contents

Key Technical Indicators Suggesting a Potential Bitcoin Rally

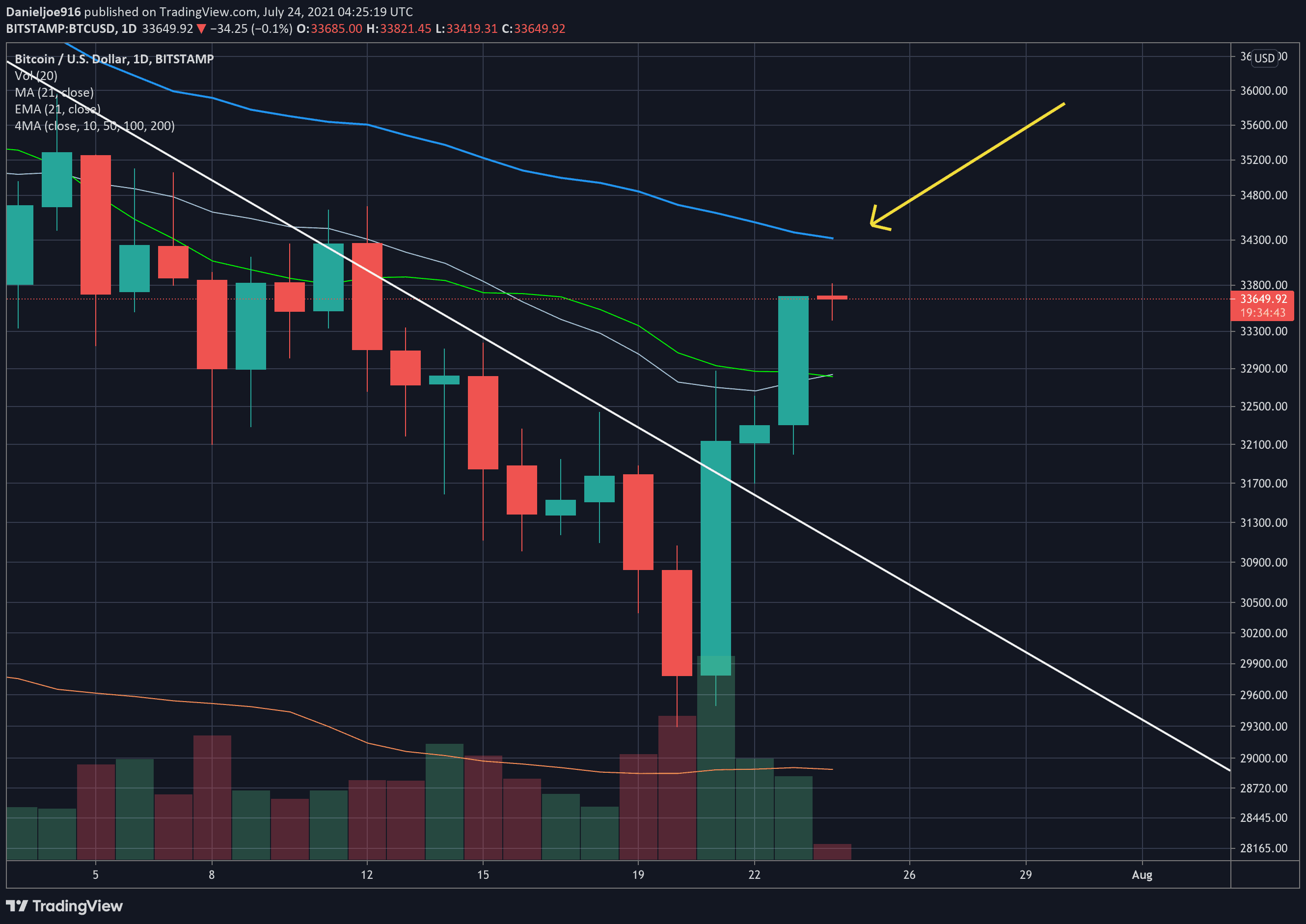

The analyst's Bitcoin price chart utilizes several key technical indicators to predict the potential rally. These indicators provide strong signals suggesting a shift from the recent bearish sentiment.

- Moving Averages: The 50-day and 200-day moving averages are showing signs of convergence, a bullish signal often preceding significant price increases. This convergence, visible on the chart below, suggests a potential upward trend.

- Relative Strength Index (RSI): The RSI is currently hovering around 40, which is considered oversold territory. This indicates the market might be ripe for a rebound. A breakout above 50 would further strengthen the bullish signal.

- Moving Average Convergence Divergence (MACD): The MACD is showing a bullish crossover, with the MACD line crossing above the signal line. This is another classic indication of a potential price increase.

[Embed Analyst's Bitcoin Price Chart Here – Clearly label support levels, resistance levels, and potential breakout points. For example: Support at $28,000, Resistance at $32,000, Potential Breakout at $35,000]

Historical Bitcoin Price Data and Patterns

Examining historical Bitcoin price data reveals patterns that bear a striking resemblance to the current situation. Several previous rallies were preceded by similar technical indicators and market sentiment.

- 2020-2021 Bull Run: The period leading up to the 2020-2021 bull run exhibited similar oversold conditions and technical convergence as we see today. The price then rallied significantly from approximately $10,000 to over $60,000.

- 2019-2020 Recovery: After a significant downturn in 2018, Bitcoin experienced a period of consolidation before a notable price increase in 2019-2020. The current market shows similarities in its consolidation phase.

These historical parallels suggest that the current technical setup could similarly precede a significant price increase. However, it's crucial to remember that past performance does not guarantee future results.

Macroeconomic Factors Influencing the Bitcoin Price

Several macroeconomic factors could influence the predicted Bitcoin rally. These external forces can either contribute to or hinder the anticipated price increase.

- Inflation Rates: High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Therefore, persistently high inflation rates could fuel the rally.

- Regulatory News: Positive regulatory developments, such as clearer regulatory frameworks in major jurisdictions, can boost investor confidence and stimulate price increases. Conversely, negative regulatory news can have the opposite effect.

- Overall Market Sentiment: General market sentiment plays a crucial role. A positive overall market outlook tends to benefit Bitcoin, while a negative outlook can suppress its price. For up-to-date information, refer to reputable financial news sources such as [link to a reputable financial news source].

Risk Assessment and Potential Downsides

While the analyst's Bitcoin price chart suggests a potential rally, it's crucial to acknowledge the inherent risks.

- Regulatory Crackdown: A sudden and severe regulatory crackdown could significantly impact Bitcoin's price, potentially negating any upward momentum.

- Unexpected Market Downturn: A broader market downturn, driven by unforeseen economic events, could also negatively affect Bitcoin's price, regardless of technical indicators.

- Failure to Break Resistance: The predicted rally hinges on Bitcoin breaking through key resistance levels. Failure to do so could prolong the sideways movement or lead to further price decline.

It is essential to approach this analysis with caution and acknowledge the possibility of negative outcomes.

Conclusion: Analyst's Bitcoin Price Chart and the Potential Rally Zone

The analyst's Bitcoin price chart, combined with supportive technical indicators and historical patterns, presents a compelling case for a potential Bitcoin price rally. However, several macroeconomic factors and potential downsides must be considered. The convergence of moving averages, an oversold RSI, and a bullish MACD crossover suggests a potential upward trend. Historical data further supports this possibility, showing similarities to previous bull runs. Yet, potential regulatory hurdles and broader market downturns could significantly impact the outcome.

While this analysis suggests a potential Bitcoin rally, remember to conduct your own thorough research before making any investment decisions. Stay informed on the latest developments affecting the Bitcoin price chart and potential rally zones. Bitcoin investment involves significant risk, and it's crucial to make informed choices based on your own due diligence.

Featured Posts

-

Micro Strategy Challenger Analyzing The Latest Spac Investment Frenzy

May 08, 2025

Micro Strategy Challenger Analyzing The Latest Spac Investment Frenzy

May 08, 2025 -

Carneys D C Meeting Labeling Trump A Transformational President

May 08, 2025

Carneys D C Meeting Labeling Trump A Transformational President

May 08, 2025 -

Champions League Inter Milans First Leg Triumph Over Bayern

May 08, 2025

Champions League Inter Milans First Leg Triumph Over Bayern

May 08, 2025 -

The Long Walk Movie Trailer Released A Bleak Adaptation Of Stephen Kings Novel

May 08, 2025

The Long Walk Movie Trailer Released A Bleak Adaptation Of Stephen Kings Novel

May 08, 2025 -

Is Betting On Natural Disasters Like The La Wildfires A New Normal

May 08, 2025

Is Betting On Natural Disasters Like The La Wildfires A New Normal

May 08, 2025