Analysts Reset Palantir Stock Forecast: Understanding The Recent Rally

Table of Contents

Factors Contributing to the Palantir Stock Price Increase

Several key factors have converged to drive the recent increase in Palantir's stock price. Understanding these elements is crucial for interpreting the current Palantir stock forecast and making informed investment decisions.

Improved Financial Performance

Palantir's recent earnings reports have showcased significant improvements, bolstering investor confidence and contributing to the positive shift in the Palantir stock forecast.

- Increased Revenue: The company has reported substantial revenue growth, exceeding analysts' expectations in several consecutive quarters. This growth is attributed to both increased government contracts and a growing presence in the commercial sector.

- Enhanced Profitability: Palantir has demonstrated improved profitability, showing positive signs of operational efficiency and cost management. This is a significant indicator often reflected in updated Palantir stock price targets.

- Positive Guidance: The company's positive outlook for future growth, coupled with specific projections, has further fueled investor optimism and influenced the Palantir stock forecast positively. For example, projections for increased AI-related revenue streams have been particularly well-received.

Increased Investor Confidence

Beyond the pure financials, a shift in investor sentiment has significantly impacted the Palantir stock forecast. This is largely driven by several key factors:

- Successful Product Launches: The release of new products and updates to existing platforms has demonstrated Palantir's ongoing innovation and ability to meet evolving market demands. This has resonated positively with investors.

- Strategic Partnerships: Key partnerships with major corporations and government agencies have solidified Palantir's market position and broadened its reach, influencing the positive shift in the Palantir stock forecast.

- Positive Media Coverage: Favorable media coverage, highlighting the company's technological advancements and successful deployments, has contributed to improved investor perception and a more bullish Palantir stock forecast. Analyst upgrades have also played a crucial role.

Market Sentiment and Sector Trends

The broader macroeconomic environment and prevailing trends within the technology sector have also played a role in shaping the Palantir stock forecast.

- Increased Interest in AI: The surge in interest surrounding artificial intelligence (AI) and its applications has benefited companies like Palantir, whose data analytics platforms are highly relevant in this space. This is a key driver in the revised Palantir stock price targets.

- Data Analytics Growth: The growing demand for sophisticated data analytics solutions across various industries has created a favorable environment for Palantir's growth, further impacting the Palantir stock forecast.

- Favorable Market Conditions: Periods of relative market stability or growth often lead to increased investor appetite for riskier, high-growth stocks like Palantir, contributing to upward pressure on the Palantir stock price.

Analyst Revisions and Updated Palantir Stock Price Targets

The recent positive developments have prompted analysts to significantly revise their Palantir stock price targets.

Summary of Analyst Forecasts

Several prominent investment banks and research firms have issued updated price targets for PLTR, reflecting the increased optimism surrounding the company's future.

| Firm | Low Target | High Target | Average Target |

|---|---|---|---|

| Goldman Sachs | $XX | $YY | $ZZ |

| JPMorgan Chase | $AA | $BB | $CC |

| Morgan Stanley | $DD | $EE | $FF |

| Note: Replace XX, YY, etc. with actual data. |

These revisions represent a significant upward shift compared to previous forecasts, highlighting the positive impact of improved financials and increased investor confidence on the Palantir stock forecast.

Rationale Behind the Revisions

Analysts cite several key factors for the upward revisions in their Palantir stock price targets:

- Stronger-than-expected financial results: The improved revenue growth, enhanced profitability, and positive guidance have significantly boosted analysts' confidence in Palantir's future performance.

- Increased market share: The success of Palantir's product launches and strategic partnerships has contributed to a more optimistic view of the company's ability to capture market share within the rapidly growing data analytics market.

- Positive market sentiment: The overall positive sentiment surrounding the technology sector and the increasing investor interest in AI have further enhanced the attractiveness of Palantir's stock. Quotes from analyst reports supporting these claims should be included here.

Risks and Potential Challenges for Palantir's Future Growth

While the outlook for Palantir appears positive, it's crucial to acknowledge potential risks and challenges:

Competition in the Data Analytics Market

Palantir faces intense competition from established players and emerging startups in the data analytics market.

- Established Competitors: Companies like Microsoft, Amazon, and Google offer competing data analytics solutions, posing a significant challenge to Palantir's market share.

- Emerging Startups: Innovative startups are constantly entering the market, bringing new technologies and approaches that could disrupt the existing landscape.

Dependence on Government Contracts

Palantir's revenue is significantly dependent on government contracts, creating vulnerabilities to potential policy changes or budget cuts.

- Political Risk: Shifts in government priorities or changes in defense spending could impact Palantir's revenue streams.

- Contract Renewals: The success of Palantir's future growth hinges, in part, on securing renewals of existing government contracts and winning new ones.

Valuation Concerns

Some investors may express concerns about Palantir's current valuation relative to its competitors and historical performance.

- Price-to-Sales Ratio: Palantir's Price-to-Sales ratio may be higher compared to some competitors, leading some to question its current valuation.

- Profitability: Sustaining profitability and demonstrating consistent growth will be crucial to justifying its current valuation in the long term.

Conclusion: Analyzing the Future of Palantir Stock

The recent rally in Palantir's stock price is largely attributed to improved financial performance, increased investor confidence, and upward revisions in analyst forecasts. However, it's vital to consider the potential risks and challenges, including competition, dependence on government contracts, and valuation concerns. The Palantir stock forecast remains dynamic, requiring ongoing monitoring of the company's performance and analyst predictions. To make informed investment decisions, continue researching the Palantir stock forecast, staying updated on company news, and consulting diverse financial resources. Consider exploring further resources, such as financial news websites and analyst reports, to develop a comprehensive understanding before making any investment decisions related to Palantir stock.

Featured Posts

-

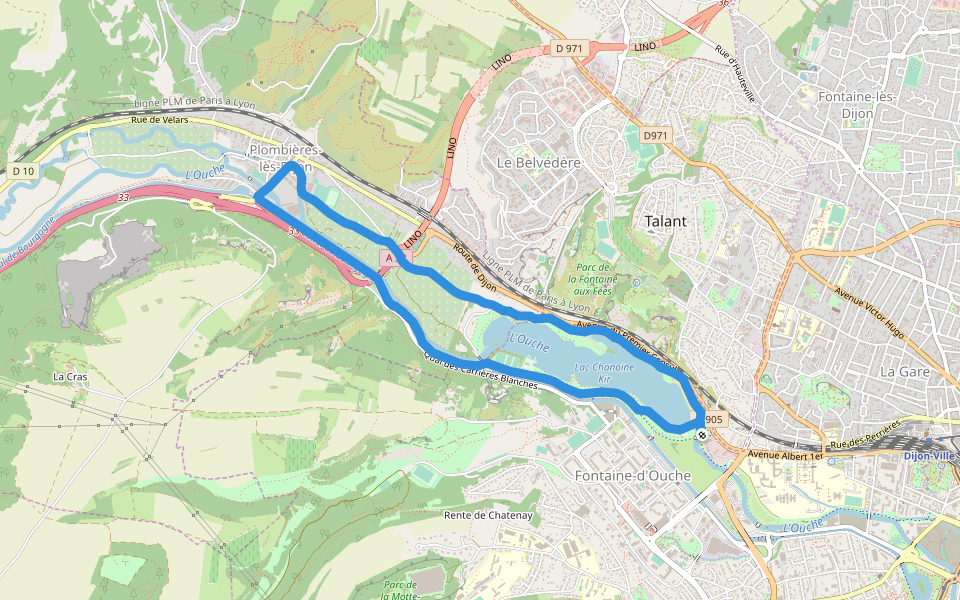

Dijon Violente Agression Au Lac Kir Trois Hommes Blesses

May 10, 2025

Dijon Violente Agression Au Lac Kir Trois Hommes Blesses

May 10, 2025 -

Novoe Voennoe Soglashenie Frantsiya I Polsha Usilivayut Oboronu

May 10, 2025

Novoe Voennoe Soglashenie Frantsiya I Polsha Usilivayut Oboronu

May 10, 2025 -

Tonights Nhl Playoffs Oilers Vs Kings Prediction Picks And Best Bets

May 10, 2025

Tonights Nhl Playoffs Oilers Vs Kings Prediction Picks And Best Bets

May 10, 2025 -

Kaitlin Olson And The Return Of High Potential Shows On Abc

May 10, 2025

Kaitlin Olson And The Return Of High Potential Shows On Abc

May 10, 2025 -

Whoop Under Fire Users Furious Over Unfulfilled Upgrade Offers

May 10, 2025

Whoop Under Fire Users Furious Over Unfulfilled Upgrade Offers

May 10, 2025