Analyzing Bitcoin's Rebound: Risks And Opportunities

Table of Contents

Understanding Bitcoin's Recent Rebound

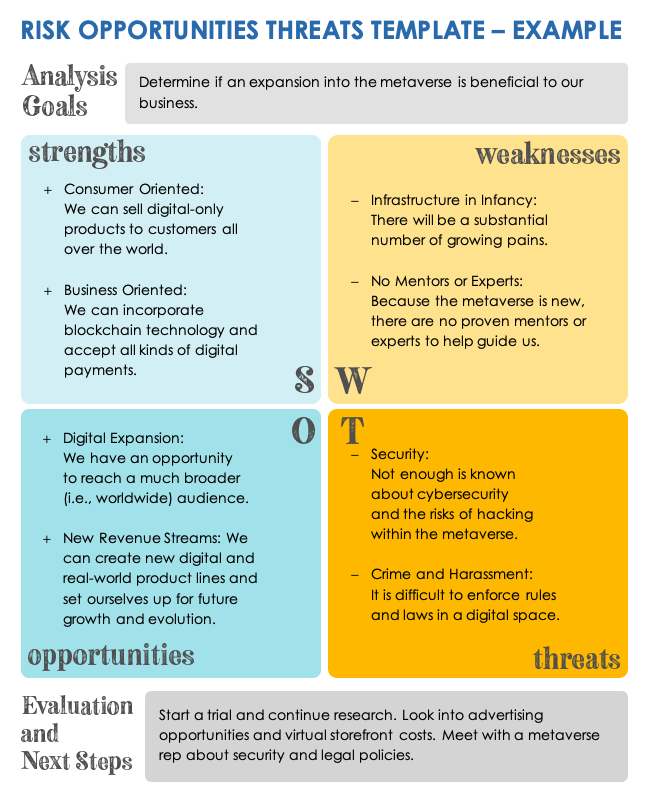

Bitcoin's price rebound isn't a random event; several intertwined factors contribute to its upward trajectory.

Factors Contributing to the Rebound

Several key elements have fueled the recent Bitcoin price increase:

- Increased Institutional Investment: Large financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversification tool. This influx of institutional capital significantly impacts market liquidity and price.

- Positive Regulatory Developments (if any): While regulatory clarity remains a challenge globally, positive developments in specific jurisdictions (mention specific examples if any are relevant at the time of writing) can boost investor confidence and attract more capital into the Bitcoin market. This can lead to a positive Bitcoin price rebound.

- Technological Advancements: The ongoing development and adoption of technologies like the Lightning Network, aiming to improve Bitcoin's scalability and transaction speed, enhances its long-term viability and attractiveness to investors. Improved transaction speeds and lower fees are key to Bitcoin’s growth.

- Macroeconomic Factors: Global macroeconomic conditions, such as inflation and geopolitical instability, often drive investors towards safe-haven assets like Bitcoin. Fear surrounding traditional markets can push investors toward Bitcoin’s perceived security.

- Market Sentiment and FOMO (Fear of Missing Out): Positive news and price increases often create a self-reinforcing cycle, fueled by FOMO. As more people invest, the price rises, attracting even more investors. This creates market momentum.

Analyzing the Sustainability of the Rebound

Determining the sustainability of this rebound requires a comprehensive analysis:

- Technical Analysis Indicators: Examining technical indicators such as moving averages (MA), Relative Strength Index (RSI), and other chart patterns can provide insights into potential price trends. These technical indicators can suggest short-term price momentum and potential reversal points.

- On-Chain Metrics: Analyzing on-chain data, including transaction volume, active addresses, and the number of coins held on exchanges, helps gauge the underlying strength of the market. These metrics provide a more fundamental outlook beyond just price movements.

- News and Events Impacting Market Sentiment: News events, regulatory announcements, and technological developments heavily influence investor sentiment and consequently, the Bitcoin price. Monitoring the news landscape is crucial.

Assessing the Risks Associated with Bitcoin Investment

While Bitcoin presents potential opportunities, it's crucial to acknowledge the inherent risks.

Price Volatility and Market Corrections

- Inherent Volatility: Bitcoin is notoriously volatile, experiencing significant price swings in short periods. This volatility is a defining characteristic of the cryptocurrency market.

- Potential for Sharp Price Drops: Sharp corrections and bear markets are common occurrences, meaning substantial losses are possible. Investors need to be psychologically prepared for these occurrences.

- Risk Tolerance and Diversification: Investing in Bitcoin requires a high-risk tolerance. Diversification across different asset classes is essential to mitigate potential losses.

Regulatory Uncertainty and Legal Risks

- Evolving Regulatory Landscape: The regulatory environment for cryptocurrencies is constantly evolving, posing challenges to investors and businesses. Regulations vary greatly between countries.

- Legal Challenges and Risks: The legal status of Bitcoin and its use vary significantly across jurisdictions. Understanding the legal implications in your region is vital.

- Country-Specific Regulations: Investors must research the specific regulations in their country before investing in Bitcoin, as legal implications can affect ownership, trading, and taxation.

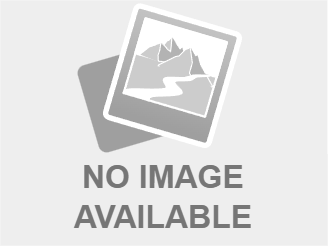

Security Risks and Scams

- Hacking, Theft, and Scams: The cryptocurrency space is unfortunately plagued by hacking incidents, theft, and scams, targeting both exchanges and individual investors.

- Secure Storage and Reputable Exchanges: Employing secure storage methods, such as hardware wallets, and using only reputable and regulated exchanges is crucial to minimize security risks.

- Phishing and Malware: Being vigilant against phishing attempts and malware is vital to protect your Bitcoin holdings. Stay informed about security best practices.

Identifying Potential Opportunities in the Bitcoin Market

Despite the risks, Bitcoin presents several potential opportunities for savvy investors.

Long-Term Investment Potential

- Potential for Long-Term Growth: Many believe Bitcoin has the potential for significant long-term growth due to its scarcity and increasing adoption.

- Store of Value: Bitcoin’s limited supply and decentralized nature make it attractive as a potential store of value, especially in uncertain economic times.

- Future Use Cases: Bitcoin's potential use cases extend beyond just a store of value, encompassing payments, decentralized finance (DeFi), and other applications.

Short-Term Trading Strategies

- Trading Strategies (with Caution): Short-term trading strategies, such as day trading and swing trading, exist but are extremely risky and should only be undertaken by experienced traders.

- Technical Analysis and Risk Management: Effective risk management and a thorough understanding of technical analysis are crucial for short-term trading. Loss limits and stop-loss orders are vital.

- High Risk Involved: Short-term trading in Bitcoin is incredibly risky and can lead to significant losses if not managed properly.

Diversification and Portfolio Management

- Importance of Diversification: Diversifying your investment portfolio across various asset classes, including stocks, bonds, and real estate, is crucial to mitigate risk.

- Bitcoin in a Broader Portfolio: Bitcoin can be a part of a diversified portfolio, but it should only represent a portion of your total investments, aligned with your risk tolerance.

- Balancing Risk: Other investment options can be used to balance the risk associated with Bitcoin's volatility.

Analyzing Bitcoin's Rebound: Key Takeaways and Call to Action

Bitcoin's recent rebound is driven by a complex interplay of institutional investment, technological advancements, macroeconomic factors, and market sentiment. While this rebound presents potential opportunities, it's crucial to carefully assess the associated risks, including price volatility, regulatory uncertainty, and security concerns. Remember, Bitcoin is a high-risk investment; thorough research and a well-defined risk management strategy are paramount. Before making any investment decisions regarding Bitcoin or other cryptocurrencies, conduct comprehensive research and seek professional financial advice. Continue your analysis of Bitcoin's rebound by [linking to relevant resources, further reading, or a contact form].

Featured Posts

-

Lawsuit Filed Against Lidl By Consumer Organisation Concerning Its Plus App

May 08, 2025

Lawsuit Filed Against Lidl By Consumer Organisation Concerning Its Plus App

May 08, 2025 -

The 10x Bitcoin Multiplier Market Analysis And Implications

May 08, 2025

The 10x Bitcoin Multiplier Market Analysis And Implications

May 08, 2025 -

Liga Na Shampioni Arsenal Go Dochekuva Ps Zh Vecherva

May 08, 2025

Liga Na Shampioni Arsenal Go Dochekuva Ps Zh Vecherva

May 08, 2025 -

Blue Origin Postpones Launch Vehicle Subsystem Issue Cited

May 08, 2025

Blue Origin Postpones Launch Vehicle Subsystem Issue Cited

May 08, 2025 -

Sms Dolandiriciligi Sikayetler Neden Artti Ve Nasil Korunabilirsiniz

May 08, 2025

Sms Dolandiriciligi Sikayetler Neden Artti Ve Nasil Korunabilirsiniz

May 08, 2025