Analyzing Buffett's Apple Investment: Key Insights For Investors

Table of Contents

The Rationale Behind Buffett's Apple Investment

Buffett's decision to invest heavily in Apple wasn't a spur-of-the-moment choice; it was a calculated move based on a thorough understanding of the company's strengths and market position. Several key factors contributed to his decision:

Apple's Strong Brand and Consumer Loyalty

Apple's unparalleled brand power is a cornerstone of its success and a significant factor in Buffett's investment decision. This translates to exceptional consumer loyalty, creating a predictable revenue stream that's less susceptible to market fluctuations.

- High customer retention rates: Apple users often remain loyal to the ecosystem, consistently upgrading to newer products.

- Premium pricing strategy: Apple's ability to command premium prices reflects the high value consumers place on its products and brand.

- Strong brand recognition across demographics: The Apple brand enjoys widespread recognition and appeal across various age groups and socioeconomic backgrounds, ensuring a broad and stable customer base.

This brand loyalty translates directly into long-term revenue predictability and stability, a key element for value investors like Buffett. The consistent demand for Apple products reduces the risk associated with the investment, a crucial factor in his investment philosophy.

Apple's Robust Cash Flow and Dividend Potential (Although not paid)

Consistent cash flow generation is a hallmark of a financially healthy company, and Apple excels in this area. While Apple doesn't pay a substantial dividend, its immense cash reserves and ability to generate substantial free cash flow represent significant long-term value.

- Historical cash flow performance: Apple has a history of consistently strong cash flow generation, providing ample resources for reinvestment and future growth.

- Ability to reinvest profits: Apple strategically reinvests its profits into research and development, product innovation, and strategic acquisitions, further fueling growth.

- Potential for future dividends: Although not a primary focus, Apple's massive cash reserves leave open the possibility of future dividend payouts, adding another layer of potential return for investors.

Strong cash flow is crucial for long-term shareholder value. It provides the financial flexibility to navigate economic downturns, invest in growth opportunities, and potentially return capital to shareholders through dividends or share buybacks.

Underestimated Growth Potential (at the time of investment)

At the time of Berkshire Hathaway's initial investment, some analysts may have underestimated Apple's growth potential. Buffett, however, recognized the company's ability to expand into new markets and product categories.

- Valuation metrics compared to peers: At the time of the initial investment, Apple's valuation might have appeared relatively low compared to its growth prospects and market dominance.

- Industry benchmarks: Compared to industry benchmarks, Apple showed a potential for significant upside, which Buffett recognized.

Buffett saw an opportunity to capitalize on a perceived undervaluation, further solidifying the investment's appeal. He saw beyond short-term market fluctuations and focused on the long-term growth potential of the company.

Performance of the Apple Investment

Berkshire Hathaway's investment in Apple has yielded exceptional returns, significantly contributing to the overall portfolio performance.

Berkshire Hathaway's Returns on Apple

The Apple investment has generated substantial gains for Berkshire Hathaway.

- Percentage increase in value over time: The investment has shown a significant percentage increase in value since its inception, generating substantial profits for Berkshire Hathaway. (Note: Specific figures would require referencing historical stock data, which is beyond the scope of this general article). Charts and graphs would visually represent these impressive returns.

- Impact on Berkshire Hathaway's overall portfolio: The success of the Apple investment has substantially bolstered Berkshire Hathaway's overall portfolio performance and return on investment.

The impressive returns demonstrate the power of long-term investment in a fundamentally strong company with a powerful brand.

Comparing Apple's Performance to other Berkshire Investments

While Apple's performance has been exceptional, it's important to compare it against Berkshire's other major holdings to understand its unique contribution to the portfolio.

- Comparative analysis of returns: Analyzing Apple's return alongside other investments highlights its exceptional performance.

- Risk profiles: A comparison of risk profiles across various holdings reveals the relatively lower risk associated with Apple due to its robust brand and financial strength.

- Investment strategies: Comparing investment strategies across different holdings demonstrates the versatility of Buffett's approach, with Apple representing a significant bet on a tech giant with strong consumer loyalty.

The Apple investment demonstrates a successful strategic allocation within Berkshire's diversified portfolio, showcasing the benefits of holding both established and growth-oriented companies.

Key Lessons for Investors

Analyzing Buffett's Apple investment offers several key takeaways for investors of all levels.

The Importance of Long-Term Investing

Patience and a long-term vision are crucial for successful investing.

- Benefits of staying invested: Staying invested during market fluctuations is key to long-term success, as shown by the Apple investment.

- Alignment with Buffett's philosophy: This strategy directly aligns with Buffett's value investing philosophy, emphasizing long-term value creation over short-term gains.

Identifying Undervalued Companies with Strong Fundamentals

Thorough due diligence is crucial to identifying undervalued companies with strong fundamentals and future growth potential.

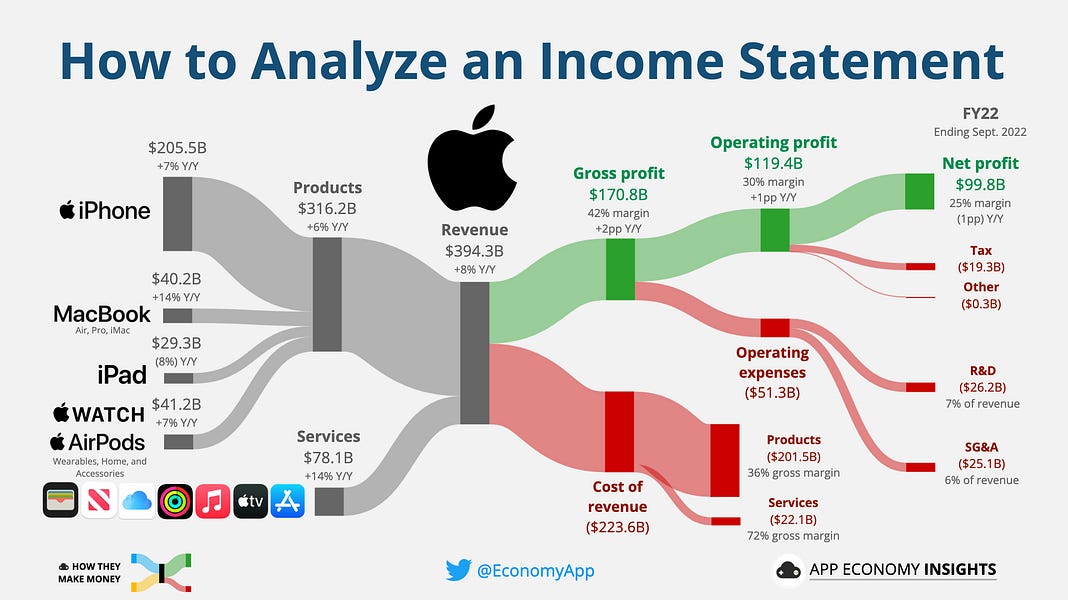

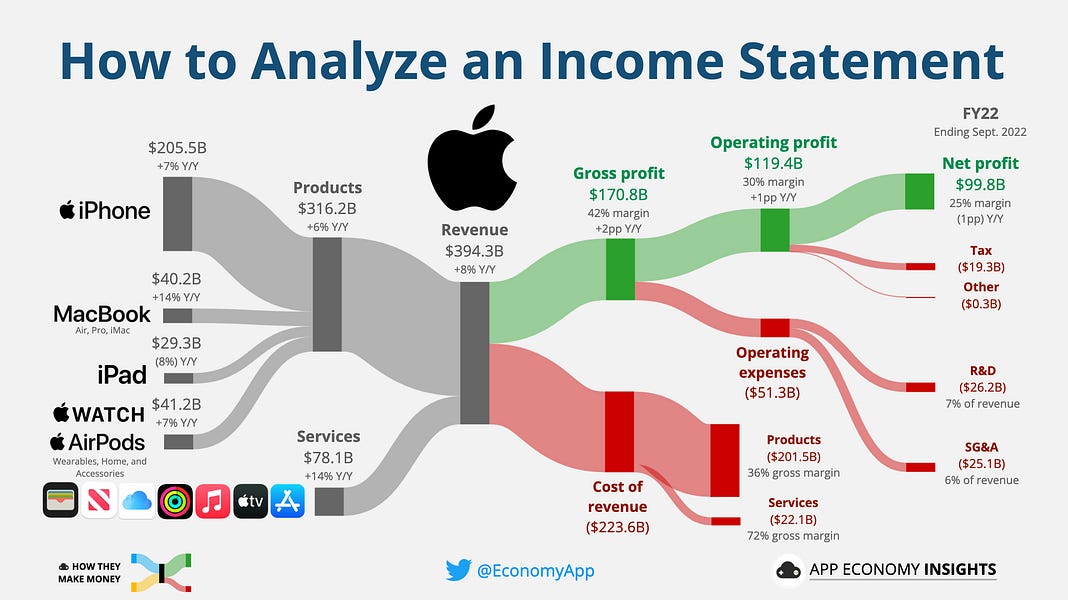

- Key financial metrics to analyze: Investors should focus on key metrics like revenue growth, profit margins, cash flow, and debt levels.

- Actionable steps for research: Investors should conduct in-depth research, analyzing financial statements, industry reports, and competitive landscape.

The Power of Brand and Consumer Loyalty

Brand strength and consumer loyalty are powerful drivers of long-term success.

- Examples of other companies with strong brands: Numerous other companies demonstrate the link between strong brands and consistent performance.

- Identifying companies with similar characteristics: Investors can look for companies with strong brand recognition, high customer retention, and a premium pricing strategy.

Conclusion

Analyzing Buffett's Apple investment provides valuable insights into successful long-term investing strategies. By focusing on strong fundamentals, identifying undervalued companies with significant growth potential, and recognizing the power of brand loyalty, investors can learn valuable lessons from this remarkable investment story. Understanding the key drivers behind Buffett's Apple investment can significantly enhance your approach to stock selection and portfolio management. Begin your own in-depth analysis of potential investments using the principles learned from studying Buffett's successful Apple investment strategy.

Featured Posts

-

Bbc I Adrbyejani Grasyenyaki Pakvo M Baqvi Azdyecvo Tyvo Ny

May 06, 2025

Bbc I Adrbyejani Grasyenyaki Pakvo M Baqvi Azdyecvo Tyvo Ny

May 06, 2025 -

Dom Kultury Predstavlyaet Azerbaydzhanskiy Kover I Cheshskiy Khrustal

May 06, 2025

Dom Kultury Predstavlyaet Azerbaydzhanskiy Kover I Cheshskiy Khrustal

May 06, 2025 -

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television

May 06, 2025

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television

May 06, 2025 -

The Latest Fortnite Update Sabrina Carpenter Dance Emotes

May 06, 2025

The Latest Fortnite Update Sabrina Carpenter Dance Emotes

May 06, 2025 -

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 06, 2025

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 06, 2025