Analyzing Dragon's Den Pitches: A Framework For Investors

Table of Contents

Deconstructing the Dragon's Den Pitch: Key Elements for Success

This section analyzes the core components of a winning pitch, those that often lead to an investment offer from the Dragons. A successful Dragon's Den pitch isn't just about a good idea; it's about a well-structured presentation of a compelling business opportunity.

-

Compelling Business Model: A successful pitch hinges on a robust and scalable business model. Investors look for businesses with significant market potential, clear pathways to profitability, and sustainable growth strategies. Analyzing a Dragon's Den pitch requires scrutinizing the proposed revenue model, understanding the target market, and assessing the overall scalability of the venture. Key questions to ask include: Is the business model truly scalable? What is the projected market size and growth rate? How will the business achieve profitability and maintain a competitive edge? Keywords: scalable business model, profitable venture, market analysis, target market, revenue streams.

-

Strong Value Proposition: What makes this business unique? A winning Dragon's Den pitch clearly articulates a unique selling proposition (USP) that differentiates it from competitors. This USP should resonate strongly with the target audience and address a genuine market need. Analyzing the value proposition involves identifying the key competitive advantages and understanding how the business creates value for its customers. Keywords: unique selling proposition, competitive advantage, market differentiation, value creation, customer needs.

-

Financials and Projections: Credible financial projections are non-negotiable. Investors need realistic forecasts showcasing revenue models, expense management, and a clear path to profitability. Analyzing the financial aspects of a Dragon's Den pitch involves scrutinizing the accuracy and feasibility of the projections, including a detailed break-even analysis and understanding of key financial metrics like customer acquisition cost (CAC) and lifetime value (LTV). Keywords: financial projections, revenue model, expense management, break-even analysis, cash flow projection, financial modeling.

-

Team Expertise and Experience: The Dragons invest in people as much as they invest in ideas. A strong team with the necessary skills and experience to execute the business plan is crucial. Analyzing the team requires assessing their entrepreneurial experience, leadership abilities, industry knowledge, and overall ability to manage a growing business. Keywords: entrepreneurial team, leadership skills, industry experience, expertise, team dynamics.

Identifying Red Flags in Dragon's Den Pitches

Not all pitches are created equal. This section highlights common mistakes that often lead to unsuccessful Dragon's Den pitches and ultimately, a lack of investment. Recognizing these red flags is crucial for both entrepreneurs and investors.

-

Unrealistic Market Projections: Overly optimistic or unsubstantiated financial forecasts are a major red flag. Investors are wary of inflated figures and pitches that lack a grounded understanding of market realities. Analyzing a pitch for unrealistic projections involves looking for evidence of thorough market research and realistic growth estimations. Keywords: unrealistic projections, inflated figures, market saturation, flawed assumptions.

-

Weak Value Proposition: Pitches lacking a clear and compelling unique selling proposition (USP) often fail to impress. A “me-too” product with no significant differentiation from competitors struggles to secure investment. Analyzing the value proposition involves identifying whether the business offers anything truly unique or innovative. Keywords: poor value proposition, lack of differentiation, me-too product, competitive landscape.

-

Inexperienced or Unprepared Team: Investors are looking for teams capable of executing their business plan. A lack of relevant experience or inadequate preparation is a significant red flag. Analyzing the team involves assessing their experience, skills, and the overall preparedness of their presentation. Keywords: lack of experience, poor preparation, unprepared presentation, inadequate knowledge.

-

Poor Financial Management: A lack of understanding of basic financial statements and cash flow management is a major concern for investors. Analyzing the financial aspects requires scrutinizing the financial literacy and management capabilities of the team. Keywords: poor financial management, cash flow problems, lack of financial literacy, burn rate, unit economics.

The Art of the Pitch: Presentation and Persuasion

Beyond the numbers, a successful Dragon's Den pitch requires strong presentation skills and the ability to connect with the investors on a personal level.

-

Storytelling: A compelling narrative can make all the difference. Investors are more likely to invest in a story that resonates with them emotionally and intellectually. Analyzing the storytelling involves assessing the clarity, engagement, and overall effectiveness of the pitch narrative. Keywords: compelling narrative, storytelling techniques, investor engagement, emotional connection.

-

Clarity and Conciseness: Effectively communicating complex information in a concise and clear manner is crucial. A rambling or confusing pitch will quickly lose the attention of the investors. Analyzing the presentation involves assessing the clarity, conciseness, and overall structure of the pitch. Keywords: clear communication, concise presentation, effective delivery, structured pitch.

-

Handling Questions and Objections: The ability to confidently and persuasively address investor concerns and objections is essential. Analyzing the pitch involves assessing the team’s ability to handle tough questions and demonstrate their preparedness. Keywords: handling objections, investor questions, confident response, problem-solving skills.

-

Passion and Enthusiasm: Genuine passion and belief in the business idea are contagious. Investors are drawn to entrepreneurs who are genuinely excited about their vision. Analyzing the presentation involves assessing the overall energy and enthusiasm of the team. Keywords: passionate presentation, enthusiastic entrepreneur, belief in the vision, commitment.

Conclusion

Analyzing Dragon's Den pitches offers a valuable learning experience for both entrepreneurs seeking funding and investors seeking promising opportunities. By understanding the key elements of a successful pitch – a strong business model, a compelling value proposition, a capable team, and a polished presentation – you can significantly increase your chances of securing investment or identifying potentially lucrative ventures. Remember to carefully scrutinize financial projections, be aware of common red flags, and master the art of pitching to effectively communicate your vision. Use this framework to analyze future Dragon's Den Pitches and sharpen your investment acumen. Start analyzing those Dragon's Den Pitches today and improve your investment strategy!

Featured Posts

-

Choosing The Best Cruise Line For Your Family 5 Top Picks

May 01, 2025

Choosing The Best Cruise Line For Your Family 5 Top Picks

May 01, 2025 -

Dragons Den Peter Jones Savage Put Down Leaves Viewers Speechless

May 01, 2025

Dragons Den Peter Jones Savage Put Down Leaves Viewers Speechless

May 01, 2025 -

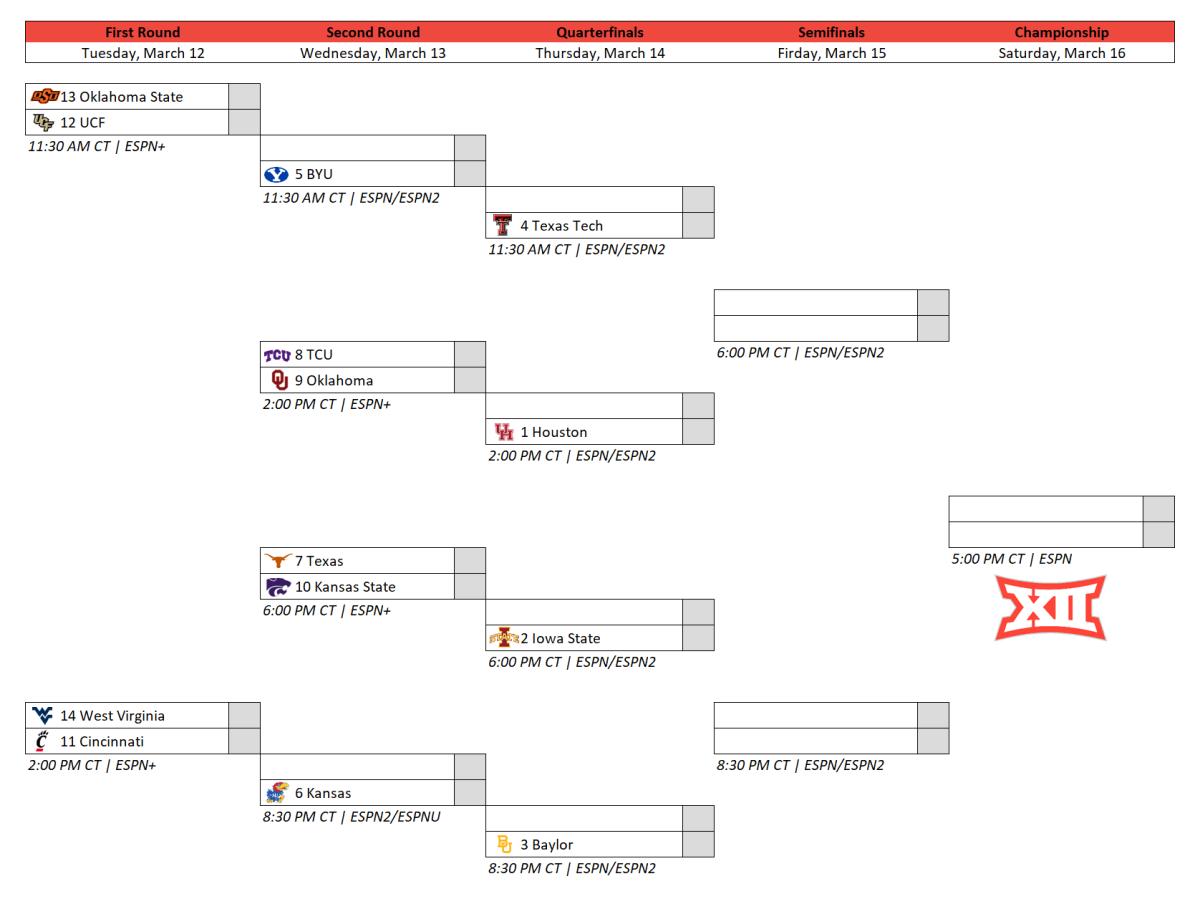

Big 12 Tournament Arizonas Love Outshines Texas Tech In Semifinal Win

May 01, 2025

Big 12 Tournament Arizonas Love Outshines Texas Tech In Semifinal Win

May 01, 2025 -

One Food Worse Than Smoking A Doctors Warning About Early Death

May 01, 2025

One Food Worse Than Smoking A Doctors Warning About Early Death

May 01, 2025 -

Recordati And The Italian Pharmaceutical Market An M And A Strategy For Tariff Uncertainty

May 01, 2025

Recordati And The Italian Pharmaceutical Market An M And A Strategy For Tariff Uncertainty

May 01, 2025