Analyzing Elon Musk's Net Worth Shifts During Trump's Initial 100 Days In Office

Table of Contents

Economic Policy Changes and Their Impact on Tesla's Stock Price

President Trump's early economic agenda significantly impacted various sectors, including the automotive industry, where Tesla holds a prominent position.

Deregulation and the Automotive Industry

Trump's focus on deregulation presented both opportunities and challenges for Tesla.

- Relaxation of fuel efficiency standards: While potentially lowering production costs, this could also impact Tesla's competitive advantage built on electric vehicle technology. The uncertainty surrounding these changes likely contributed to stock price volatility.

- Environmental regulation rollbacks: Similar to fuel efficiency changes, easing environmental regulations could have short-term benefits but might negatively affect Tesla's long-term brand image and investor perception.

- Stock Price Impact: During the first 100 days, Tesla's stock price experienced significant fluctuations, partly influenced by the unfolding regulatory landscape. Data from sources like Yahoo Finance and Google Finance revealed periods of both sharp increases and declines. These shifts directly impacted Elon Musk's net worth, given his substantial stake in the company.

Tax Cuts and Corporate Profits

The proposed and eventual implementation of corporate tax cuts were anticipated to boost Tesla's profitability.

- Increased Profit Margins: Lower tax rates translate to higher after-tax profits, potentially leading to increased investment in research and development, expansion, and stock buybacks.

- Investor Sentiment: The promise of higher profits could enhance investor confidence, driving up Tesla's stock price and consequently boosting Elon Musk's net worth. News reports from this period widely discussed the anticipated positive effects of tax cuts on tech companies, including Tesla.

- Financial Data: Analyzing Tesla's financial reports from Q1 and Q2 of 2017 provides concrete evidence of the impact of tax cuts (or the anticipation thereof) on their profits and investor reaction.

Geopolitical Events and Their Influence on SpaceX and Tesla

International relations and space exploration policy shifts under the Trump administration also influenced Elon Musk's net worth.

International Trade Relations

Changes in trade policies had significant implications for Tesla's global operations.

- Tariffs and Trade Wars: The threat (and implementation) of tariffs on imported goods could impact Tesla's supply chain and its ability to compete in international markets, affecting production costs and potentially reducing profits.

- Export Markets: Changes in trade relations with key markets like China could limit Tesla's growth potential, influencing investor sentiment and thus Musk's net worth.

- News Coverage: Numerous news articles from 2017 detail the anxieties surrounding international trade tensions and their potential impact on various industries, including automotive and aerospace.

Space Exploration Policy Shifts

SpaceX's fortunes were also partly linked to changes in U.S. space exploration policy.

- NASA Funding and Contracts: Increased or decreased NASA funding under the Trump administration, whether direct or through private sector partnerships, could directly impact SpaceX's revenue and valuations.

- Private Sector Initiatives: Trump's encouragement of private sector participation in space exploration could create new opportunities for SpaceX, but it could also increase competition.

- SpaceX Valuation: Analyzing SpaceX funding rounds and valuations during this period would provide insights into how policy changes may have affected its overall worth, subsequently impacting Elon Musk's net worth.

Market Sentiment and Investor Confidence

Beyond direct policy impacts, market sentiment and investor confidence played a significant role.

Trump's Communication Style and Market Volatility

President Trump's frequent and often unpredictable pronouncements via Twitter and public statements contributed to market volatility.

- Tweets and Stock Reactions: Specific examples of Trump's tweets or statements regarding Tesla or other related industries could be linked to immediate shifts in Tesla's stock price. Analysis of these events highlights the impact of political rhetoric on market sentiment.

- Investor Uncertainty: The unpredictable nature of Trump's pronouncements might have fueled investor uncertainty, leading to fluctuations in Tesla's stock and subsequently, Elon Musk's net worth.

Overall Market Trends

It's crucial to acknowledge that broader market trends influenced Elon Musk's net worth, independently of Trump's policies.

- Economic Indicators: Factors like overall economic growth, interest rates, and inflation contributed to the overall market sentiment and investor behavior, affecting Tesla and SpaceX valuations.

- Global Events: External shocks like geopolitical instability or significant economic events outside the U.S. also played a part in the overall market environment.

Conclusion: Summarizing Elon Musk's Net Worth Shifts Under the Early Trump Presidency

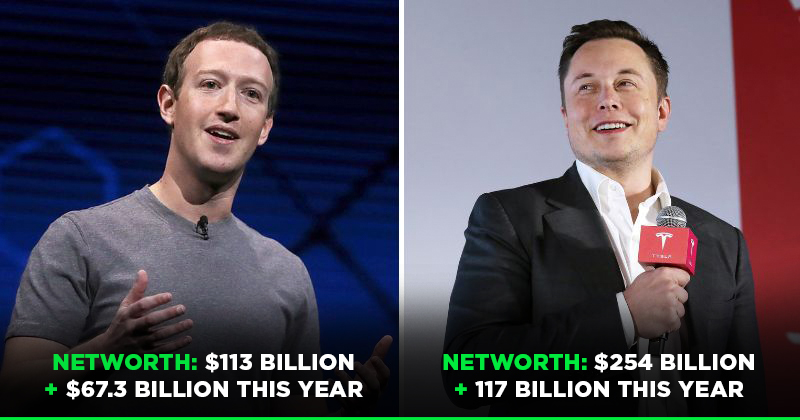

Elon Musk's net worth during Trump's first 100 days was subject to a complex interplay of factors. Economic policy changes, particularly around deregulation and tax cuts, influenced Tesla's stock price and profitability. Geopolitical events and shifts in space exploration policy impacted both Tesla and SpaceX. Meanwhile, President Trump's communication style and overall market trends added layers of complexity to the equation. Analyzing these intertwined influences offers a comprehensive understanding of the dynamics that shaped Elon Musk's financial standing during this pivotal period. Learn more about the interplay between political climates and market fluctuations affecting Elon Musk's net worth by exploring reputable financial news sources and academic research on the subject.

Featured Posts

-

Pakistans Imf Bailout 1 3 Billion Package Under Review Amidst India Tensions

May 10, 2025

Pakistans Imf Bailout 1 3 Billion Package Under Review Amidst India Tensions

May 10, 2025 -

Trump Administration Considers Halting Migrant Detainment Appeals

May 10, 2025

Trump Administration Considers Halting Migrant Detainment Appeals

May 10, 2025 -

Vegas Golden Knights Hertl Injury Clouds Lightning Matchup

May 10, 2025

Vegas Golden Knights Hertl Injury Clouds Lightning Matchup

May 10, 2025 -

Growing Tensions Impact Pakistan Stock Exchange Website Offline

May 10, 2025

Growing Tensions Impact Pakistan Stock Exchange Website Offline

May 10, 2025 -

Massive Whistleblower Payout Credit Suisse Settles For 150 Million

May 10, 2025

Massive Whistleblower Payout Credit Suisse Settles For 150 Million

May 10, 2025