Analyzing Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: An Investor's Guide

![Analyzing Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: An Investor's Guide Analyzing Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: An Investor's Guide](https://baynatna.de/image/analyzing-gibraltar-industries-rock-q-quarter-2024-earnings-an-investors-guide.jpeg)

Table of Contents

Gibraltar Industries (ROCK) recently released its Q2 2024 earnings report, providing valuable insights into the company's performance and future prospects. This investor's guide delves into the key takeaways from the report, analyzing the financial results and offering perspectives for investors considering ROCK stock. We will explore the company's revenue growth, profitability, and future guidance to help you make informed investment decisions regarding this important market player.

Revenue and Growth Analysis

Keywords: Gibraltar Industries revenue, ROCK stock revenue growth, Q2 2024 revenue, year-over-year growth, sales performance

Gibraltar Industries' Q2 2024 revenue performance offers a crucial perspective on the company's trajectory. Analyzing this data alongside previous quarters (Q1 2024 and Q2 2023) allows for a comprehensive understanding of ROCK stock's growth potential.

-

Detailed breakdown of Q2 2024 revenue figures compared to Q2 2023 and Q1 2024: [Insert actual figures here. For example: Q2 2024 revenue was $XXX million, compared to $YYY million in Q2 2023 and $ZZZ million in Q1 2024. This represents a year-over-year growth of X% and a sequential growth of Y%]. This detailed comparison provides a clear picture of the trend in Gibraltar Industries' revenue.

-

Analysis of revenue growth across different segments (e.g., residential, commercial): [Insert segmented revenue data here. For example: The residential segment showed Z% growth, while the commercial segment experienced X% growth. This disparity may be attributed to…]. Breaking down revenue by segment allows investors to identify strengths and weaknesses within Gibraltar Industries' business model.

-

Discussion of factors driving revenue growth or decline (e.g., market demand, pricing strategies, new product launches): [Discuss specific factors influencing revenue, such as increased demand for specific products, successful marketing campaigns, pricing adjustments, or the impact of new product introductions. For example: The strong performance in the residential segment can be attributed to the increasing demand for [mention specific products] and the successful launch of [new product].]

-

Comparison of revenue growth to industry benchmarks and competitors: [Compare Gibraltar Industries' revenue growth to that of its key competitors. For example: Compared to industry average growth of A%, Gibraltar Industries outperformed with its X% growth. This highlights the company's competitive advantage in the market.]

-

Charts and graphs illustrating revenue trends: [Include relevant charts and graphs visually representing the revenue data discussed above. This visual representation enhances understanding and adds credibility to the analysis.]

Profitability and Margins

Keywords: Gibraltar Industries profitability, ROCK stock profit margins, gross profit margin, operating income, net income

Analyzing Gibraltar Industries' profitability provides insights into the efficiency and effectiveness of its operations. Profit margins are key indicators of a company's ability to generate profits from its sales.

-

Examination of gross profit margin, operating margin, and net profit margin: [Insert the relevant figures for each margin. For example: Gross profit margin stood at X%, operating margin at Y%, and net profit margin at Z%. These figures indicate…]. A trend analysis of these margins over time is vital for evaluating the health of the business.

-

Analysis of changes in profitability compared to previous quarters and the same period last year: [Compare the current profitability figures with those from Q1 2024 and Q2 2023. Highlight any significant changes and explain the reasons behind them. For instance: The increase in operating margin can be largely attributed to…]. Understanding the underlying causes of changes in profitability is crucial for forecasting future performance.

-

Discussion of factors influencing profitability (e.g., cost of goods sold, operating expenses): [Analyze the impact of cost of goods sold and operating expenses on profitability. For instance: A rise in raw material costs might negatively impact the gross profit margin. Effective cost management is essential for maintaining healthy profit margins.]

-

Comparison of profitability metrics to industry averages and competitors: [Compare Gibraltar Industries' profitability metrics to those of its competitors and industry benchmarks. For example: The company's operating margin is higher/lower than the industry average, indicating better/worse operational efficiency.]

-

Identification of potential areas for improving profitability: [Identify potential opportunities to improve profitability. This might involve cost-cutting measures, increased efficiency, or focusing on high-margin products.]

Future Guidance and Outlook

Keywords: Gibraltar Industries outlook, ROCK stock forecast, Q3 2024 guidance, future growth prospects, investment opportunities

Management's guidance for Q3 2024 and the full year provides valuable insight into the company's future expectations. This section critically assesses the feasibility of these projections.

-

Detailed review of management's guidance for Q3 2024 and the full year: [Summarize the management's guidance. For example: Management projects revenue growth of X% in Q3 2024 and Y% for the full year. This outlook suggests…]. A clear understanding of management's expectations is paramount.

-

Assessment of the realism and achievability of the guidance: [Analyze the realism of the guidance based on current market conditions, the company's performance, and industry trends. For example: Considering the current market dynamics, the projected revenue growth seems achievable/optimistic/pessimistic because…]. A realistic assessment is crucial for a well-informed investment decision.

-

Discussion of potential risks and challenges facing the company: [Identify potential headwinds that could impact the company's future performance. For example: Increased competition, changes in regulatory environments, or economic downturns could all pose challenges.]

-

Identification of key growth drivers for the future: [Highlight the factors that could drive Gibraltar Industries' future growth. This could include new product launches, expansion into new markets, or strategic acquisitions.]

-

Evaluation of long-term investment opportunities in ROCK stock: [Based on the analysis, evaluate the long-term investment prospects of ROCK stock. Consider factors like the company’s growth potential, financial strength, and competitive landscape.]

Key Financial Metrics and Ratios

Keywords: Gibraltar Industries financial ratios, ROCK stock valuation, price-to-earnings ratio (P/E), debt-to-equity ratio, return on equity (ROE)

A thorough analysis of key financial ratios provides a comprehensive overview of Gibraltar Industries' financial health and valuation.

-

Analysis of key financial ratios such as P/E ratio, debt-to-equity ratio, and ROE: [Provide the values for these ratios and analyze their implications. For example: A high P/E ratio might suggest that the market is optimistic about the company's future growth, while a high debt-to-equity ratio could indicate higher financial risk.]

-

Evaluation of the company's financial health and stability: [Assess the company's overall financial health based on the analyzed ratios and other relevant data. For example: A strong balance sheet with low debt and high profitability suggests a financially healthy company.]

-

Comparison of key ratios to industry averages and competitors: [Compare Gibraltar Industries' key ratios to industry averages and competitors to gain a better understanding of its relative financial position.]

-

Interpretation of the implications of these ratios for investors: [Discuss the implications of the analyzed ratios for potential investors. For example: A low P/E ratio might suggest the stock is undervalued, while a high ROE indicates strong profitability.]

Conclusion

This analysis of Gibraltar Industries (ROCK) Q2 2024 earnings provides a comprehensive overview of the company's performance and future prospects. We examined key metrics like revenue growth, profitability, and future guidance, providing investors with crucial insights for making informed decisions. Understanding these factors is crucial for developing a well-informed investment strategy.

Call to Action: Are you ready to make informed investment decisions based on the latest data about Gibraltar Industries (ROCK)? Stay updated on the latest financial reports and analyses to refine your investment strategy regarding ROCK stock and other key market players. Continue your research and consider consulting with a financial advisor before making any investment decisions. Remember to always conduct thorough due diligence before investing in any stock.

![Analyzing Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: An Investor's Guide Analyzing Gibraltar Industries (ROCK) Q[Quarter] 2024 Earnings: An Investor's Guide](https://baynatna.de/image/analyzing-gibraltar-industries-rock-q-quarter-2024-earnings-an-investors-guide.jpeg)

Featured Posts

-

Espn Shakes Up Nba Draft Lottery Coverage Analysis And Predictions

May 13, 2025

Espn Shakes Up Nba Draft Lottery Coverage Analysis And Predictions

May 13, 2025 -

Apples Murderbot A Funny Thought Provoking Sci Fi Adventure

May 13, 2025

Apples Murderbot A Funny Thought Provoking Sci Fi Adventure

May 13, 2025 -

Ken Paxtons Request For Plano Isd Records On Epic City

May 13, 2025

Ken Paxtons Request For Plano Isd Records On Epic City

May 13, 2025 -

La And Orange County Face Record High Temperatures Extreme Heat Warnings Issued

May 13, 2025

La And Orange County Face Record High Temperatures Extreme Heat Warnings Issued

May 13, 2025 -

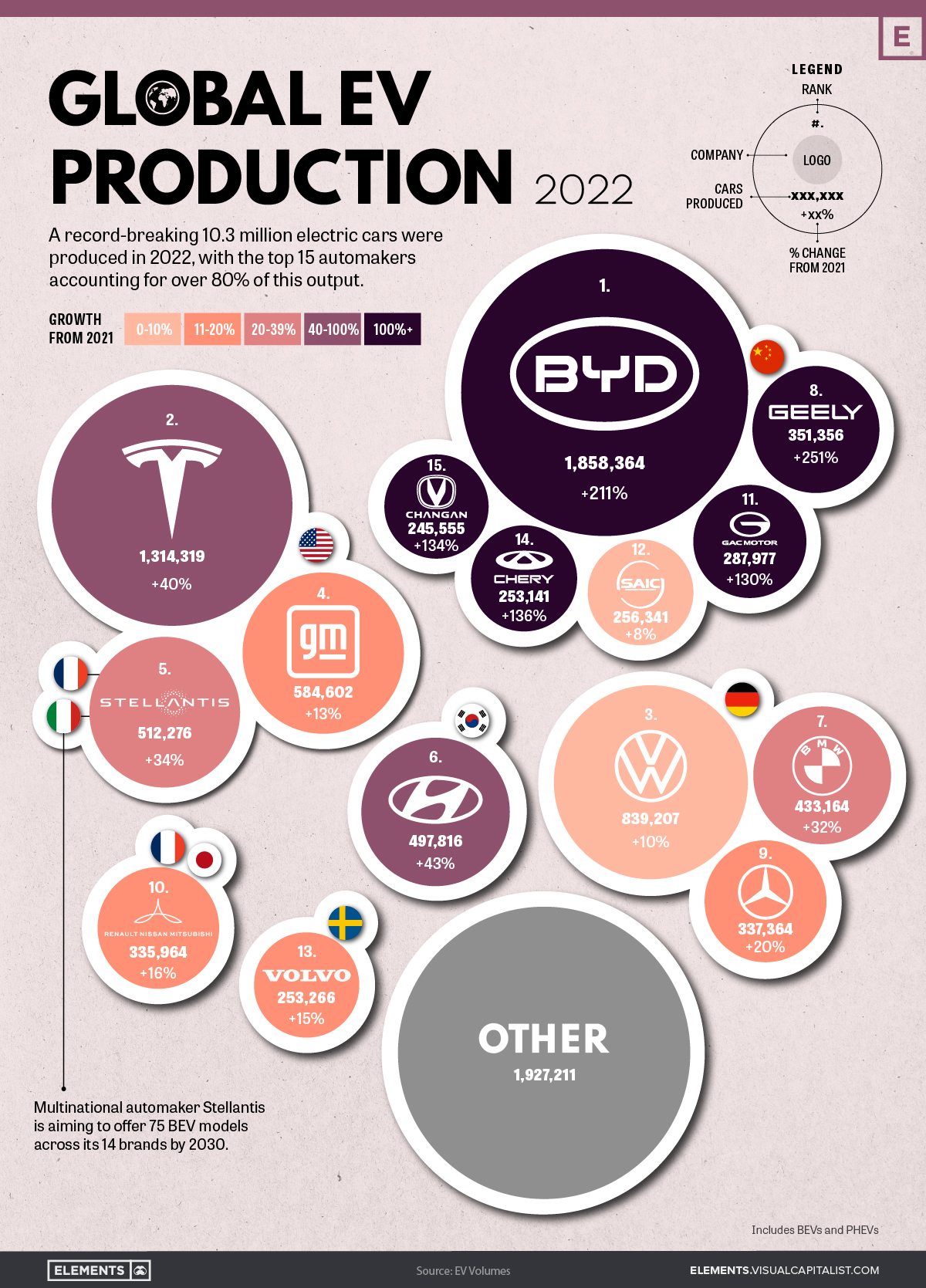

Maluf Fords Brazilian Legacy Fades As Byds Global Ev Dominance Rises

May 13, 2025

Maluf Fords Brazilian Legacy Fades As Byds Global Ev Dominance Rises

May 13, 2025