Analyzing Market Swings: Professional Vs. Individual Investor Behavior

Table of Contents

Professional Investor Behavior During Market Swings

Professional investors, with their access to resources and expertise, approach market swings with a fundamentally different mindset than individual investors. Their actions are often more calculated and less influenced by emotion.

Risk Management Strategies of Professionals

Professionals employ sophisticated risk management techniques to mitigate losses and capitalize on opportunities during periods of market volatility. These strategies are crucial for navigating the unpredictable nature of market swings.

-

Utilize Diversification: Diversification is a cornerstone of professional investment. They spread investments across various asset classes (stocks, bonds, real estate, commodities, alternative investments), reducing the overall portfolio volatility. This helps to cushion the impact of negative market swings affecting one particular sector.

-

Employ Hedging Strategies: Professionals utilize sophisticated hedging techniques, such as employing derivatives (options, futures, swaps), to protect against potential losses. These instruments can offset losses in one investment by generating gains in another, minimizing the impact of adverse market swings.

-

Fundamental Analysis: A core component of professional investment is in-depth fundamental analysis. This involves meticulously researching company financials, industry trends, and macroeconomic conditions to make informed, long-term investment decisions. This helps them to identify undervalued assets and mitigate risks associated with market swings.

-

Quantitative Analysis: Many professional investors utilize quantitative analysis, employing statistical models and algorithms to identify patterns, predict market movements, and optimize investment portfolios. This data-driven approach helps in anticipating market swings and adjusting strategies proactively.

The Role of Institutional Investors

Large institutional investors, such as mutual funds, pension funds, hedge funds, and insurance companies, play a significant role in shaping market swings. Their sheer size and trading power influence market liquidity and price movements.

-

Influence on Market Liquidity: The buying and selling activities of institutional investors significantly impact market liquidity. Large trades can create short-term volatility, particularly during periods of uncertainty.

-

Impact of Long-Term Strategies: Unlike many individual investors, institutional investors generally maintain a longer-term perspective. They are less affected by short-term market fluctuations and focus on achieving long-term investment goals.

-

Regulatory Compliance: Institutional investors operate under strict regulatory frameworks that govern their investment strategies and risk management practices. These regulations aim to protect investors and maintain market stability, even during significant market swings.

Individual Investor Behavior During Market Swings

Individual investors, lacking the resources and expertise of professionals, often react emotionally to market swings, leading to potentially suboptimal investment decisions.

Emotional Decision-Making

One of the biggest challenges for individual investors is managing their emotions during periods of market volatility. Fear and greed frequently drive impulsive actions.

-

Fear and Greed: Market downturns trigger fear, leading to panic selling at potentially unfavorable prices. Conversely, market rallies can ignite greed, encouraging over-investment and increasing risk exposure.

-

Herd Mentality: Individuals often follow the crowd, exacerbating market trends. During bull markets, this can lead to overvaluation, while during bear markets, it can intensify downward pressure.

-

Lack of Diversification: Individual investors often lack the resources or expertise to create well-diversified portfolios, making them more vulnerable to significant losses during market swings.

The Impact of Market News and Media

Individual investors are heavily influenced by market news and media, which can lead to uninformed decisions during periods of market volatility.

-

Misinformation and Hype: Sensationalized news reports and social media hype can significantly influence investor sentiment, leading to emotional reactions and poor investment choices.

-

Lack of Critical Analysis: Individuals may struggle to critically analyze information, separating factual data from speculation or opinion, making them susceptible to manipulation during market swings.

-

Influence of Social Media: Social media platforms can amplify market trends, creating echo chambers that reinforce emotional biases and contribute to herd behavior, particularly impacting individual investors' responses to market swings.

Understanding the Differences and Their Market Impact

The contrasting approaches of professional and individual investors significantly influence the dynamics of market swings.

-

Contrasting Approaches: Professional investors employ data-driven, long-term strategies, focusing on fundamental and quantitative analysis to mitigate risk and capitalize on opportunities. Individual investors often react emotionally to short-term market movements, leading to impulsive decisions.

-

Market Volatility: The emotional reactions of individual investors often amplify market volatility, particularly during periods of uncertainty or significant market swings. This can create exaggerated price movements and increased risk.

-

Investment Opportunities: Market swings create opportunities for both professional and individual investors. However, professionals are better equipped to identify and capitalize on these opportunities due to their sophisticated strategies and risk management techniques.

Conclusion

Analyzing market swings reveals a stark contrast between professional and individual investor behavior. Professionals utilize sophisticated strategies and risk management to navigate volatility, while individual investors often succumb to emotional biases. Understanding these differences is crucial for every investor, regardless of experience level. By learning to recognize and manage emotional responses, diversifying your portfolio, and seeking professional advice when necessary, you can better navigate market swings and improve your investment outcomes. Mastering the analysis of market swings can lead to more informed and successful investment strategies.

Featured Posts

-

Times Trump Interview 9 Key Takeaways On Annexing Canada Xis Calls And Third Term Loopholes

Apr 28, 2025

Times Trump Interview 9 Key Takeaways On Annexing Canada Xis Calls And Third Term Loopholes

Apr 28, 2025 -

Exploring Southeast Asias Energy Landscape A Canadian Perspective

Apr 28, 2025

Exploring Southeast Asias Energy Landscape A Canadian Perspective

Apr 28, 2025 -

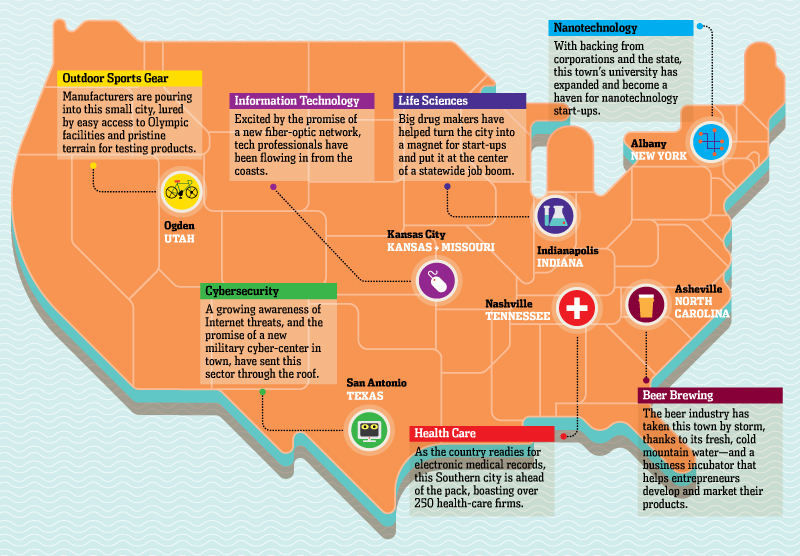

Mapping The Countrys Newest Business Hotspots

Apr 28, 2025

Mapping The Countrys Newest Business Hotspots

Apr 28, 2025 -

Pirates Walk Off Win Ends Yankees Extra Innings Rally

Apr 28, 2025

Pirates Walk Off Win Ends Yankees Extra Innings Rally

Apr 28, 2025 -

Uae Travel Sim 10 Gb Data 15 Abu Dhabi Attraction Savings

Apr 28, 2025

Uae Travel Sim 10 Gb Data 15 Abu Dhabi Attraction Savings

Apr 28, 2025