Analyzing MicroStrategy Stock And Bitcoin For Investment Potential In 2025

Table of Contents

MicroStrategy, a business intelligence company, has made headlines for its substantial Bitcoin holdings, totaling billions of dollars. This aggressive Bitcoin strategy has intertwined the company's stock price (MSTR) with the volatile cryptocurrency market. This article analyzes the investment potential of both MicroStrategy stock and Bitcoin (BTC) in 2025, exploring their interconnected fates and helping you determine which presents a better investment opportunity. We will delve into MicroStrategy's Bitcoin strategy, Bitcoin's market outlook, and compare the risks and rewards of investing directly in Bitcoin versus investing in MSTR stock. Our goal is to equip you with the information needed to assess the "MicroStrategy Stock and Bitcoin Investment Potential 2025."

MicroStrategy's Bitcoin Strategy: A Deep Dive

MicroStrategy's Bitcoin Holdings and their Impact on Stock Price

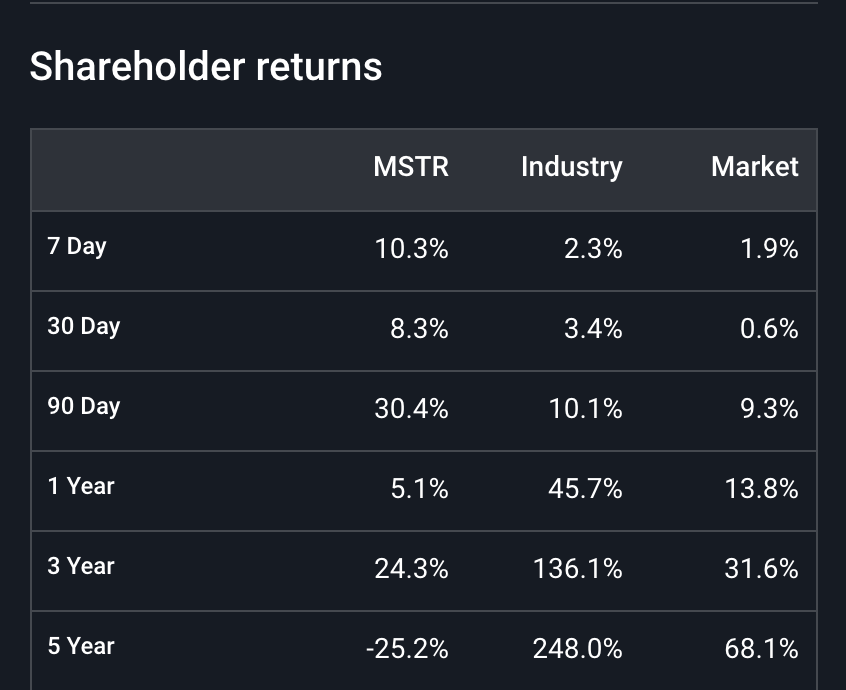

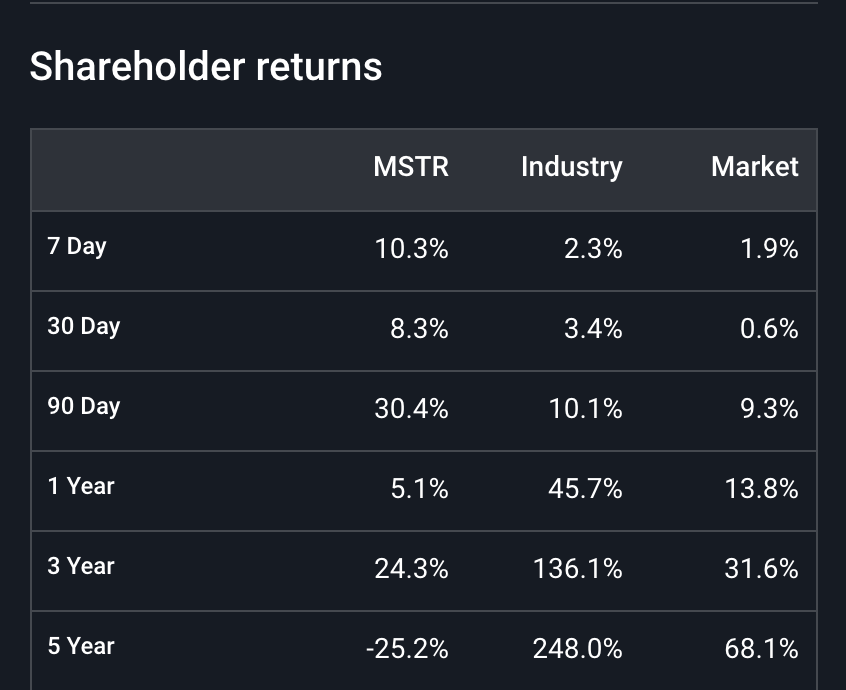

MicroStrategy's significant Bitcoin holdings directly influence its stock price. A rise in Bitcoin's price generally boosts MSTR, while a Bitcoin price drop negatively impacts the stock. This high correlation presents both significant risk and reward. Historically, periods of high Bitcoin volatility have corresponded with increased volatility in MSTR's share price.

- Significant Bitcoin price drops impact MSTR stock. A substantial correction in the Bitcoin market can lead to significant losses for MSTR investors.

- MSTR stock is leveraged to Bitcoin performance. The company's success is increasingly tied to the performance of Bitcoin.

- Potential for high returns if Bitcoin price increases. Conversely, a sustained bull market for Bitcoin could yield substantial returns for MSTR shareholders.

[Insert chart/graph illustrating the historical correlation between MSTR stock price and Bitcoin's price.]

Financial Health and Future Outlook of MicroStrategy

While MicroStrategy's Bitcoin strategy has attracted attention, its overall financial health and long-term strategy are crucial considerations. Analyzing financial reports reveals debt levels and revenue diversification efforts beyond Bitcoin.

- Debt-to-equity ratio analysis: A thorough assessment of MicroStrategy's financial leverage is critical to understanding the risk associated with its debt burden.

- Revenue diversification strategy: The extent to which MicroStrategy can diversify its revenue streams beyond Bitcoin is important for its long-term sustainability.

- Potential for future acquisitions or strategic partnerships: Future business developments can significantly impact MSTR's future performance and should be carefully monitored.

Bitcoin's Market Position and Future Predictions

Bitcoin's Price Volatility and Market Sentiment

Bitcoin's price is famously volatile, exhibiting significant swings even within short periods. This volatility stems from numerous factors:

- Bitcoin's price history and major fluctuations: Examining past price action provides valuable insights into potential future volatility.

- Impact of regulatory frameworks on Bitcoin's price: Government regulations and legal decisions globally can significantly influence Bitcoin's market value.

- Adoption by institutional investors and its effect: The increasing adoption of Bitcoin by large financial institutions continues to influence market sentiment and price.

Bitcoin's Long-Term Potential as a Store of Value and Investment Asset

Bitcoin is often considered a potential hedge against inflation and a store of value, similar to gold. Its limited supply contributes to this narrative. However, its long-term value proposition depends on several factors:

- Bitcoin's scarcity and limited supply: This inherent scarcity is seen by many as a key driver of its long-term value.

- Comparison with gold as a store of value: Evaluating Bitcoin's potential as a store of value alongside traditional assets like gold is crucial.

- The potential for Bitcoin ETFs and their impact: The potential approval of Bitcoin exchange-traded funds (ETFs) could significantly increase institutional investment and liquidity.

Comparing Investment Strategies: MicroStrategy Stock vs. Direct Bitcoin Investment

Risk Tolerance and Investment Goals

Investing in MSTR stock or Bitcoin directly presents different risk profiles.

- High-risk, high-reward potential of Bitcoin: Direct Bitcoin investment carries higher volatility and risk but also the potential for significant returns.

- Lower risk, but potentially lower returns, with MSTR stock: Investing in MSTR offers relatively lower volatility compared to direct Bitcoin exposure.

- Importance of risk assessment and diversification: Both investments should be considered within the context of a well-diversified portfolio based on your individual risk tolerance.

Practical Considerations for Investing

Investing in both MSTR and Bitcoin requires careful planning:

- Choosing the right brokerage account: Select a reputable brokerage that supports trading in both stocks and cryptocurrencies.

- Understanding tax implications for cryptocurrency investments: Cryptocurrency taxation varies widely based on jurisdiction. Consult a tax professional for guidance.

- Risks associated with self-custody of Bitcoin: Storing Bitcoin yourself requires robust security measures to avoid potential theft or loss.

Conclusion: MicroStrategy Stock and Bitcoin: A 2025 Investment Verdict

Investing in MicroStrategy or Bitcoin in 2025 presents both opportunities and risks. MSTR stock offers leveraged exposure to Bitcoin's price, but its performance is dependent on the broader financial health of the company. Direct Bitcoin investment carries greater volatility but also the potential for higher returns. The ideal strategy depends heavily on your individual risk tolerance, investment timeline, and overall portfolio diversification. Analyze your investment strategy for MicroStrategy and Bitcoin in 2025 carefully, considering the factors discussed above. Begin your research into MicroStrategy stock and Bitcoin investment potential now to make informed decisions.

Featured Posts

-

Brutal Enfrentamiento Entre Flamengo Y Botafogo La Pelea Llego A Los Vestuarios

May 08, 2025

Brutal Enfrentamiento Entre Flamengo Y Botafogo La Pelea Llego A Los Vestuarios

May 08, 2025 -

Kripto Para Mirasi Ve Sifre Sorunu Yasal Coezuem Yollari

May 08, 2025

Kripto Para Mirasi Ve Sifre Sorunu Yasal Coezuem Yollari

May 08, 2025 -

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025

Surge In Dwp Home Visits Impact On Benefit Claimants

May 08, 2025 -

Pulgar Un Gesto Que Llego Al Corazon De La Aficion Del Flamengo

May 08, 2025

Pulgar Un Gesto Que Llego Al Corazon De La Aficion Del Flamengo

May 08, 2025 -

Uber Big Change Auto Service Now Cash Only

May 08, 2025

Uber Big Change Auto Service Now Cash Only

May 08, 2025