Analyzing NCLH Stock: Insights From Hedge Fund Investments

Table of Contents

Recent Hedge Fund Activity in NCLH

Identifying Key Hedge Fund Investors

Several prominent hedge funds hold significant positions in NCLH. Tracking these holdings provides a valuable window into market sentiment and potential future price movements. To find the most up-to-date information, refer to SEC filings and reputable financial news sources like the Wall Street Journal or Bloomberg. (Note: Specific hedge fund names and holdings would need to be researched and inserted here from current data sources; this is a template).

- Example 1: [Hedge Fund Name A] reported [Number] shares of NCLH as of [Date], representing a [Percentage]% increase/decrease from the previous quarter. [Link to Source]

- Example 2: [Hedge Fund Name B] recently decreased its stake in NCLH by [Percentage]%. [Link to Source]

- Example 3: [Hedge Fund Name C] maintains a significant position in NCLH, suggesting continued confidence in the company's long-term prospects. [Link to Source]

The overall percentage of NCLH stock held by hedge funds is currently estimated at [Percentage]%, a figure that fluctuates based on quarterly filings and market conditions.

Analyzing Hedge Fund Investment Strategies

Understanding why hedge funds invest in NCLH is crucial for interpreting their actions. Several factors might influence their decisions:

- Value Play: Hedge funds may see NCLH as undervalued relative to its intrinsic worth, anticipating a price appreciation as the market corrects this discrepancy. This would be particularly relevant if the stock price has dipped following a period of negative news or market downturn.

- Growth Stock: Some might view NCLH as a growth stock, believing the company's expansion plans and potential market share gains will lead to significant future growth. The recovery of the travel industry post-pandemic is a key factor here.

- Turnaround Opportunity: Others may perceive NCLH as a turnaround opportunity, believing that the company can overcome current challenges and achieve substantial future profitability. This might involve focusing on cost-cutting measures or implementing new business strategies.

Macroeconomic factors also play a critical role. Fuel prices, fluctuating currency exchange rates, and overall economic health heavily influence the cruise industry and impact hedge fund investment decisions. The risk tolerance implied by their investments in NCLH varies depending on their overall portfolio strategy and risk appetite.

Impact of Hedge Fund Activity on NCLH Stock Price

Correlation between Hedge Fund Activity and Stock Performance

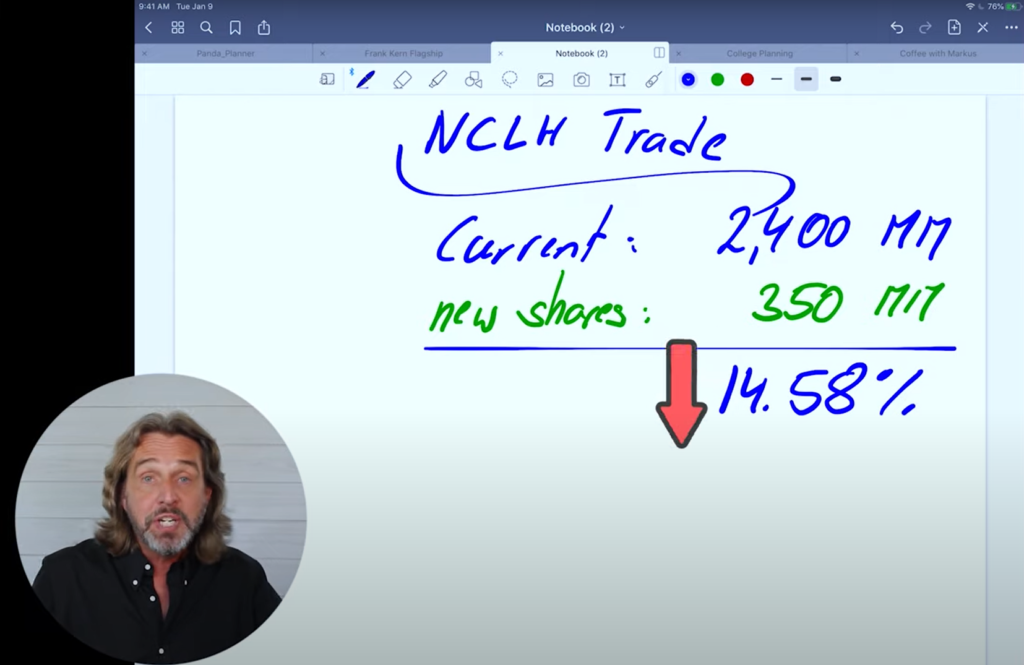

Analyzing the relationship between hedge fund activity and NCLH's stock price requires examining historical data. (Note: This section would ideally include charts and graphs illustrating this correlation. Data would need to be sourced and incorporated).

- Increased Holdings: Do increases in hedge fund ownership correlate with subsequent price increases in NCLH stock? If so, it suggests a positive market sentiment influenced by these large investors.

- Decreased Holdings: Conversely, do decreases in hedge fund ownership predict price drops? This might indicate a shift in market sentiment, possibly driven by concerns about the company's future or broader economic conditions.

- Divergence: There will be periods where hedge fund activity and the stock price diverge. Understanding the reasons for these divergences – perhaps due to broader market trends, company-specific news, or other unforeseen events – is essential for a comprehensive NCLH analysis.

Interpreting Market Sentiment Based on Hedge Fund Behavior

Hedge fund activity often serves as a barometer of market sentiment. A high concentration of bullish hedge fund investors usually indicates positive market sentiment towards NCLH and the cruise industry as a whole. Conversely, a significant exodus of hedge funds might signal bearish sentiment and potential downward pressure on the stock price.

- Conflicting Signals: It is important to note that not all hedge funds will agree on the outlook for NCLH. Conflicting signals from different funds can create uncertainty and complicate the analysis.

- Investor Implications: Investors should carefully consider the overall picture presented by hedge fund actions, combined with other relevant factors like financial news and industry trends, before making any investment decisions related to NCLH stock.

Risks and Considerations for NCLH Investment

Industry-Specific Risks

The cruise industry faces inherent risks:

- Economic Downturns: Recessions and economic uncertainty can significantly impact discretionary spending on leisure travel, affecting NCLH's bookings and revenue.

- Geopolitical Events: Global instability, terrorism, or political crises in key cruise destinations can disrupt operations and impact customer demand.

- Health Crises: Past experiences demonstrate the devastating impact of pandemics on the cruise industry. Outbreaks of infectious diseases can lead to travel restrictions, cancellations, and significant financial losses.

Financial Health of NCLH

Assessing NCLH's financial health requires a thorough analysis of its financial statements. (Note: This section requires incorporating relevant financial data from NCLH's financial reports, such as debt-to-equity ratios, profit margins, and cash flow statements. Include citations).

- Debt Levels: High debt levels can increase financial risk and make the company vulnerable during economic downturns.

- Profitability: Analyzing profit margins and return on equity helps determine the company’s ability to generate profits and reward shareholders.

- Cash Flow: Strong cash flow is vital for a company's financial stability, allowing it to meet its obligations and invest in future growth. Analyzing NCLH's free cash flow and operating cash flow will reveal important insights into their financial health.

Conclusion

Analyzing NCLH stock requires a multifaceted approach, with hedge fund activity providing a valuable, albeit incomplete, piece of the puzzle. While the observed activity of prominent hedge funds can suggest potential market sentiment and future price movements, it's crucial to remember that this is just one factor among many. Our analysis has shown a complex picture, with potential benefits offset by considerable industry-specific risks and the need for careful consideration of NCLH's financial health.

While analyzing NCLH stock and considering the insights gleaned from hedge fund activity can inform your investment decisions, it's crucial to conduct thorough due diligence before investing. Remember that past performance is not indicative of future results. Continue your own research on NCLH stock and consider consulting with a financial advisor before making any investment decisions. Learn more about analyzing NCLH stock and other similar opportunities.

Featured Posts

-

The Spd And Germanys New Coalition From Powerhouse To Supporting Cast

Apr 30, 2025

The Spd And Germanys New Coalition From Powerhouse To Supporting Cast

Apr 30, 2025 -

Super Bowl Lvii A Family Affair For Jay Z Blue Ivy And Rumi

Apr 30, 2025

Super Bowl Lvii A Family Affair For Jay Z Blue Ivy And Rumi

Apr 30, 2025 -

Coronation Street A First Look At Daisy Midgeleys Exit Storyline

Apr 30, 2025

Coronation Street A First Look At Daisy Midgeleys Exit Storyline

Apr 30, 2025 -

Super Bowl 2024 Blue Ivy And Rumis Red Carpet Moment Beyonces Absence Sparks Speculation

Apr 30, 2025

Super Bowl 2024 Blue Ivy And Rumis Red Carpet Moment Beyonces Absence Sparks Speculation

Apr 30, 2025 -

Dzhey Zi Teylor Svift I Serena Uilyams Na Superboule 2025 Polniy Obzor Sobytiy

Apr 30, 2025

Dzhey Zi Teylor Svift I Serena Uilyams Na Superboule 2025 Polniy Obzor Sobytiy

Apr 30, 2025