Analyzing News Corp's Undervalued Assets: A Deeper Look

Table of Contents

News Corp's Diverse Portfolio: A Closer Look

News Corp boasts a remarkably diverse portfolio spanning news media, book publishing, and digital real estate. This diversification, while seemingly beneficial, may contribute to the market's struggle to accurately assess the true value of its individual components. Let's examine some key areas:

The Undervalued Publishing Division:

News Corp's publishing arm, despite possessing strong brand recognition and a loyal readership base across several key markets, appears to be undervalued. This division holds significant potential for growth and profitability.

- Strong brand recognition in key markets: Names like HarperCollins and other imprints enjoy considerable brand equity and customer loyalty, translating into consistent revenue streams.

- Potential for digital expansion and diversification: The transition to digital formats presents opportunities for expansion into e-books, audiobooks, and subscription services, diversifying revenue sources and reaching new audiences.

- Cost-cutting measures and efficiency improvements: Streamlining operations and implementing cost-effective strategies can significantly boost profitability.

- Acquisition potential to expand market share: Strategic acquisitions of smaller publishing houses or digital platforms could bolster market share and expand content offerings.

Real Estate Holdings: Hidden Gems?

News Corp owns significant real estate assets in prime locations across major cities globally. These holdings represent a substantial, yet often overlooked, component of the company's overall value.

- Prime locations in major cities: The strategic positioning of these properties ensures high rental income and significant appreciation potential.

- Potential for redevelopment or sale: Some properties might benefit from redevelopment projects, increasing their value, while others could be strategically sold to unlock capital for reinvestment.

- Market analysis comparing current valuation to potential market value: A detailed analysis comparing News Corp's current real estate valuations to comparable properties in similar markets reveals significant undervaluation.

- Comparison with similar real estate holdings of competitors: A comparison with competitors' real estate portfolios reveals that News Corp's holdings are often undervalued relative to their market counterparts.

Digital Real Estate and its Growth Potential:

News Corp's digital real estate, encompassing websites, online platforms, and digital media properties, holds considerable potential for growth in the evolving digital media landscape.

- Growth potential in the digital media landscape: The increasing shift towards digital consumption provides significant growth opportunities for News Corp's online properties.

- Strategic partnerships and potential acquisitions: Collaborations with other digital media companies or acquisitions of complementary platforms could unlock further growth.

- Monetization strategies and revenue generation models: Optimizing revenue generation models, through targeted advertising, subscriptions, and premium content, can dramatically increase profitability.

- Analysis of market trends and future prospects: A thorough examination of industry trends indicates strong growth potential for News Corp's digital assets.

Market Mispricing and Factors Affecting Valuation:

The market's undervaluation of News Corp's assets may stem from several factors:

- Short-term market sentiment and investor perceptions: Short-term market fluctuations and negative investor sentiment can overshadow the long-term value of News Corp's assets.

- Lack of understanding of the underlying value of certain assets: Investors may not fully appreciate the long-term value of the publishing and real estate divisions, leading to underestimation.

- Impact of recent events and industry trends: Recent industry changes and market disruptions may have temporarily impacted investor confidence.

- Comparison with competitor valuations: A comparison with competitors reveals that News Corp's assets are often valued less than those of comparable companies.

Potential for Future Growth and Investment Strategies:

News Corp possesses significant potential for future growth and attractive returns on investment. Potential strategies include:

- Strategic acquisitions and divestments: Acquiring complementary businesses and divesting underperforming assets can optimize the portfolio.

- Improved operational efficiency and cost reduction: Streamlining operations and reducing costs can significantly improve profitability.

- Expansion into new markets and segments: Exploring new market opportunities and expanding into related sectors can drive growth.

- Potential for increased dividend payouts: Improved profitability could lead to increased dividend payouts for shareholders.

- Long-term value appreciation: The long-term value appreciation of News Corp's diverse assets is a key factor for potential investors.

Conclusion:

By analyzing News Corp's undervalued assets, we've identified significant potential for future growth and returns. The diverse portfolio, encompassing publishing, real estate, and digital properties, exhibits characteristics of substantial undervaluation by current market pricing. The underestimation of the long-term value of these assets presents a compelling opportunity for investors. Conduct your own thorough due diligence and consider the potential of News Corp's undervalued holdings. By carefully evaluating News Corp's undervalued assets, investors can identify potentially lucrative investment opportunities. Don't overlook the potential of undervalued News Corp assets – further research could reveal significant returns.

Featured Posts

-

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

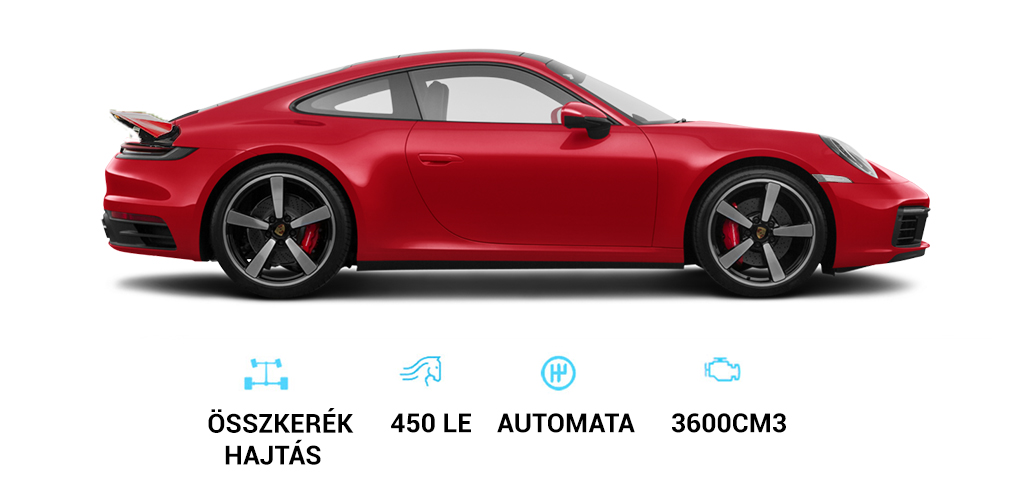

Egyeduelallo Porsche Legendas F1 Hajtomuvel

May 24, 2025

Egyeduelallo Porsche Legendas F1 Hajtomuvel

May 24, 2025 -

Shajee Traders In Essen Geschlossen Hygienemaengel Festgestellt

May 24, 2025

Shajee Traders In Essen Geschlossen Hygienemaengel Festgestellt

May 24, 2025 -

Trumps Air Traffic Control Plan Newark Airports Recent Issues Explained

May 24, 2025

Trumps Air Traffic Control Plan Newark Airports Recent Issues Explained

May 24, 2025 -

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025