Analyzing Palantir Stock: Should You Buy Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Stock Price Trends

Analyzing Palantir's recent financial performance is crucial for assessing its current valuation and future potential. Let's examine the key metrics:

-

Quarterly Earnings: Palantir's Q4 2022 earnings report revealed continued revenue growth, although profitability remains a focus area. Investors should examine subsequent reports for trends in revenue growth, operating margins, and net income to inform their May 5th Palantir investment decisions. Specific figures and year-over-year comparisons are readily available on their investor relations page.

-

Revenue Growth: While Palantir has demonstrated consistent revenue growth, investors should scrutinize the sources of this growth. Is it primarily driven by government contracts or commercial clients? A balanced portfolio of clients is crucial for long-term stability in Palantir stock.

-

Stock Price Fluctuations: PLTR stock has experienced significant volatility in the past. Analyzing the stock's performance leading up to May 5th, relative to broader market trends, is essential for understanding its current trajectory and potential future movements.

-

Key Financial Metrics & Competitor Analysis:

- Revenue: [Insert specific revenue figures and YoY growth percentages from recent quarters]

- Operating Margin: [Insert specific operating margin figures and YoY changes]

- Net Income: [Insert specific net income figures and YoY changes]

- Competitor Comparison: Palantir faces competition from other data analytics companies. Comparing PLTR's key metrics to competitors like Databricks and Snowflake provides valuable context for evaluating its performance and market position.

Key Catalysts Affecting Palantir Stock Before May 5th

Several factors could significantly influence Palantir stock before May 5th. Understanding these potential catalysts is paramount for making an informed Palantir investment.

-

Upcoming Earnings Reports & Announcements: Any upcoming earnings reports or product announcements scheduled around May 5th will undoubtedly impact the stock price. Positive news could drive up the price, while negative news might cause a decline.

-

New Contracts & Partnerships: The securing of substantial new contracts, particularly large government contracts or strategic partnerships, could significantly boost investor confidence and the PLTR stock price. Monitor for announcements of new deals and their potential impact.

-

Geopolitical Events & Regulatory Changes: Geopolitical instability or changes in government regulations (especially in sectors Palantir operates within) can impact the company's performance and thus the Palantir stock price.

-

Specific Catalysts:

- Date of Upcoming Earnings Reports: [Insert date, if applicable]

- Details of New Contracts (if any): [Insert details, if available]

- Geopolitical Factors to Watch: [Mention any relevant geopolitical events]

- Regulatory Changes to Monitor: [Mention relevant regulatory changes, if applicable]

Assessing Palantir's Long-Term Growth Potential

Palantir's long-term growth prospects are intertwined with its ability to expand into new markets and maintain a competitive edge in the data analytics sector.

-

Market Position & Competitive Advantage: Palantir's proprietary software and expertise in big data analytics provide a competitive advantage. However, assessing its market share and the intensity of competition is crucial.

-

Market Expansion: Palantir's expansion into new sectors beyond government contracts (such as commercial applications) is a key driver of its long-term growth potential. The success of this diversification is critical for the Palantir investment outlook.

-

Innovation & Technological Advancements: Palantir's investment in research and development (R&D) is a key factor driving innovation. Monitoring their technological advancements and their adoption by clients is essential.

-

Long-Term Growth Outlook: The overall outlook for the data analytics industry is positive, suggesting long-term growth potential for Palantir. However, the company's ability to capitalize on this growth will be a determining factor.

-

Specific Growth Factors:

- Market Share Data: [Insert data on market share, if available]

- New Market Expansions: [Mention specific sectors Palantir is targeting]

- R&D Investment: [Mention details about R&D spending and new product development]

- Industry Growth Outlook: [Cite forecasts and predictions for the data analytics industry]

Understanding the Risks Associated with Investing in Palantir Stock

Despite the potential for growth, investing in Palantir stock carries inherent risks. A thorough understanding of these risks is crucial before making any Palantir investment decision.

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. This dependence exposes the company to risks associated with government funding cycles and changes in procurement policies.

-

Stock Price Volatility: PLTR stock is known for its volatility. Investors should be prepared for significant price fluctuations and potential losses.

-

Competition: The data analytics market is highly competitive. New entrants and existing competitors could erode Palantir's market share and profitability.

-

Valuation Concerns: Palantir's current valuation might be considered high by some analysts. The potential for stock price corrections should be considered.

-

Specific Risks:

- Government Contract Risks: [Elaborate on the potential risks associated with government contracts]

- Competitive Threats: [Identify key competitors and their potential impact]

- Valuation Risks: [Discuss potential valuation concerns and risks of overvaluation]

- Overall Risk Assessment: [Summarize the overall risk profile of Palantir stock]

Conclusion

Analyzing Palantir stock requires careful consideration of its recent financial performance, upcoming catalysts, long-term growth potential, and associated risks. The period leading up to May 5th presents several key decision points for potential investors. While Palantir shows promise in the rapidly growing data analytics sector, the company's dependence on government contracts and stock price volatility present significant risks. Based on this analysis, potential investors should carefully weigh these factors before making an investment decision. The recommendation regarding whether to buy, hold, or sell Palantir stock before May 5th depends heavily on your individual risk tolerance and investment strategy.

Recommendation: [Insert clear buy/hold/sell recommendation based on your analysis. Justify your recommendation.]

Call to Action: Analyze your investment strategy and decide if Palantir stock is right for your portfolio before May 5th. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions. For more information, visit Palantir's investor relations page: [Insert link to Palantir's investor relations page].

Featured Posts

-

Divine Mercy Extended Exploring Religious Faiths In 1889

May 10, 2025

Divine Mercy Extended Exploring Religious Faiths In 1889

May 10, 2025 -

New Trade Deal Trump And Britain To Announce Agreement Details

May 10, 2025

New Trade Deal Trump And Britain To Announce Agreement Details

May 10, 2025 -

Cowboy Carter Streams Explode After Beyonces Tour Launch

May 10, 2025

Cowboy Carter Streams Explode After Beyonces Tour Launch

May 10, 2025 -

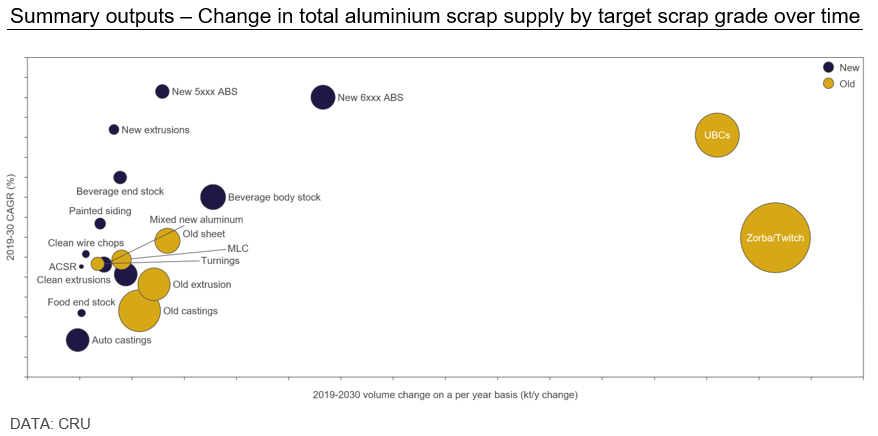

Growth Opportunities Pinpointing The Countrys Best Business Locations

May 10, 2025

Growth Opportunities Pinpointing The Countrys Best Business Locations

May 10, 2025 -

Snls Failed Harry Styles Impression His Disappointed Reaction

May 10, 2025

Snls Failed Harry Styles Impression His Disappointed Reaction

May 10, 2025