Analyzing QBTS Stock's Potential Movement Following Upcoming Earnings

Table of Contents

Review of QBTS's Recent Performance and Financial Health

Analyzing QBTS's recent financial performance is paramount to predicting its stock price movement after earnings. A strong financial foundation usually translates to positive market sentiment and a higher stock valuation. Let's examine several key aspects of QBTS's financial health:

-

QBTS Revenue Growth: Examining QBTS's revenue growth trajectory over the past few quarters reveals its underlying strength. Consistent, upward trending revenue indicates a healthy business model and strong demand for its products or services. Conversely, significant fluctuations or declines may signal underlying issues. Investors should scrutinize the sources of revenue growth to understand its sustainability. Is it driven by organic growth, acquisitions, or market share gains?

-

QBTS Profitability and Margins: Analyzing QBTS's profitability involves examining its profit margins – both gross and operating. Improving profit margins indicate efficient cost management and increasing pricing power. Conversely, declining margins could suggest increased competition or rising costs. Investors should also consider the cost of goods sold (COGS) and operating expenses as these significantly impact profitability. A detailed analysis of QBTS's income statement is necessary for a thorough understanding.

-

QBTS Debt and Cash Flow: A strong balance sheet, characterized by manageable debt levels and robust cash flow, is crucial for a company's long-term stability and growth. High levels of debt can restrict future investments and increase financial risk. A healthy cash flow, on the other hand, allows QBTS to fund operations, invest in growth opportunities, and return capital to shareholders. Investors should closely examine QBTS's cash flow statement to ascertain its liquidity and solvency.

-

Significant Corporate Actions: Any recent acquisitions, mergers, partnerships, or divestitures by QBTS can significantly influence its financial standing and stock price. These actions can impact revenue streams, cost structures, and overall market positioning. Understanding the strategic rationale and potential financial implications of such actions is crucial for accurate QBTS stock analysis.

-

Recent News and Announcements: Keep abreast of any recent news or announcements concerning QBTS. Positive news, such as new product launches, strategic partnerships, or regulatory approvals, can boost investor confidence and drive up the stock price. Negative news, conversely, could lead to a decline. Staying informed through reliable financial news sources is essential.

Factors Influencing QBTS Stock Price After Earnings Release

The reaction of QBTS stock price to the earnings release will depend on several interacting factors. Understanding these factors allows for a more informed QBTS stock price prediction.

-

Earnings Expectations: Market expectations regarding QBTS's earnings report significantly impact its stock price. Analysts' ratings and consensus earnings estimates provide a benchmark against which actual results are measured. Exceeding expectations usually results in a positive market reaction, while missing them often leads to a decline.

-

Impact of Earnings Surprises: Historically, how has the market reacted to positive and negative surprises in QBTS earnings? Understanding this historical context provides valuable insight into potential price volatility. A history of strong positive reactions to exceeding expectations suggests a more bullish market outlook.

-

Market Sentiment: The overall market sentiment toward QBTS and the broader industry plays a critical role. Positive market sentiment, driven by factors like economic growth or strong industry trends, can amplify the positive impact of good earnings. Negative sentiment, however, can dampen the positive impact or even exacerbate the negative impact of disappointing earnings. Macroeconomic factors such as inflation, interest rates, and geopolitical events can also influence investor confidence and market sentiment.

-

Competitor Analysis: The performance of QBTS's competitors significantly affects its market position and investor sentiment. If competitors are gaining market share or reporting stronger financial results, it could put downward pressure on QBTS's stock price. A competitive landscape analysis is vital for assessing QBTS's relative strength.

-

Management Guidance: Guidance provided by QBTS management on future performance is crucial. Positive guidance, indicating strong future growth prospects, often boosts investor confidence and stock prices. Negative guidance, suggesting slower growth or challenges ahead, can lead to a decline.

Technical Analysis of QBTS Stock Chart

Technical analysis of QBTS's stock chart provides valuable insights into potential price movements. By examining past price action, trading volume, and technical indicators, we can identify potential support and resistance levels.

-

Support and Resistance Levels: Identifying key support and resistance levels on QBTS's stock chart helps anticipate potential price reversals. Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels represent price points where selling pressure is expected to dominate.

-

Trading Volume: Analyzing trading volume patterns reveals periods of high investor interest and potential momentum shifts. High volume during price increases suggests strong buying pressure, while high volume during price declines suggests significant selling pressure.

-

Technical Indicators: Employing technical indicators, such as moving averages (e.g., 50-day and 200-day moving averages) and the Relative Strength Index (RSI), provides further insights into potential price trends and momentum. Moving averages help to smooth out price fluctuations and identify trend direction, while RSI helps identify overbought and oversold conditions.

-

Overall Price Trend: Determining whether QBTS's stock price is in an overall bullish, bearish, or sideways trend is important. A bullish trend suggests increasing upward momentum, while a bearish trend suggests increasing downward momentum. A sideways trend, also known as consolidation, indicates indecision in the market.

-

Chart Patterns: Recognizing significant chart patterns, such as head and shoulders, double tops, or double bottoms, can suggest potential future price movements. These patterns provide visual cues of potential trend reversals or continuations.

Conclusion

Analyzing QBTS stock's potential movement requires a multifaceted approach, combining a review of its financial health, understanding the factors influencing investor sentiment, and performing technical analysis of the stock chart. The upcoming earnings report will be a crucial catalyst for price movements. By carefully considering QBTS financials, market expectations, and technical indicators, investors can develop a more informed QBTS stock price prediction.

Call to Action: Stay informed about QBTS’s upcoming earnings announcement and continue to monitor QBTS stock performance for informed investment decisions. Conduct your own thorough due diligence before making any investment decisions regarding QBTS stock. Remember to always diversify your portfolio and consult a financial advisor for personalized advice. Understanding QBTS stock's potential movement is key to making smart investment choices in QBTS.

Featured Posts

-

Cote D Ivoire Le Port D Abidjan Accueille Le Plus Grand Navire De Son Histoire

May 20, 2025

Cote D Ivoire Le Port D Abidjan Accueille Le Plus Grand Navire De Son Histoire

May 20, 2025 -

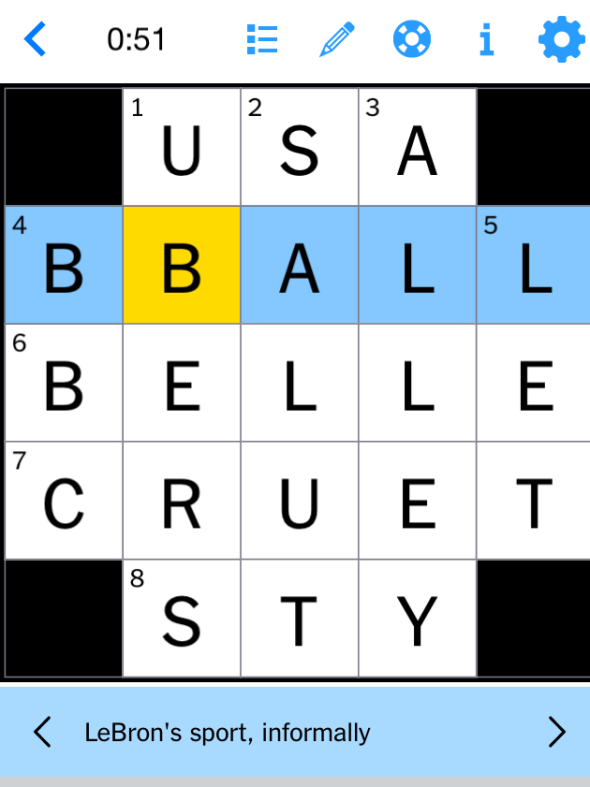

Solve The Nyt Mini Crossword March 18 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 18 Answers

May 20, 2025 -

Cote D Ivoire Le Salon International Du Livre D Abidjan Ouvre Ses Portes Pour Sa 15eme Edition

May 20, 2025

Cote D Ivoire Le Salon International Du Livre D Abidjan Ouvre Ses Portes Pour Sa 15eme Edition

May 20, 2025 -

Alnwab Yqrwn Bmkhalfat Dywan Almhasbt 2022 2023 Tfasyl Altqaryr

May 20, 2025

Alnwab Yqrwn Bmkhalfat Dywan Almhasbt 2022 2023 Tfasyl Altqaryr

May 20, 2025 -

Huuhkajien Kaellmanin Ja Hoskosen Laehtoe Puolasta Vahvistui Mitae Seuraavaksi

May 20, 2025

Huuhkajien Kaellmanin Ja Hoskosen Laehtoe Puolasta Vahvistui Mitae Seuraavaksi

May 20, 2025