Analyzing Ripple's (XRP) Potential To Reach $3.40

Table of Contents

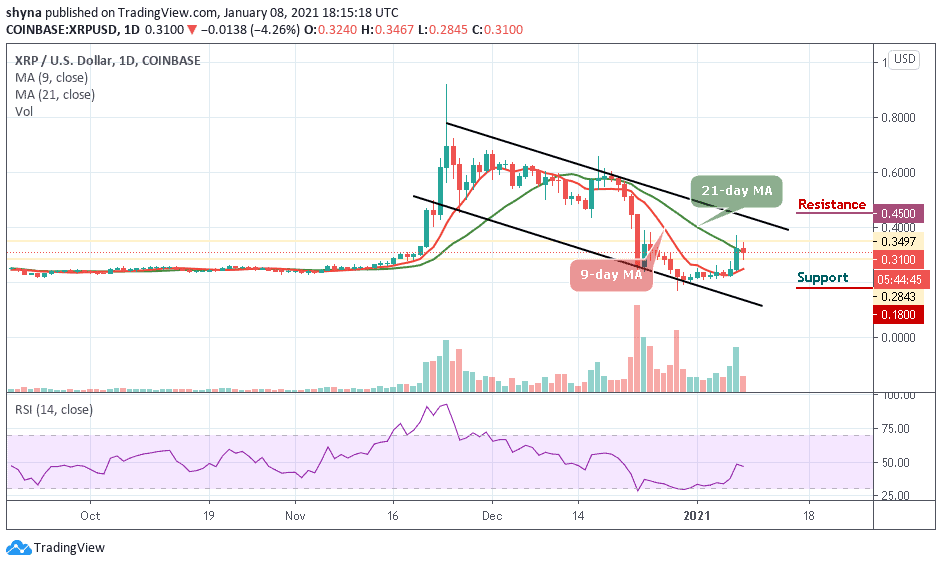

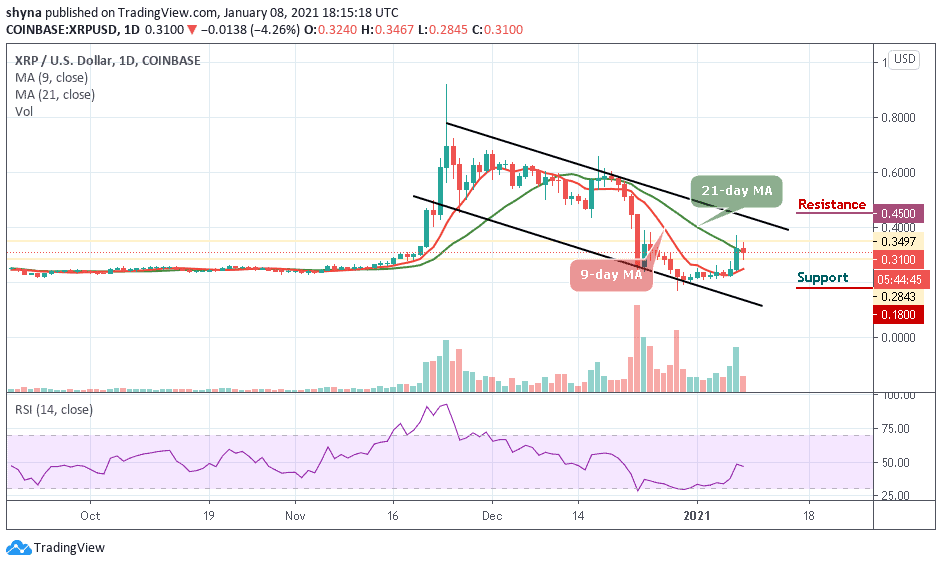

Recent price fluctuations have ignited excitement around XRP, leaving many wondering: can Ripple's (XRP) potential to reach $3.40 truly be realized? This article delves into a comprehensive analysis of the factors that could contribute to such a significant price surge. We'll explore key aspects including XRP's current market position, the influence of institutional adoption, technological advancements, regulatory hurdles, and competitive pressures. Understanding these elements is crucial for assessing Ripple's (XRP) potential to reach $3.40 and beyond.

2. H2: Current Market Conditions and XRP's Position

H3: Market Capitalization Analysis: XRP currently holds a significant market capitalization, but reaching $3.40 would require a substantial increase. To understand the magnitude of this task, we need to compare its current market cap to leading cryptocurrencies like Bitcoin and Ethereum. A price of $3.40 would place XRP in a completely different league, demanding a massive influx of capital and widespread market adoption.

- Market cap comparison: XRP's market cap needs to be significantly higher than its current value to justify a $3.40 price. A detailed comparison to Bitcoin and Ethereum's market caps at various price points can illustrate this. (Charts and data would be inserted here)

- Required market cap increase: Calculations showing the enormous increase in market cap needed to support a $3.40 XRP price are essential for a realistic assessment.

- Potential hurdles: Reaching this market cap would depend on various factors, including investor confidence, regulatory clarity, and sustained growth in the overall crypto market.

H3: Trading Volume and Liquidity: High trading volume and sufficient liquidity are crucial for price stability and rapid price movements. Analyzing XRP's trading volume across major exchanges is vital. High liquidity means large buy and sell orders can be executed without significantly impacting the price.

- Data on daily/monthly trading volume: Presenting data on XRP's trading volume on major exchanges will reveal its current liquidity status.

- Liquidity depth analysis: A deeper dive into order book data can illustrate the depth of liquidity available, providing insights into its resilience to large price swings.

- Comparison to other cryptocurrencies: Comparing XRP's trading volume and liquidity to similar cryptocurrencies helps to gauge its relative strength and potential for price surges.

H3: Overall Crypto Market Sentiment: The overall sentiment in the cryptocurrency market heavily influences XRP's price. Positive sentiment, driven by factors like Bitcoin's price performance or positive regulatory news, can lead to increased investment in XRP, while negative sentiment can cause sell-offs.

- Factors impacting overall sentiment: Macroeconomic conditions, Bitcoin's price, regulatory changes, and major technological advancements all play significant roles.

- How positive/negative sentiment influences XRP: Analyzing how these factors impact XRP's price will reveal its sensitivity to broader market trends.

3. H2: Factors Contributing to Potential Price Growth

H3: Increasing Institutional Adoption: The growing adoption of XRP by financial institutions for cross-border payments is a significant factor potentially driving price growth. This institutional interest signals increased trust and legitimacy.

- List of banks and financial institutions using XRP: Highlighting concrete examples of institutions utilizing XRP for transactions showcases its real-world applications.

- Examples of successful cross-border transactions: Success stories demonstrate the efficiency and cost-effectiveness of XRP in international payments.

- Impact on demand and price: Increased institutional demand for XRP would directly influence its price.

H3: Technological Advancements and RippleNet: Ripple's continuous development of RippleNet and its ongoing technological improvements play a vital role in boosting its appeal and potentially driving price increases.

- New features and upgrades to RippleNet: Highlighting new functionalities and improvements demonstrates Ripple's commitment to innovation.

- Partnerships and collaborations: Strategic partnerships can expand RippleNet's reach and increase its adoption rate, thereby benefiting XRP's price.

- Expansion into new markets: Growth into new geographical regions signifies increased demand and potential for price appreciation.

H3: Regulatory Clarity and Legal Battles: The outcome of Ripple's ongoing legal battle with the SEC could significantly impact XRP's price. A favorable ruling could remove uncertainty and potentially unlock massive price growth.

- Summary of the legal case: A concise summary of the key arguments and ongoing developments is necessary.

- Potential scenarios and their impact on price: Analyzing potential outcomes (positive or negative) and their effects on XRP's price is crucial.

- Expert opinions: Including perspectives from industry experts adds credibility and depth to the analysis.

4. H2: Challenges and Potential Roadblocks

H3: Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains uncertain, posing a significant challenge to XRP's price growth. Different jurisdictions have varying regulatory approaches, creating complexity and potential risks.

- Key regulatory hurdles: Identifying and explaining the major regulatory challenges facing XRP and the broader crypto market is important.

- Potential impact on adoption and price: Regulatory uncertainty can hinder adoption and negatively influence investor sentiment.

- Different regulatory approaches across countries: Highlighting the inconsistencies in regulatory approaches across different countries provides a clearer understanding of the challenges.

H3: Competition from other Cryptocurrencies: XRP faces competition from other cryptocurrencies offering similar functionalities in cross-border payments and blockchain technology. This competitive landscape necessitates continuous innovation and adaptation.

- Key competitors to XRP: Identifying and comparing XRP's key competitors helps in assessing its market position.

- Comparison of functionalities and market share: Comparing the functionalities and market share of competitors helps to understand XRP's competitive advantage or disadvantage.

- Potential impact on XRP's growth: Assessing how competition affects XRP's growth provides a balanced perspective.

H3: Market Volatility and Risk: The cryptocurrency market is inherently volatile, presenting significant risks to investors. Understanding and managing these risks is crucial.

- Historical price volatility: Analyzing XRP's past price volatility helps investors gauge its potential for future price swings.

- Factors contributing to volatility: Identifying the key factors contributing to XRP's volatility allows for better risk management.

- Risk management strategies for investors: Offering suggestions for investors to manage risk effectively is beneficial.

5. Conclusion: The Path to $3.40 for XRP – A Realistic Assessment?

Reaching $3.40 for XRP hinges on a confluence of factors. While institutional adoption, technological advancements, and regulatory clarity present significant opportunities, challenges such as regulatory uncertainty, competition, and inherent market volatility remain. Whether XRP will reach $3.40 is ultimately dependent on the interplay of these positive and negative forces. Based on the current analysis, reaching $3.40 represents a significant undertaking, requiring substantial market growth and overcoming substantial regulatory and competitive hurdles. However, the potential for growth is undeniably present. Continue your own research into Ripple's (XRP) potential to reach $3.40, considering all aspects of this complex equation. Stay informed about the factors influencing Ripple's (XRP) price to make informed investment decisions.

Featured Posts

-

Jayson Tatum Ankle Injury Update On Celtics Forwards Status

May 08, 2025

Jayson Tatum Ankle Injury Update On Celtics Forwards Status

May 08, 2025 -

Bitcoin Price Rebound Understanding The Potential For Future Growth

May 08, 2025

Bitcoin Price Rebound Understanding The Potential For Future Growth

May 08, 2025 -

Understanding Xrp Ripple Is It A Viable Investment For Financial Security

May 08, 2025

Understanding Xrp Ripple Is It A Viable Investment For Financial Security

May 08, 2025 -

Kripto Varliklar Ve Riskler Bakan Simsek In Aciklamalari

May 08, 2025

Kripto Varliklar Ve Riskler Bakan Simsek In Aciklamalari

May 08, 2025 -

5 0 355 Nl 3

May 08, 2025

5 0 355 Nl 3

May 08, 2025