Analyzing The Dax: The Impact Of German Politics And Economics

Table of Contents

The German Economy's Influence on the DAX

The performance of the DAX is intrinsically linked to the health of the German economy. Two key aspects significantly influence DAX movements: Germany's export-oriented nature and crucial domestic economic indicators.

Export-Oriented Economy and Global Trade

Germany's economy heavily relies on exports, making the DAX highly susceptible to global economic fluctuations. Changes in international demand, particularly from major trading partners like China and the United States, directly impact German manufacturing and, consequently, the DAX.

- Impact of global supply chain disruptions on German manufacturers: Disruptions, such as those experienced during the pandemic, can lead to production slowdowns, impacting export volumes and negatively affecting DAX-listed companies. This highlights the vulnerability of the DAX to unforeseen global events. Analyzing supply chain resilience is crucial for DAX analysis.

- The role of the Eurozone economy and its influence on DAX performance: As a member of the Eurozone, Germany's economic fate is intertwined with that of its European partners. Economic downturns or crises within the Eurozone can trigger negative spillover effects on the German economy and the DAX. Understanding Eurozone economic indicators is vital for effective DAX analysis.

- Analysis of key export sectors (automotive, machinery, chemicals) and their effect on the DAX: The automotive, machinery, and chemical sectors are major contributors to German exports. Positive or negative trends within these sectors directly translate into corresponding movements in the DAX. Monitoring the performance of these sectors is key to accurate DAX analysis and forecasting.

Domestic Economic Indicators and the DAX

Domestic economic indicators provide valuable insights into the German economy's health and directly influence investor sentiment and DAX performance. Key indicators include GDP growth, inflation rates, unemployment figures, and consumer confidence.

- How changes in German GDP directly correlate with DAX movements: Positive GDP growth generally indicates a healthy economy, boosting investor confidence and pushing the DAX upwards. Conversely, negative GDP growth can trigger a decline in the DAX. This correlation is a fundamental aspect of DAX analysis.

- The impact of inflation on corporate profits and investor confidence: High inflation erodes corporate profits and can lead to decreased investor confidence, potentially negatively impacting the DAX. Monitoring inflation rates is essential for DAX analysis.

- Analysis of the relationship between unemployment and DAX performance: High unemployment rates signal a weakening economy and can lead to decreased consumer spending, impacting corporate earnings and negatively affecting the DAX. Low unemployment, conversely, often boosts investor confidence.

The Impact of German Politics on the DAX

German political decisions significantly influence the DAX through government policies and the overall political climate.

Government Policies and Regulations

Government policies, including fiscal policy (taxation and spending), monetary policy (largely influenced by the European Central Bank), and regulatory changes, can have a profound impact on DAX-listed companies.

- Influence of government spending on infrastructure projects: Increased government spending on infrastructure projects can stimulate economic growth and benefit related companies, positively impacting the DAX. Monitoring government budgets is a crucial element of DAX analysis.

- Impact of tax reforms on corporate profitability: Tax reforms can significantly influence corporate profitability and investor sentiment. Tax cuts can boost corporate earnings, while tax increases can have the opposite effect, influencing DAX performance.

- Effect of environmental regulations on specific DAX-listed companies: Stricter environmental regulations can impact companies in energy-intensive sectors, potentially affecting their profitability and consequently the DAX.

Political Stability and Uncertainty

Political stability and predictable government policies are crucial for investor confidence. Periods of political uncertainty can create volatility in the DAX.

- Analysis of the impact of elections on DAX performance: Elections can lead to uncertainty in the short term, potentially causing fluctuations in the DAX until the new government's policies become clear. Post-election DAX analysis is crucial.

- The effect of coalition government changes on investor sentiment: Changes in coalition governments can lead to policy shifts, impacting investor confidence and potentially causing volatility in the DAX. Understanding the political landscape is essential for DAX analysis.

- How geopolitical risks and international relations affect the DAX: Global geopolitical events and Germany's international relations can influence investor sentiment and subsequently impact the DAX. Monitoring global events is crucial for comprehensive DAX analysis.

Analyzing the DAX: Key Indicators and Strategies

Effective DAX analysis involves utilizing both technical and fundamental analysis methods.

Technical Analysis of the DAX

Technical analysis uses historical price and volume data to identify potential trading opportunities.

- Explanation of common technical indicators used in DAX analysis: Indicators like moving averages, relative strength index (RSI), and MACD provide insights into potential price trends and momentum.

- Examples of chart patterns that signal potential buy or sell signals: Identifying chart patterns like head and shoulders, double tops/bottoms, and triangles can signal potential turning points in the DAX.

- Importance of risk management in DAX trading: Risk management strategies like stop-loss orders and position sizing are crucial for mitigating potential losses in DAX trading.

Fundamental Analysis of the DAX

Fundamental analysis assesses the intrinsic value of DAX-listed companies by examining their financial health and underlying economic factors.

- Importance of evaluating company earnings and financial statements: Analyzing financial statements reveals a company's profitability, financial stability, and future growth potential.

- Role of industry analysis in DAX investment strategies: Understanding industry trends and competitive landscapes helps evaluate the prospects of individual DAX-listed companies.

- Understanding the impact of macroeconomic factors on individual DAX stocks: Macroeconomic factors like interest rates, inflation, and economic growth affect the performance of individual DAX stocks differently.

Conclusion

DAX analysis requires a multifaceted approach, considering the interplay of the German economy, its political landscape, and global market forces. By integrating technical and fundamental analysis techniques and staying informed about key economic and political developments, investors can make more informed decisions and navigate the complexities of the DAX effectively. Begin your in-depth DAX analysis today to effectively navigate this dynamic market and capitalize on potential opportunities. Understanding DAX analysis is crucial for successful investing in this important market.

Featured Posts

-

Bencic Claims Abu Dhabi Open Title

Apr 27, 2025

Bencic Claims Abu Dhabi Open Title

Apr 27, 2025 -

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada

Apr 27, 2025

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada

Apr 27, 2025 -

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 27, 2025

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 27, 2025 -

Kanopy Your Guide To Free Movies And Tv Shows

Apr 27, 2025

Kanopy Your Guide To Free Movies And Tv Shows

Apr 27, 2025 -

Ariana Grandes Bold Transformation A Look At The Professional Stylists

Apr 27, 2025

Ariana Grandes Bold Transformation A Look At The Professional Stylists

Apr 27, 2025

Latest Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

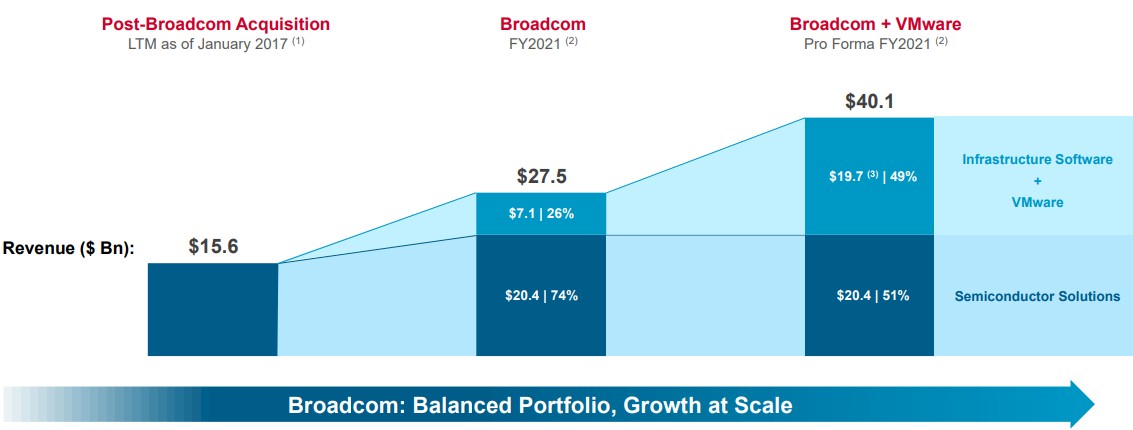

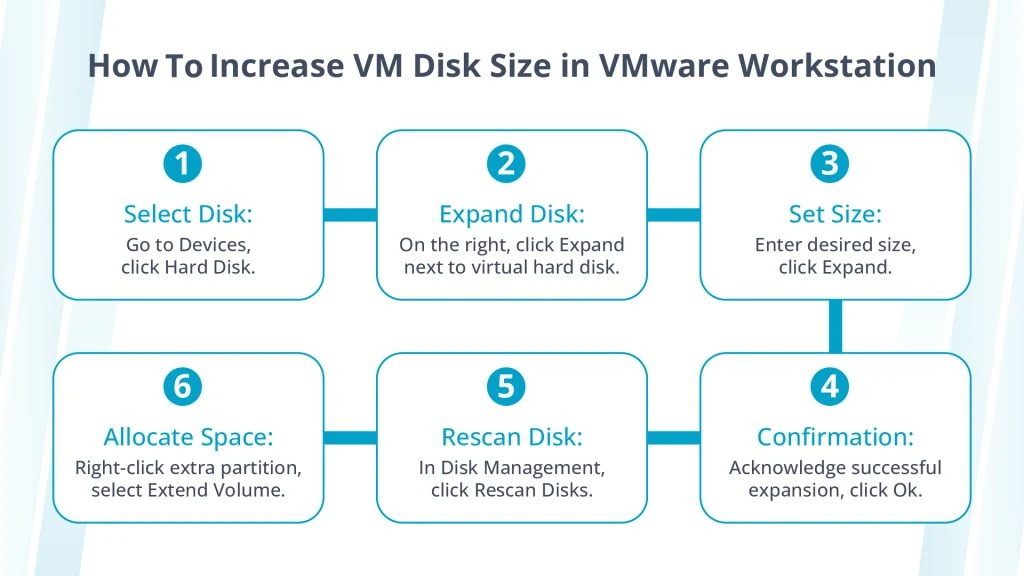

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025