Analyzing The GOP Tax Plan: The Reality Of Deficit Reduction

Table of Contents

Projected vs. Actual Revenue Under the GOP Tax Plan

Initial Projections and Assumptions

The initial projections supporting the GOP Tax Plan deficit reduction relied heavily on the theory of supply-side economics, often referred to as "trickle-down" economics. The core assumption was that significant tax cuts, particularly for corporations, would stimulate substantial economic growth. This growth, in turn, would generate increased tax revenue, offsetting the initial revenue loss from the tax cuts.

- Key Economic Indicators Used: Projections relied on optimistic forecasts for GDP growth, increased business investment, and higher employment rates.

- Trickle-Down Economics: The central premise was that lower corporate tax rates would lead to increased investment, job creation, and higher wages, ultimately boosting overall tax revenue.

Actual Revenue Collected After Implementation

The reality, however, fell short of these ambitious projections. While some economic growth did occur, it was significantly less than initially predicted. The actual revenue collected following the enactment of the GOP Tax Plan was considerably lower than projected.

- Tax Revenue Statistics: Data from the Congressional Budget Office (CBO) and the IRS reveal a consistent shortfall in tax revenue compared to initial projections. Specific figures showing the year-over-year revenue shortfalls would be included here. (Note: This section would require insertion of specific data and relevant charts/graphs)

- Data Sources: Data sources for this analysis include official reports from the CBO, IRS data releases, and other reputable economic analyses.

Factors Contributing to Discrepancies

Several factors contributed to the significant discrepancies between projected and actual revenue under the GOP Tax Plan. These include:

- Slower-Than-Expected Economic Growth: The actual rate of economic growth following the tax cuts was notably lower than the optimistic projections used to justify the plan.

- Changes in Corporate Behavior: Corporations did not invest as heavily as projected, choosing instead to increase stock buybacks or pay dividends.

- Exploitation of Loopholes: Taxpayers found and exploited loopholes within the new tax code, reducing their overall tax liability.

The Impact of the GOP Tax Plan on the National Debt

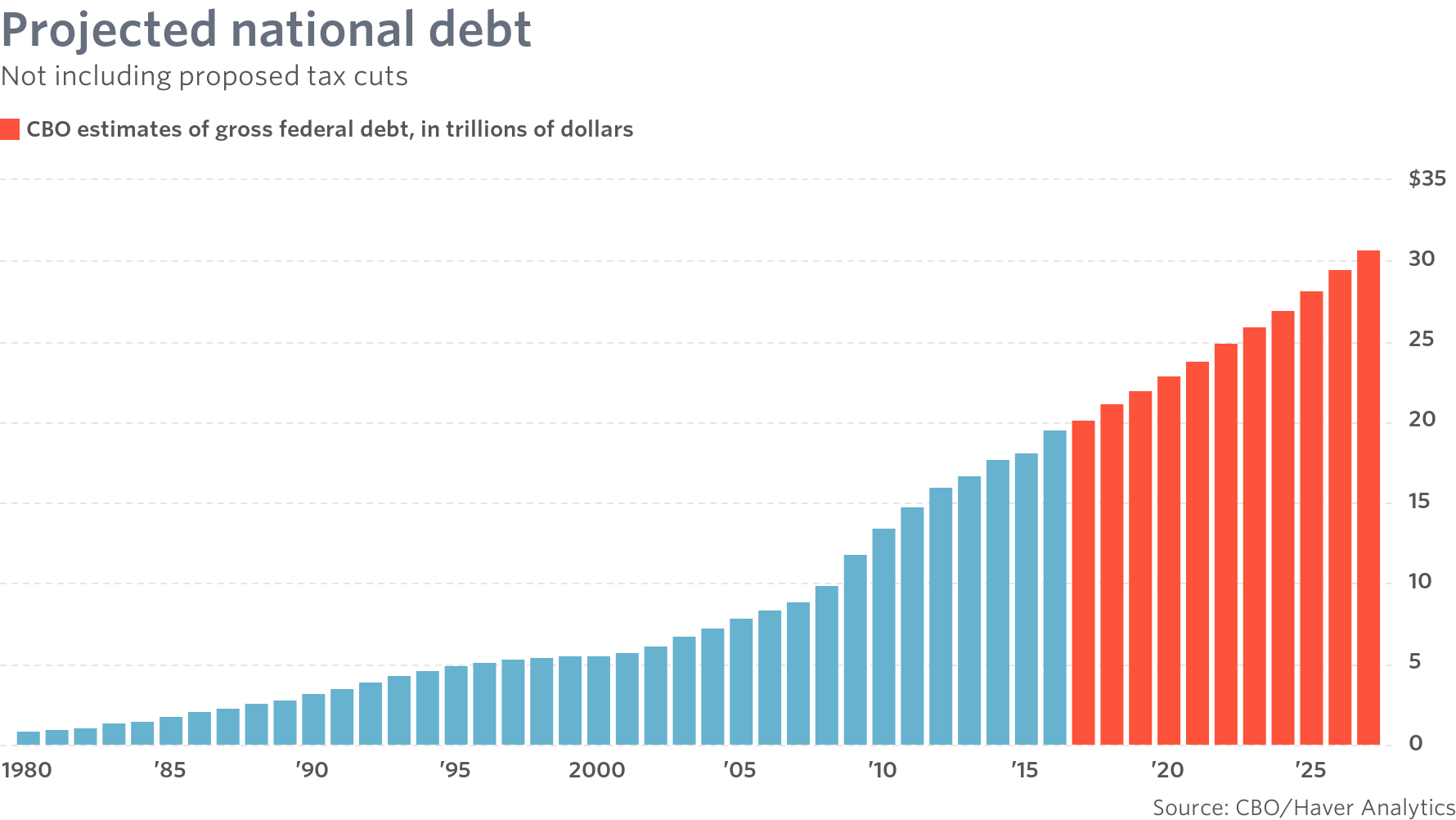

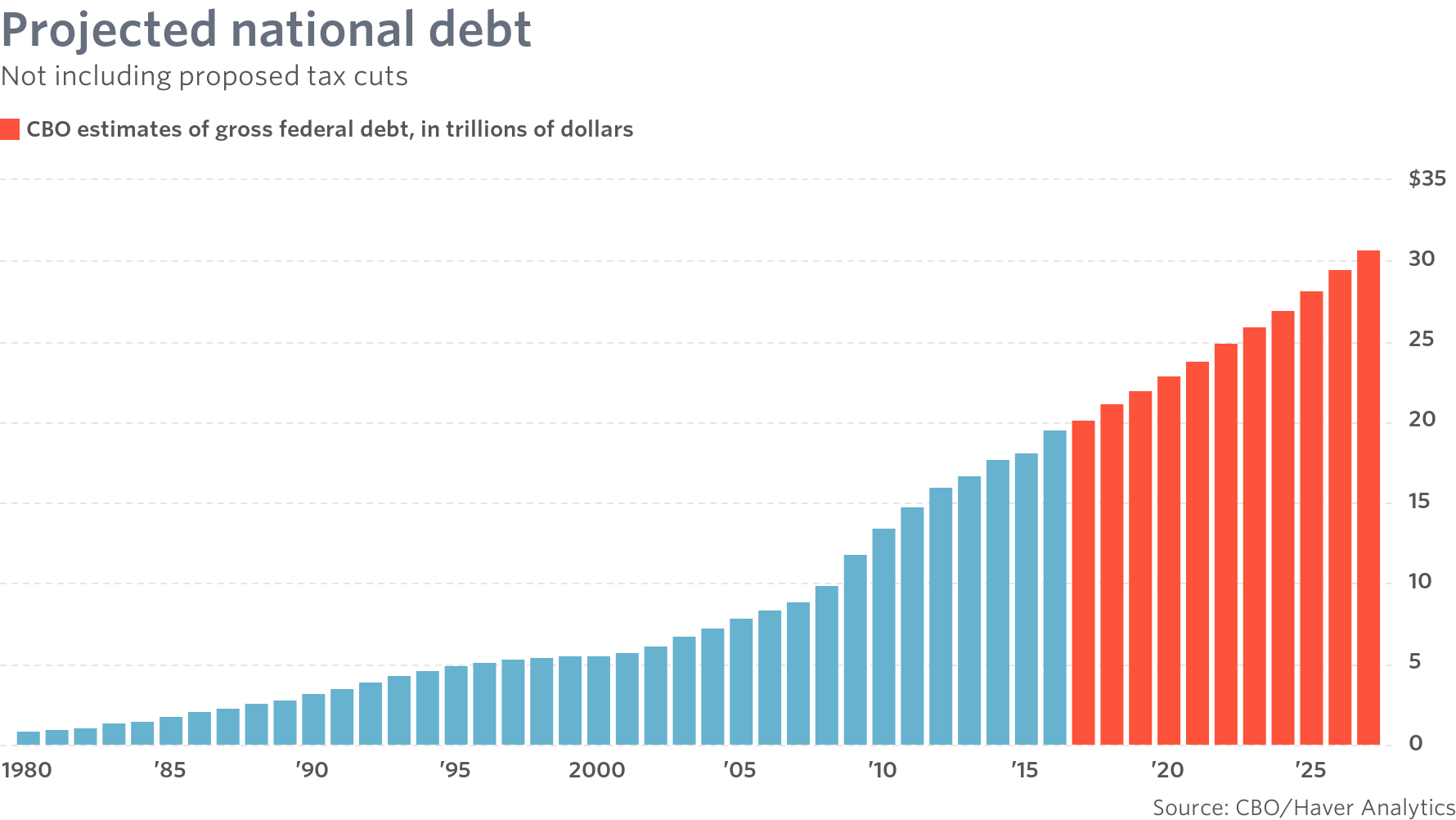

Increased National Debt

The GOP Tax Plan's failure to generate the projected revenue increase has significantly impacted the national debt. The substantial tax cuts, without corresponding spending cuts, resulted in a widening budget deficit and a rapid increase in the national debt.

- Increase in National Debt: Data from the Treasury Department would be included here illustrating the increase in the national debt during the years following the tax plan's implementation. (Note: This section would require insertion of specific data and relevant charts/graphs)

- National Debt as a Percentage of GDP: The national debt as a percentage of GDP provides a useful metric for comparing debt levels across different time periods and economic conditions. (Note: This section would require insertion of specific data and relevant charts/graphs)

Arguments for and Against the Plan's Impact on Debt

The impact of the GOP Tax Plan on the national debt is a highly debated topic.

- Arguments For (often made by supporters): Supporters argue that the tax cuts stimulated short-term economic growth and laid the groundwork for long-term economic expansion that will eventually offset the initial deficit increase. They point to potential increases in productivity and investment as long-term benefits.

- Arguments Against (often made by critics): Critics argue that the immediate impact on the deficit was unsustainable and that the long-term benefits are questionable. They emphasize the need for responsible fiscal policies that balance tax cuts with spending cuts or revenue-generating measures to prevent further increases in the national debt.

Long-Term Fiscal Sustainability and the GOP Tax Plan

Analysis of Long-Term Projections

Long-term projections from organizations like the CBO and the Committee for a Responsible Federal Budget paint a concerning picture of the nation's fiscal future, particularly considering the continued effects of the GOP Tax Plan. These projections generally show a steadily increasing national debt under various scenarios, even with modest economic growth.

- CBO and CRFB Projections: This section would include specific data and analysis from reports issued by these organizations. (Note: This section would require insertion of specific data and relevant charts/graphs)

Policy Recommendations for Fiscal Responsibility

Addressing the long-term fiscal challenges created or exacerbated by the GOP Tax Plan requires a multi-pronged approach. This could include:

- Spending Cuts: Identifying areas for government spending reductions without compromising essential services.

- Tax Increases: Considering targeted tax increases on higher earners or corporations to increase revenue.

- Fiscal Reforms: Implementing structural reforms to improve the efficiency and effectiveness of government spending.

Conclusion

The GOP Tax Plan's impact on deficit reduction remains a highly contested and complex issue. While projections promised significant economic growth and deficit reduction, the actual results have shown a substantial increase in the national debt, raising serious concerns about long-term fiscal sustainability. The discrepancies between initial projections and actual outcomes highlight the limitations of relying solely on supply-side economics for fiscal policy. Further research and detailed examination of the plan's unintended consequences are crucial for shaping more responsible and sustainable fiscal policies in the future. Understanding the intricacies of the GOP Tax Plan's impact on deficit reduction is vital for informed participation in the ongoing debate surrounding fiscal policy and economic planning. Continue your research on GOP Tax Plan deficit reduction to stay informed and engaged in this crucial national discussion.

Featured Posts

-

L Integrale Agatha Christie Une Vie D Aventures Et De Mysteres

May 20, 2025

L Integrale Agatha Christie Une Vie D Aventures Et De Mysteres

May 20, 2025 -

Restaurants Biarritz Les Dernieres Ouvertures Et Adresses A Connaitre

May 20, 2025

Restaurants Biarritz Les Dernieres Ouvertures Et Adresses A Connaitre

May 20, 2025 -

Wintry Mix Rain And Snow Forecast

May 20, 2025

Wintry Mix Rain And Snow Forecast

May 20, 2025 -

Hl Stktb Aghatha Krysty Rwayat Jdydt Aldhkae Alastnaey Yjyb

May 20, 2025

Hl Stktb Aghatha Krysty Rwayat Jdydt Aldhkae Alastnaey Yjyb

May 20, 2025 -

Istoriya Uspekha Mirry Andreevoy Ot Pervykh Shagov Do Vershin Tennisa

May 20, 2025

Istoriya Uspekha Mirry Andreevoy Ot Pervykh Shagov Do Vershin Tennisa

May 20, 2025