Analyzing The Impact Of Reciprocal Tariffs On Indian Sectors

Table of Contents

Impact on the Indian Agricultural Sector

Reciprocal tariffs, a tit-for-tat trade policy instrument, significantly impact India's agricultural sector, a cornerstone of the Indian economy. The effects are far-reaching, affecting farmers, consumers, and the nation's food security.

Reduced Export Competitiveness: Reciprocal tariffs imposed by trading partners directly hinder the export potential of Indian agricultural products. This is particularly true for products like rice, wheat, spices, tea, and coffee, which are major export earners.

- Increased costs: Tariffs increase the price of Indian agricultural goods in international markets, making them less competitive against similar products from countries not facing these tariffs.

- Reduced demand: Higher prices lead to reduced demand from importing countries, resulting in lower export volumes for Indian farmers.

- Price volatility and stockpiles: Decreased export demand can lead to surplus production within India, causing price volatility and potentially large stockpiles, impacting farmer income significantly.

Increased Prices for Imported Agricultural Inputs: The impact of reciprocal tariffs isn't limited to exports. India relies on imported fertilizers, pesticides, and agricultural machinery. Tariffs on these inputs drive up production costs for Indian farmers.

- Reduced profitability: Higher input costs directly reduce the profitability of farming, impacting farmers' livelihoods and potentially leading to reduced agricultural output.

- Food security and inflation: Increased production costs can translate into higher food prices for consumers, potentially impacting food security and contributing to inflation.

- Government intervention needed: The government needs to implement supportive measures, including subsidies and alternative sourcing strategies, to mitigate the negative consequences of these increased input costs.

Effects on the Indian Manufacturing Sector

The Indian manufacturing sector, a key driver of economic growth, also feels the ripple effects of reciprocal tariffs. These tariffs introduce complexities and challenges across various sub-sectors.

Disruption of Global Supply Chains: Reciprocal tariffs can significantly disrupt established global supply chains, affecting the availability and cost of raw materials and intermediate goods for Indian manufacturers.

- Increased production costs: Higher import costs for raw materials and components directly translate into increased production costs for manufacturers.

- Loss of competitiveness: Higher production costs reduce the competitiveness of Indian manufactured goods in the global market, potentially leading to decreased export volumes and market share.

- Supply chain diversification: Indian manufacturers need to explore diversification strategies, seeking alternative suppliers and sourcing materials domestically to mitigate the risks of tariff-related disruptions.

Impact on Specific Manufacturing Sub-sectors: The impact of reciprocal tariffs varies across different manufacturing sub-sectors. For example:

- The textile industry might face challenges due to higher input costs for cotton and other raw materials.

- The pharmaceutical sector may struggle with increased costs of imported APIs (active pharmaceutical ingredients) impacting the affordability and export competitiveness of Indian-made medicines.

- The automobile sector might encounter difficulties due to higher tariffs on imported parts and components.

Influence on the Indian Services Sector

While reciprocal tariffs primarily target goods, they indirectly impact the Indian services sector, particularly sectors relying on international trade and collaboration.

Reduced Demand for Indian Services: Reciprocal tariffs can lead to a slowdown in global trade, reducing demand for Indian services such as IT, outsourcing, and tourism.

- Job losses: Reduced demand for services can lead to job losses in the IT, BPO, and tourism sectors.

- Reduced foreign exchange earnings: Lower demand for Indian services reduces foreign exchange earnings, affecting the country's balance of payments.

- Service sector adaptation: The Indian service sector needs to adapt by diversifying its offerings, focusing on niche markets, and enhancing its competitiveness to mitigate the impact of reciprocal tariffs.

Increased Costs for Imported Services: Tariffs might not directly target services, but higher import costs for goods used in service delivery indirectly increase operational costs.

- Increased business burden: Increased costs for imported technology, software, or equipment negatively impact the profitability and growth potential of businesses in the service sector.

- Reduced innovation: The increased burden on businesses may lead to reduced investment in innovation and technological advancements.

The Role of Government Policy in Mitigating the Impact of Reciprocal Tariffs

Effective government policies are crucial to minimize the negative impacts of reciprocal tariffs on the Indian economy. A multi-pronged approach is necessary.

Trade Diversification Strategies: Reducing reliance on countries imposing tariffs is paramount. This involves:

- Exploring new markets: Actively seeking new export destinations and trade partners to diversify export markets.

- Free Trade Agreements (FTAs): Negotiating and strengthening FTAs with alternative trading partners to reduce or eliminate tariffs.

- Regional trade agreements: Promoting regional trade agreements to boost intra-regional trade and reduce dependence on specific countries.

Domestic Industry Support Measures: Providing support to domestic industries is essential to help them cope with increased costs and competition.

- Financial assistance and subsidies: Offering financial support, subsidies, and tax benefits to help industries facing difficulties due to tariffs.

- Investment in R&D: Investing in research and development to enhance technological capabilities and improve the competitiveness of Indian industries.

- Skills development: Investing in workforce training programs to upskill the labor force and meet the demands of evolving industries.

Negotiation and Diplomacy: Engaging in diplomatic efforts to resolve trade disputes and reduce or eliminate reciprocal tariffs is essential. This involves:

- Bilateral and multilateral discussions: Participating actively in bilateral and multilateral trade negotiations to address concerns and seek mutually beneficial solutions.

- WTO dispute settlement mechanism: Utilizing the WTO dispute settlement mechanism to address unfair trade practices and resolve tariff-related disputes.

Conclusion:

Reciprocal tariffs present substantial challenges to various Indian sectors, impacting agricultural exports, manufacturing supply chains, and the services sector. However, strategic government policies, including trade diversification, domestic industry support, and diplomatic engagement, are vital in mitigating these negative effects. A comprehensive understanding of the impact of reciprocal tariffs on Indian sectors is essential for navigating this complex global trade environment. By proactively addressing these challenges through informed policy decisions and strategic adjustments, India can protect its economic interests and ensure sustainable long-term growth. Continued monitoring, analysis, and adaptation to evolving global trade dynamics are crucial for effectively managing the impact of reciprocal tariffs in India. Further research on the nuanced implications of these tariffs will be vital in developing effective countermeasures for a resilient Indian economy.

Featured Posts

-

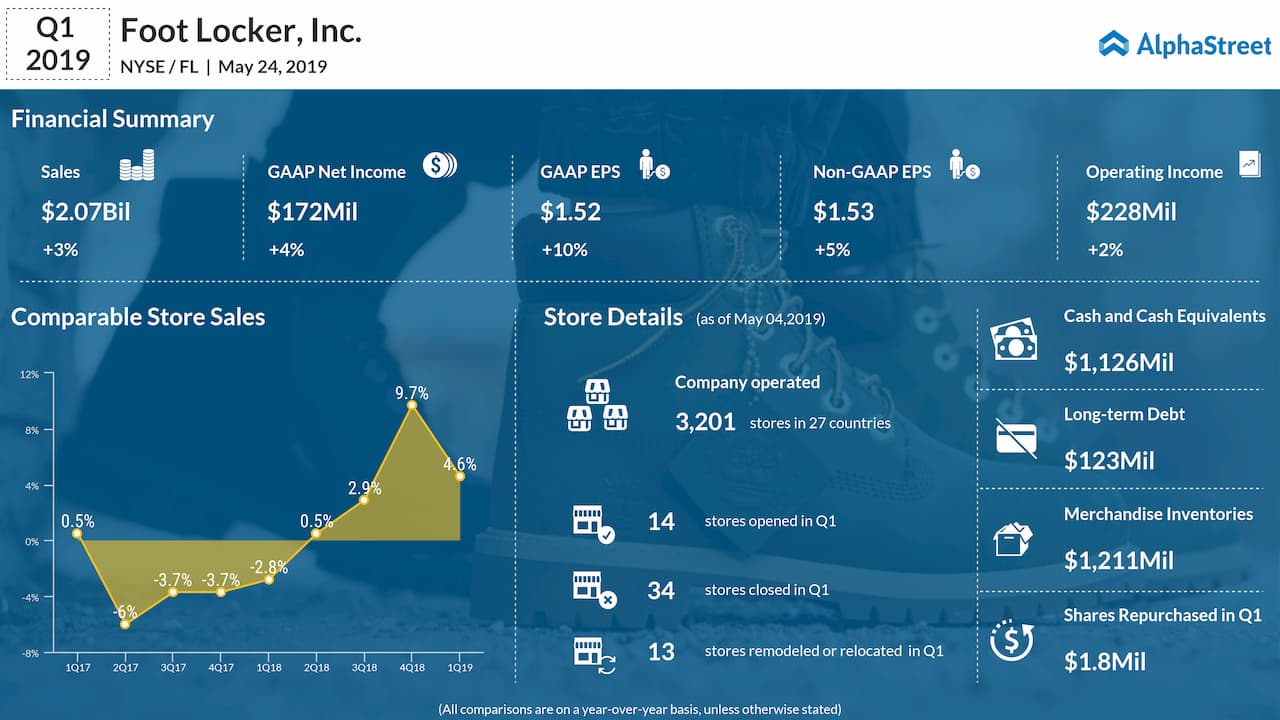

Analysis Of Foot Locker Earnings Positive Outlook For Nikes Future

May 15, 2025

Analysis Of Foot Locker Earnings Positive Outlook For Nikes Future

May 15, 2025 -

Jimmy Butler Partners With Bigface To Offer Exclusive Deal To Warriors Employees

May 15, 2025

Jimmy Butler Partners With Bigface To Offer Exclusive Deal To Warriors Employees

May 15, 2025 -

New York Knicks Demonstrating Depth During Brunsons Absence

May 15, 2025

New York Knicks Demonstrating Depth During Brunsons Absence

May 15, 2025 -

Blocking Triggers A Deep Dive Into Block Mirror Technology And Its Implications

May 15, 2025

Blocking Triggers A Deep Dive Into Block Mirror Technology And Its Implications

May 15, 2025 -

Pagkypria Ereyna Timon Kaysimon Poy Tha Breite Tis Kalyteres Times

May 15, 2025

Pagkypria Ereyna Timon Kaysimon Poy Tha Breite Tis Kalyteres Times

May 15, 2025