Analyzing The Investment Strategy Of Warren Buffett's Canadian Successor

Table of Contents

Identifying Warren Buffett's Canadian Successor

Finding a true "successor" to Warren Buffett is a challenging task. No single investor perfectly replicates his decades of experience and unique investment style. However, by focusing on key characteristics—a long-term value investing philosophy, a proven track record of success, and a commitment to ethical business practices—we can identify Canadian investors who share significant similarities. For this analysis, we will focus on Prem Watsa, the chairman and CEO of Fairfax Financial Holdings. Watsa, often dubbed "Canada's Warren Buffett," has built a remarkably successful investment empire based on principles closely aligned with Buffett's.

- Key Investment Principles: Watsa, like Buffett, emphasizes long-term value investing, focusing on undervalued companies with strong fundamentals and durable competitive advantages. He favors businesses with predictable cash flows and a strong management team. Unlike Buffett's more publicly available investment decisions, Watsa maintains a more private approach, making detailed analysis challenging.

- Media Recognition and Accolades: Watsa has earned significant recognition for his astute investment strategies, frequently appearing in prominent financial publications and being lauded for his long-term vision and success in navigating market volatility.

- Fairfax Financial Holdings: [Link to Fairfax Financial Holdings website]

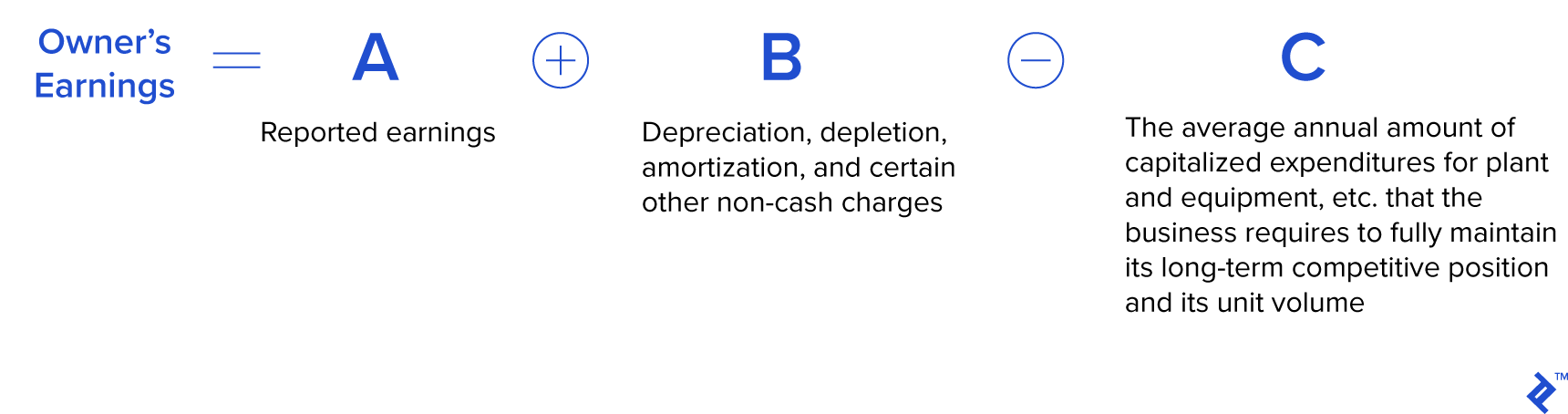

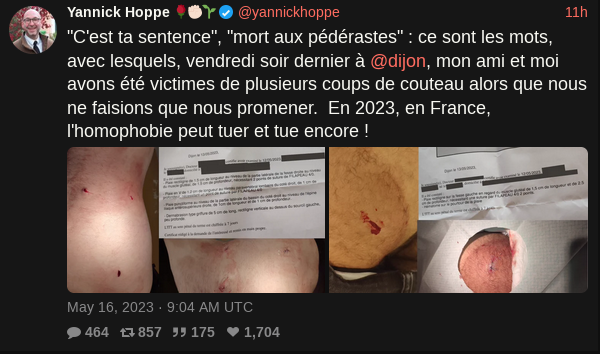

Value Investing Principles and Portfolio Composition

Prem Watsa's value investing approach centers on meticulous research, identifying undervalued assets, and holding them for the long term. He meticulously analyzes financial statements, assesses management quality, and understands the underlying business before making any investment. His portfolio reflects this strategy.

- Portfolio Holdings: Fairfax Financial Holdings' portfolio is diverse but leans towards insurance businesses, with significant holdings in various sectors including technology, real estate, and manufacturing. He frequently invests in companies facing temporary setbacks or market mispricing.

- Successful Investments: Watsa's success stems from patient investments in companies that have subsequently demonstrated significant growth. Specific examples are often difficult to ascertain publicly due to Fairfax’s investment strategies, however, long-term success speaks for itself.

- Portfolio Diversification and Risk Tolerance: While diverse across sectors, Watsa's portfolio demonstrates a lower diversification than Buffett's. This reflects his higher risk tolerance and his willingness to make concentrated bets on companies he believes are significantly undervalued. His long investment timeline mitigates risks.

Long-Term Vision and Strategic Decision-Making

Watsa's approach exemplifies long-term value investing. He's not swayed by short-term market fluctuations. His long-term perspective allows him to capitalize on market downturns, viewing them as opportunities to acquire high-quality assets at discounted prices.

- Navigating Market Downturns: During market crises, Watsa has often made strategic acquisitions, leveraging his strong balance sheet and long-term outlook. This reflects a clear confidence in his long-term vision and his ability to find profitable opportunities in times of uncertainty.

- Strategic Acquisitions and Divestments: Information on specific acquisitions and divestments is limited due to the private nature of many of Fairfax's investments. However, their overall success demonstrates the effectiveness of their approach.

- Corporate Governance and Ethical Investing: While details are scarce, Fairfax's consistent performance suggests a strong emphasis on responsible corporate governance and ethical investment practices, aligning with Buffett's values.

Lessons for Investors and Future Outlook

Analyzing Prem Watsa's investment strategy offers valuable lessons for investors of all levels. His success demonstrates the power of long-term value investing, meticulous research, and disciplined decision-making.

- Practical Advice: Investors can learn to focus on fundamental analysis, identify undervalued companies, and resist the urge to react to short-term market noise. This requires patience and a thorough understanding of the businesses you are investing in.

- Adaptability in a Changing Landscape: While Watsa's core principles remain consistent, his investment strategies adapt to changes in the economic landscape and technological advancements. This ability to evolve while remaining true to core values is crucial for long-term success.

- Future Performance Prediction: Given Watsa's proven track record and his strategic approach, the outlook for Fairfax Financial Holdings and his investment philosophy remains positive, although predicting future performance remains impossible.

Conclusion

Prem Watsa’s investment strategy, while differing in some aspects from Warren Buffett’s, shares core principles of long-term value investing, thorough research, and disciplined decision-making. His approach underscores the importance of patience, risk management, and a deep understanding of the underlying businesses. By studying the investment strategy of Warren Buffett’s Canadian successor, you can gain valuable insights and build a more robust and successful investment portfolio for the long term. Further research into Fairfax Financial Holdings and the specific holdings of the company will enhance your understanding of this fascinating investment approach and how it compares to that of the Oracle of Omaha.

Featured Posts

-

Nhls Hart Trophy Finalists Draisaitl Hellebuyck And Kucherov In The Running

May 09, 2025

Nhls Hart Trophy Finalists Draisaitl Hellebuyck And Kucherov In The Running

May 09, 2025 -

Hot Mic Reveals Colapinto Sponsorship Details Breaking F1 News

May 09, 2025

Hot Mic Reveals Colapinto Sponsorship Details Breaking F1 News

May 09, 2025 -

Lac Kir Dijon Violente Agression De Trois Hommes

May 09, 2025

Lac Kir Dijon Violente Agression De Trois Hommes

May 09, 2025 -

Updated Prediction Rio Ferdinand On Psg Vs Arsenal Champions League Final

May 09, 2025

Updated Prediction Rio Ferdinand On Psg Vs Arsenal Champions League Final

May 09, 2025 -

Mental Illness And Violent Crime Addressing Academic Shortcomings

May 09, 2025

Mental Illness And Violent Crime Addressing Academic Shortcomings

May 09, 2025