Analyzing The Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is directly influenced by several key factors. Understanding these factors is crucial for interpreting NAV changes and making informed investment choices.

The most significant factor is the performance of the underlying asset: the Dow Jones Industrial Average (DJIA). The DJIA's daily fluctuations, driven by the individual stock price movements of its 30 constituent companies, directly impact the ETF's NAV. A rising DJIA generally leads to a higher NAV, while a falling DJIA results in a lower NAV.

Currency fluctuations can also play a role, especially for investors holding the ETF in a currency different from the ETF's base currency (likely EUR). If the Euro strengthens against the investor's currency, the NAV expressed in that currency will increase, even if the DJIA remains unchanged. Conversely, a weakening Euro would decrease the NAV.

Finally, the ETF's expenses, including management fees and other operational costs, gradually reduce the NAV over time. These expenses are deducted from the ETF's assets, impacting the overall value available to investors.

- Daily price movements of the Dow Jones Industrial Average: A strong positive correlation exists between the DJIA's daily performance and the ETF's NAV.

- Exchange rate changes: Fluctuations between the Euro (or the ETF's base currency) and the investor's currency directly affect the NAV calculated in the investor's currency.

- Impact of dividend distributions: Dividend payouts from the underlying companies in the DJIA are usually reinvested, impacting the NAV positively, though this effect might be small compared to DJIA performance.

- The effect of the ETF's expense ratio: The expense ratio gradually erodes the NAV over time, representing the cost of managing the ETF.

How to Access and Interpret the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Accessing the NAV for the Amundi Dow Jones Industrial Average UCITS ETF is relatively straightforward. You can typically find this information on Amundi's official website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account if you hold shares of the ETF.

Interpreting the NAV involves comparing it to the ETF's market price. The difference between the NAV and the market price represents the premium or discount to NAV. A premium indicates the ETF is trading above its net asset value, while a discount signifies it's trading below. These premiums and discounts are usually small for liquid ETFs like this one, but understanding them is important.

- Specific websites and platforms: Check Amundi's investor relations section, major financial news portals, and your brokerage platform for daily NAV updates.

- Explanation of how to read and understand NAV tables or charts: Look for clear labeling of the date and the NAV figure, usually presented in the base currency of the ETF.

- Examples illustrating the interpretation of NAV data: A NAV of €100 and a market price of €101 indicates a premium, while a market price of €99 would reflect a discount.

- Clarification on premium/discount situations and their significance: Small premiums or discounts are common and usually reflect market liquidity and trading activity. Significant deviations should be investigated further.

Utilizing NAV Data for Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Using the NAV data effectively allows for informed investment decisions. Tracking the NAV over time provides insights into the ETF's long-term performance, helping you assess whether it aligns with your investment goals. Comparing the NAV of this ETF with those of similar ETFs tracking the same or similar indices enables a relative performance assessment.

The NAV should be considered alongside other relevant market factors (like broader market trends and economic indicators) when making buy or sell decisions. While NAV offers a valuable perspective on the intrinsic value of the ETF, it should not be the sole determinant of your investment strategy. Remember, it is important to practice risk management; significant and unexpected drops in NAV can indicate a need to re-evaluate your investment strategy.

- Strategies for using NAV data for long-term investment monitoring: Regularly charting the NAV helps to visualize trends and long-term growth (or decline).

- Comparative analysis with competing ETFs using NAV as a benchmark: Comparing NAVs allows for relative performance evaluation amongst similar ETFs.

- Risk mitigation strategies based on NAV fluctuations: Sharp drops in NAV can trigger stop-loss orders or other risk mitigation strategies.

- Importance of considering other factors beyond NAV alone (e.g., market trends): A holistic investment approach requires considering various market and economic factors beyond the NAV.

Conclusion: Mastering NAV Analysis for the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for making informed investment decisions. Factors like the underlying Dow Jones Industrial Average's performance, currency fluctuations, and ETF expenses significantly influence the NAV. By regularly accessing and interpreting this data, comparing it to the market price, and considering other market factors, you can effectively track performance, benchmark against competitors, and implement risk management strategies. Regularly analyze the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF to make informed investment choices and optimize your portfolio. For more information, visit the Amundi website: [Link to Amundi's website].

Featured Posts

-

2026 Porsche Cayenne Ev Spy Shots What We Know So Far

May 24, 2025

2026 Porsche Cayenne Ev Spy Shots What We Know So Far

May 24, 2025 -

Jonathan Groff And The Tony Awards A Just In Time Prediction

May 24, 2025

Jonathan Groff And The Tony Awards A Just In Time Prediction

May 24, 2025 -

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 24, 2025

Months Long Lingering Of Toxic Chemicals In Buildings After Ohio Train Derailment

May 24, 2025 -

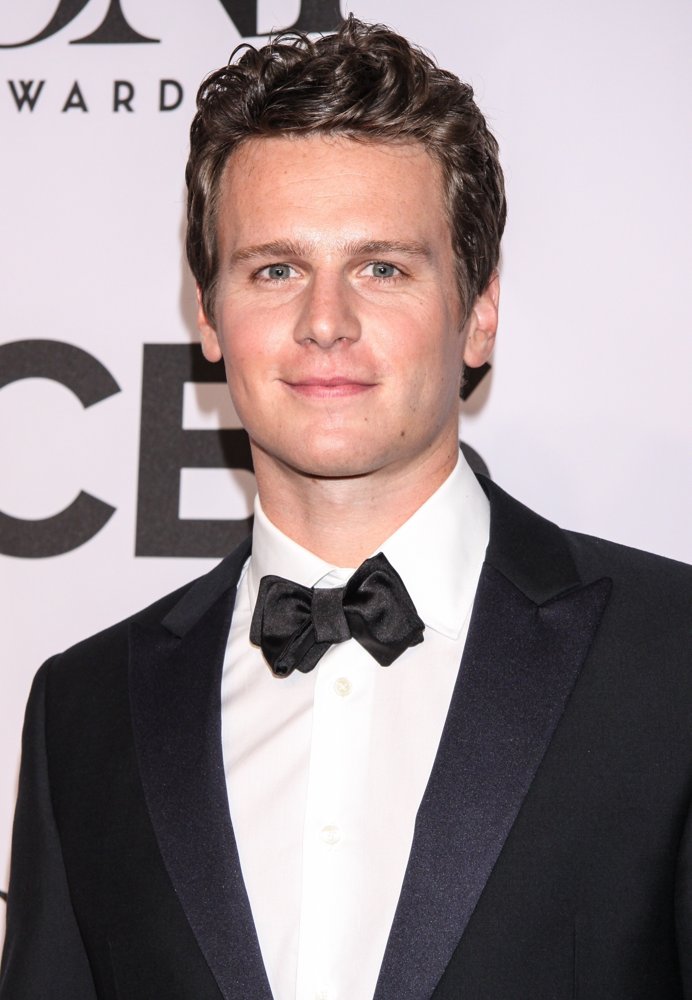

France To Rehabilitate Dreyfus Parliament Debates Posthumous Promotion

May 24, 2025

France To Rehabilitate Dreyfus Parliament Debates Posthumous Promotion

May 24, 2025 -

Bardellas Presidential Bid A Contender Among The Crowd

May 24, 2025

Bardellas Presidential Bid A Contender Among The Crowd

May 24, 2025