Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. It's a crucial indicator of the fund's underlying value. For the Amundi Dow Jones Industrial Average UCITS ETF, this calculation reflects the collective value of its holdings, which mirror the 30 companies comprising the Dow Jones Industrial Average.

The specific calculation is as follows:

- NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

Let's break down the components:

- Assets: Primarily consist of the holdings in the 30 constituent companies of the Dow Jones Industrial Average. The value of these holdings fluctuates constantly based on the market price of each individual stock.

- Liabilities: Include management fees, operating expenses, and other administrative costs associated with running the ETF.

- Number of Outstanding Shares: The total number of shares of the Amundi Dow Jones Industrial Average UCITS ETF currently held by investors.

Regular updates on the daily NAV are essential for investors to track the fund's performance. A custodian bank plays a vital role in independently verifying the ETF's assets, ensuring transparency and accuracy in the NAV calculation.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF, impacting its overall performance. Understanding these factors is key to interpreting NAV changes effectively.

- Market Movements: The most significant influence is the performance of the underlying assets – the 30 companies within the Dow Jones Industrial Average. A bull market generally leads to an increase in the NAV, while a bear market typically results in a decrease. Changes in individual stock prices within the index also directly impact the NAV.

- Currency Fluctuations: Since the ETF is denominated in a specific currency (likely Euros, given its UCITS structure), currency exchange rate fluctuations against other currencies could affect the NAV if investors hold the ETF in a different currency.

- Dividends: Dividends paid by the constituent companies of the Dow Jones Industrial Average are reinvested into the ETF, generally increasing the NAV. However, this effect is often offset by management fees.

Here's a summary of key influencing factors:

- Changes in individual stock prices within the Dow Jones Industrial Average.

- Overall market trends (bull or bear market).

- Impact of economic news and geopolitical events on market sentiment.

- Dividend payouts from constituent companies, impacting NAV positively.

- Currency exchange rate fluctuations (if applicable).

Analyzing NAV Trends and Performance of the Amundi Dow Jones Industrial Average UCITS ETF

Analyzing NAV trends is crucial for assessing the Amundi Dow Jones Industrial Average UCITS ETF's performance. This involves tracking NAV changes over time using various methods:

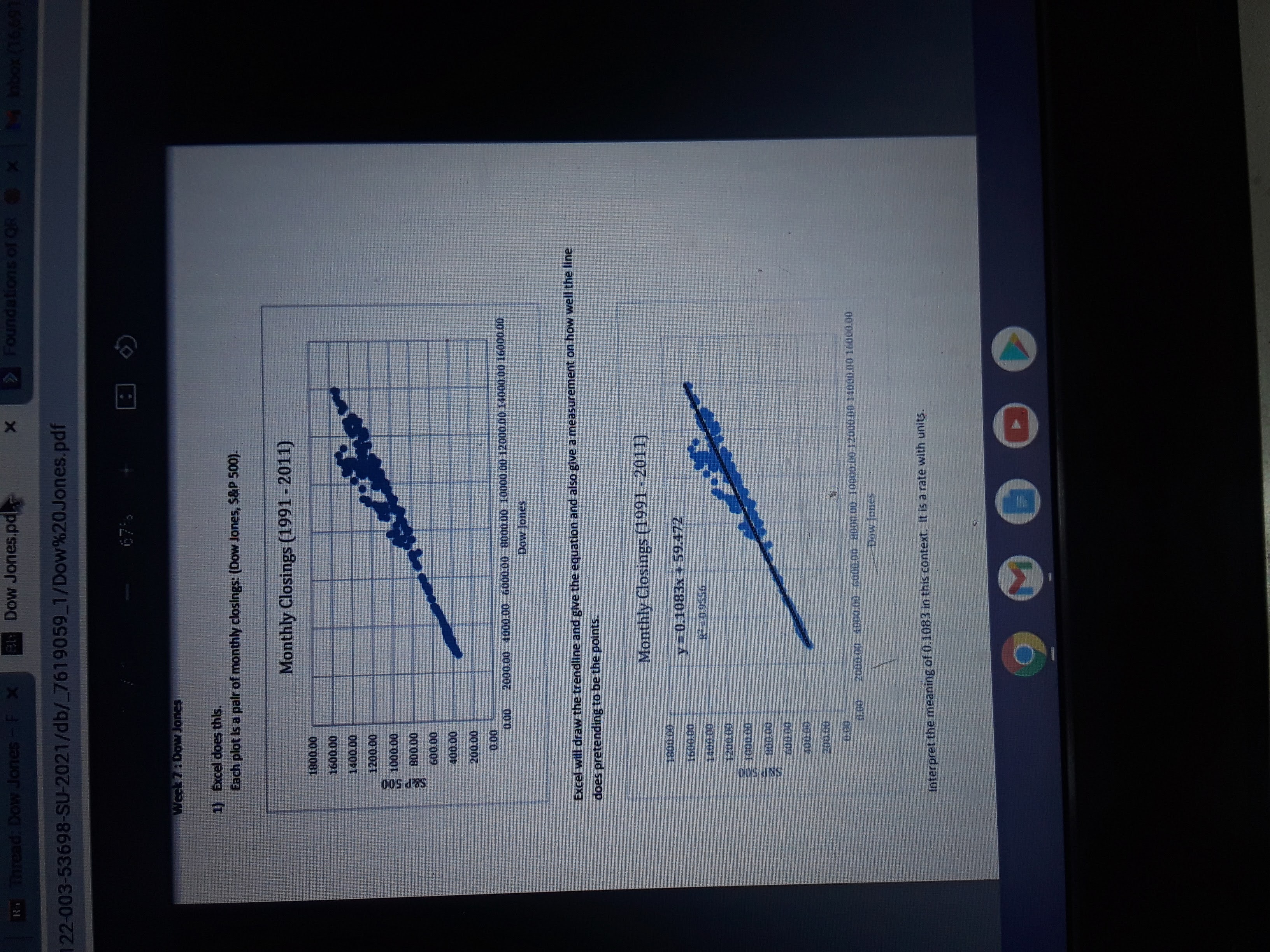

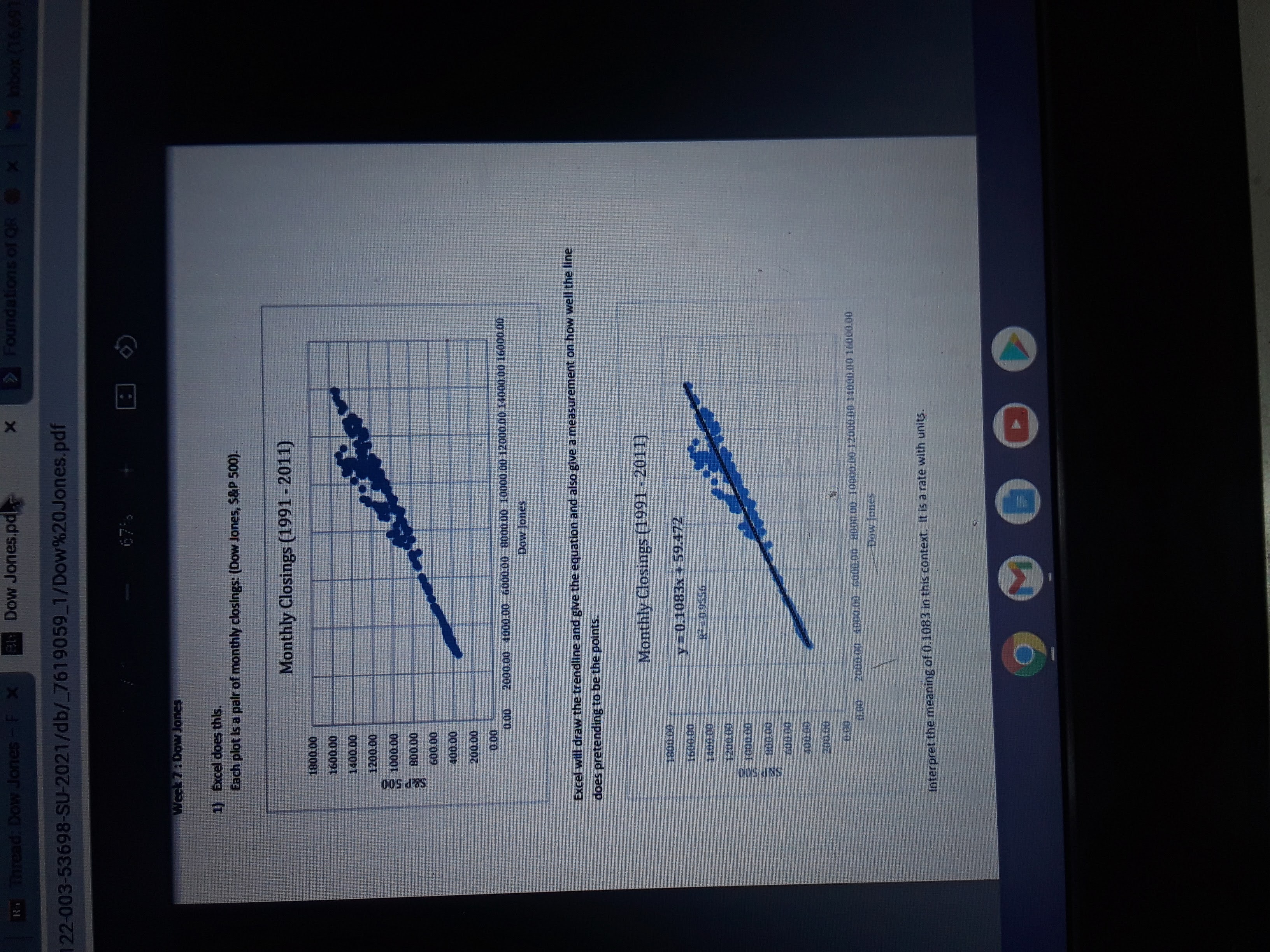

- Charts and Graphs: Visual representations of historical NAV data offer a clear picture of performance trends.

- Percentage Changes: Calculating percentage changes in the NAV over specific periods (daily, weekly, monthly, or yearly) reveals the rate of growth or decline.

To gain a comprehensive perspective, compare the ETF's NAV performance against relevant benchmarks:

- Other Dow Jones ETFs: Comparing the Amundi ETF's NAV to other ETFs tracking the Dow Jones Industrial Average helps gauge its relative performance.

- Broader Market Indices: Comparing the NAV to broader market indices like the S&P 500 provides context within the overall market landscape.

Remember:

- Utilize online resources and financial platforms for access to historical NAV data.

- Compare historical NAV data to assess performance over various timeframes.

- Analyze the ETF's expense ratio and its impact on long-term NAV growth.

- Consider the implications of any tracking error (the difference between the ETF's performance and the underlying index).

Interpreting NAV Changes in Context

While NAV is a critical indicator, it's not the sole determinant of an ETF's performance. Consider other factors:

- Trading Volume: High trading volume generally indicates greater liquidity and potentially better price discovery.

- Expense Ratio: A higher expense ratio eats into returns and affects NAV growth.

- Management Fees: These fees directly impact the NAV, reducing its overall growth potential.

The relationship between the ETF's NAV and its market price is important. While ideally they should be very close, small discrepancies can arise due to trading activity and market demand. A holistic view, incorporating these additional factors alongside NAV, provides a more accurate assessment of the Amundi Dow Jones Industrial Average UCITS ETF's performance.

Conclusion

Analyzing the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF provides crucial insights into its performance and growth potential. Understanding the factors influencing NAV fluctuations is vital for making well-informed investment decisions. Remember to consider the NAV in conjunction with other performance indicators and prevailing market conditions for a complete picture.

To stay updated on the NAV and performance of the Amundi Dow Jones Industrial Average UCITS ETF and other investment options, regularly consult reputable financial sources and consider seeking advice from a qualified financial advisor. Understanding the Net Asset Value is crucial for any investor looking to utilize the Amundi Dow Jones Industrial Average UCITS ETF effectively in their portfolio.

Featured Posts

-

Musk Supera Zuckerberg E Bezos La Nuova Classifica Degli Uomini Piu Ricchi Del Mondo Forbes 2025

May 24, 2025

Musk Supera Zuckerberg E Bezos La Nuova Classifica Degli Uomini Piu Ricchi Del Mondo Forbes 2025

May 24, 2025 -

Test Porsche Cayenne Gts Coupe Plusy I Minusy Sportowego Suv A

May 24, 2025

Test Porsche Cayenne Gts Coupe Plusy I Minusy Sportowego Suv A

May 24, 2025 -

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025 -

France Debates Harsher Penalties For Juvenile Delinquency

May 24, 2025

France Debates Harsher Penalties For Juvenile Delinquency

May 24, 2025 -

Understanding Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025

Understanding Amundi Msci World Ii Ucits Etf Usd Hedged Dist Net Asset Value

May 24, 2025