Analyzing The U.S. Dollar's Trajectory: Potential For Worst Start Since Nixon Era

Table of Contents

H2: Inflationary Pressures and the U.S. Dollar

H3: The Impact of Persistent Inflation

High inflation is a significant threat to the U.S. dollar's value. Persistent inflation erodes purchasing power, making goods and services more expensive. This, in turn, weakens the dollar's value relative to other currencies. The relationship between inflation, interest rates, and the dollar's value is complex but crucial to understand.

- Inflation and Interest Rates: When inflation rises, central banks like the Federal Reserve typically raise interest rates to cool down the economy. Higher interest rates can attract foreign investment, increasing demand for the dollar and potentially strengthening its value. However, excessively high interest rates can also stifle economic growth, leading to a weaker dollar in the long run.

- Current Inflation Rates: As of [Insert Date], the U.S. inflation rate stands at [Insert Current Inflation Rate, cite source]. This persistent inflation is a major concern for the dollar's stability and a key factor in analyzing the U.S. dollar's trajectory.

- The Federal Reserve's Response: The Federal Reserve has been aggressively raising interest rates to combat inflation. The effectiveness of these measures in stabilizing the dollar and curbing inflation remains to be seen.

H3: Comparison to the Nixon Era

The current inflationary environment shares some similarities with the circumstances leading up to the Nixon shock. In both cases, persistent inflation and a weakening dollar were major concerns. However, there are also crucial differences.

- Nixon Era Factors: The Nixon shock, which involved closing the gold window and effectively ending the Bretton Woods system, was driven by factors like unsustainable government spending and the Vietnam War.

- Differences Today: Today's challenges include globalization, supply chain disruptions, and geopolitical instability, creating a different economic landscape. While the underlying issue of inflation is a common thread, the specific context and the tools available to policymakers differ significantly.

H2: Geopolitical Risks and Their Influence on the U.S. Dollar

H3: The Role of Global Uncertainty

Geopolitical tensions and global uncertainty significantly impact investor confidence and the demand for the U.S. dollar as a safe haven asset. During times of crisis, investors often flock to the dollar, viewing it as a relatively stable investment. However, prolonged uncertainty can erode this perception.

- Impacting Geopolitical Events: [Mention specific current geopolitical events, e.g., the war in Ukraine, US-China relations, etc., and their impact on the dollar]. These events create volatility in the currency market and make predicting the U.S. dollar's trajectory more challenging.

- Flight to Safety: The "flight to safety" phenomenon sees investors moving their assets to perceived safe havens like the U.S. dollar during times of global instability. However, sustained geopolitical risks can undermine this effect.

H3: International Trade and the Dollar's Strength

Trade imbalances and shifts in global economic power also play a crucial role in shaping the dollar's trajectory.

- Trade Wars and Sanctions: Trade wars and sanctions can disrupt global trade flows and negatively impact the dollar's exchange rate. [Provide examples and data on recent trade disputes and their influence on the dollar].

- Rising Global Currencies: The rising influence of other global currencies, such as the Euro and the Chinese Yuan, is challenging the dollar's dominance in international trade and finance. This shift in the global economic landscape is a key element in analyzing the U.S. dollar's trajectory.

H2: Economic Indicators and Forecasting the U.S. Dollar's Future

H3: Analyzing Key Economic Data

Several key economic indicators help predict the dollar's future movements.

- GDP Growth: Strong GDP growth generally supports a strong dollar, while slow growth can weaken it. [Cite current GDP growth figures and their potential implications for the dollar].

- Unemployment Rates: Low unemployment rates often indicate a healthy economy, which can positively impact the dollar. High unemployment can signal economic weakness and potentially lead to a decline in the dollar's value. [Cite current unemployment figures].

- Consumer Confidence: High consumer confidence suggests a strong economy and can support the dollar, while low confidence may indicate weakening economic conditions. [Cite data on consumer confidence].

H3: Expert Opinions and Market Sentiment

Forecasting the U.S. dollar's future requires considering expert opinions and market sentiment.

- Economist Views: Leading economists offer diverse opinions on the dollar's trajectory, ranging from cautious optimism to predictions of a significant decline. [Mention a range of expert opinions and their reasoning].

- Market Sentiment: Market sentiment, reflecting investor confidence and expectations, is a crucial factor affecting the dollar's value. [Discuss how current market sentiment influences the dollar's trajectory].

3. Conclusion

Analyzing the U.S. dollar's trajectory reveals a complex interplay of inflationary pressures, geopolitical risks, and economic indicators. The potential for a significant decline in the dollar's value, mirroring the severity of the Nixon era's impact, is a real possibility. The parallels with the Nixon era, while not exact, highlight the potential for a dramatic shift. To understand the factors impacting the U.S. dollar, one must closely monitor key economic data and geopolitical events.

To effectively track the U.S. dollar's trajectory, continuous monitoring is vital. Further research into economic forecasting models and geopolitical risk assessments is recommended. Understanding the U.S. dollar's potential decline is crucial for investors and policymakers alike, given its central role in the global economy. Stay informed, analyze the U.S. dollar's potential decline, and make informed decisions.

Featured Posts

-

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025 -

Analyzing The Impact Of Tax Credits On Minnesotas Film Production

Apr 29, 2025

Analyzing The Impact Of Tax Credits On Minnesotas Film Production

Apr 29, 2025 -

Paternity Case Resolved Ayesha Howard Granted Custody Of Child

Apr 29, 2025

Paternity Case Resolved Ayesha Howard Granted Custody Of Child

Apr 29, 2025 -

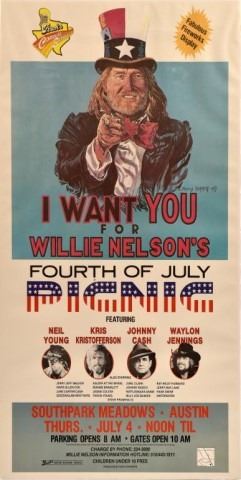

The Willie Nelson 4th Of July Picnic Back In Texas

Apr 29, 2025

The Willie Nelson 4th Of July Picnic Back In Texas

Apr 29, 2025 -

Unlocking The Potential How Middle Managers Drive Company Performance And Employee Satisfaction

Apr 29, 2025

Unlocking The Potential How Middle Managers Drive Company Performance And Employee Satisfaction

Apr 29, 2025