Apple Stock Forecast: Is $254 Realistic? Buy Or Sell AAPL At $200?

Table of Contents

Apple's Current Financial Performance and Market Position

Understanding Apple's current financial health is crucial for any Apple stock forecast. Recent quarterly earnings reports paint a picture of continued growth, though not without challenges. Analyzing key performance indicators (KPIs) provides insight into the company's strength and potential for future growth.

- Revenue Growth: Apple consistently demonstrates strong revenue growth year-over-year (YoY), though the percentage fluctuates based on product cycles and global economic conditions. Analyzing the trend over the past few years is essential for predicting future performance. A consistent upward trend suggests a healthy and expanding market share.

- Profit Margins: Apple maintains impressive profit margins, reflecting its premium pricing strategy and strong brand loyalty. Comparing profit margins across different quarters and years reveals the company's ability to manage costs and maintain profitability even during economic downturns. High profit margins are a positive indicator for future stock performance.

- Market Share: Apple dominates the smartphone market in terms of profitability, while also holding significant market share in wearables, tablets, and services. Analyzing market share data for key product categories helps assess its competitive positioning and future growth potential. Slight decreases in market share in certain sectors should be considered alongside overall revenue growth.

Factors Influencing Apple Stock Price

Several factors significantly influence Apple's stock price. Understanding these factors is crucial for formulating an effective Apple stock forecast.

Product Innovation and Future Product Launches

Apple's ability to innovate and release successful new products is a major driver of its stock price. Upcoming product releases, such as new iPhones, Apple Watches, and potential entries into new markets like augmented reality (AR) and virtual reality (VR), will significantly impact future revenue and thus, stock valuation.

- Upcoming Products: Anticipation surrounding new iPhones, Apple Watch Series, and potential new MacBooks often creates a surge in investor interest, leading to increased stock prices. Conversely, delays or setbacks can negatively affect investor sentiment.

- Impact on Revenue: Each new product launch has the potential to boost revenue and profits, contributing to a higher AAPL stock price. Analyzing the success of past product launches can provide clues about the potential impact of future releases.

Global Economic Conditions and Market Sentiment

Global economic conditions significantly impact investor sentiment and thus, the Apple stock forecast. Factors such as inflation, recession fears, and interest rate hikes influence investor risk appetite, impacting the valuation of even strong companies like Apple.

- Economic Climate: A strong global economy usually translates to increased consumer spending and higher demand for Apple products, positively impacting the stock price. Conversely, economic uncertainty can lead to lower demand and decreased stock prices.

- Geopolitical Events: Geopolitical events, such as trade wars or international conflicts, can create uncertainty in the market, affecting investor confidence and impacting Apple's stock price.

Competition and Market Saturation

While Apple maintains a strong market position, increasing competition and potential market saturation pose risks to future growth.

- Key Competitors: Companies like Samsung, Google, and other tech giants constantly challenge Apple's dominance in various product categories. Analyzing their strategies and market share is crucial for assessing the long-term prospects of AAPL.

- Market Saturation: As the smartphone market matures, there's a risk of market saturation, potentially limiting Apple's future growth. Innovation and expansion into new markets are essential for mitigating this risk.

Analyzing the $254 Price Target

The $254 price target for AAPL is a subject of much debate. Various analysts offer different predictions, based on their interpretation of Apple's financial performance, future prospects, and market conditions.

- Analyst Predictions: A range of price targets exist, reflecting differing viewpoints on the company's future. Some analysts might predict a higher price, while others might forecast a lower one.

- Valuation Metrics: Analyzing valuation metrics like the Price-to-Earnings (P/E) ratio can help determine whether the $254 price target is justified. Comparing Apple's P/E ratio to its historical average and to competitors can provide valuable insight.

| Analyst | Price Target | Rationale |

|---|---|---|

| Analyst A | $260 | Strong product pipeline and continued service revenue growth. |

| Analyst B | $245 | Concerns about economic slowdown and increased competition. |

| Analyst C | $255 | Positive outlook based on strong brand loyalty and innovative products. |

Buy or Sell AAPL at $200? Investment Strategies

Whether buying or selling AAPL at $200 depends on individual investor profiles and risk tolerance.

- Long-Term vs. Short-Term: Long-term investors might view $200 as a buying opportunity, believing in Apple's long-term growth potential. Short-term investors might adopt a more cautious approach, considering the market volatility.

- Risk Tolerance: Risk-averse investors might prefer a "wait-and-see" approach, while aggressive investors might view the current price as a favorable entry point.

- Stop-Loss Orders: Implementing stop-loss orders can help mitigate potential losses if the stock price falls below a certain level.

Conclusion: Apple Stock Forecast: Is $254 Realistic? Buy or Sell AAPL at $200?

The $254 price target for AAPL is achievable but depends on several factors, including continued product innovation, positive global economic conditions, and successful navigation of the competitive landscape. While Apple's financial performance currently indicates strong fundamentals, external factors introduce uncertainty. At $200, the decision to buy, sell, or hold AAPL depends heavily on individual investment strategies and risk tolerance. Long-term investors with a high-risk tolerance might consider buying, while more conservative investors may prefer to wait for further clarification.

While this analysis suggests a balanced approach, remember to perform your own due diligence before making any investment decisions regarding Apple stock (AAPL). Consider consulting with a financial advisor for personalized guidance.

Featured Posts

-

Silence Des Dissidents Chinois En France Les Methodes De Pekin

May 24, 2025

Silence Des Dissidents Chinois En France Les Methodes De Pekin

May 24, 2025 -

Price Gouging Allegations Surface Following La Fires

May 24, 2025

Price Gouging Allegations Surface Following La Fires

May 24, 2025 -

The Impact Of Industry Downsizing On Game Accessibility

May 24, 2025

The Impact Of Industry Downsizing On Game Accessibility

May 24, 2025 -

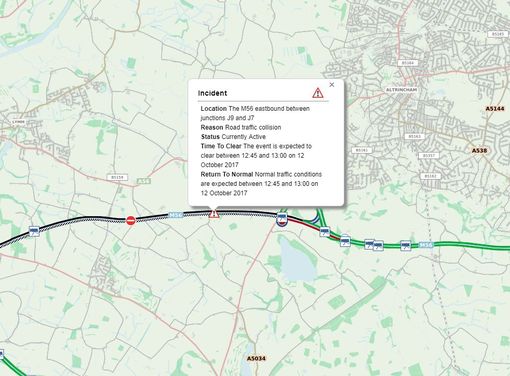

Serious M56 Motorway Collision Car Overturn Paramedic Response

May 24, 2025

Serious M56 Motorway Collision Car Overturn Paramedic Response

May 24, 2025 -

Wrestle Mania 41 Golden Belts And Tickets Memorial Day Weekend Sales Event

May 24, 2025

Wrestle Mania 41 Golden Belts And Tickets Memorial Day Weekend Sales Event

May 24, 2025